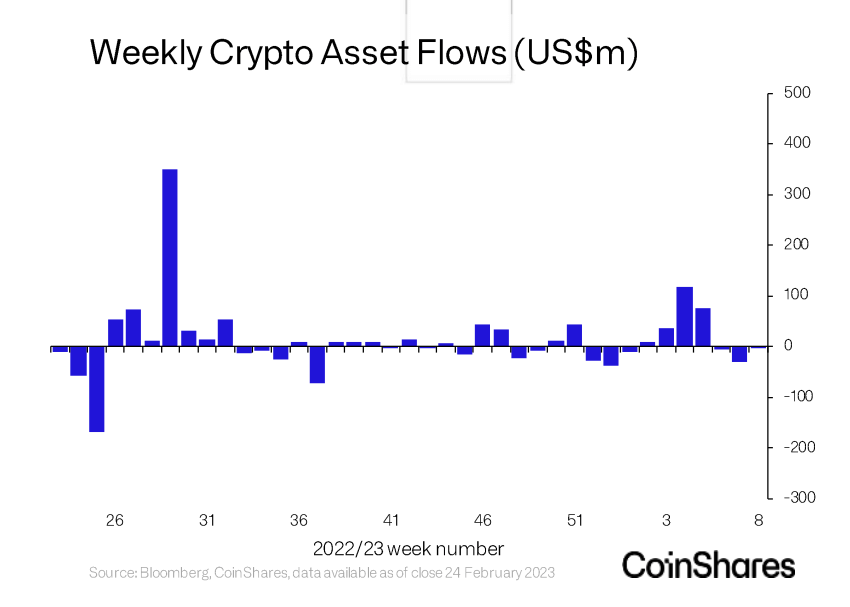

The crypto business has but to exit a interval of heightened volatility as asset outflows stay the dominant market development.

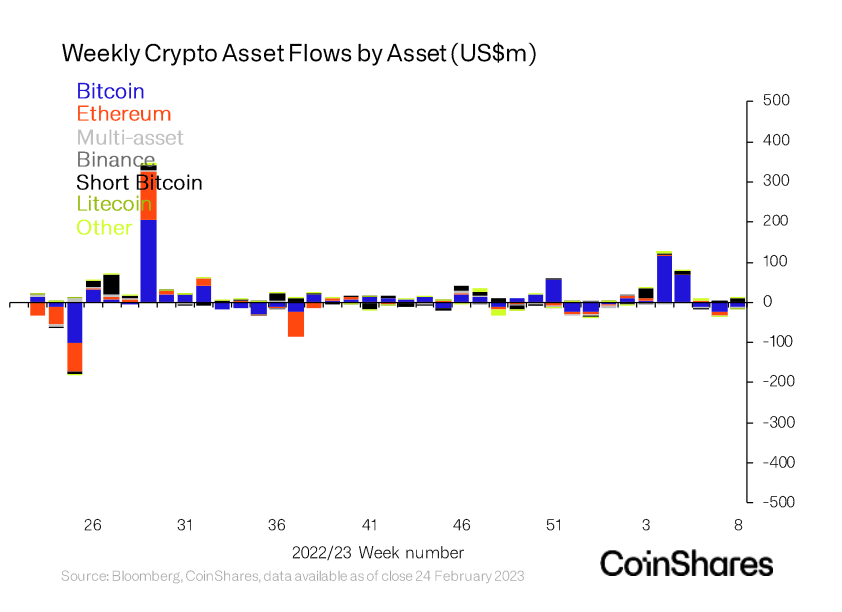

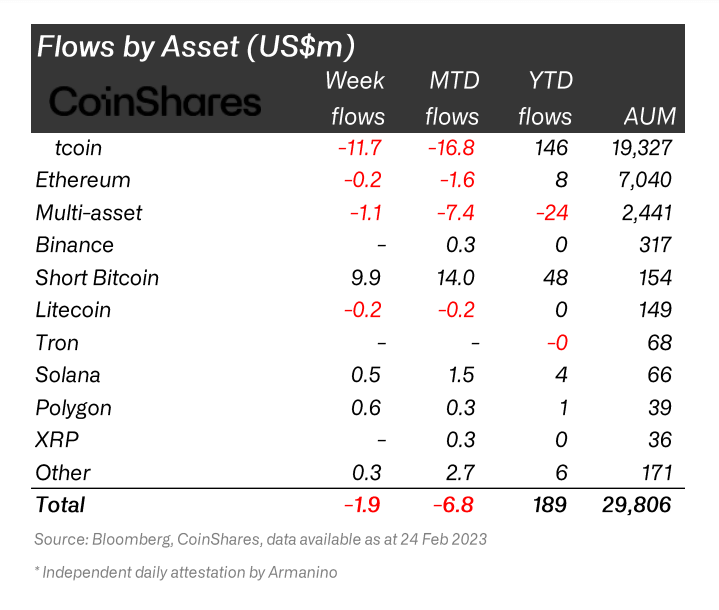

Regardless of its slowly rising worth, Bitcoin noticed outflows for the third week in a row. Information from CoinShares confirmed that the outflows totaled $12 million final week — whereas inflows reached $10 million.

