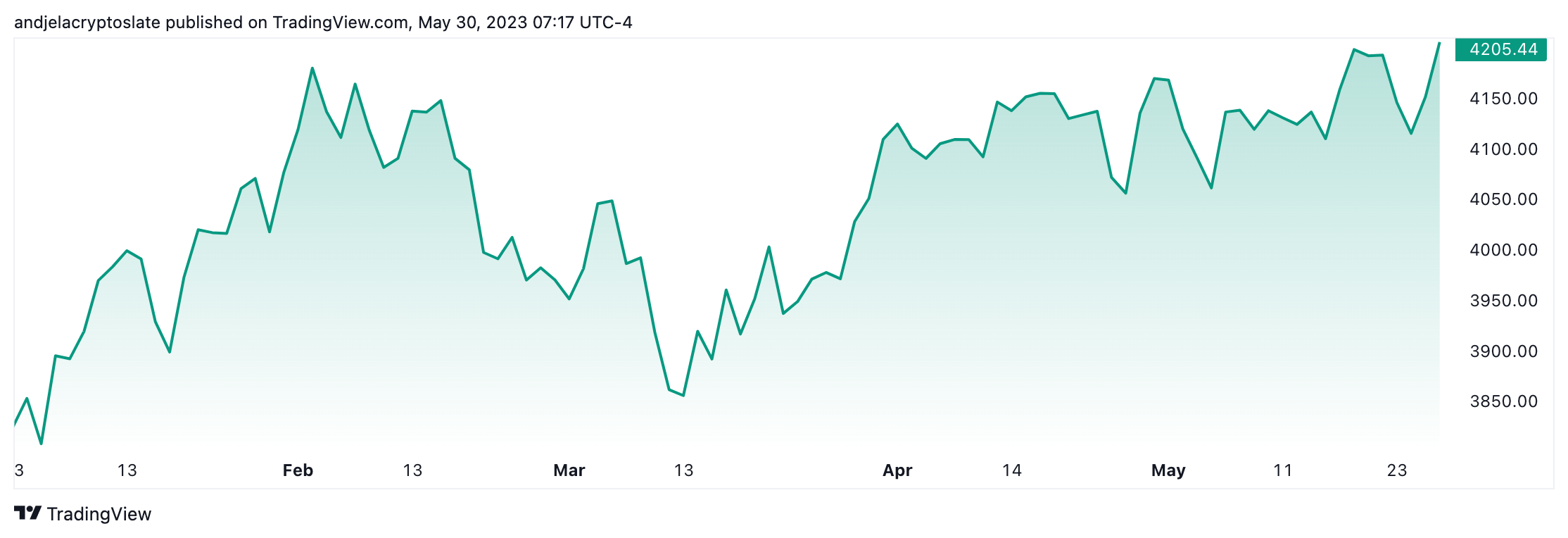

The S&P 500 index, a key barometer of U.S. equities, stood at 4,151 factors on the closing bell on Could 29, exhibiting a year-to-date (YTD) proportion development of 9.15%, standing at odds with the rising inflation and potential recession.

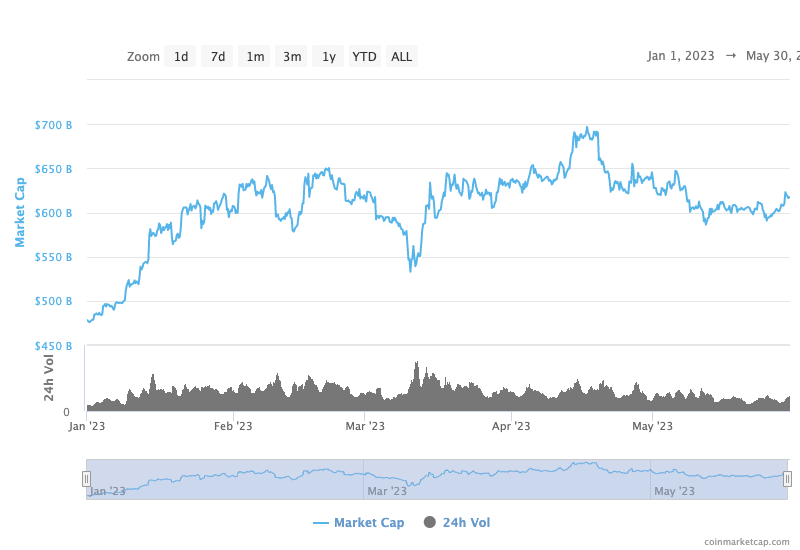

In parallel, the crypto market, as measured by its complete market capitalization, witnessed substantial oscillations, ending the month at a commanding $1.16 trillion. Regardless of periodic downturns, the general YTD development fee for the crypto market stands at a powerful 45.3%.

