4 days after the Ethereum (ETH) Shapella improve, greater than 1 million ETH has been withdrawn, in accordance with beaconcha.in knowledge.

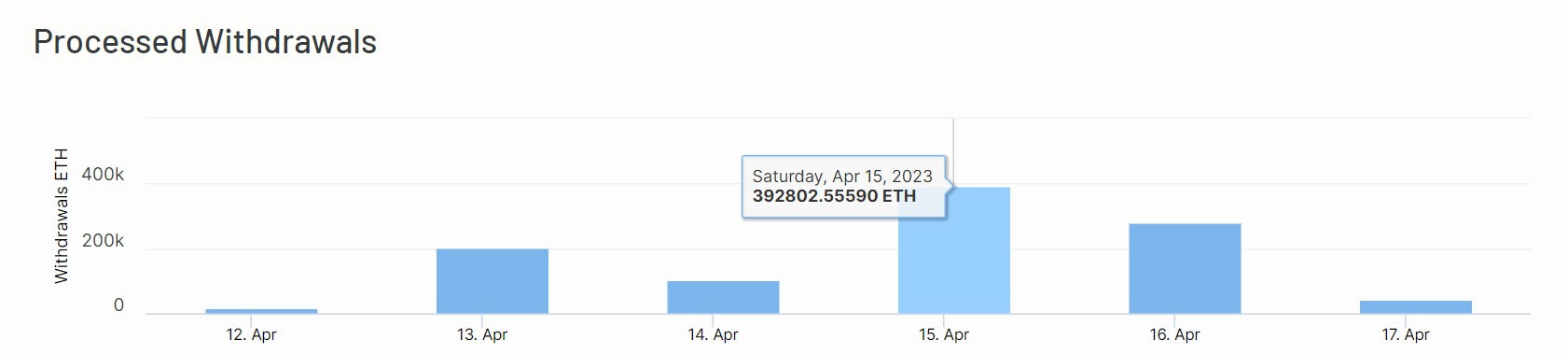

Based on the info, 1.04 million ETH has been withdrawn from the 491,037 processed withdrawals. The very best withdrawal was processed on April 15 when validators eliminated 392,8012 ETH from the Beacon Chain.

On different days, over 150,000 ETH had been withdrawn, respectively.

In the meantime, extra ETH shall be withdrawn over the approaching days. Based on Token Unlocks, 866,850 ETH valued at $1.81 billion are awaiting withdrawal from 471,370 validators.

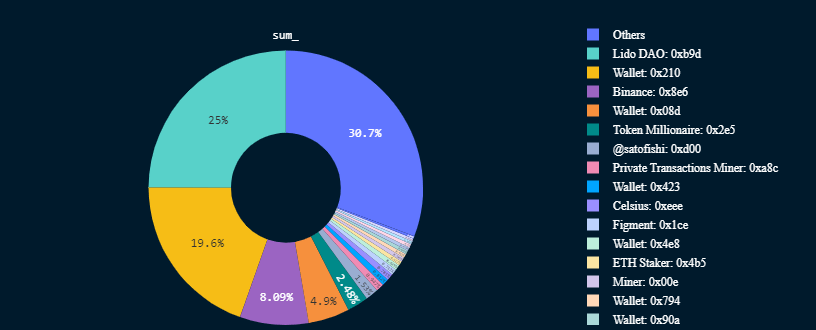

Lido tops withdrawals

Based on Nansen’s dashboard, Lido DAO is liable for most withdrawals. The liquid staking platform accounts for 25% of all withdrawals processed.

It’s adopted by Binance — which has withdrawn 84,145 staked ETH, equating to eight.11% of withdrawn ETH. Different centralized entities like bankrupt lender Celsius, Figment, and Satofishi are additionally among the many high addresses which have withdrawn their staked tokens.

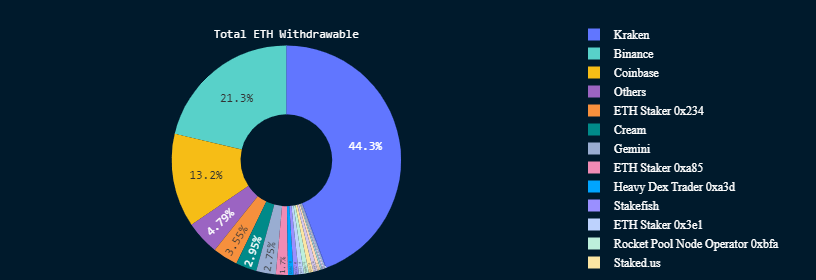

Centralized exchanges dominate pending withdrawals

In the meantime, centralized exchanges — Kraken, Coinbase, Binance, and Gemini — dominate the platforms awaiting withdrawals of their staked ETH.

starcrypto beforehand reported that these platforms account for 78% of the entities ready to withdraw their staked Ethereum. As of press time, these platforms wish to withdraw 736,500 ETH.

Current regulatory troubles in the US are forcing these platforms to withdraw their property to stay in compliance with the Securities and Trade Fee (SEC).

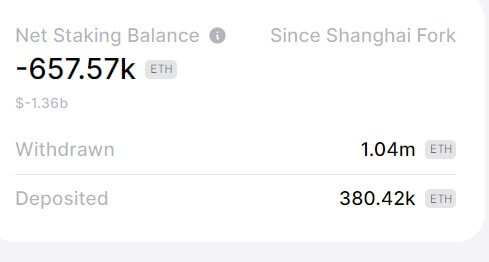

Over 380,000 ETH have been deposited since Shapella improve

For the reason that Shanghai exhausting fork, staked ETH stability has declined by 3.8% to 17.3 million ETH regardless of buyers depositing 380,420 ETH, in accordance with Token Unlocks.

This implies there was a web decline of 657,570 ETH ($1.36 billion) in staked ETH as of press time.

In the meantime, Lookonchain reported that some addresses withdrawing their staked ETH instantly re-staked them. Based on the on-chain sleuth, three wallets out of the highest 15 withdrawal addresses re-staked 19,844 ETH.

Lookonchain additional identified that some addresses withdrawing their property had been additionally promoting them. The investigator highlighted three wallets that despatched 71,444 ETH to unnamed centralized exchanges.

ETH has been one of many best-performing digital property for the reason that Shapella improve. The cryptocurrency elevated by greater than 12% over the previous week and pulled the broader market right into a inexperienced run.

The publish Staked Ethereum declines 3.8% as withdrawals cross 1M appeared first on starcrypto.