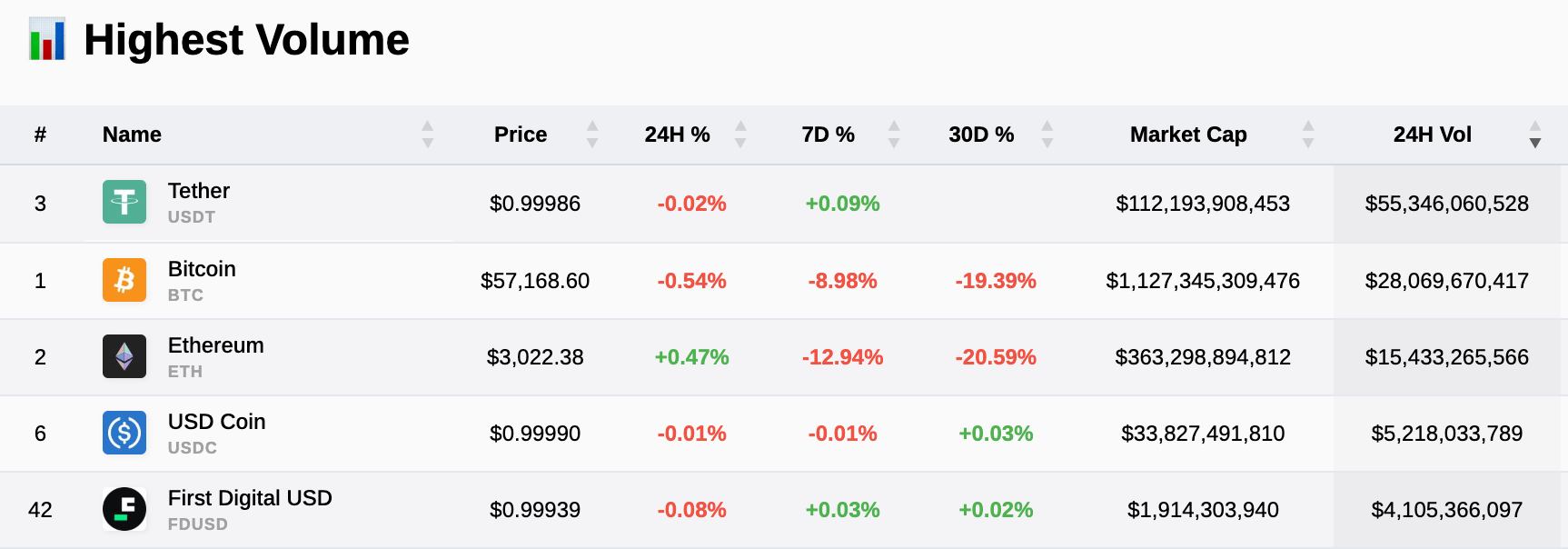

Tether USDT’s 24-hour buying and selling quantity exceeds the mixed whole of the next 5 digital belongings, together with Bitcoin and Ethereum.

Reflecting on Tether’s dominance in buying and selling quantity supplies perception into market liquidity. As starcrypto information signifies, Tether (USDT) maintains the next quantity than Bitcoin (BTC), Ethereum (ETH), USD Coin (USDC), Solana (SOL), and First Digital USD (FDUSD), pointing to its important presence out there. Particularly, Tether recorded a 24-hour quantity of over $55 billion, far surpassing Bitcoin’s $28 billion and Ethereum’s $15 billion.

