- Bullish XLM worth prediction ranges from $0.1700 to $0.6900.

- Evaluation means that the XLM worth may attain $0.900.

- The XLM bearish market worth prediction for 2023 is $0.057.

What’s Stellar (XLM)?

Stellar is a blockchain mission that was launched in July 2014. Its native token is denoted with XLM.

Stellar buyers are bullish on the token because it guarantees a excessive return on funding (ROI) of over 61 instances previously 5 years. The crypto bubble of late December 2017 and early January 2018, led to the surge within the worth of XLM to its current all-time excessive (ATH) of $0.9381 in response to CoinMarketCap which was attained in January 2018. Regardless of the latest crypto winter, XLM buyers are assured that the way forward for XLM is bullish.

In case you are considering the way forward for Stellar (XLM) and want to know the value evaluation and worth prediction of XLM for 2023, 2024, 2025, 2030, 2040 and 2050 maintain studying this Coin Version article.

Stellar (XLM) Market Overview

| 🪙 Title | Stellar |

| 💱 Image | xlm |

| 🏅 Rank | #21 |

| 💲 Value | $0.163183 |

| 📊 Value Change (1h) | 0.46296 % |

| 📊 Value Change (24h) | 2.04102 % |

| 📊 Value Change (7d) | 3.49217 % |

| 💵 Market Cap | $4450999712 |

| 📈 All Time Excessive | $0.875563 |

| 📉 All Time Low | $0.00047612 |

| 💸 Circulating Provide | 27269529532.3 xlm |

| 💰 Complete Provide | 50001787265.5 xlm |

Analysts’ View on Stellar (XLM)

A crypto analyst by the identify of Cryptic Poet said that XLM was on the transfer contemplating its exponential rise. Furthermore, the chart embedded exhibits how XLM costs are based mostly above the 50-day and 200-day MA, which supplies it a bullish outlook.

Stellar (XLM) Present Market Standing

Stellar (XLM) has a circulating provide of 27,269,529,822 XLM cash, whereas its most provide is 50,001,806,812 XLM cash, in response to CoinMarketCap. On the time of writing, XLM is buying and selling at $0.164 representing 24 hours enhance of 1.32%. The buying and selling quantity of XLM previously 24 hours is $321,762,905 which represents a 3.89% lower.

Some prime cryptocurrency exchanges for buying and selling XLM are Binance, LBank, Bitget, Bybit, and BingX.

Now that you understand XLM and its present market standing, we will focus on the value evaluation of XLM for 2023.

Stellar (XLM) Value Evaluation 2023

At the moment, Stellar (XLM) ranks 165 on CoinMarketCap. Will XLM’s most up-to-date enhancements, additions, and modifications assist its worth go up? First, let’s concentrate on the charts on this article’s XLM worth forecast.

