- LUNC is buying and selling at $0.00012 after a major restoration from its current dump.

- The optimistic divergence would possibly assist the LUNC worth climb to $0.00014.

- If consumers are absent, LUNC may not dump again to the help at $0.00011.

After tapping a low of $0.00011 on January 3, the value of Terra Luna Basic (LUNC) jumped and hit $0.00013 just lately. The rise represents an roughly 30% worth rise. Regardless of the run, LUNC was unable to carry the area.

At press time, LUNC was buying and selling at $0.00012, based mostly on CoinMarketCap knowledge. Ten days in the past, Coin Version reported how LUNC had the eye of the market. Throughout that point, the cryptocurrency confirmed indications that it might break into the highest 50.

Nevertheless, press time knowledge confirmed that LUNC’s market cap place was at quantity 89. By way of the value motion, the 4-hour chart confirmed {that a} descending channel sample had been fashioned.

LUNC Makes an attempt to Breakout

From the chart under, the trendline had damaged under completely different help ranges. On December 26, bulls couldn’t defend the $0.00014 help. So, the value declined. The help subsequently fell to $0.00012 on January 4. Once more, the value fell.

Nevertheless, the next drop to $0.00011 appeared just like the breakthrough LUNC wanted. Shopping for strain pushed the value again as much as $0.00012. Moreover, alerts from the sample instructed that the value might quickly transfer to the upside and hit $0.00014 as soon as extra.

The RSI had additionally fashioned a optimistic divergence by forming larger lows. If LUNC’s worth makes decrease lows, it might affirm the bias and probably set off a breakout.

Nevertheless, the RSI is just one of many indicators wanted to assist LUNC obtain the prediction. Indicators from the Superior Oscillator (AO) confirmed that the studying was damaging.

This damaging studying implies that the 5-period MA was not better than the 34-period MA, suggesting a bearish momentum. Nevertheless, the development can rapidly reverse if shopping for momentum will increase. Ought to this occur, LUNC could rise to $0.00014.

However, a scarcity of consumers might trigger the LUNC worth to maintain hovering round $0.00011.

A Transfer to $0.00014 Is Probably

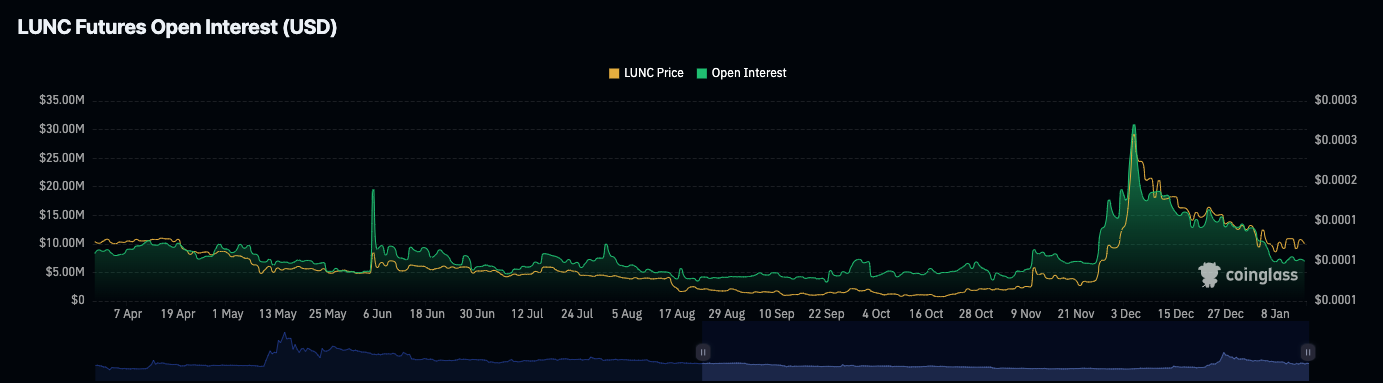

Coinglass knowledge confirmed that the Open Curiosity had decreased considerably, At press time, LUNC’s it was all the way down to $6.9 million. Towards the tip of December 2023, it was as excessive as $20 million.

The lower implies that market individuals had been more and more closing their web positions. Additionally, shorts with open positions had been extra aggressive than longs.

This Open Curiosity lower would possibly result in LUNC climbing again into the resistance at $0.00014 if shopping for strain will increase. But when shopping for strain doesn’t enhance, the value would possibly dump into the help at $0.00011.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version will not be answerable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.