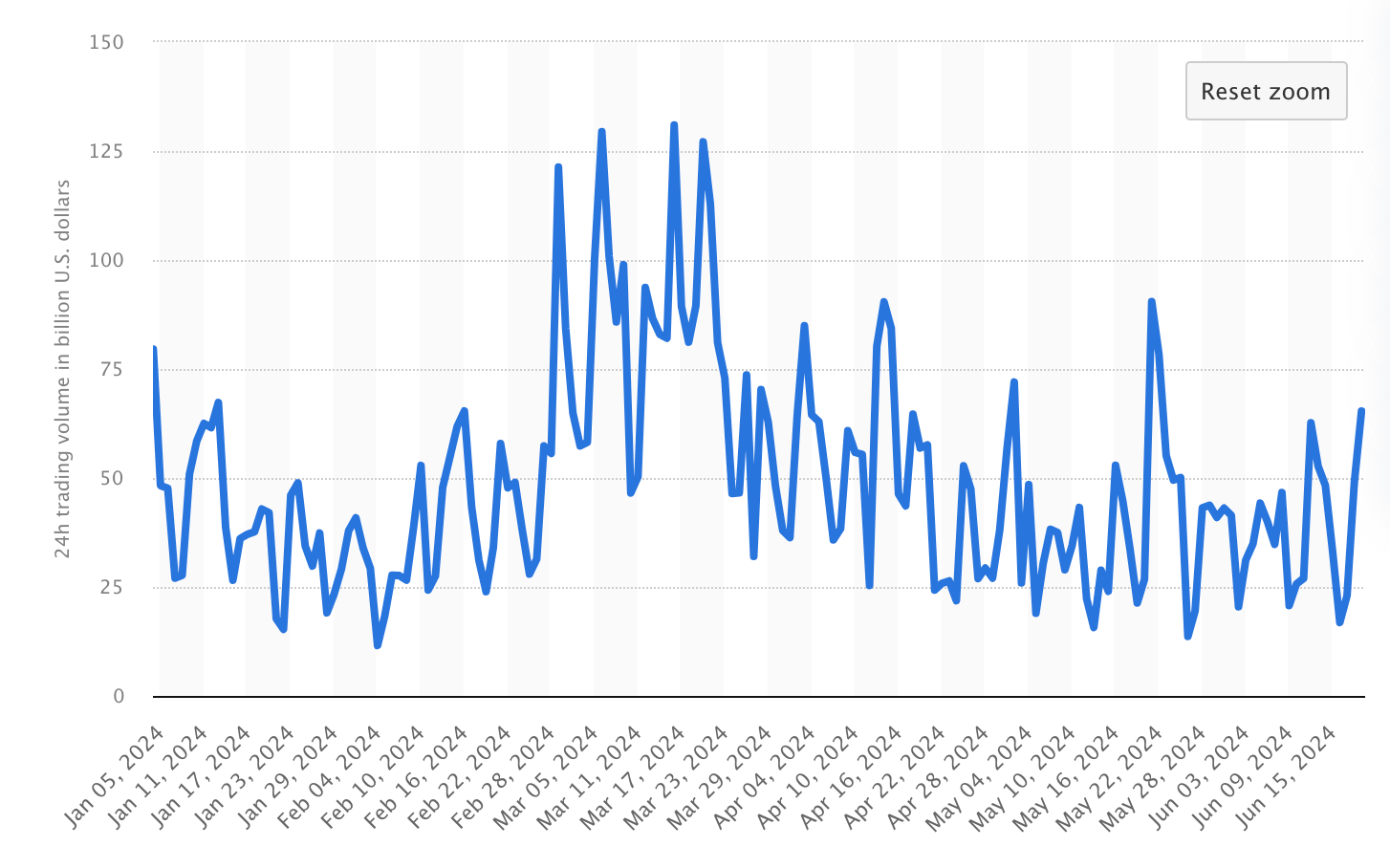

With a market cap of over $112 billion, the buying and selling patterns additionally present that Tether’s quantity has persistently been strong all through 2024, peaking at $130 billion on March 16. Tether’s stability and frequent use in buying and selling pairs make it a most well-liked selection for merchants in search of to hedge towards volatility.

With a market cap of over $112 billion, the buying and selling patterns additionally present that Tether’s quantity has persistently been strong all through 2024, peaking at $130 billion on March 16. Tether’s stability and frequent use in buying and selling pairs make it a most well-liked selection for merchants in search of to hedge towards volatility.

These quantity statistics mirror broader market tendencies as Tether supplies liquidity and stability. Tether usually achieves every day buying and selling volumes exceeding $25 billion, reinforcing its standing as a key liquidity supplier within the crypto ecosystem.