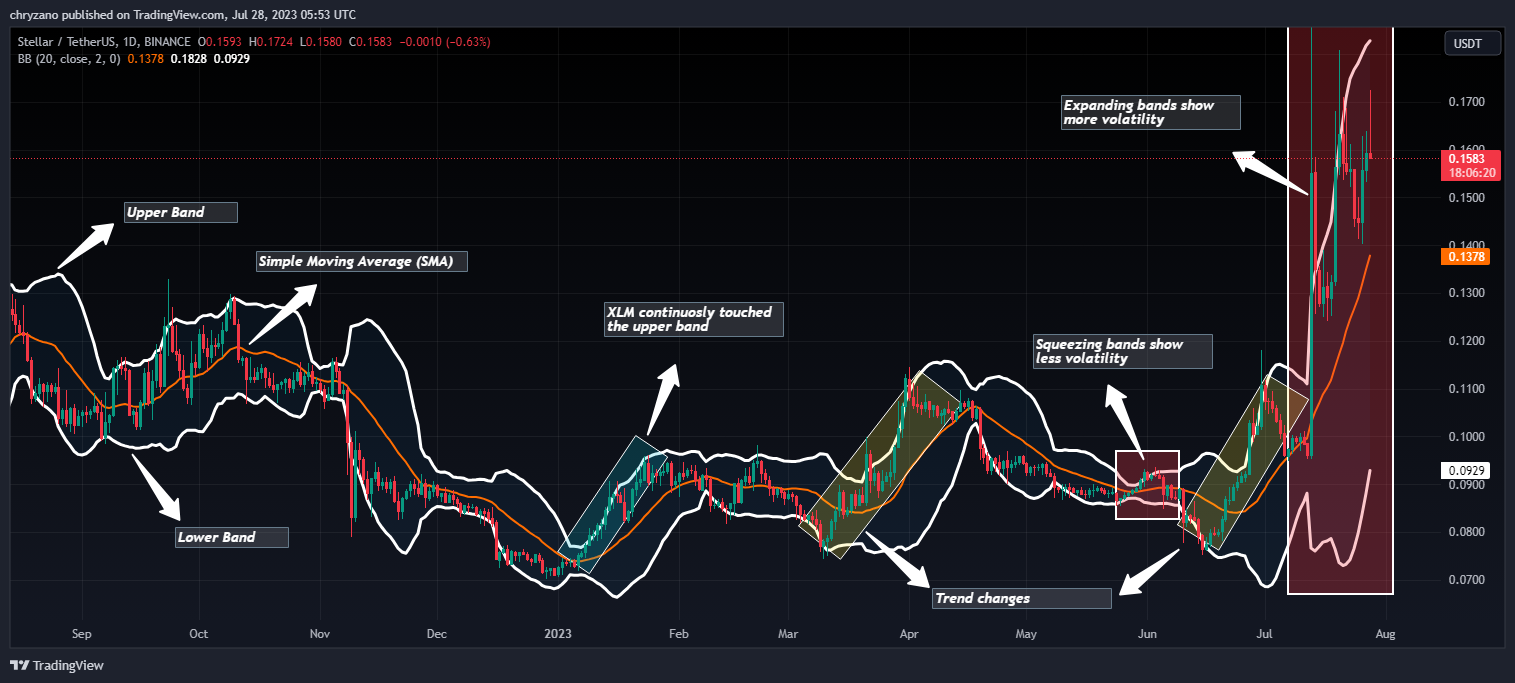

Stellar (XLM) Value Evaluation – Bollinger Bands

The Bollinger bands had been developed by John Bollinger. It consists of three bands, the higher band, the decrease band, and the Easy Transferring Common (SMA). The higher band provides a prime restrict and the decrease band provides a decrease restrict for the value to fluctuate whereas the SMA within the center is the common worth. The Bollinger bands work on the precept of ordinary deviation and interval (time).

When the bands widen, it exhibits there’s going to be extra volatility and after they contract, there may be much less volatility. When the value reaches the higher band the cryptocurrency is taken into account overbought, and, oversold when it reaches the decrease band. Furthermore, when the cryptocurrency reaches both of the bands, it has a 95% probability of retracing and heading in the wrong way.

The sections highlighted by pink rectangles within the chart above present how the bands broaden and contract. When the bands widen, we might anticipate extra volatility, and when the bands contract, it denotes much less volatility. The inexperienced rectangles present how XLM retraced after touching the higher band (oversold).

At the moment, the bands are increasing, as such, there appears to be extra volatility out there. The higher band is at $0.1828 whereas the decrease band is at $0.0928. At press time, the value of XLM is at $0.1586. XLM is at the moment buying and selling between the higher band and SMA.

Because the formation of an inverted candle was noticed on the time of writing, we might anticipate the value of XLM to rise towards the higher band. Moreover, there may be additionally an opportunity that XLM might rise whereas hugging onto the higher band.

The above thesis could possibly be justified by the truth that XLM has simply crossed the SMA and could possibly be shifting towards the higher band. As such, though within the shorter time-frames, there could possibly be a retracement, XLM could transfer up within the foreseeable future.

Stellar (XLM) Value Evaluation – Relative Energy Index

The Relative Energy Index is an indicator that’s used to search out out whether or not the value of a safety is overvalued or undervalued. As per its identify, RSI indicators assist decide how the safety is doing at current, relative to its earlier worth.

At the moment, the RSI reads a price of 65.86 and it appears to be heading parallel to the horizontal axis. Furthermore, the RSI is overlapping the sign line, as such there’s a risk that the RSI might cross under the sign line. Nonetheless, as per the longer timeframes, we may even see the RSI going additional up as XLM has reached the underside of its worth.

Nonetheless, earlier than the RSI begins to rise there could also be a small retracement because the weekly chart RSI worth is within the overbought area.

Stellar (XLM) Value Evaluation – Transferring Common

The Exponential Transferring averages are fairly much like the easy shifting averages (SMA), apart from the truth that it provides extra weightage to the current costs.

The 200-day MA is taken into account to be the long-term shifting common whereas the 50-day MA is taken into account the short-term shifting common in buying and selling. Primarily based on how these two strains behave, the energy of the cryptocurrency or the development will be decided on common.

Particularly, when the short-term shifting common (50-day MA) approaches the long-term shifting common (200-day MA) from under and crosses it, we name it a Golden Cross.

