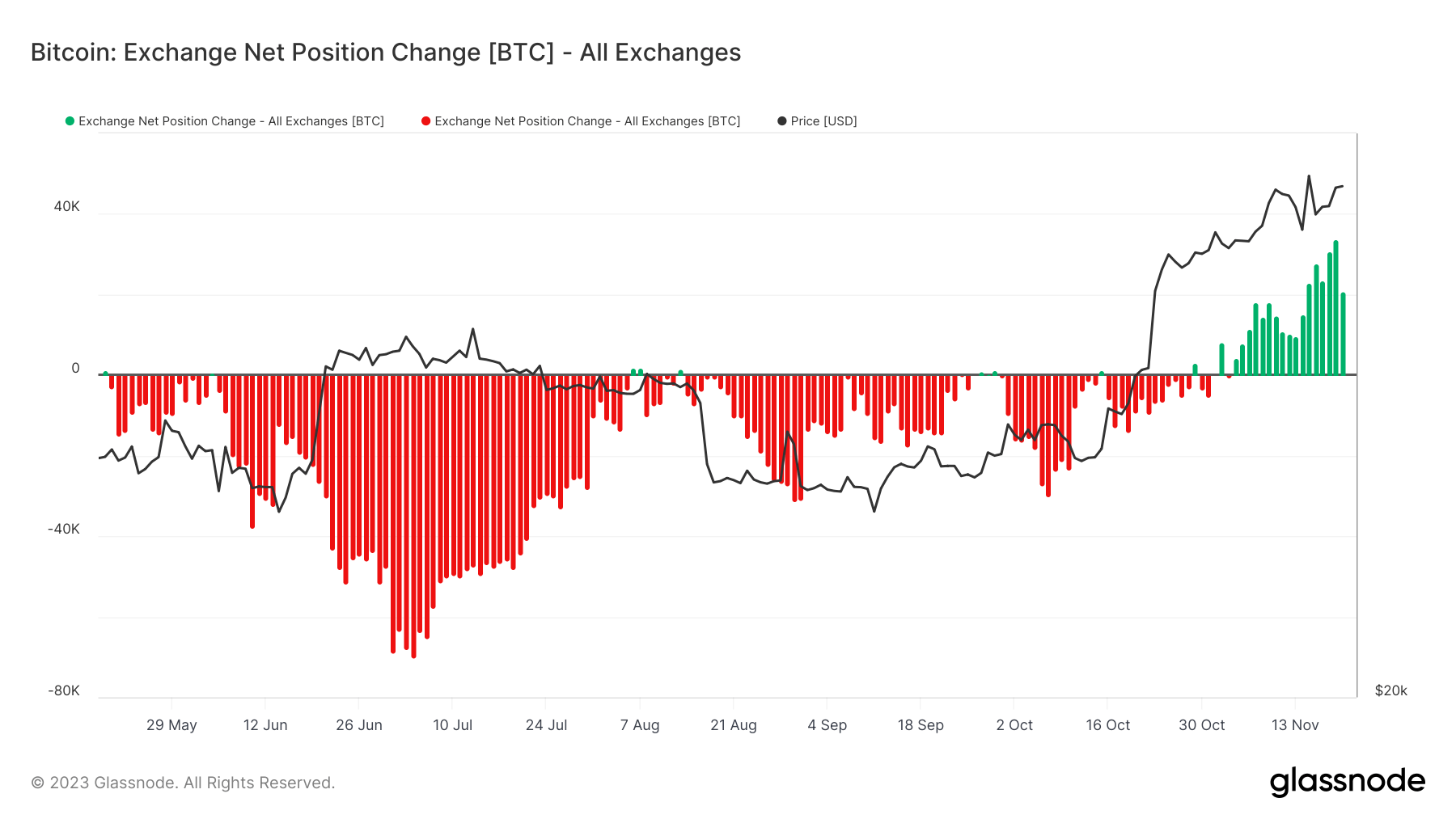

After six months of Bitcoin alternate withdrawals outpacing deposits, a reversal occurred this month, signaling a change in holder habits.

The alternate internet move, which measures the distinction between Bitcoin deposits and withdrawals on exchanges, turned optimistic originally of November, indicating a renewed curiosity in alternate actions amongst Bitcoin holders.

This shift is especially important given the unfavourable inflows that endured from Could 20 to Oct. 31, suggesting a interval the place holders have been extra inclined to retailer their Bitcoin off exchanges, presumably for long-term holding or in anticipation of market restoration. Nonetheless, this development reversed in November, with the alternate internet place change displaying a definite enhance in Bitcoin being moved to exchanges. This inflow peaked on Nov.19, when a staggering 33,854 BTC have been deposited onto exchanges. Such a considerable spike can usually be interpreted as an indication of holders getting ready to promote or commerce their Bitcoin, presumably as a result of altering market circumstances or to capitalize on worth actions.

