- Bullish LUNA value prediction ranges from $0.300 to $3.00.

- Evaluation means that the LUNA value may attain above $2.5446.

- The LUNA bearish market value prediction for 2023 is $0.3180.

Terra is an open-sourced blockchain challenge supporting decentralized purposes (DApps) growth. Its native token is named LUNA.

Terra buyers are bullish on the token, though the worth of their funding has decreased by over 90% previously six months. The current all-time excessive (ATH) value of LUNA is $19.54, attained in Could 2022 after a market implosion. Regardless of the latest crypto winter, LUNA buyers are assured that the way forward for LUNA is bullish.

In case you are fascinated by the way forward for Terra (LUNA) and need to know the value evaluation and value prediction of LUNA for 2023, 2024, 2025, 2026, and as much as 2030, hold studying this Coin Version article?

Terra (LUNA) Market Overview

HTTP Request Failed… Error: file_get_contents(https://api.coingecko.com/api/v3/cash/terra-luna-2): Did not open stream: HTTP request failed! HTTP/1.1 429 Too Many Requests

What’s Terra (LUNA)?

Terra is an open-source, community-owned blockchain that hosts a vibrant ecosystem of purposes. LUNA is the Terra protocol’s native staking token. LUNA is used for governance and mining. Customers stake LUNA to validators who file and confirm transactions on the blockchain in trade for rewards from transaction charges.

Terra (LUNA) emerged from Terra Traditional, which was house to the algorithmic stablecoin TerraClassicUSD (UST). Nonetheless, its now-renamed LUNC token collateralized UST, which crashed in a financial institution run in Could 2022. That crash devalued LUNA to nearly zero and induced a launch of a brand new chain — leading to Terra Traditional and Terra.

The event of Terra Traditional launched in January 2018 and the blockchain was launched in April 2019. It was constructed with the purpose of mixing the value stability and extensive adoption of fiat currencies with the censorship resistance of Bitcoin (BTC) and providing quick and inexpensive settlements by means of its UST stablecoin.

Terra Traditional supplied stablecoins pegged to the U.S. greenback, South Korean gained, Mongolian tugrik, and the Worldwide Financial Fund’s Particular Drawing Rights basket of currencies.

Analysts’ View on Terra (LUNA)

Cosmosdaily tweeted concerning the Alliance module unveiling which stole the highlight on the Terra ecosystem. Furthermore, LUNA had a minor increment since after Cosmosdaily tweeted about this.

Terra (LUNA) Present Market Standing

LUNA has a circulating provide of 283,255,651 LUNA cash, whereas its most provide will not be accessible, in line with CoinMarketCap. On the time of writing, LUNA is buying and selling at $0.8650 representing 24 hours lower of 0.54%. The buying and selling quantity of LUNA previously 24 hours is $254,119,468 which represents a 462.36% enhance.

Some high cryptocurrency exchanges for buying and selling LUNA are Binance, BTCEX, OKX, CoinW, and Deepcoin.

Now that you already know LUNA and its present market standing, we will focus on the value evaluation of LUNA for 2023.

Terra (LUNA) Worth Evaluation 2023

At present, Terra (LUNA) ranks 123 on CoinMarketCap. Will LUNA’s most up-to-date enhancements, additions, and modifications assist its value go up? First, let’s concentrate on the charts on this article’s LUNA value forecast.

Terra (LUNA) Worth Evaluation – Bollinger Bands

The Bollinger bands are a kind of value envelope developed by John Bollinger. It provides a spread with an higher and decrease restrict for the value to fluctuate. The Bollinger bands work on the precept of normal deviation and interval (time).

The higher band as proven within the chart is calculated by including two occasions the usual deviation to the Easy Transferring Common whereas the decrease band is calculated by subtracting two occasions the usual deviation from the Easy Transferring Common. When the bands widen, it exhibits there’s going to be extra volatility and once they contract, there may be much less volatility.

When Bollinger bands are utilized in a cryptocurrency chart, we may count on the value of the cryptocurrency to reside throughout the higher and decrease bounds of the Bollinger bands 95% of the time. The above thesis is derived from an Empirical regulation.

The sections highlighted by crimson rectangles within the chart above present how the bands broaden and contract. When the bands widen, we may count on extra volatility, and when the bands contract, it denotes much less volatility. The inexperienced rectangles present how LUNA retraced after touching the higher band (overbought).

