- Bullish Stream (FLOW) worth prediction ranges from $0.6536 to $3.200

- Evaluation means that the FLOW worth may attain above $3 quickly.

- The FLOW bearish market worth prediction for 2023 is $0.65.

Stream is a blockchain challenge that was launched as a complement to the Ethereum blockchain. Its native token FLOW is used within the cost of transaction charges inside the Stream community.

Stream buyers are bullish on the token because it has had a return on funding (ROI) of over 26 instances up to now 2 years. The crypto growth of 2021, led to the value enhance in FLOW to its current all-time excessive (ATH) of $46.16 which was attained in April 2021. Regardless of the latest crypto winter in 2022, FLOW buyers are assured that the way forward for FLOW is bullish.

If you’re excited about the way forward for Stream (FLOW) and would wish to know the value evaluation and worth prediction of FLOW for 2023, 2024, 2025, 2026, as much as 2030, preserve studying this CoinEdition article.

Stream (FLOW) Market Overview

| 🪙 Identify | Stream |

| 💱 Image | circulation |

| 🏅 Rank | #55 |

| 💲 Value | $0.923935 |

| 📊 Value Change (1h) | 0.81149 % |

| 📊 Value Change (24h) | 0.78103 % |

| 📊 Value Change (7d) | -13.44143 % |

| 💵 Market Cap | $954821316 |

| 📈 All Time Excessive | $42.4 |

| 📉 All Time Low | $0.646701 |

| 💸 Circulating Provide | 1036200000 circulation |

| 💰 Whole Provide | 1427854705.5 circulation |

What’s Stream (FLOW)?

Stream is a developer-friendly decentralized layer-one blockchain that’s designed as the muse for a brand new technology of video games, apps, and digital property.

Stream (FLOW) was launched in 2020 by the creators of CryptoKitties. It’s current in each Stream and Ethereum blockchains. The circulation group is made up of Web3 builders and creators of high manufacturers.

A few of the high companions within the Stream community are Rarible, Shopify, Gaia, Blocto, Everlasting, Alchemy, and Mint. Instagram, Mixi, and others. It has a $725 ecosystem fund as grants to builders that want to construct on the Stream blockchain.

The Stream blockchain makes use of HotStuff which is without doubt one of the greenest Proof-of-Stake mechanisms to decrease the emission of carbon in minting non-fungible tokens (NFTs). This provides a singular multi-node structure to its consensus mechanism, subsequently, growing the throughput, environmental friendliness, and pace of the community in contrast to different Sharding and layer 2 platforms.

On the circulation blockchain, the creation of a Good Person Account provides decentralized purposes (DApps) and wallets the power to get well misplaced keys of their customers. That is in contrast to what’s obtainable in most blockchains. Its human-readable safety ensures that customers are protected against malicious apps.

Stream Present Market Standing

The utmost provide of Stream (FLOW) is unknown whereas its circulating provide is 1,036,200,000 FLOW cash based on CoinMarketCap. On the time of writing, FLOW is buying and selling for $0.9563 which represents 24 hours enhance of 4.66%. The buying and selling quantity of Stream up to now 24 hours is $44,072,523 which represents a 3.54% enhance.

A few of the high cryptocurrencies for buying and selling Stream (FLOW) are Binance, Kraken, Coinbase, Kucoin, Gate.io, and others.

Now that you’ve got recognized what FLOW is and its present market standing, we will focus on the value evaluation of Stream (FLOW) for 2023.

Stream Value Evaluation 2023

At the moment, FLOW is ranked within the 52nd place on CoinMarketCap. Will developments and upgrades inside the Stream group result in rising within the worth of Stream (FLOW)? We will see this on this Coin Version worth evaluation 2023 article.

Stream Value Evaluation – Keltner Channel

The Keltner channel is a technical indicator launched by American grain dealer, Chester W. Keltner to gauge the volatility of the market. For this objective, it has three bands; the Higher band, Center band (EMA), and decrease band.

The higher band is calculated by including twice the Common True Vary (ATR) to the EMA (center band), whereas the decrease band is calculated by subtracting twice the ATR from the EMA. Furthermore, the Keltner bands is also used to find out the course of the value motion.