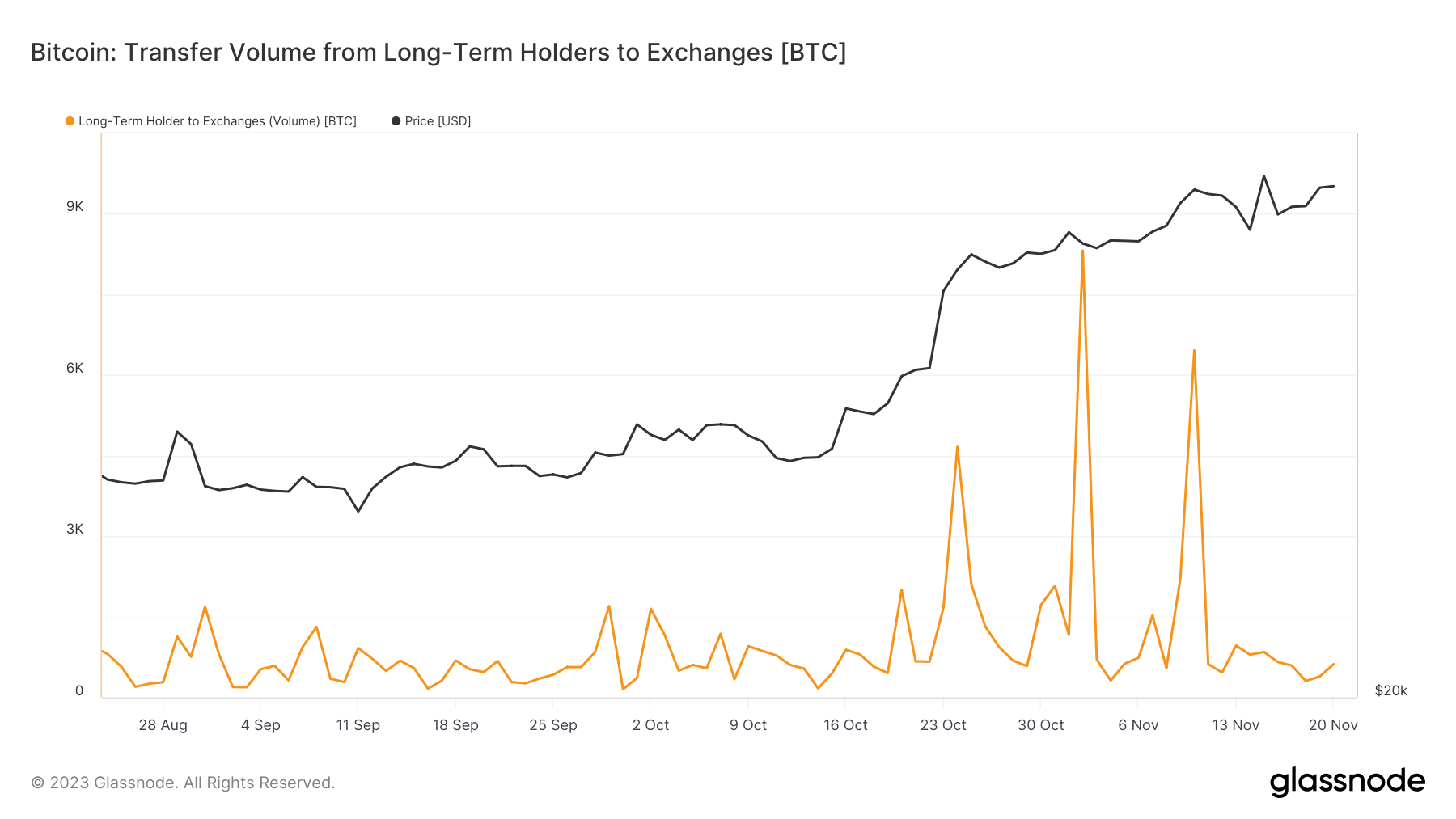

Analyzing the switch volumes by particular cohorts of holders supplies extra profound perception. The switch quantity from long-term holders (LTHs) to exchanges is especially noteworthy, with two important spikes occurring in November: 1,163 BTC on Nov. 1 and a extra important 8,318 BTC on Nov. 2. These transfers counsel that some LTHs, sometimes characterised by their tendency to carry property by way of varied market cycles, selected to maneuver their holdings to exchanges, presumably indicating a shift of their long-term funding methods or reactions to present market dynamics.

