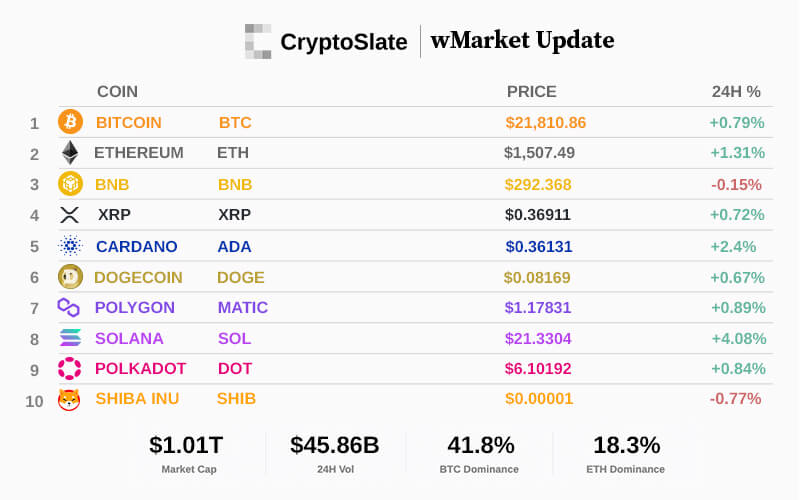

The cryptocurrency market cap noticed web inflows of $12 billion within the final 24 hours and at present stands at $1.01 trillion — up 0.89% from $998.09 billion.

Through the reporting interval, Bitcoin and Ethereum’s market cap rose 0.98% and 1.52% to $421.18 billion and $185.72 billion, respectively.

The highest 10 crypto property recorded features over the past 24 hours, besides Binance’s BNB and Shiba Inu, which misplaced 0.15% and 0.77%, respectively. Solana and Cardano recorded the best acquire of 4.08% and a pair of.4%, respectively.

The market caps of Tether (USDT)and Binance USD (BUSD) decreased to $68.47 billion and $15.68 billion, respectively. Against this, USD Coin’s (USDC) market cap elevated to $41.03 billion.