The chart above reveals two pink rectangles that denote the growth and contraction of the Keltner channels. When the bands widen it means that there’s going to be extra volatility. Or in different phrases, the costs may drastically drop or enhance. When the bands squeeze, there may very well be much less volatility. It’s because the vary of fluctuation can be restricted and the costs shall be constrained to maneuver sideways.

Moreover, when the value of a cryptocurrency repeatedly touches the higher or decrease band and thereafter touches the alternative band, (which is, if a cryptocurrency repeatedly touches the higher band and eventually touches the decrease band, then we may decide that the bullish pattern has light.) This is applicable vice-versa as properly. This conduct may very well be seen contained in the inexperienced rectangle.

At the moment, FLOW is testing the decrease band, therefore, there may very well be a pattern reversal awaiting FLOW. Since that is the preliminary stage of testing the decrease band, we may count on FLOW to check the decrease band just a few extra instances earlier than the pattern reverses.

Nonetheless, though it’s onerous to adjudicate when the pattern reversal may happen, it’s extra possible that FLOW could rise in worth and transfer towards the center band. If the Bulls are robust, then FLOW may transfer into the primary half of the Keltner channel.

Moreover, because the bands are constricting, the value fluctuation may very well be restricted even within the occasion of a pattern reversal. Merchants could wish to think about this and focus extra on quantity to benefit from this state of affairs.

Stream Value Evaluation – Bollinger Bands

The Bollinger bands are a kind of worth envelope developed by John Bollinger. It provides a spread with an higher and decrease restrict for the value to fluctuate. The Bollinger bands work on the precept of normal deviation and interval (time). The higher band as proven within the chart is calculated by including two instances the usual deviation to the Easy Shifting Common whereas the decrease band is calculated by subtracting two instances the usual deviation from the Easy Shifting Common.

When this setup is utilized in a cryptocurrency chart, we may count on the value of the cryptocurrency to abide inside the higher and decrease bounds of the Bollinger bands 95% of the time.

The above thesis is derived from an Empirical regulation also called the three-sigma rule or the 68-95-99.7 which states that the majority noticed knowledge for a traditional distribution (regular scattering of information) will fall inside three normal deviations.

As such for an information set that follows a standard distribution, 68% of information will fall inside 1 normal deviation of the imply, whereas 95% of information for the conventional distribution will fall inside 2 normal deviations of the imply and 99.7% of information will fall inside 3 normal deviations of the imply.

Therefore, because the Bollinger bands are calculated utilizing two normal deviations, we may count on FLOW to abide inside the Bollinger bands 95% of the time. (i.e at any time when the cryptocurrency touched the higher band, the probabilities of it coming down are 95%.). This idea applies vice-versa as properly.

Furthermore, the sections highlighted by pink rectangles present how the bands develop and contract. When the bands widen, we may count on extra volatility, and when the bands contract, it denotes much less volatility. At the moment, the bands are opening up after being in a closed place.

This might point out that there’s going to be extra volatility for FLOW sooner or later. Since FLOW has touched the decrease band, the market may appropriate the value and FLOW may enhance in worth. This presents a superb alternative for these seeking to quick. Nonetheless, it’s critical to time the entry level to grab the chance.

Notably, the Bollinger Band behaves very intently with the Keltner channel. As an illustration, if you happen to have been to make use of each the Bollinger bands and Keltner channel indicators for a cryptocurrency, you’d see that just about more often than not each indicators overlap. Nonetheless, the one distinction between with Bollinger band and the Keltner channel is that the Bollinger bands use Customary Deviation whereas the Keltner channel makes use of Common True Vary for calculating its bands that are the highest and backside limits.

Stream Value Evaluation – Relative Energy Index

The Relative Energy Index is an indicator that’s used to search out out whether or not the value of a safety is overvalued or undervalued. As per its identify, RSI indicators assist decide how the safety is doing at current, relative to its earlier worth.

Furthermore, it has a sign line which is a Easy Shifting Common (SMA) that acts as a yardstick or reference to the RSI line. Therefore, at any time when the RSI line is above the SMA it’s thought of bullish and if it’s beneath the SMA then it’s bearish.