Whereas the $2 million in outflows isn’t noteworthy, the quantity of inflows is. The whole thing of the $10 million in inflows was into digital asset funding merchandise shorting Bitcoin.

Ethereum remained unscathed — seeing solely $200,000 of outflows previously week — whereas minor inflows had been seen in Polygon (MATIC), Solana (SOL), and Cardano (ADA).

The rise in short-bitcoin inflows will be attributed to elevated unfavourable sentiment within the U.S. Traders within the nation have grow to be more and more nervous following the coveted FOMC assembly final week, because the Federal Reserve launched stronger-than-expected macro information.

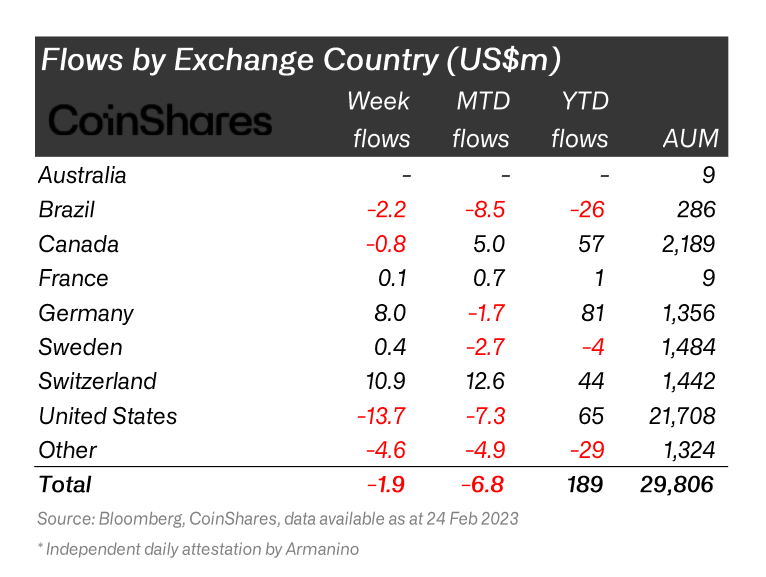

The huge distinction between the outflows seen within the U.S. and the remainder of the world will be attributed to the U.S. market’s sensitivity to regulatory crackdowns. Much less regulated markets are much less prone to see important outflows or a rise in brief positions following bulletins or enforcement from authorities companies.

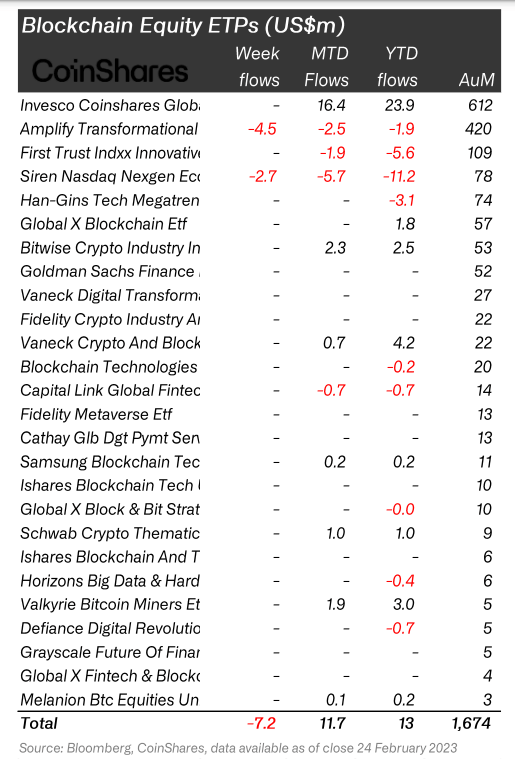

That is evident in blockchain shares — a regulated product accessible to traders within the U.S. and Canada. Unfavourable sentiment additionally hit them, resulting in $7.2 million in outflows.

Since reaching their peak in November 2021, publicly-listed blockchain corporations have grow to be more and more delicate to broader market actions. Most publicly-listed blockchain corporations are centered on development — which means that even the slightest adjustments in rates of interest depart them weak and vulnerable to volatility.