- Bullish Sui value prediction ranges from $1.032 to $1.288.

- Sui value may additionally attain $2 this 2023.

- SUI’s bearish market value prediction for 2023 is $0.6517.

Ever since its launch, SUI has caught the eye of the crypto neighborhood, and the demand could possibly be noticed throughout numerous digital public spheres. Sui describes itself as an progressive, decentralized Layer 1 blockchain that “redefines asset possession.” Sui goals to offer a versatile community, enhancing the velocity and decreasing the price of charges.

As Sui hopes to unfold throughout numerous initiatives and people, it may have an effect on its native token. SUI, the native token of Sui, is utilized as a method to pay for gasoline. Furthermore, SUI holders can stake their tokens and achieve voting energy. Nonetheless, whether or not its upcoming developments would drive the value of SUI upwards or downwards?

Let’s now take an in depth have a look at the SUI community’s operations and its native token, SUI. Furthermore, this text will conduct a complete evaluation of SUI and forecast the value for 2023, 2024, 2025, 2026, until 2050.

Sui (SUI) Market Overview

| 🪙 Title | Sui |

| 💱 Image | sui |

| 🏅 Rank | #92 |

| 💲 Worth | $0.712582 |

| 📊 Worth Change (1h) | 0.08415 % |

| 📊 Worth Change (24h) | -2.98066 % |

| 📊 Worth Change (7d) | 6.2451 % |

| 💵 Market Cap | $466787497 |

| 📈 All Time Excessive | $2.16 |

| 📉 All Time Low | $0.557963 |

| 💸 Circulating Provide | 654546805.846 sui |

| 💰 Complete Provide | 10000000000 sui |

What’s Sui (SUI)?

Sui describes itself as an progressive, decentralized Layer 1 blockchain that “redefines asset possession.” Sui goals to offer a versatile community, enhancing the velocity and decreasing the price of charges. Furthermore, Sui makes use of the consensus mechanism of delegated Proo-of-Stake (dPoS) blockchain. Sui was written in Rust and helps sensible contracts that had been written in Sui Transfer.

Sui Transfer is a local programming language for the community, aimed to assist blockchain builders to construct purposes with enhanced efficiency, safety, and wealthy options. Furthermore, Sui Transfer was an enchancment based mostly on the Transfer language.

Moreover, Sui has an object-centric design method that makes use of objects as its primary unit of knowledge storage. The builders may outline, create, and handle these objects. Among the many many options, the item makes use of distinct attributes corresponding to possession, and the values can be up to date based mostly on the “governing logic of the sensible contract that created it.”

SUI is the native token of the Sui community. SUI is used to pay charges and execute transactions inside the community. Furthermore, SUI holders can stake their tokens with validators within the dPoS mannequin and improve the safety of the community. SUI holder additionally earns the fitting to take part within the voting on-chain proposal which decides the protocol upgrades and different Sui governance adjustments.

Sui hopes to create “transformative experiences” for numerous industries and people. Within the gaming business, Sui hopes to remodel the gaming expertise via the introduction of expressive sensible contracts. Sui additionally hopes to develop the Finance sector by enabling immediate peer-to-peer funds and asset transfers. Lastly, Social networks constructed on Sui will permit media, posts, and interactions to be owned by their creator and verifiable by customers.

Sui Present Market Standing

SUI is ranked within the 65 place based mostly on its market capitalization, in accordance with CoinMarketCap. The present circulating provide of the SUI community’s native token is 654,546,806 SUI, whereas its complete provide is 10,000,000,000.

Furthermore, SUI is priced at $0.7406, experiencing an 8.58% surge in seven days. With a market cap of $484,779,563, SUI additionally witnessed a 3.58% spike in 24 hours. Furthermore, SUI is experiencing a fall in its demand because the buying and selling quantity, valued at $362,907,991, skilled a fall of 16.96%% in at some point.

A number of the crypto exchanges for buying and selling SUI are at present Binance, OKX, CoinW, Bybit, and Bitget.

Now, let’s dive additional and talk about the value evaluation of the Sui community’s native token, SUI, for 2023.

Sui Worth Evaluation 2023

Will SUI’s most up-to-date enhancements, additions, and modifications assist the value of cryptocurrencies rise? Furthermore, would the adjustments within the blockchain business have an effect on SUI’s sentiment over time? Learn extra to seek out out about SUI’s 2023 value evaluation.