When scrutinizing LUNA’s fluctuating sample, we may see that a big fall (massive crimson candlestick) was adopted by small inexperienced and crimson candlesticks

At present, LUNA has fallen by a big margin. As such, we may count on LUNA to maneuver sideways with small inexperienced and crimson candlesticks. Furthermore, since LUNA has at present touched the decrease band, we may count on it to retrace towards the SMA.

Nonetheless, LUNA has a historical past of repeatedly touching the decrease band earlier than the market corrects the value. Therefore, we may even see a couple of extra bars of LUNA contact the decrease band.

Moreover, the Bollinger band width indicator used on the backside of the chart appears to be rising, as such, we may count on the bands to widen. Therefore, there might be extra volatility out there. Nonetheless, the bands are titled in the direction of the underside of the chart, as such, we may even see LUNA lose worth additional.

Terra (LUNA) Worth Evaluation – Relative Energy Index

The Relative Energy Index is an indicator that’s used to seek out out whether or not the value of a safety is overvalued or undervalued. As per its title, RSI indicators assist decide how the safety is doing at current, relative to its earlier value.

Furthermore, it has a sign line which is a Easy Transferring Common (SMA) that acts as a yardstick or reference to the RSI line. Therefore, each time the RSI line is above the SMA, it’s thought of bullish; if it’s beneath the SMA, it’s bearish.

At present, the RSI is above the Sign, therefore, LUNA is bullish. LUNA’s RSI is at present at 34.01 and it’s menacingly near the oversold area. Nonetheless, the road is positioned parallel to the horizontal axis. Furthermore, LUNA can also be transferring in the identical path because the RSI, therefore, we may even see some consolidation.

The Stochastic RSI measures the power or the weak point of the RSI indicator. As such, it compares the present RSI with the vary of previous RSI values for a selected interval. The StochRSI turns out to be useful when the market is transferring sideways. Since it’s delicate to the smallest RSI actions, it might be used to seek out out whether or not the RSI is overbought or oversold when there are sideways actions.

At present, Stochastic RSI alerts a worth of 74.30 and it’s near the overbought area. Nonetheless, the road is positioned parallel to the horizontal axis, as such, the Stochastic RSI too alerts that there might be consolidation for LUNA.

Moreover, the RSI Assist and Resistance (RSI S&R) indicator exhibits the Crossover Overbought, Crossunder Overbought, Crossover Oversold, and Crossunder Oversold area for a given RSI worth.

In accordance with the RSI S&R indicator, we may see that LUNA is nearly on the verge of touching the cross-bear zone (blue line). If LUNA crashes additional, we may even see it search for help from the cross-bear zone.

We may even see it ricochet off of the cross-bear zone and head upwards in the direction of the crossover oversold zone marked (orange cross-line). If the previous is to occur then the cross-bear zone presents a superb entry level for patrons. Nonetheless, if the cross-bear zone doesn’t help LUNA, we may even see it reaching for brand spanking new help areas.

Terra (LUNA) Worth Evaluation – Transferring Common

The Exponential Transferring averages are fairly much like the straightforward transferring averages (SMA). Nonetheless, the SMA equally distributes down all values whereas the Exponential Transferring Common provides extra weightage to the present costs. Since SMA undermines the weightage of the current value, the EMA is utilized in value actions.

The 200-day MA is taken into account to be the long-term transferring common whereas the 50-day MA is taken into account the short-term transferring common in buying and selling. Primarily based on how these two strains behave, the power of the cryptocurrency or the pattern will be decided on common.

Specifically, when the short-term transferring common (50-day MA) approaches the long-term transferring common (200-day MA) from beneath and crosses it, we name it a Golden Cross.

Contrastingly, when the short-term transferring common crosses the long-term transferring common from above then, a loss of life cross happens.

Often, when a Golden Cross happens, the costs of the cryptocurrency will shoot up drastically, however when there’s a Demise Cross, the costs will crash.

Every time the value of cryptocurrency is above the 50-day or 200-day MA, or above each we could say that the token is bullish (Crimson rectangle). Contrastingly, if the token is beneath the 50-day or 200-day, or beneath each, then we may name it bearish (Blue triangle part).

At present, LUNA is buying and selling nicely beneath each transferring averages and it appears to be going additional down. Nonetheless, when taking a look at LUNA’s motion previously we may see that the 50-day MA has acted just like the resistance and help degree.

