- LUNC’s buying and selling quantity surge alerts heightened market participation and volatility.

- Key assist at $0.000094 for LUNC might bolster worth if quantity momentum slows.

- LUNA’s resistance at $0.360 may break if buying and selling quantity stays sturdy.

Terra Labs faces an intense authorized battle with the U.S. SEC, sparking important curiosity in Terra Traditional (LUNC) and Terra (LUNA) costs. Buyers are watching worth actions and up to date tendencies carefully given the renewed authorized scrutiny.

Moreover regulatory considerations, each LUNC and LUNA have proven notable shifts in buying and selling exercise, suggesting heightened market curiosity. Worth tendencies, key assist and resistance ranges, and technical indicators provide insights into potential future strikes for each property.

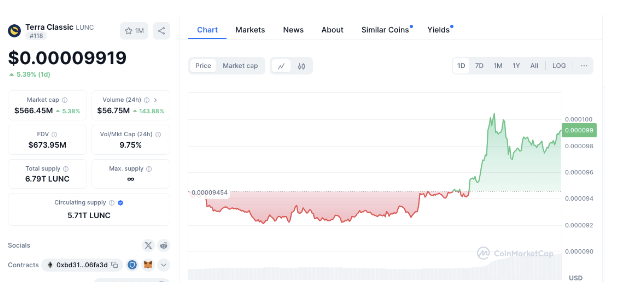

LUNC Worth Momentum and Buying and selling Quantity Surge

LUNC has not too long ago proven an upward trajectory, rising 4.43% over the previous day to 0.0000919. This enhance comes after a interval of consolidation, suggesting that investor curiosity is rising once more.

The buying and selling quantity has surged 140.46%, indicating stronger market participation. These will increase in buying and selling quantity usually sign a lift in shopping for or promoting strain, which might enhance volatility.

Key ranges for LUNC embody assist at $0.000094, which held regular throughout current consolidations. Moreover, $0.000092 acted as a security web in earlier downward tendencies, stopping sharper declines.

On the resistance aspect, $0.000098 is a vital barrier that LUNC is working to breach. If profitable, the subsequent psychological resistance is at $0.00010, a threshold that always sees elevated market exercise.

If the buying and selling quantity stays excessive, LUNC might try to interrupt the $0.00010 resistance. Nonetheless, if the quantity falls, a retest of assist ranges may observe. Excessive buying and selling quantity relative to market cap, which is 9.75% for LUNC, highlights the asset’s risky nature, displaying robust purchaser or vendor confidence.

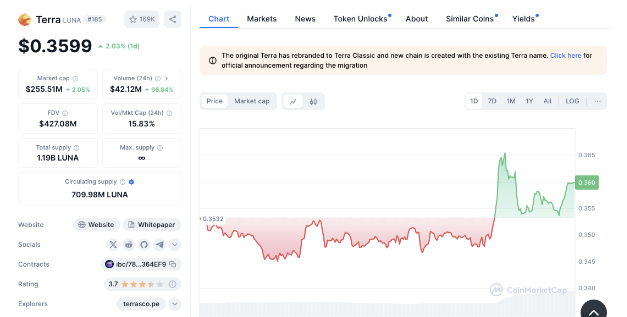

LUNA Worth Motion and Potential Resistance

During the last 24 hours, Terra (LUNA) noticed a worth enhance of 1.78%, with the worth at present round $0.3596. This follows a consolidation section, hinting at renewed momentum.

Buying and selling quantity for LUNA has additionally risen sharply, up by 93.03%, which may sign intensified buying and selling curiosity. Such quantity spikes usually point out a possible pattern shift, as rising quantity can usually precede upward or downward worth swings.

Key assist for LUNA contains $0.3532, which helped stabilize costs throughout current declines. A extra substantial assist stage at $0.345 has traditionally prevented additional downward motion.

Conversely, $0.360 at present acts as a resistance level. A breakthrough right here may open the trail to $0.365, a stage marking the current excessive. If buying and selling quantity stays sturdy, LUNA might problem this higher resistance. Nonetheless, a quantity drop may see costs revert towards the assist at $0.3532.

Technical Indicators and Implications for LUNC and LUNA

LUNC’s present buying and selling volume-to-market cap ratio of 9.75% signifies robust exercise, usually an indication of conviction available in the market. Likewise, LUNA’s volume-to-market cap ratio of 15.83% factors to sustained curiosity.

For each tokens, continued progress in buying and selling quantity may result in costs breaking by means of the rapid resistance ranges. Nonetheless, if quantity momentum weakens, each LUNC and LUNA might fall again to check their respective assist zones.

Associated: Terra’s $4.5 Billion Nice: A Warning Shot to Crypto Fraudsters

Associated: Terra’s Collapse: The Fallout Reaches a Prime Minister’s Workplace

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version shouldn’t be liable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.