Sui Worth Evaluation – Bollinger Bands

The Bollinger Bands is a technical evaluation device that’s used to research value motion and volatility. Bollinger Bands (BB) makes use of the time interval and the stand deviation of the value. Usually, the default worth of BB’s interval is about at 20. The higher band of the BB is calculated by including 2 occasions the usual deviations to the Easy Transferring Common (SMA), whereas the decrease band is calculated by subtracting 2 occasions the usual deviation from the SMA. Based mostly on the empirical regulation of ordinary deviation, 95% of the information units will fall inside the two commonplace deviations of the imply.

Observing the previous value actions, SUI was buying and selling in a risky market because the bands expanded frequently. Furthermore, the candlesticks touched the higher and decrease band a number of occasions which brought on value retracements and corrections. In the course of the risky market, SUI dropped from $1 to $0.5.

The lately shaped candlesticks are testing the higher band of the Bollinger Band because the bands proceed to increase. Presently, the decrease band is positioned horizontally and acts as a help degree for SUI. In the meantime, the higher band continues to maneuver upwards. Furthermore, the BBW indicator additionally confirms that the band could increase over time because it pointed upwards. SUI could proceed to commerce close to the higher band earlier than going through a retracement.

Sui Worth Evaluation – Relative Power Index

The Relative Power Index (RSI) is a momentum indicator utilized to seek out out the present pattern of the value motion and decide whether it is within the oversold or overbought area. Merchants usually use this device to make selections about when to purchase or promote the tokens. When the RSI is usually valued beneath or at 30, it’s thought-about an oversold area, and a value correction may occur quickly. Furthermore, when the RSI is valued above or at 70, it’s thought-about because the overbought area, and merchants count on the value may fall quickly.

There’s a bearish divergence noticed within the chart because the candlesticks present an equal excessive formation, whereas the RSI indicators shaped decrease lows. This could possibly be thought-about a bearish sign, indicating that bulls have exhausted their energy. Furthermore, the bearish crossover additionally shaped could possibly be one other affirmation that SUI’s value could drop.

The Stoch RSI, which is extra delicate to the costs, shaped a bearish crossover, earlier. Presently, the Stoch RSI continues to maneuver downwards away from the SMA. Analyzing these two indicators, SUI’s value retracement could possibly be occurring quickly as one of many latest spikes made the altcoin attain the overbought area. The brand new upcoming value retracement which will occur could possibly be a response to the overbought spike.

Sui Worth Evaluation – Transferring Averages

Earlier, SUI was buying and selling beneath the 50SMA, which could possibly be thought-about as a bearish motion. Nonetheless, lately, the candlesticks crossed past the 200SMA and 50SMA even earlier than the golden cross occurred. Whereas some merchants speculate that this bull run could possibly be shortlived, there’s nonetheless an opportunity {that a} bullish crossover(golden cross) could occur in the long term. There may be additionally one other probability that the SMA’s may miss the assembly level.

Taking a look at short-term indicators, the 10SMA and the 20SMA shaped a bullish crossover, confirming an uptrend. Furthermore, the 10SMA and the SMA lately broke past the 200SMA degree, which could possibly be an additional affirmation that SUI may expertise an uptrend sentiment. Nonetheless, with the lately shaped purple candlestick, there’s nonetheless an unclear path for SUI, and requires additional alerts.

Sui Worth Evaluation – Transferring Averages Convergence Divergence (MACD)

The Transferring Common Convergence Divergence (MACD) indicator can be utilized to determine potential value tendencies, momentums, and reversals in markets. MACD will simplify the studying of a transferring common cross simpler. The MACD indicator is calculated by subtracting the long-term EMA (Exponential Transferring Common) indicator from the short-term EMA. Usually, the default values for the MACD are set at 12-day EMA, 26-day EMA, and 9-day EMA. Furthermore, MACD is taken into account a lagging indicator because it can not present commerce alerts with none previous value information. MACD performs an essential position as it might verify the tendencies and determine potential reversals.

The MACD line is above the sign line, indicating a bullish sign. Nonetheless, the MACD line may quickly contact the sign line, which may point out {that a} bearish crossover could occur quickly. The inexperienced bars on the histogram can be decreasing, one other affirmation that SUI may face falls quickly. Nonetheless, there’s a probability that MACD would by no means kind a bearish crossover additionally. Merchants want to attend for alerts earlier than deciding on the entry.