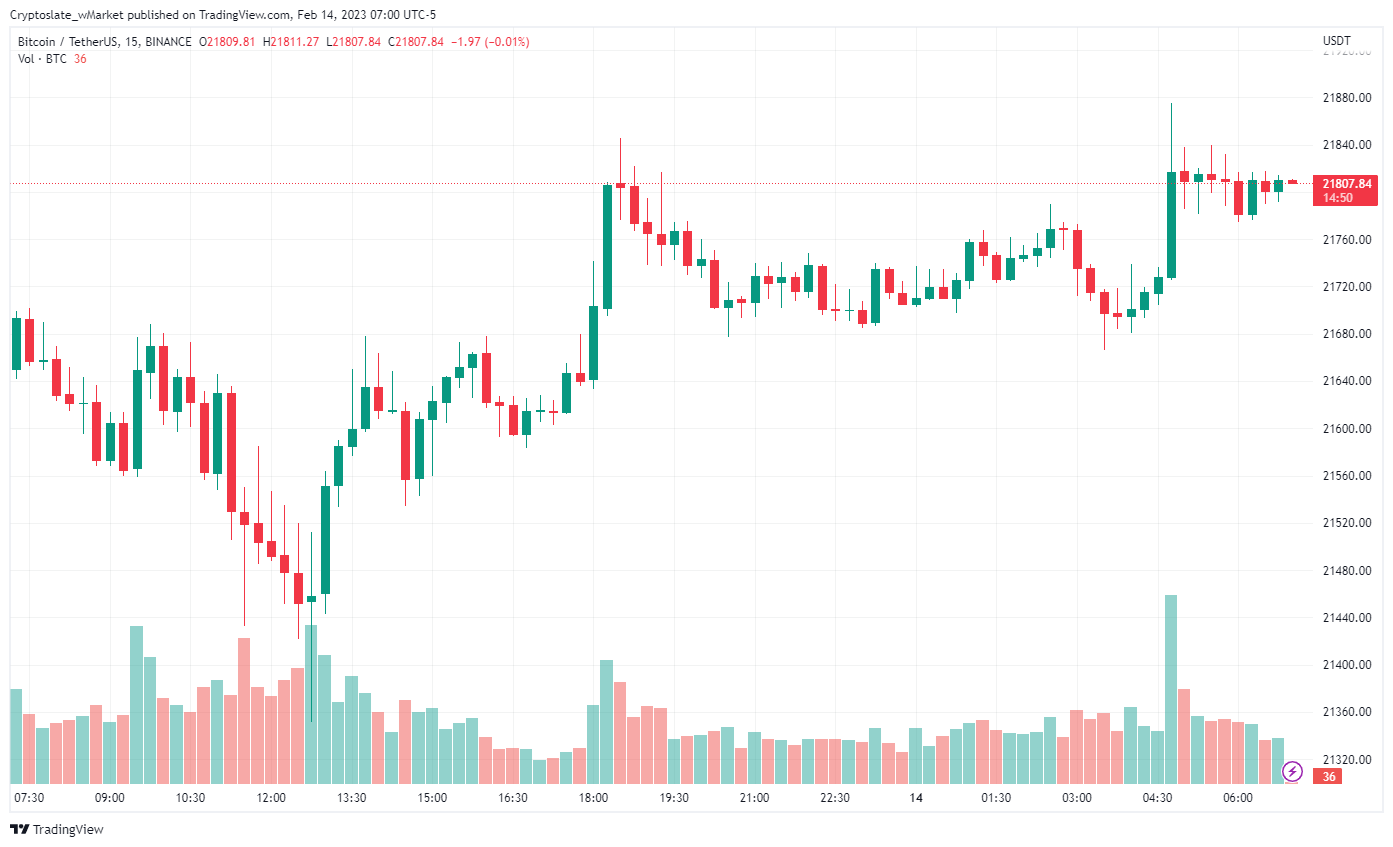

Bitcoin

Within the final 24 hours, Bitcoin gained 0.74% to commerce at $21,810 as of 07:00 ET. Its market dominance remained flat at 41.8%.

After dropping to its lowest worth of $21,400 for the primary time in three weeks, BTC peaked at $21,489 because the market anticipates the US Client Worth Index (CPI) numbers for January.

