- SUI’s value has climbed by over 80% within the final seven days.

- Following the expansion pattern within the altcoin market, SEI has recorded a 16% uptick.

- Nevertheless, SEI’s MACD indicator hints at the opportunity of a decline.

SUI and SEI are two altcoins whose values have climbed considerably within the final week. In line with information from CoinMarketCap, SUI’s value has risen by 85% within the final seven days to rank because the crypto asset with essentially the most positive factors throughout that interval. At press time, the coin exchanged arms at $1.42.

Conversely, SEI has seen its worth climb by 16% throughout the identical interval. As of this writing, the coin traded at $0.72.

Demand Pushes SUI Up

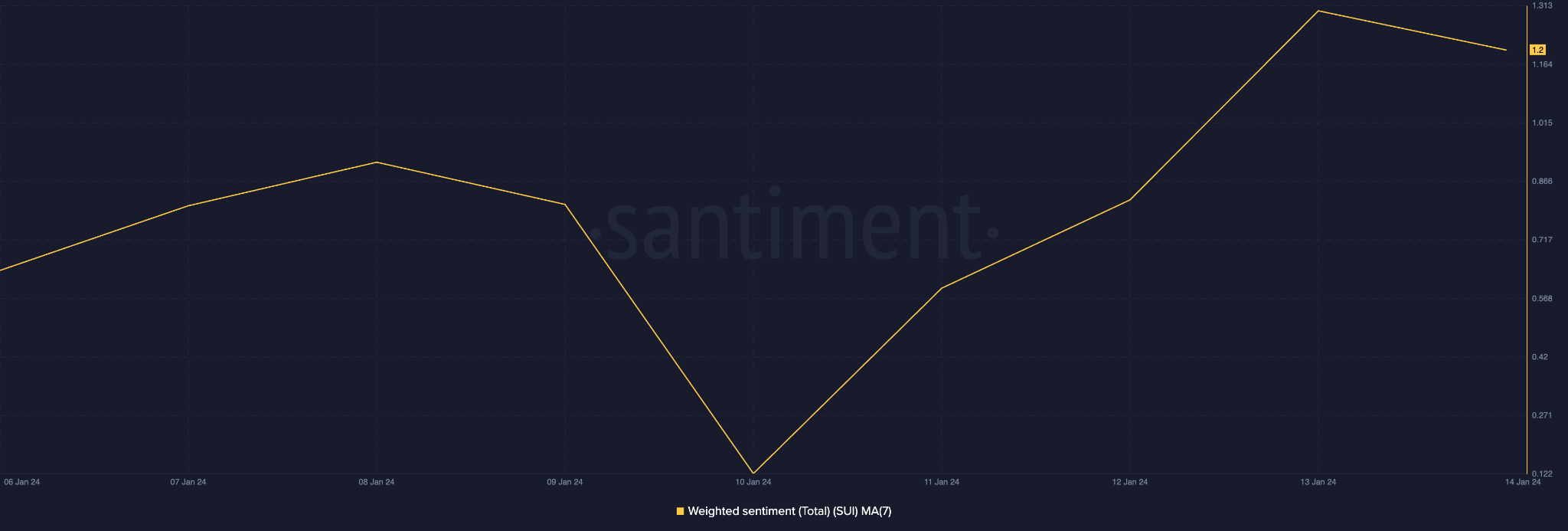

SUI’s weighted sentiment noticed on a seven-day transferring common confirmed that the coin continues to get pleasure from a bullish momentum, in response to information from Santiment. This has offered itself within the type of elevated accumulation for the altcoin.

The coin’s key momentum indicators revealed that regardless of the double-digit rise in SUI’s worth within the final week, merchants proceed to favor coin accumulation. For instance, SUI’s Relative Power Index (RSI) was 77.35, whereas its Cash Move Index (MFI) was 81.93.

Confirming the power of the present bullish pattern, SUI’s Aroon Up Line (orange) was 100%. This indicator is used to determine pattern power and potential pattern reversal factors in a crypto asset’s value motion. When the Aroon Up line is near 100, it signifies that the uptrend is robust and that the newest excessive was reached comparatively just lately.

Nevertheless, it’s trite to notice that at SUI’s RSI and MFI ranges, the market is usually deemed to be overbought. Patrons’ exhaustion is typical; therefore, a reversal could be on the horizon.

SEI Sees Elevated Accumulation, However There’s a Catch

SEI’s value noticed on a every day chart additionally revealed an uptick in coin accumulation. Its RSI and MFI rested at 60.88 and 81.44, respectively.

Nevertheless, regardless of its value rally, readings from the coin’s Transferring Common Convergence Divergence (MACD) confirmed that SEI’s market remained affected by bearish sentiment.

This confirmed that the value rally and the uptick in coin accumulation merely mirror the overall progress within the altcoin market post-ETF approval.

In line with SEI’s MACD indicator, its MACD line crossed under the pattern line on 11 January, inflicting the indicator to return solely purple histogram bars since then.

When an asset’s MACD line crosses under its pattern line on this method, it suggests the graduation of a brand new bear cycle.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version isn’t liable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.