When contemplating the primary inexperienced rectangle from the left of the chart beneath we will see that the RSI line (purple) is above the Sign line (yellow). As such, FLOW is bullish or gaining worth as its making larger highs. The second inexperienced rectangle reveals that the RSI is beneath the sign. Therefore, FLOW is bearish as it’s making decrease lows.

At the moment, the RSI is beneath the Sign line. Nonetheless, the RSI is at 44.23 and is tilting upwards, therefore, we may count on the FLOW costs to extend.

Furthermore, the RSI compares the features of the securities in opposition to the losses it made up to now. This ratio of features in opposition to the losses is then deducted from the 100.

If the reply is lower than 30, then we name that the value of the safety is within the oversold area. Which means that many are promoting the safety available in the market, and as such the safety is undervalued. Furthermore, as per the Provide-demand curve principle, the value is meant to drop when there is a rise in provide.

If the reply is greater than 70 then the safety is overbought as many are shopping for. Since many wish to purchase the safety the demand will increase which intuitively will increase the costs.

Moreover, the RSI may very well be used to find out how robust a pattern is. As an illustration, when a cryptocurrency is bullish or reaching larger highs, then the RSI line additionally needs to be making larger highs in unison.

As an illustration, if the RSI is making decrease highs when the cryptocurrency is making larger highs, then we could say that though the token/coin is on a bullish pattern it’s shedding worth. As such, there may very well be a pattern reversal sooner or later.

Nonetheless, the RSI may additionally give false alarms for breakouts. Though we could count on, the costs to retrace if it goes to the oversold or overbought area, the costs can also keep within the oversold or overbought area for an prolonged interval. As such, merchants needs to be cautious of it and let the market saturate earlier than making important selections.

Stream Value Prediction – Shifting Averages

The Exponential Shifting averages are fairly much like the easy transferring averages (SMA). Nonetheless, the SMA equally distributes down all values whereas the Exponential Shifting Common provides extra weightage to the present costs. Since SMA undermines the weightage of the current worth, the EMA is utilized in worth actions.

The 200-day MA is taken into account to be the long-term transferring common whereas the 50-day MA is taken into account the short-term transferring common in buying and selling. Primarily based on how these two traces behave, the power of the cryptocurrency or the pattern may be decided on common.

Specifically, when the short-term transferring common (50-day MA) approaches the long-term transferring common (200-day MA) from beneath and crosses it, we name it a Golden Cross. Contrastingly, when the short-term transferring common crosses the long-term transferring common from above then, a dying cross happens.

Often, when a Golden Cross happens, the costs of the cryptocurrency will shoot up drastically, however when there’s a Demise Cross, the costs will crash.

Every time the value of cryptocurrency is above the 50-day or 200-day MA, or above each we could say that the coin is bullish. Contrastingly, if the token is beneath the 50-day or 200-day, or beneath each, then we may name it bearish (Inexperienced triangle part).

When contemplating the pink rectangle, FLOW was above the 50-day MA. Therefore lets say that it was bullish within the quick time period. Nonetheless, FLOW is at present testing the 50-day after falling beneath each transferring averages. Furthermore, the 50-day MA and the 200-day MA are in shut quarters, however they’re parallel to one another. Nonetheless, if the 50-day MA approaches the 200-day MA above it, then a Golden cross may happen.

If the previous occurs, then FLOW costs may surge dramatically. This may give sufficient momentum to FLOW to interrupt above each transferring averages.