Contrastingly, when the short-term shifting common crosses the long-term shifting common from above then, a demise cross happens.

Normally, when a Golden Cross happens, the costs of the cryptocurrency will shoot up drastically, however when there’s a Dying Cross, the costs will crash.

It could possibly be famous that XLM had a Golden cross recently. As such, the costs are going up drastically. Furthermore, because the 50-day is and 200-day MA are each pointing upwards we could XLM rising within the brief and long run.

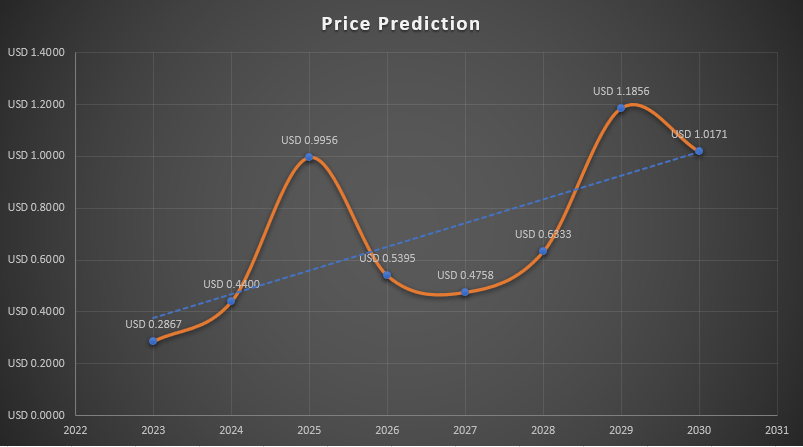

Stellar (XLM) Value Prediction 2023-2030 Overview

| 12 months | Minimal Value | Common Value | Most Value |

| 2023 | $0.1950 | $0.2867 | $ 0.3015 |

| 2024 | $0.3850 | $0.4400 | $0.4700 |

| 2025 | $0.8750 | $0.9956 | $1.2500 |

| 2026 | $0.4500 | $0.5395 | $0.6250 |

| 2027 | $0.3500 | $0.4758 | $0.5500 |

| 2028 | $0.5900 | $0.6333 | $0.7500 |

| 2029 | $1.0500 | $1.1856 | $1.400 |

| 2030 | $0.9500 | $1.0171 | $1.2500 |

| 2040 | $1.5050 | $1.7791 | $2.1500 |

| 2050 | $1.8500 | $2.5209 | $3.2500 |

Stellar (XLM) Value Prediction 2023

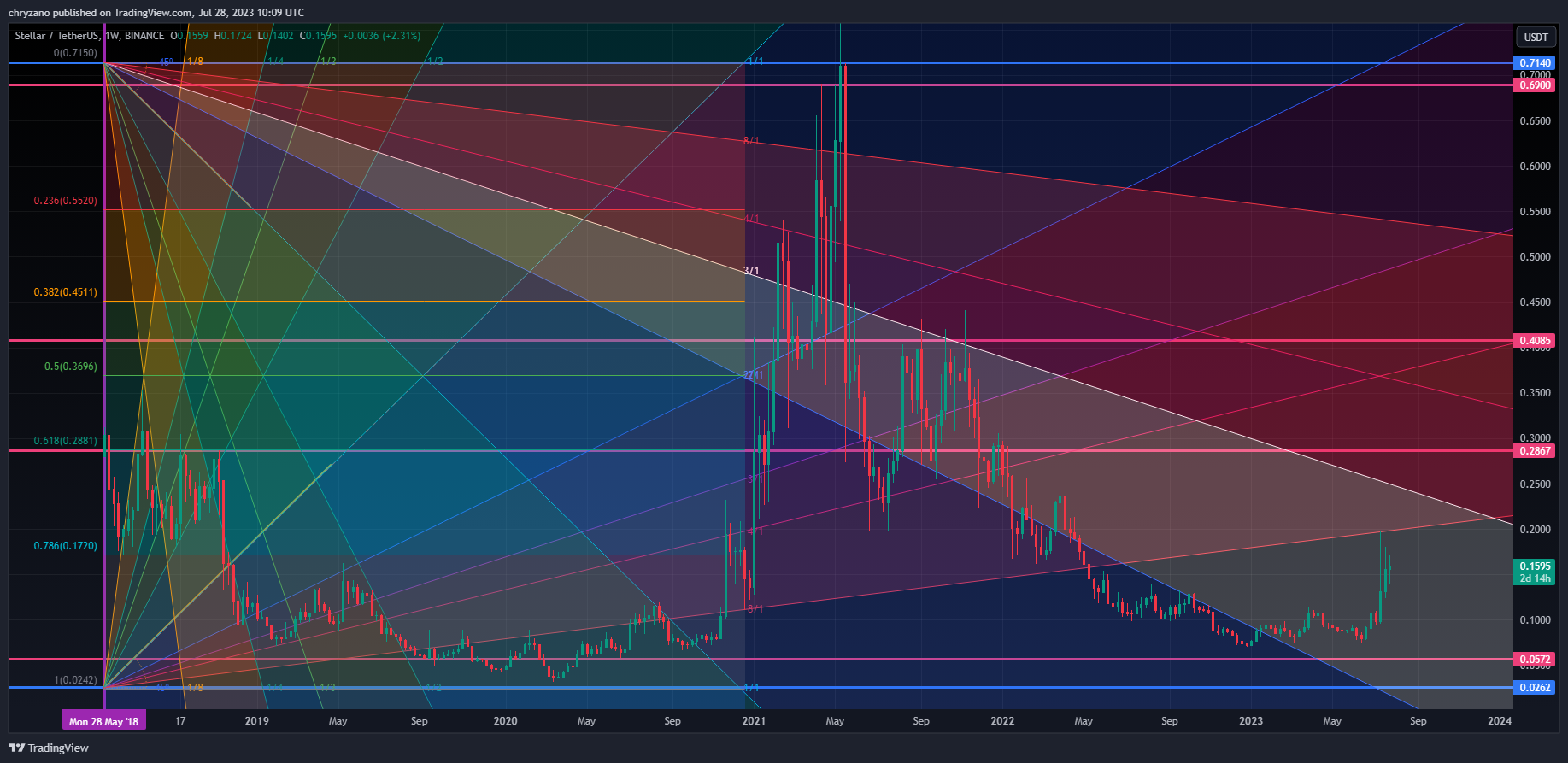

When contemplating the above chart we might see that XLM has been forming the top and shoulders sample within the longer time-frame. At the moment, it appears to be forming the correct shoulder and it might attain Resistance 1 at $0.2867. And within the occasion that Resistance 1 is damaged, then XLM might attain Resistance 2 at $0.4085. Nonetheless, if XLM is rejected at Resistance 1, it might search help from $0.0572.

The above chart exhibits Stellar fluctuating in a shorter time-frame. Since XLM is at the moment on the rise after being held collectively by Assist 3 ($0.0847). XLM could proceed rising sooner or later. As such, it has the potential to achieve Resistance 1 at $0.2372. if XLM manages to interrupt Resistance 1 it might finally attain Resistance 2 at $0.2867.

