- Bullish STX value prediction ranges from $0.200 to $1.5.

- Evaluation means that the STX value may attain above $1.2550.

- The STX bearish market value prediction for 2023 is $0.2235.

What’s Stacks (STX)?

Stacks is a Bitcoin layer for sensible contracts; it permits sensible contracts and decentralized functions to trustlessly use Bitcoin as an asset and settle transactions on the Bitcoin blockchain. DApps are open and modular, which implies that builders can construct on prime of different’s apps to create capabilities which are unattainable for normal apps. Since Stacks employs Bitcoin as its basis layer, all community exercise is settled on the preferred and maybe most safe blockchain.

Stacks leverages BTC performance by immediately linking to the Bitcoin blockchain utilizing its proof-of-transfer (PoX) consensus mechanism, which requires miners to pay BTC to mint new Stacks (STX) tokens.

The preliminary model of Stacks, launched in early 2021, launched the Bitcoin settlement of transactions, the “Readability” language for secure contracts that may reply to Bitcoin transactions and atomic swaps of property with BTC.

Nonetheless, the subsequent main proposed improve of Stacks, the Nakamoto launch (anticipated 2023), provides essential capabilities that may improve the ability of Stacks as a Bitcoin layer: (a) a decentralized, two-way Bitcoin peg to maneuver BTC in/out of the layer and write to Bitcoin, (b) transactions secured by Bitcoin finality, and (c) quick transactions between Bitcoin blocks.

” Based on the Stacks white paper, it has the next improvements that make it distinctive:

- S – Secured by your complete hash energy of Bitcoin (Bitcoin finality).

- T – Belief-minimized Bitcoin peg mechanism; write to Bitcoin.

- A – Atomic BTC swaps and property owned by BTC addresses.

- C – Readability language for secure, decidable sensible contracts.

- Ok – Data of full Bitcoin state; learn from Bitcoin.

- S – Scalable, quick transactions that decide on Bitcoin. “

Stacks (STX) Market Overview

| 🪙 Identify | Stacks |

| 💱 Image | stx |

| 🏅 Rank | #51 |

| 💲 Worth | $0.616925 |

| 📊 Worth Change (1h) | -2.97729 % |

| 📊 Worth Change (24h) | -6.9704 % |

| 📊 Worth Change (7d) | 0.66857 % |

| 💵 Market Cap | $870903796 |

| 📈 All Time Excessive | $3.39 |

| 📉 All Time Low | $0.04559639 |

| 💸 Circulating Provide | 1383515933.18 stx |

| 💰 Whole Provide | 1818000000 stx |

Analysts’ views on Stacks (STX)

Crypto dealer and investor EliZ¥ tweeted that Stacks was exhibiting response with a better excessive albeit Safety Change Fee taking up Changpeng Zhao.

The chart under reveals how STX examined the higher development line on what appears to be a falling wedge.

A crypto analyst and researcher explaining about Stacks (STX) is value studying on how persons are investing on STX.

Additionally analysts and buyers are getting the STX spot bag round $0.3211 which is a golden place to purchase.

Stacks (STX) Present Market Standing

Stacks has a circulating provide of 1,383,367,425 STX cash, whereas its most provide IS 1,818,000,000 STX cash, in line with CoinMarketCap. On the time of writing, STX is buying and selling at $0.6284 representing 24 hours lower of 1.98%. The buying and selling quantity of STX up to now 24 hours is $279,422,046 which represents a 39.78% improve.

Some prime cryptocurrency exchanges for buying and selling STX are Binance, OKX, Bitrue, LBank, and Bybit.

Now that you recognize STX and its present market standing, we will talk about the value evaluation of STX for 2023.

Stacks (STX) Worth Evaluation 2023

At the moment, Stacks (STX) ranks 50 on CoinMarketCap. Will STX’s most up-to-date enhancements, additions, and modifications assist its value go up? First, let’s deal with the charts on this article’s STX value forecast.

Stacks (STX) Worth Evaluation – Bollinger Bands

The Bollinger bands are a kind of value envelope developed by John Bollinger. It provides a spread with an higher and decrease restrict for the value to fluctuate. The Bollinger bands work on the precept of ordinary deviation and interval (time).

The higher band as proven within the chart is calculated by including two occasions the usual deviation to the Easy Transferring Common whereas the decrease band is calculated by subtracting two occasions the usual deviation from the Easy Transferring Common. When the bands widen, it reveals there’s going to be extra volatility and after they contract, there may be much less volatility.