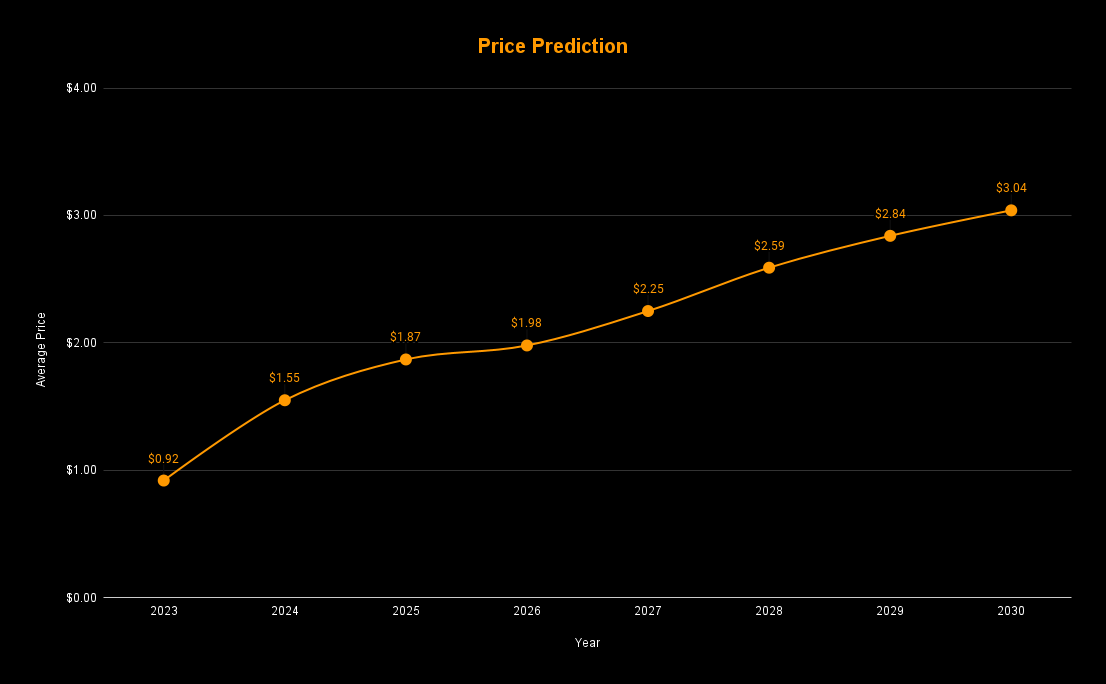

Sui Worth Prediction 2023-2030 Overview

| Yr | Minimal Worth | Common Worth | Most Worth |

| 2023 | $0.65 | $0.92 | $1.28 |

| 2024 | $1.17 | $1.55 | $1.80 |

| 2025 | $1.68 | $1.87 | $2.04 |

| 2026 | $1.86 | $1.98 | $2.28 |

| 2027 | $2.01 | $2.25 | $2.43 |

| 2028 | $2.30 | $2.59 | $2.79 |

| 2029 | $2.61 | $2.84 | $3.12 |

| 2030 | $2.76 | $3.04 | $3.35 |

| 2040 | $3.96 | $4.06 | $4.27 |

| 2050 | $7.42 | $7.65 | $7.89 |

Sui Worth Prediction 2023

The chart highlights that SUI is at present buying and selling beneath the minor resistance degree factors after failing to cross past it. SUI must cross each the minor resistance ranges earlier than fascinated with a restoration to the foremost key resistance. The ADX’s worth of 41, addresses that SUI could possibly be stating that the pattern’s energy is fairly sturdy.

If SUI is going through a bearish pattern, then, the altcoin must cease on the 200SMA which is the important help area. If it fails to carry on to that area, then, the final help area can be at $0.6478. Though the RSI is falling, if it bounces away after touching the impartial zone, there’s a probability that SUI may transfer upwards.

In the meantime, the value prediction of SUI for 2023 stays to be bullish and is anticipated to achieve past the extent of $1.288. The bearish value prediction vary for SUI is between $0.6478 to $0.6517. Nonetheless, if SUI experiences excessive bullish sentiment, then it will attain the $2 degree.

| Bullish Worth Prediction | Bearish Worth Prediction |

| $1.032 – $1.288 | $0.6478 – $0.6517 |

Sui Worth Prediction 2024

Merchants are trying ahead to this 12 months because it could possibly be a historic second for cryptocurrencies, because the Bitcoin halving is anticipated to occur in 2024. More often than not, every time BTC rises, merchants have noticed an analogous surge within the altcoins. SUI is also affected by Bitcoin halving and will commerce past the value of $1.8 by the top of 2024.

Sui Worth Prediction 2025

SUI may nonetheless expertise the after-effects of the Bitcoin halving and is anticipated to commerce above its 2024 value. Many commerce analysts speculate that BTC halving may create a huge effect on the crypto market. Furthermore, just like many altcoins, SUI will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that SUI would commerce past the $2.04 degree.