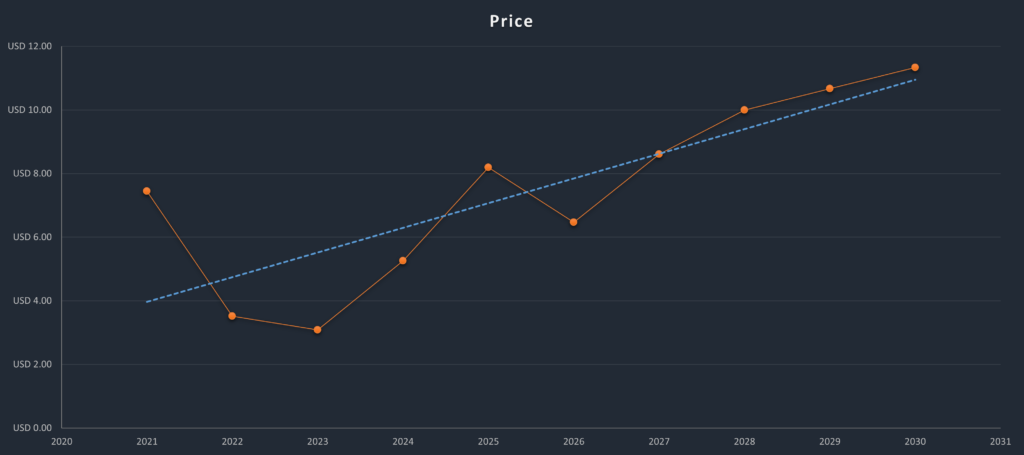

Stream Value Prediction 2023 – 2030 Overview

| 12 months | Minimal Value | Common Value | Most Value |

| 2023 | $1.25 | $3.09 | $4.15 |

| 2024 | $4.45 | $5.26 | $6.135 |

| 2025 | $7.150 | $8.19 | $9.125 |

| 2026 | $5.147 | $6.47 | $ 7.75 |

| 2027 | $7.95 | $8.61 | $9.162 |

| 2028 | $9.78 | $10.00 | $10.5 |

| 2029 | $10.58 | $10.67 | $11.29 |

| 2030 | $11.32 | $11.33 | $15.19 |

| 2040 | $24 | $28 | $30 |

| 2050 | $36 | $38 | $40 |

Stream Value Prediction 2023

When trying on the chart above we may see that FLOW traded taking the form of a head and shoulders sample from June 2022 to November 2022. In the course of the formation of this sample, FLOW examined Resistance 3 ≈ at $3.086 with the formation of its head whereas each its shoulders examined Resistance 2 at ≈$2.123. However simply after forming the proper shoulder FLOW descended and reached Assist 1 at ≈ $ 0.653 in December.

As such FLOW is at present buying and selling between Resistance 1 and Assist 1. Apparently, it has fashioned one other head and shoulders sample inside these previous resistance and assist zone. Nonetheless, the latter head and shoulders sample appears to be shrunk.

However the query is, simply as FLOW decreased in worth after forming the final head and shoulders sample, will FLOW fall this time once more after forming the proper shoulder? If it does fall it might resort the help of Assist 1. If Assist 1 involves FLOW’s rescue, then the token may rebound off of Assist 1 and transfer sideways.

Nonetheless, the autumn of FLOW is negated by the Bollinger bands as FLOW has touched the decrease band and is due for a reversal —upwards motion.

If FLOW is to extend it might check Resistance 1 at ≈$1.8 however earlier than its assessments Resistance 1 there lies a weak Resistance at ≈$1.5, which can intrude FLOW’s path.

There lies one other chance the place FLOW may break Resistance 1 and check Resistance 2 at ≈$2.123. Nonetheless, with an impending Golden Cross, we may even count on FLOW to interrupt Resistance 1 and a couple of and attain Resistance 3 at ≈ $3.1.

Stream Value Prediction – Resistance and Assist Ranges

When trying on the chart above we may see how FLOW was sandwiched between the pattern line and the surface of the arc since August 2021 to early 2022. Nonetheless, Resistance 1 which then acted as a Assist helped FLOW acquire momentum. As such FLOW was capable of decelerate its crashing costs. As such FLOW which was fluctuating beneath the arc was capable of break the arc and commerce inside it as proven within the chart.

Had not FLOW acquired assist from Resistance 1 which acted as a Assist to FLOW on its means, then FLOW would have taken the trail as proven by the yellow damaged traces.

Nonetheless, due to Resistance 1 that retarded FLOW’s crash. At the moment, FLOW has been closely relying on Assist 1 at $0.6. Since late June 2022, FLOW has been sustained by Assist 1.