Nonetheless, within the occasion, XLM falls from the place it’s as now it might straightway fall to Assist 2 at $0.1039. Since Assist 1 at $0.1241 is weak the above thesis has been derived. If Assist 2 is breached, then, XLM might attain Assist 3.

Stellar (XLM) Value Prediction – Resistance and Assist Ranges

The above chart exhibits the habits of XLM since 2018. We might see that XLM was buying and selling between the fib retracement ranges of 0.786 and 0.618 from Might 2018 to November 2018. Nonetheless, in mid-November 2018 XLM misplaced help from the 0.618 degree and fell under it reaching for help on the fib retracement 1 degree.

From 2018 November to late 2020 XLM has been fluctuating between the 1 and 0.786 fib retracement ranges. Nonetheless, the daybreak of 2021 introduced the bulls dormant bulls into the market, as XLM began to surge.

XLM rose from as little as $0.0768 to as excessive as $0.7140 throughout the span of 5 months. It could have been the after-effects of BTC halving which befell in 2020. After reaching $0.7140, XLM began sliding down alongside the two:1 Gann fan line till 2022. At the moment, XLM is shifting slightly below the 8:1 Gann fan line.

If it manages to interrupt the 8:1 Gann line it might be met with resistance by the three:1 Gann line. Nonetheless, if the 8:1 Gann line is simply too robust for the bulls to interrupt, then, we may even see XLM rebound off of the 8:1 Gann line and search help from the two:1 Gann line.

Stellar (XLM) Value Prediction 2024

There might be Bitcoin halving in 2024, and therefore we should always anticipate a optimistic development out there as a consequence of consumer sentiments and the hunt by buyers to build up extra of the coin. Nonetheless, the 12 months of BTC halving didn’t yield the utmost XLM based mostly on the earlier halving. Therefore, we might anticipate XLM to commerce at a worth not under $0.44 by the tip of 2024.