Sui Worth Prediction 2026

It’s anticipated that after an extended interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, SUI may tumble into its help area of $1.94. Furthermore, when SUI stays within the oversold area, there could possibly be a value correction quickly. SUI, by the top of 2026, could possibly be buying and selling past the $2.28 resistance degree after experiencing the value correction.

Sui Worth Prediction 2027

Naturally, merchants count on a bullish market sentiment after the crypto business was affected negatively by the bears’ claw. SUI is anticipated to rise after its slumber within the bear season. Furthermore, SUI may even break extra resistance ranges because it continues to get well from the bearish run. Due to this fact, SUI is anticipated to commerce at $2.43 by the top of 2027.

Sui Worth Prediction 2028

As soon as once more, the crypto neighborhood is trying ahead to this 12 months as there will probably be a Bitcoin halving. Alike many altcoins, SUI will proceed to kind new greater highs and is anticipated to maneuver in an upward trajectory. Therefore, SUI can be buying and selling at $2.79 after experiencing an enormous surge by the top of 2028.

Sui Worth Prediction 2029

2029 is anticipated to be one other bull run because of the aftermath of the BTC halving. Nonetheless, merchants speculate that the crypto market would step by step develop into steady by this 12 months. In tandem with the steady market sentiment and the slight value surge anticipated after the aftermath, SUI could possibly be buying and selling at $3.12 by the top of 2029.

Sui Worth Prediction 2030

After witnessing a bullish run out there, SUI and plenty of altcoins would present indicators of consolidation and may commerce sideways for a while whereas experiencing minor spikes. Due to this fact, by the top of 2030, SUI could possibly be buying and selling at $3.35.

Sui Worth Prediction 2040

The long-term forecast for SUI signifies that this altcoin may attain a brand new all-time excessive(ATH). This might be one of many key moments as HODLERS could count on to promote a few of their tokens on the ATH level. Nonetheless, SUI could face a slight fall earlier than beginning its upward journey as soon as once more. It’s anticipated that the value of SUI may attain $4.27 by 2040.

| Minimal Worth | Common Worth | Most Worth |

| $3.96 | $4.06 | $4.27 |

Sui Worth Prediction 2050

The neighborhood believes that there will probably be widespread adoption of cryptocurrencies, which may preserve gradual bullish positive factors. By the top of 2050, if the bullish momentum is maintained, SUI may surpass the resistance degree of $7.89.

| Minimal Worth | Common Worth | Most Worth |

| $7.42 | $7.65 | $7.89 |

Conclusion

To summarize, if buyers proceed to point out curiosity in SUI and add these tokens to their portfolio, then, it may proceed to stand up. SUI’s bullish value prediction exhibits that it may go past the $1.532 degree. Furthermore, SUI may surpass the $7.89 degree by the top of 2050.

FAQ

Sui describes itself as an progressive, decentralized Layer 1 blockchain that “redefines asset possession.” Sui goals to offer a versatile community, enhancing the velocity and decreasing the price of charges. Furthermore, Sui makes use of the consensus mechanism of delegated Proo-of-Stake (dPoS) blockchain. Sui was written in Rust and helps sensible contracts that had been written in Sui Transfer.

SUI may be traded on many exchanges corresponding to Binance, OKX, CoinW, Bybit, and Bitget.

SUI’s ecosystem has numerous potentials, thus, it may drive its native token’s value upwards. If SUI continues to showcase a bullish sentiment, then, the altcoin may commerce at $4 by 2040.

The utmost provide of the SUI is 10,000,000,000.

SUI’s Mainnet was launched on Could 3, 2023.

SUI may be saved in a chilly pockets, sizzling pockets, or alternate pockets.

Mysten Labs is the unique contributor to Sui.

SUI is anticipated to achieve $1.288 in 2023.

SUI is anticipated to achieve $1.8 in 2024.

SUI is anticipated to achieve $2.04 in 2025.

SUI is anticipated to achieve $2.28 in 2026.

SUI is anticipated to achieve $2.43 in 2027.

SUI is anticipated to achieve $2.79 in 2028.

SUI is anticipated to achieve $3.12 in 2029.

SUI is anticipated to achieve $3.35 in 2030.

SUI is anticipated to achieve $4.27 in 2040.

SUI is anticipated to achieve $7.89 in 2050.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this value prediction, are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates won’t be held chargeable for any direct or oblique injury or loss.