We may even see LUNA testing the 50-day MA within the close to future. However since LUNA has been fluctuating in a sample that includes a big fall adopted by a interval of sideways motion, it could take a while for LUNA to check the 50-day MA. Nonetheless, whether it is dominated by the bulls originally of 2023, we may even see it rise exponentially.

Terra (LUNA) Worth Evaluation – Elder Drive Index

Elder Drive Index is an indicator that was invented by Alexander Elder, who was an entrepreneur. The indicator primarily makes use of two parameters to adjudicate the shopping for and promoting power and thereby predicts the market pattern. Specifically, it depends on value change and quantity. As such the power of the shopping for power or promoting power depends on both the value change or the quantity.

Every time the EFI is bigger than zero, or constructive, let’s imagine that the pattern is bullish, as there may be extra shopping for strain. Nonetheless, when the EFI is within the detrimental zone, let’s imagine that the cryptocurrency is within the detrimental zone and the promoting strain is extra.

Furthermore, the Elder Drive may be used to determine pattern reversals and breakouts. As an illustration when the EFI is making decrease highs whereas the cryptocurrency is making greater highs, then let’s imagine that this can be a bearish divergence. Nonetheless, within the occasion that the cryptocurrency is making decrease lows whereas the EFI is making greater lows, then it’s a bullish divergence represented within the chart.

When contemplating the chart, we may see that the EFI of LUNA is at -100.366K and the road is positioned parallel to the horizontal axis. Therefore, we may even see the EFI transferring sideways moreover. Nonetheless, the Bear Bull Energy indicator used within the chart means that the bear energy is growing as the road is transferring deep into the detrimental territory. At present, the BBP information a worth of -0.1503, and this may occasionally carry on growing as the times go by.

As such it could take a couple of extra days to satiate the sellers and thereafter the customer may make it into the market making LUNA surge once more. Therefore, these seeking to enter into an extended place might have to contemplate ready for the formation of inexperienced candlesticks earlier than coming into the market.