Stream Value Prediction 2024

There shall be Bitcoin halving in 2024, and therefore we should always count on a optimistic pattern available in the market as a consequence of person sentiments and the hunt by buyers to build up extra of the coin. For the reason that Bitcoin pattern impacts the course of commerce of different cryptocurrencies, we may count on FLOW to commerce at a worth not beneath $5.26 by the top of 2024.

Stream Value Prediction 2025

FLOW should expertise the after-effects of the Bitcoin halving and is anticipated to commerce above its 2024 worth. Many commerce analysts speculate that BTC halving may create a big impact on the crypto market. Furthermore, much like many altcoins, FLOW will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that FLOW would commerce past the $8.19 stage.

Stream Value Prediction 2026

It’s anticipated that after a protracted interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, FLOW may tumble into its assist areas. Throughout this era of worth correction, FLOW may lose momentum and be somewhat beneath its 2025 worth. As such it may very well be buying and selling at $6.47 by 2026.

Stream Value Prediction 2027

Naturally, merchants count on a bullish market sentiment after the crypto business was affected negatively by the bears’ claw. Furthermore, the build-up to the following Bitcoin halving in 2028 may evoke pleasure in merchants. As such we may count on FLOW to commerce at round $8.61 by the top of 2027.

Stream Value Prediction 2028

Because the crypto group’s hope shall be re-ignited trying ahead to Bitcoin halving like many altcoins, FLOW will proceed to kind new larger highs and is anticipated to maneuver in an upward trajectory. Therefore, FLOW can be buying and selling at $10 after experiencing an enormous surge by the top of 2028.

Stream Value Prediction 2029

2029 is anticipated to be one other bull run because of the aftermath of the BTC halving. Nonetheless, merchants speculate that the crypto market would steadily change into steady by this yr. In tandem with the steady market sentiment and the slight worth surge anticipated after the aftermath, FLOW may very well be buying and selling at $10.67 by the top of 2029.

Stream Value Prediction 2030

After witnessing a bullish run available in the market, FLOW and plenty of altcoins would present indicators of consolidation and may commerce sideways and transfer downwards for a while whereas experiencing minor spikes. Subsequently, by the top of 2030, FLOW may very well be buying and selling at $11.33.

Stream Value Prediction 2040

The long-term forecast for FLOW signifies that this altcoin may attain a brand new all-time excessive(ATH). This could be one of many key moments as HODLERS could count on to promote a few of their tokens on the ATH level.

Nonetheless, FLOW could face a slight fall earlier than beginning its upward journey as soon as once more. It’s anticipated that the typical worth of FLOW may attain $28 by 2040.

Stream Value Prediction 2050

The group believes that there shall be widespread adoption of cryptocurrencies, which may keep gradual bullish features. By the top of 2050, if the bullish momentum is maintained, DOT may surpass the resistance stage of $38.

Conclusion

As mentioned above, the value of FLOW could even attain above $3.087 if buyers have determined that the cryptocurrency is an effective funding, together with mainstream cryptocurrencies.

FAQ

FLOW is the native token of the Stream blockchain.

Like different cryptocurrencies, Stream (FLOW) may be traded in cryptocurrency exchanges like Binance, Kraken, Kucoin, Gate.io, Bitfinex, and others.

Stream has a low chance of surpassing its current all-time excessive (ATH) worth of $46.16 in 2022.

It was launched in 2020.

Stream (FLOW) worth is anticipated to succeed in $25 by 2023.

Stream is anticipated to succeed in $5.26 by 2024.

Stream is anticipated to succeed in $8.19 by 2025.

Stream is anticipated to succeed in $6.47 by 2026.

Stream is anticipated to succeed in $8.61 by 2027.

Stream is anticipated to succeed in $10.00 by 2028.

Stream is anticipated to succeed in $10.67 by 2029.

Stream is anticipated to succeed in $11.33 by 2030.

Stream is anticipated to succeed in $28 by 2040.

Stream is anticipated to succeed in $38 by 2050.

Disclaimer: The views and opinions, in addition to all the data shared on this worth prediction, are printed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates is not going to be held responsible for any direct or oblique harm or loss.