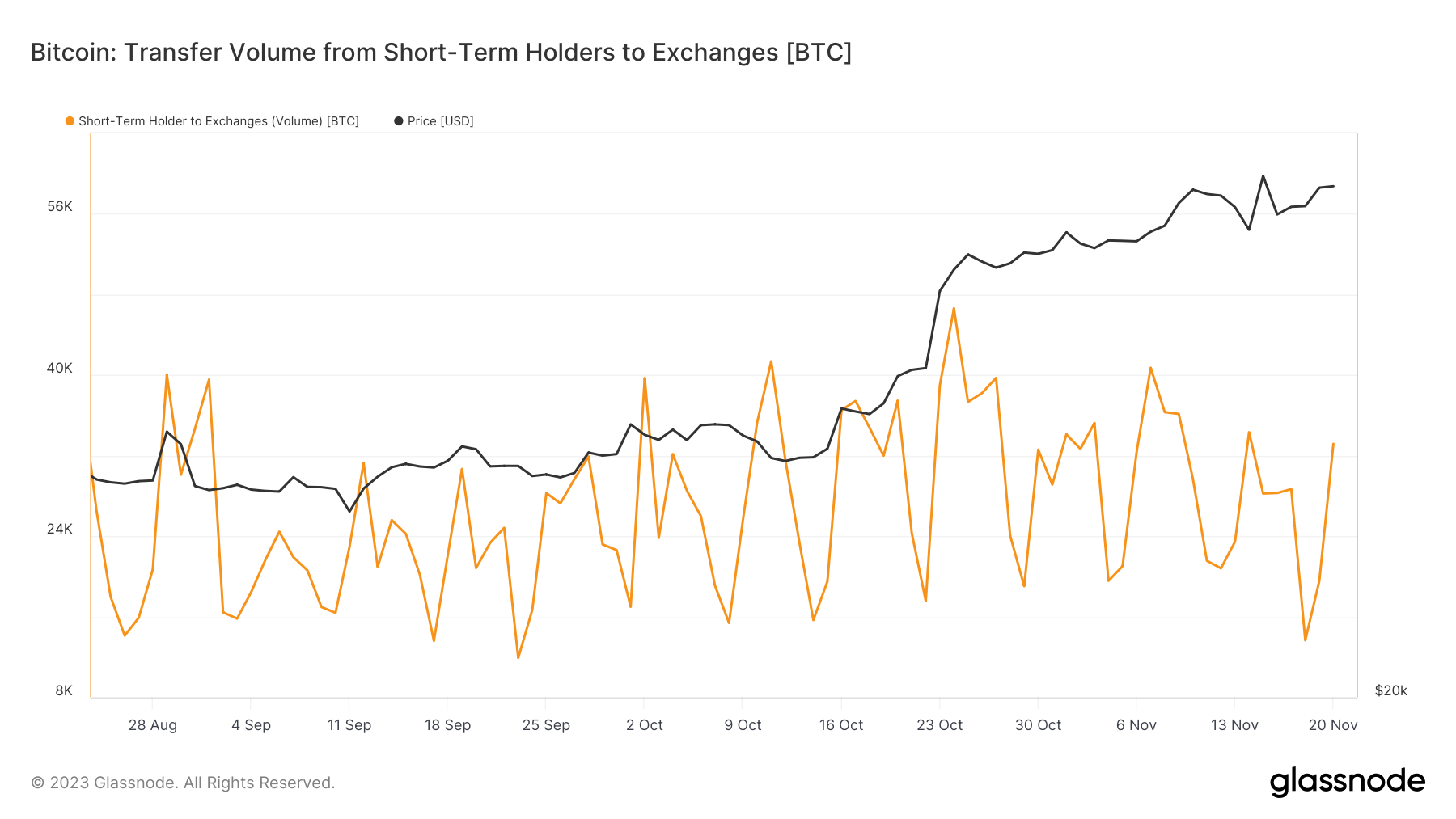

In distinction, the switch quantity from short-term holders (STHs) to exchanges was markedly increased, reflecting their extra lively and responsive buying and selling habits. Vital inflows have been noticed on a number of days, together with 34,111 BTC on Nov. 1 and 33,170 BTC on Nov. 20. These figures align with the yr’s common however are indicative of the unstable nature of short-term holding, the place buyers usually tend to react to speedy market modifications.