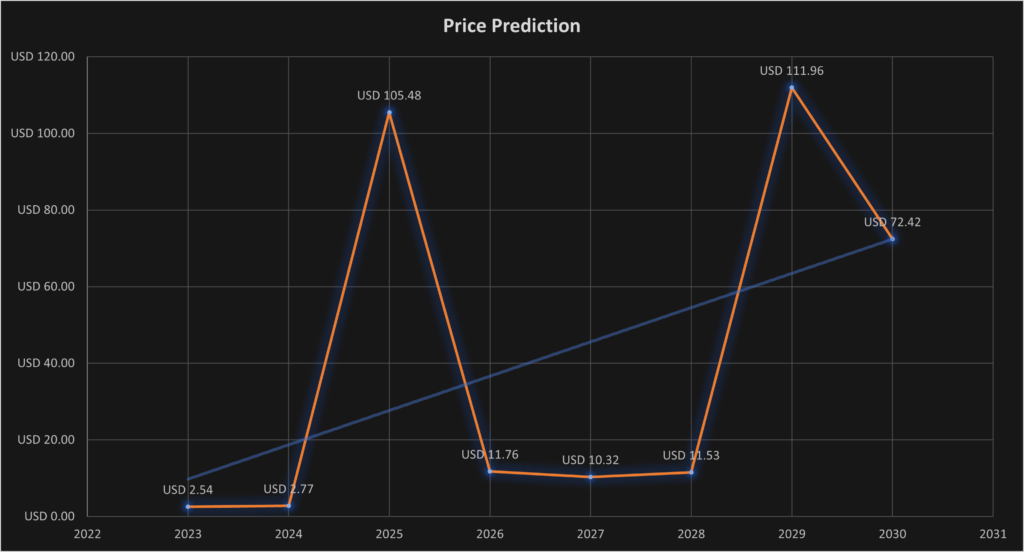

Terra (LUNA) Worth Prediction 2023-2030 Overview

| Yr | Minimal Worth | Common Worth | Most Worth |

| 2023 | $1.9850 | $2.5446 | $2.6140 |

| 2024 | $2.6925 | $2.7696 | $3.0012 |

| 2025 | $100.102 | $105.48 | $110.25 |

| 2026 | $10.658 | $11.7593 | $12.897 |

| 2027 | $9.782 | $10.3216 | $12.154 |

| 2028 | $10.1125 | $11.5266 | $12.871 |

| 2029 | $105.123 | $111.9567 | $120.587 |

| 2030 | $68.487 | $72.4214 | $78.950 |

| 2040 | $125.64 | $149.5262 | $155.25 |

| 2050 | $203.125 | $217.0436 | $225.002 |

Terra (LUNA) Worth Prediction 2023

When contemplating the chart above we may see that LUNA’s rise early in 2023 was disturbed by its drastic fall. As such LUNA has been buying and selling inside a falling wedge since mid-January. It has been making decrease lows and decrease highs ever since.

LUNA has nearly accomplished forming the falling wedge, therefore, we may count on it to interrupt out from the wedge at any given time. As such, if LUNA breaks out of the wedge near the given value, we may count on it to rise to nearly Resistance 1 at $1.7009. Furthermore, as per the practices of buying and selling a falling wedge, when the peak of the wedge originally, is ready on the breakout level of the wedge, then we may count on LUNA to achieve Resistance 1.

Nonetheless, primarily based on LUNA’s historic habits, its rise has not stopped with reaching Resistance 1, however it has somewhat reached Resistance 2 at $ 2.2120. Moreover, we could even see LUNA testing Resistance 3 at $ 2.5446.

As such, merchants taking an extended place might have to attend for the primary glimpse of LUNA breaking out of the wedge and set their entry level on the breakout. Furthermore, they could take into account having their cease loss near the decrease pattern line of the wedge, to offer LUNA some slack to fluctuate. Lastly, they may set their take revenue at their very own discretion.

Contrastingly, if LUNA crashes we may even see it descend alongside the 1:1 Gann line. And, at occasions LUNA breaks the 1:1 Gann line, we may even see LUNA testing it. It would fascinating to see LUNA make new help ranges.

Terra (LUNA) Worth Prediction – Resistance and Assist Ranges

When contemplating LUNA’s motion since December 2020, we may see that it was fluctuating beneath the two:1 Gann line. Specifically, LUNA was fluctuating between the two:1 Gann line and the 8:1 Gann line, aside from the half highlighted in a rectangle.

When contemplating the motion of LUNA after August, we may see that it broke above the 8:1 Gann line and examined the 4:1 Gann line, at occasions breaking it. Nonetheless, LUNA wasn’t in a position to maintain above the 4:1 Gann line.

Nonetheless, the latter finish of November 2021 led to a spike for LUNA which helped it rise above the 4:1 Gann line, it rose above the three:1 Gann line forming the top and shoulder sample, with the excessive proper shoulder. Throughout this era, the 4:1 Gann line acted as a help for LUNA, though as soon as LUNA crashed beneath the 4:1 Gann line.

As seen within the chart, the second head and shoulder sample had a decrease left shoulder which examined the three:1 Gann line. Nonetheless, following this sample LUNA crashed in Could 2022.

As seen within the chart above LUNA rose alongside the 1:3 Gann line at occasions testing and breaking the 1:4 Gann line. Furthermore, when contemplating the way it has descended, we may be aware that it has been fluctuating between the 1:1 and a couple of:1 Gann strains. Though at occasions, LUNA examined the two:1 Gann line taking help from the rising Gann fan, it was obstructed by the two:1 Gann line.

As such, we may count on LUNA to check the two:1 Gann fan line sooner or later. There’s a risk of LUNA breaking the two:1 Gann line as it’s at present buying and selling in a falling wedge. Nonetheless, if LUNA doesn’t have the momentum to interrupt the above-mentioned Gann line, then it could rebound off it and keep throughout the highlighted vary within the chart.

Terra (LUNA) Worth Prediction 2024

There can be Bitcoin halving in 2024, and therefore we should always count on a constructive pattern out there as a result of consumer sentiments and the search by buyers to build up extra of the coin. Nonetheless, the yr of BTC halving didn’t yield the utmost LUNA primarily based on the earlier halving. Therefore, we may count on LUNA to commerce at a value not beneath $2.7696 by the top of 2024.

Terra (LUNA) Worth Prediction 2025

LUNA could expertise the after-effects of the Bitcoin halving and is predicted to commerce a lot greater than its 2024 value. Many commerce analysts speculate that BTC halving may create a huge effect on the crypto market. Furthermore, much like many altcoins, LUNA will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that LUNA would commerce past the $104.58 degree.