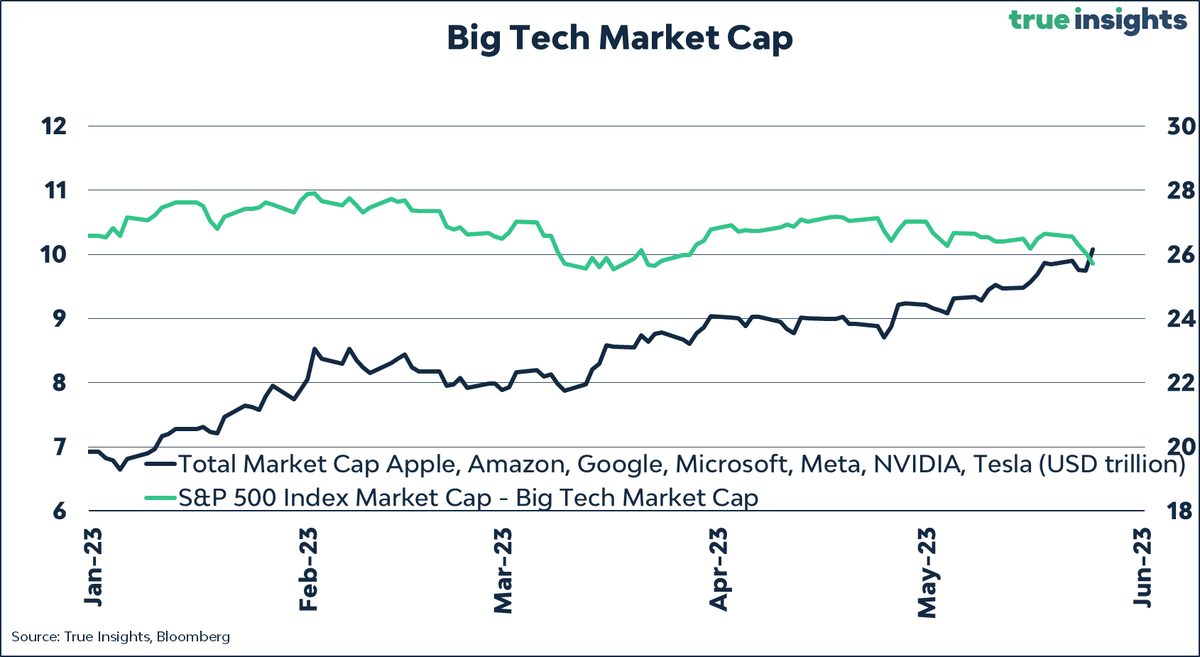

Nonetheless, the S&P 500’s efficiency doesn’t illustrate precise market circumstances. A better look reveals the disproportionate affect of tech behemoths Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla — which type a good portion of the index’s complete market cap — on the index’s total efficiency.

The mixed market capitalization of those shares has elevated by $3.16 trillion, representing a 46% YTD development fee.

When these corporations are faraway from the YTD efficiency calculation, the S&P 500 paints a unique image, with the YTD proportion development dropping to simply 3% and indicating a extremely skewed dependency on these entities for its strong efficiency.

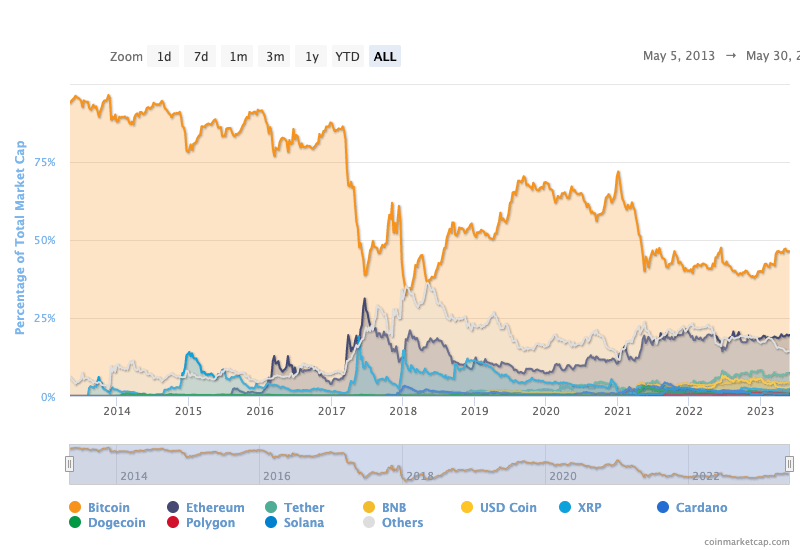

Nonetheless, the crypto market can also be dominated by a major participant: Bitcoin. As of Could 23, 2023, Bitcoin alone accounted for $542.7 billion of the whole crypto market cap. Its sheer measurement and affect typically overshadow the efficiency of different cryptocurrencies out there.

In truth, Bitcoin’s dominance stands at roughly 46% of your complete crypto market cap, reflecting its standing as the unique and most generally adopted cryptocurrency. The determine considerably shapes the crypto market’s dynamics, illustrating Bitcoin’s resilience and rising recognition.

Once we exclude Bitcoin’s market cap from the whole, the remaining crypto market cap involves $617.3 billion, indicating a decrease YTD development fee of 29.1% for the remainder of the market and highlighting the numerous affect Bitcoin has on the general crypto market development.

Evaluating the performances of the S&P 500 and the crypto market presents insightful parallels. Each are extremely concentrated, with choose entities massively influencing their respective market caps. This disproportionate affect factors to attention-grabbing concerns relating to the variety and resilience of those markets.

Nonetheless, the resilience proven by the crypto market, even amidst a world disaster, underlines its potential as a formidable contender towards conventional markets.

As we proceed to traverse by way of 2023, the unfolding efficiency of those markets will unquestionably stay below the lens, making for an intriguing commentary for market watchers and contributors.

The publish Tech giants’ and Bitcoin’s dominance skew S&P 500, crypto market development charges appeared first on StarCrypto.