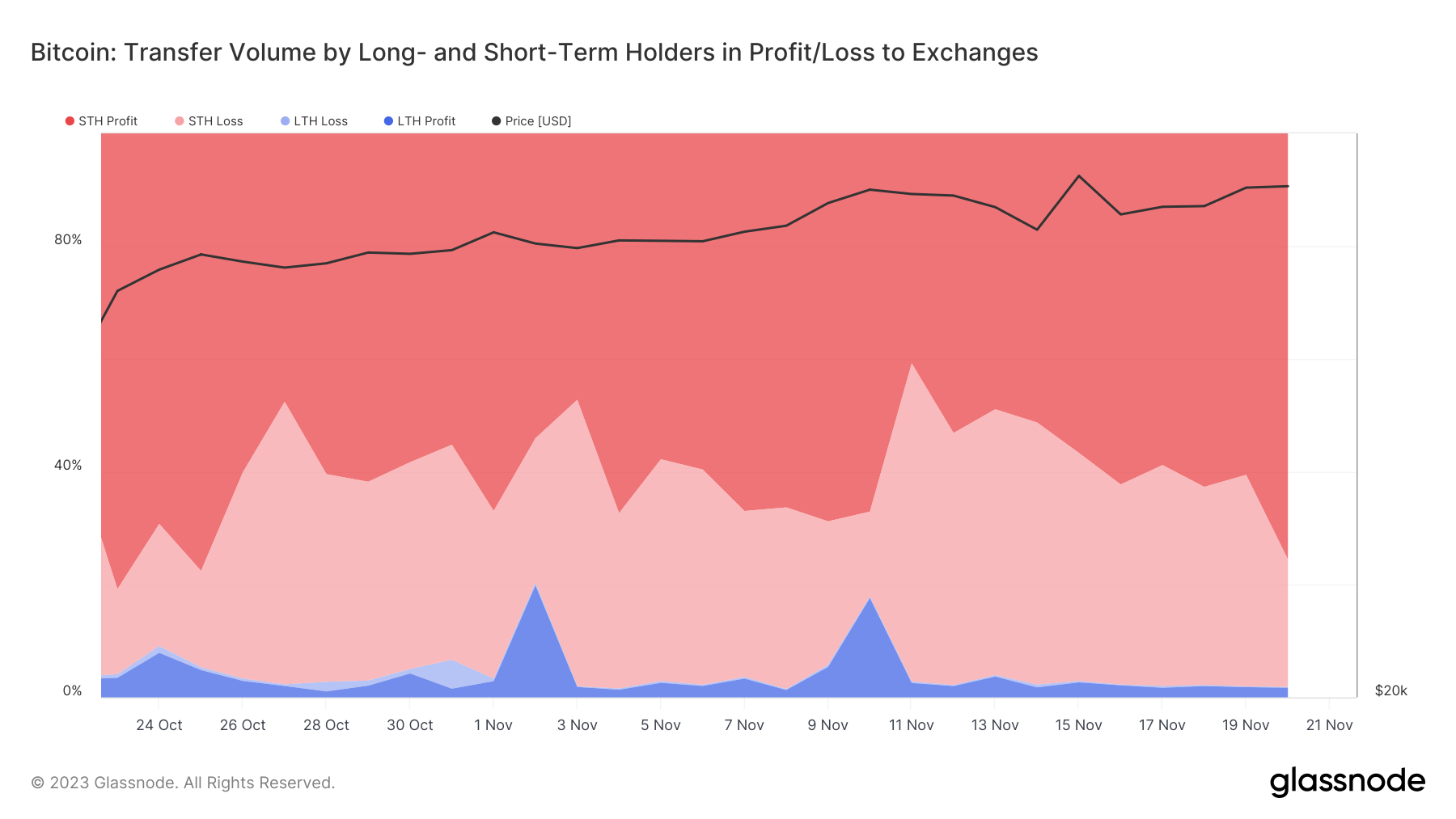

One other vital measure to contemplate is the quantity of Bitcoin moved to exchanges by long-term and short-term holders and whether or not they’re making a revenue or loss. This metric reveals the share of holders in revenue throughout their transfers. On Nov. 1, 66.9% of STHs and solely 2.8% of LTHs have been worthwhile, reflecting these two teams’ totally different funding horizons and methods. By Nov. 20, the share of worthwhile STHs elevated to 75.5%, whereas that of LTHs decreased to 1.69%. This development signifies that extra STHs, extra attuned to short-term worth actions, have been capitalizing on their earnings.

The elevated alternate inflows from STHs and LTHs, notably with a good portion of STHs in revenue, counsel a market the place short-term buying and selling dynamics are more and more influential. STHs, buoyed by latest earnings, are driving this development, probably trying to lock in features amidst fluctuating costs. Nonetheless, regardless of these actions, Bitcoin’s worth remained comparatively secure, rising barely from $35,421 on Nov. 1 to $37,485 on Nov. 20.

This stability, regardless of the elevated alternate inflows and promoting strain, would possibly counsel a sturdy underlying demand absorbing the sell-off, or a market nonetheless in equilibrium, ready for a extra decisive directional transfer.

The put up Surge in Bitcoin alternate deposits breaks six-month withdrawal streak appeared first on StarCrypto.