Terra (LUNA) Worth Prediction 2026

It’s anticipated that after an extended interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, LUNA may tumble into its help areas. Throughout this era of value correction, LUNA may lose momentum and be approach beneath its 2025 value. As such it might be buying and selling at $11.7593 by 2026.

Terra (LUNA) Worth Prediction 2027

Naturally, merchants count on a bullish market sentiment after the crypto trade was affected negatively by the bears’ claw. Furthermore, the build-up to the subsequent Bitcoin halving in 2028 may evoke pleasure in merchants. Nonetheless, that pleasure has not been reciprocated in LUNA. As such, we may count on LUNA to commerce just under its 2026 worth at round $10.3216 by the top of 2027.

Terra (LUNA) Worth Prediction 2028

Because the crypto neighborhood’s hope can be re-ignited wanting ahead to Bitcoin halving like many altcoins, LUNA could reciprocate its previous habits in the course of the BTC halving. Therefore, LUNA can be buying and selling at $11.5266 after experiencing a substantial surge by the top of 2028.

Terra (LUNA) Worth Prediction 2029

2029 is predicted to be one other bull run as a result of aftermath of the BTC halving. Nonetheless, merchants speculate that the crypto market would progressively change into steady by this yr. In tandem with the steady market sentiment, LUNA might be buying and selling at $111.9567 by the top of 2029.

Terra (LUNA) Worth Prediction 2030

After witnessing a bullish run out there, LUNA and lots of altcoins would present indicators of consolidation and may commerce sideways and transfer downwards for a while whereas experiencing minor spikes. Due to this fact, by the top of 2030, LUNA might be buying and selling at $72.4214

Terra (LUNA) Worth Prediction 2040

The long-term forecast for LUNA signifies that this altcoin may attain a brand new all-time excessive(ATH). This could be one of many key moments as HODLERS could count on to promote a few of their tokens on the ATH level.

If they begin promoting then LUNA may fall in worth. It’s anticipated that the common value of LUNA may attain $149.5262 by 2040.

Terra (LUNA) Worth Prediction 2050

The neighborhood believes that there can be widespread adoption of cryptocurrencies, which may preserve gradual bullish good points. By the top of 2050, if the bullish momentum is maintained, LUNA may hit $217.0436

Conclusion

If buyers proceed exhibiting their curiosity in LUNA and add these tokens to their portfolio, it may proceed to rise. LUNA’s bullish value prediction exhibits that it may attain the $2.5446 degree.

FAQ

Terra is an open-source, community-owned blockchain that hosts a vibrant ecosystem of purposes. LUNA is the Terra protocol’s native staking token. LUNA is used for governance and mining.

LUNA tokens will be traded on many exchanges like Binance, OKX, BTCEX, Deepcoin, and Bitrue.

LUNA has a risk of surpassing its current all-time excessive (ATH) value of $19.54 in 2022.

LUNA is likely one of the few cryptocurrencies that has proven resilience. If LUNA breaks out of its falling wedge, it’d attain $2.5 quickly after it breaks the Resistance 1 and 2levels.

LUNA has been one of the vital appropriate investments within the crypto area. It’s extremely risky, as such, it has fairly a margin when its value fluctuates. Therefore, merchants could also be allured to spend money on LUNA. It’s a superb funding within the quick time period and in the long run as nicely.

The current all-time low value of LUNA is $0.7209.

The utmost provide of LUNA is unavailable.

LUNA will be saved in a chilly pockets, scorching pockets, or trade pockets.

Terra was based by Daniel Shin and Do Kwon.

It was launched in 2018.

LUNA is predicted to achieve $2.5446 by 2023.

LUNA is predicted to achieve $2.7696 by 2024.

LUNA is predicted to achieve $105.48 by 2025.

LUNA is predicted to achieve $11.7593 by 2026.

LUNA is predicted to achieve $10.3216 by 2027.

LUNA is predicted to achieve $11.5266 by 2028.

LUNA is predicted to achieve $111.9567 by 2029.

LUNA is predicted to achieve $72.4214 by 2030.

LUNA is predicted to achieve $149.5262 by 2040.

LUNA is predicted to achieve $217.0436 by 2050.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this value prediction, are revealed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be held answerable for any direct or oblique harm or loss.