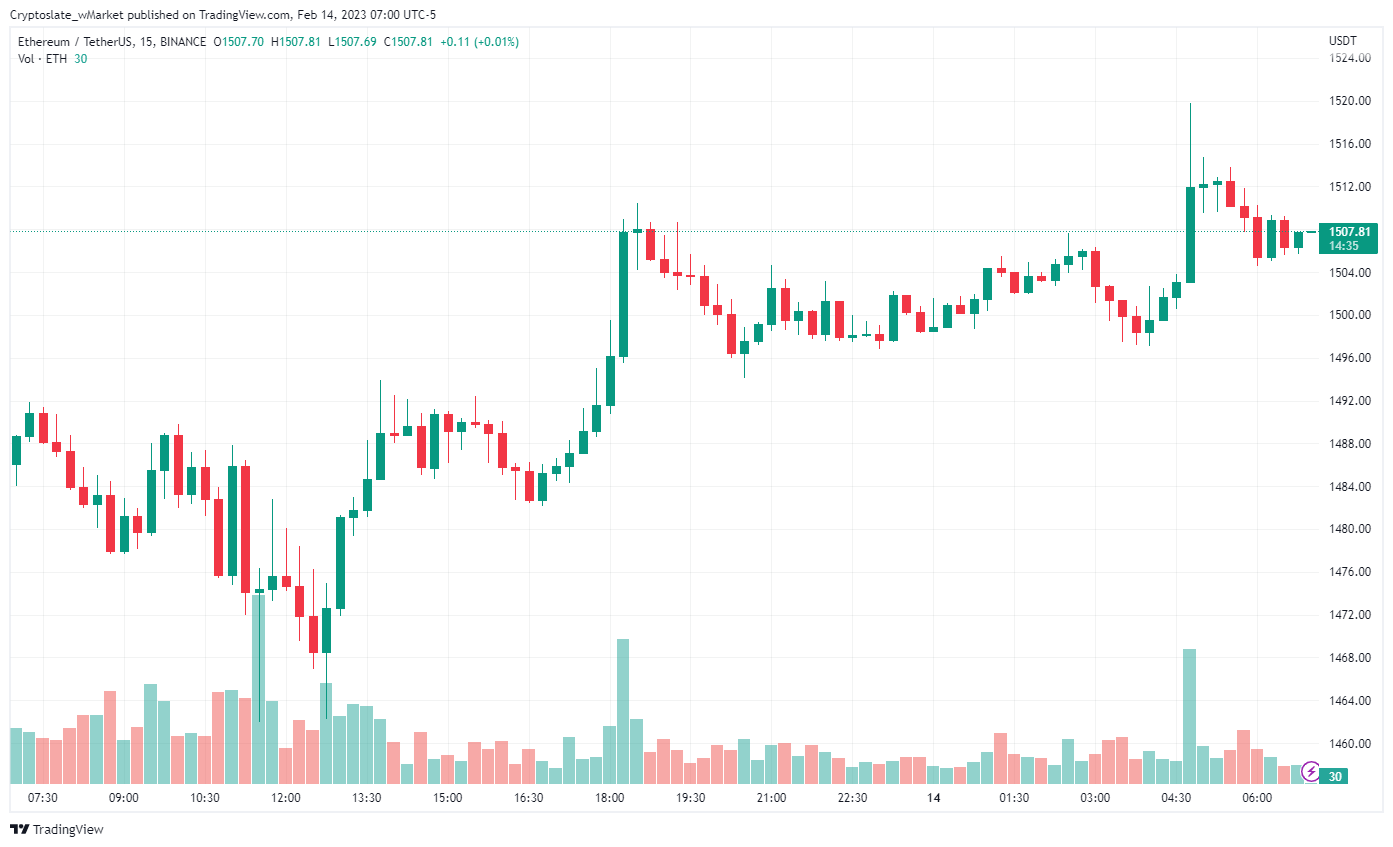

Ethereum

Over the past 24 hours, Ethereum rose 1.31% to commerce at $1,507 as of 07:00 ET. Its market dominance rose to 18.3% from 18.2%.

ETH’s value motion mirrored BTC’s — largely buying and selling sideways — and peaked at $1,514 over the reporting interval.

Prime 5 Gainers

Hashflow

HFT is the day’s greatest gainer, rising 34.06% over the reporting interval to $0.67 as of press time. Binance just lately made the undertaking a borrowable asset whereas the builders made progress on bettering its scalability. Its market cap stood at $125.3 million.

Bitget Token

BGB rose 23.17% to $0.407 within the final 24 hours. The crypto change introduced a partnership with the fintech firm Capitual to take part in Brazil’s Central Financial institution Digital Foreign money (CBDC) undertaking. Its market cap stood at $570.61 million.

TerraUSD

USTC elevated 14.91% to $0.031 as of press time. The failed algorithmic stablecoin has rallied following information of a deliberate protocol improve scheduled for Feb. 14. Its market cap stood at $305.18 million.

GMX

GMX gained 13.82% to commerce at $70.89 as of press time. The decentralized change reportedly generated over $5 million in income on Feb. 11, based on DeFillama information. Its market cap stood at $600.18 million.

Fetch

FET jumped 11.82% to $0.43 as of press time. The bogus intelligence (AI)-related token has profited from the rising curiosity in AI expertise, rising by over 80% within the final 30 days. Its market cap stood at $356.64 million.

Prime 5 Losers

DAO Maker

DAO is the day’s greatest loser, falling 9.59% to $1.26 as of press time. The token seems to have shed a number of the features it made on Feb. 13, when it rose by over 16%. Its market stood at $180.66 million.

GensoKishi Metaverse

MV declined 8.67% within the final 24 hours to $0.18 as of press time. The NFT-related token has fallen by round 10% within the earlier seven days. Its market cap stood at $317.66 million.

SKALE Community

SKL plunged 6.84% to $0.049 as of press time. The sensible contract-enabled platform skilled a selloff regardless of asserting new integrations with NFT bridge XP Community. Its market cap stood at $205.67 million.

Horizen

ZEN misplaced 5.95% and was buying and selling for $11.99 as of press time. The privateness token rose by 11% within the final 30 days. Its market cap stood at $160.35 million.

Celer Community

CELR shed 3.75% over the reporting interval to $0.019. The Polkadot-based token just lately revealed that its Inter-chain Messaging (IM) framework at present serves totally different functions throughout 15 decentralized functions. Its market cap stood at $139.53 million.