Stellar (XLM) Value Prediction 2025

XLM could expertise the after-effects of the Bitcoin halving and is anticipated to commerce a lot greater than its 2024 worth. Many commerce analysts speculate that BTC halving might create a big impact on the crypto market. Furthermore, much like many altcoins, XLM will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that XLM would commerce past the $0.995 degree.

Stellar (XLM) Value Prediction 2026

It’s anticipated that after a protracted interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, XLM might tumble into its help areas. Throughout this era of worth correction, XLM might lose momentum and be means under its 2025 worth. As such it could possibly be buying and selling at $0.539 by 2026.

Stellar (XLM) Value Prediction 2027

Naturally, merchants anticipate a bullish market sentiment after the crypto trade was affected negatively by the bears’ claw. Furthermore, the build-up to the following Bitcoin halving in 2028 might evoke pleasure in merchants. Nonetheless, that pleasure has not been reciprocated in XLM . As such, we might anticipate XLM to commerce just under its 2026 worth at round $0.4758 by the tip of 2027.

Stellar (XLM) Value Prediction 2028

Because the crypto group’s hope might be re-ignited wanting ahead to Bitcoin halving like many altcoins, XLM could reciprocate its previous habits through the BTC halving. Therefore, XLM can be buying and selling at $0.633 after experiencing a substantial surge by the tip of 2028.

Stellar (XLM) Value Prediction 2029

2029 is anticipated to be one other bull run because of the aftermath of the BTC halving. Nonetheless, merchants speculate that the crypto market would steadily grow to be steady by this 12 months. In tandem with the steady market sentiment, XLM could possibly be buying and selling at $1.185 by the tip of 2029.

Stellar (XLM) Value Prediction 2030

After witnessing a bullish run out there, XLM and lots of altcoins would present indicators of consolidation and may commerce sideways and transfer downwards for a while whereas experiencing minor spikes. Due to this fact, by the tip of 2030, XLM could possibly be buying and selling at $1.017

Stellar (XLM) Value Prediction 2040

The long-term forecast for XLM signifies that this altcoin might attain a brand new all-time excessive(ATH). This is able to be one of many key moments as HODLERS could anticipate to promote a few of their tokens on the ATH level.

If they begin promoting then XLM might fall in worth. It’s anticipated that the common worth of XLM might attain $1.77 by 2040.

Stellar (XLM) Value Prediction 2050

The group believes that there might be widespread adoption of cryptocurrencies, which might preserve gradual bullish beneficial properties. By the tip of 2050, if the bullish momentum is maintained, XLM might hit $2.520

Conclusion

If buyers proceed exhibiting their curiosity in XLM and add these tokens to their portfolio, it might proceed to rise. XLM’s bullish worth prediction exhibits that it might attain the $0.3 degree.

FAQ

Stellar (XLM) is a peer-to-peer (P2P) decentralized community created in 2014 by The Stellar Improvement Basis or Stellar.org. The community was formally launched in 2015 in an try to attach the world’s monetary programs and guarantee a protocol for fee suppliers and monetary establishments.

Like different cryptocurrencies, Stellar (XLM) will be traded in cryptocurrency exchanges like Binance, Huobi International, Kucoin, Gate.io, Kraken, and others.

Stellar has a risk of surpassing its current all-time excessive (ATH) worth of $0.9381 in 2025.

XLM is among the rising tokens and if it manages to interrupt above the Resistance degree 2 zone it has the potential to hit $10.

Since XLM supplies buyers with a number of alternatives to kind their crypto holdings, it grooms to be a great funding in 2023, particularly with a latest golden cross.

The bottom worth of XLM is $0.001227

XLM was launched in 2014.

XLM was based by established Wall Road and Silicon Valley entrepreneurs.

XLM will be saved in a scorching pockets, chilly pockets, or change pockets.

XLM is anticipated to achieve $0.2867 by 2023.

XLM is anticipated to achieve $0.4400 by 2024.

XLM is anticipated to achieve $0.9956 by 2025.

XLM is anticipated to achieve $0.5395 by 2026.

XLM is anticipated to achieve $0.4758 by 2027.

XLM is anticipated to achieve $0.6333 by 2028.

XLM is anticipated to achieve $1.1856 by 2029.

XLM is anticipated to achieve $1.0171 by 2030.

XLM is anticipated to achieve $1.7791 by 2040.

XLM is anticipated to achieve $2.5209 by 2050.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this worth prediction, are printed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates is not going to be held accountable for any direct or oblique injury or loss.