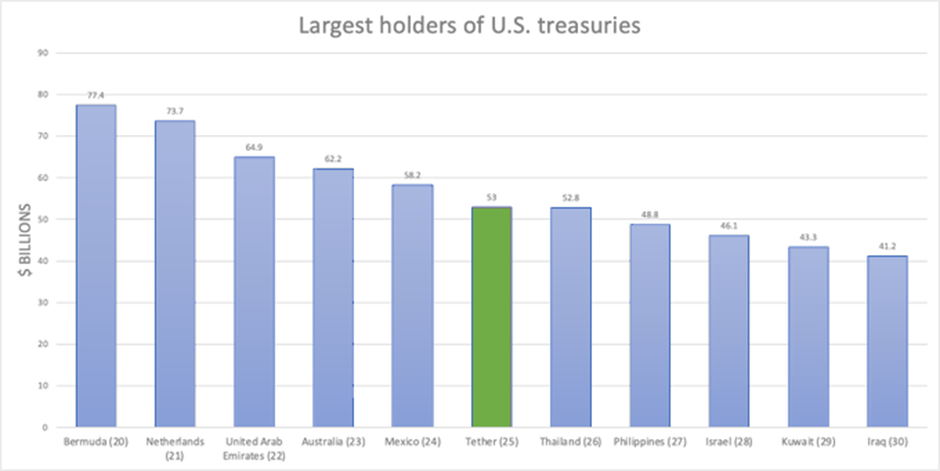

- Tether’s technique advisor in contrast the coin to the twenty fifth largest holder of U.S. treasuries.

- Gabor Gurbacs shared that Tether is holding a considerable reserve of $3.4 billion in gold.

- Gurbacs suggests {that a} mixture of gold and Bitcoin serves as a sturdy safeguard towards market dangers.

In a latest tweet, Tether’s technique advisor, Gabor Gurbacs, identified the numerous affect of Tether by stating that if it had been thought of a rustic, it will rank because the twenty fifth largest holder of U.S. treasuries.

Gurbacs burdened the significance of responsibly distributing USD-backed stablecoins, notably in Rising Markets, emphasizing that such motion aligns with the nationwide curiosity of the USA. Moreover, Gurbacs recommended that Tether deserves recognition from the U.S., because it continues to buy U.S. {dollars} whereas others are transferring away from the foreign money.

On Might 12, Gurbacs said that the importance of gold has been steadily rising for Tether Restricted. By holding a considerable reserve of $3.4 billion on this invaluable steel, the platform has emerged as a dominant drive within the realm of valuable metals.

Furthermore, the technique skilled highlighted that roughly $500 million is supporting the circulating provide of Tether Gold (XAUT), which occurs to be the biggest stablecoin pegged to gold issued by Tether.

Consequently, the portion of Tether’s reserves represented by gold is 127% better than that of Bitcoin. Tether holds solely round $1.5 billion price of the first cryptocurrency. Based on Gurbacs, this mixture of gold and BTC seems to function a sturdy safeguard towards potential market “catastrophic eventualities” and unexpected “Black Swan” occasions.

As well as, he expressed the view that diversified portfolios ought to contemplate allocating a portion of 5-10% to gold, Bitcoin, and commodities.

Historically, valuable metals exhibit the least volatility in comparison with different funding choices obtainable to each particular person and institutional buyers. Moreover, the market capitalization of Tether (USDT) has practically recovered all of the losses incurred as a result of Terra (LUNA) collapse a 12 months in the past. Presently, its market capitalization stands at over $82 billion. The all-time excessive for this metric was $83 billion.