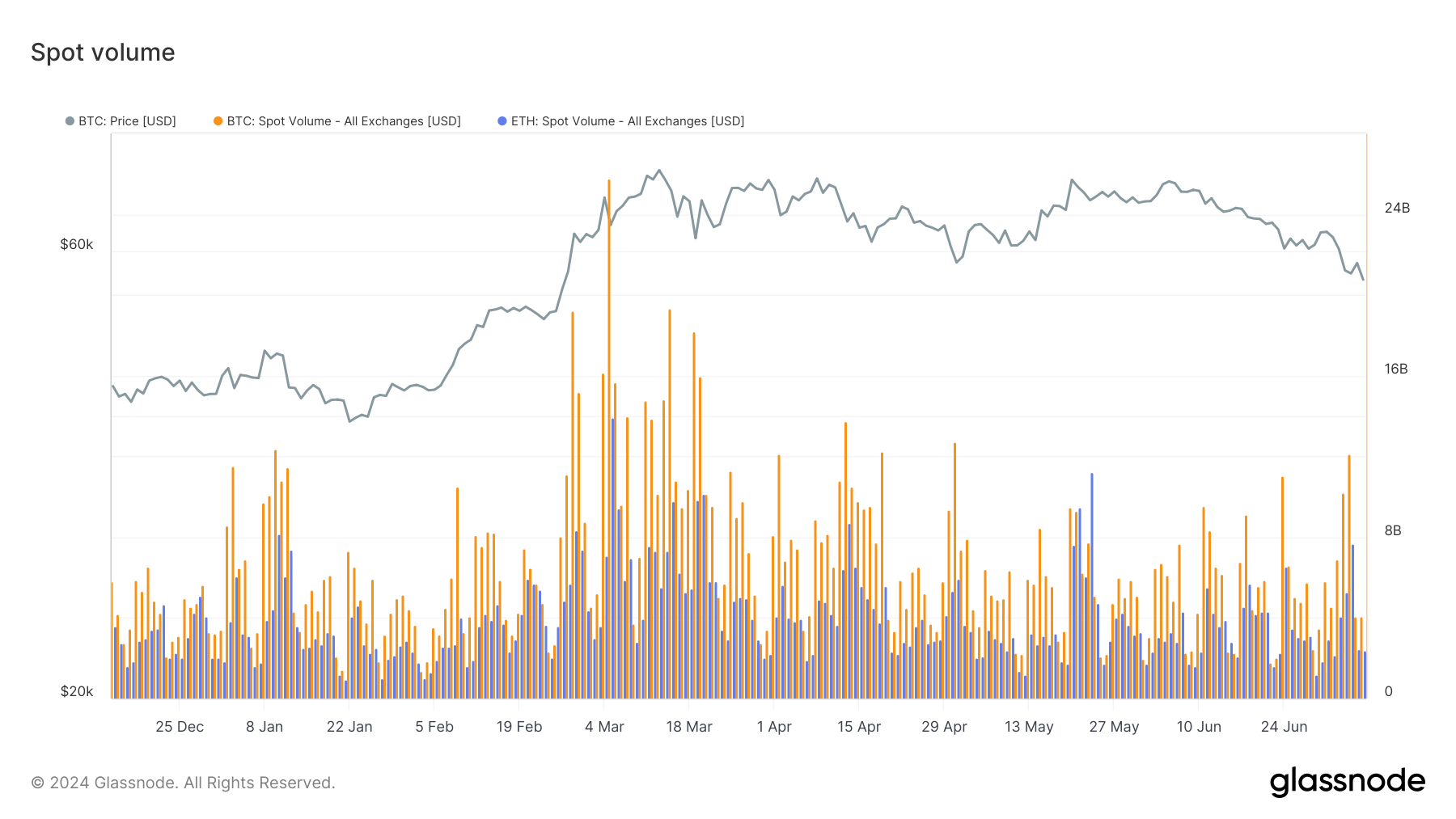

Per Glassnode information, all through 2024, Bitcoin and Ethereum have seen round $4 – $8 billion per day, far beneath Tether’s volumes.

The excessive buying and selling quantity of Tether in comparison with different main digital belongings illustrates its integral function in every day buying and selling actions and the broader market technique that merchants and establishments make use of. This steady high-volume buying and selling signifies belief and reliance on Tether’s stability and accessibility, making it indispensable for environment friendly market functioning.

Whereas Tether has traditionally confronted recounted challenges relating to its reserves and use in illicit actions, these volumes showcase its resilience in combating these claims. Tether’s CEO Paolo Ardoino just lately informed starcrypto that Tether is at the moment over-collateralized, with the agency’s income being put again into reserves to strengthen its stability.

Additional, Ardoino commented how Senator Warren’s discouragement of accounting corporations from participating with Tether had hindered its potential to make use of one of many US’s prime 4 accountants for audits. The CEO claimed that Tether is repeatedly in search of to rent one of many main corporations however has virtually given up on it taking place any time quickly, no matter their efforts to take action.