When Bollinger bands are utilized in a cryptocurrency chart, we may count on the value of the cryptocurrency to reside inside the higher and decrease bounds of the Bollinger bands 95% of the time. The above thesis is derived from an Empirical legislation.

The sections highlighted by purple rectangles within the chart above present how the bands broaden and contract. When the bands widen, we may count on extra volatility, and when the bands contract, it denotes much less volatility. The inexperienced rectangles present how STX retraced after touching the decrease band (oversold).

When contemplating the above chart, we may see that Stacks has been transferring in a zig-zag sample contained in the Bollinger bands. On the 2 events when the bands expanded as proven within the chart, we may see that STX elevated by roughly 227.5% and 140% as proven within the chart. Nonetheless, for the reason that starting of April, the Bollinger bands are sloping downwards.

Furthermore, the bandwidth indicator reveals that there have been very effective changes to the bandwidth. We may see that the value motion has been diminished from 140% to 30% after which to 24%. Because the line on the Bandwidth indicator is dealing with downward, we may count on the bands to squeeze additional.

The Bandwidth indicator at the moment reads a worth of 0.18. Nonetheless, 0.14 has been the place the place the indicator has turned its course up. Therefore, we might even see the bands squeeze till the bandwidth indicator reveals 0.14. Throughout, this time period we may count on the value motion to shrink to 16.73%, based mostly on the earlier remark.

In the meantime, as STX has touched the higher Bollinger band, we may count on it to retrace and fall again near the SMA, and ultimately contact the decrease band. Because the STX value motion has been constrained, merchants could wish to deal with quantity.

Stacks (STX) Worth Evaluation – Relative Power Index

The Relative Power Index is an indicator that’s used to seek out out whether or not the value of a safety is overvalued or undervalued. As per its title, RSI indicators assist decide how the safety is doing at current, relative to its earlier value.

Furthermore, it has a sign line which is a Easy Transferring Common (SMA) that acts as a yardstick or reference to the RSI line. Therefore, at any time when the RSI line is above the SMA, it’s thought-about bullish; if it’s under the SMA, it’s bearish.

At the moment, the RSI is above the Sign, therefore, STX is bullish. STX’s RSI is at the moment at 54.09. Because it’s neither overbought nor oversold, let’s imagine that the development is robust. Nonetheless, because the RSI is titling upwards, we might even see it attain the overbought area.

The Stochastic RSI measures the energy or the weak point of the RSI indicator. As such, it compares the present RSI with the vary of previous RSI values for a particular interval. The StochRSI turns out to be useful when the market is transferring sideways. Since it’s delicate to the smallest RSI actions, it could possibly be used to seek out out whether or not the RSI is overbought or oversold when there are sideways actions.

The Stochastic RSI reads a worth of 70.07, and the road is heading in direction of the overbought area. As such we might even see the RSI rise additional earlier than it begins to fall.

As per the RSI Help and Resistance by DGT, we may see that STX has acquired assist from the bear zone (Pink Line). We may see it rising after receiving assist from the bear zone. As such, we may count on it to succeed in the bull zone (mild inexperienced). Moreover, if the RSI is above the Sign line when STX will increase, then we may count on STX to interrupt the bull zone and attain the Crossover overbought area (darkish inexperienced).

The bull zone presents a wonderful entry level for patrons who count on the costs to rise to the Crossover Oevrbought area. Furthermore, we may count on STX to crash and fall down in worth. When the previous occurs these shorting could wish to enter the market on the Crossover Overbought and set their take revenue near the Crossunder Overbought.

Stacks (STX) Worth Evaluation – Transferring Common

The Exponential Transferring averages are fairly just like the straightforward transferring averages (SMA). Nonetheless, the SMA equally distributes down all values whereas the Exponential Transferring Common provides extra weightage to the present costs. Since SMA undermines the weightage of the current value, the EMA is utilized in value actions.

The 200-day MA is taken into account to be the long-term transferring common whereas the 50-day MA is taken into account the short-term transferring common in buying and selling. Primarily based on how these two strains behave, the energy of the cryptocurrency or the development may be decided on common.

Particularly, when the short-term transferring common (50-day MA) approaches the long-term transferring common (200-day MA) from under and crosses it, we name it a Golden Cross.

Contrastingly, when the short-term transferring common crosses the long-term transferring common from above then, a loss of life cross happens.

Normally, when a Golden Cross happens, the costs of the cryptocurrency will shoot up drastically, however when there’s a Demise Cross, the costs will crash.

Every time the value of cryptocurrency is above the 50-day or 200-day MA, or above each we could say that the token is bullish (Pink rectangle). Contrastingly, if the token is under the 50-day or 200-day, or under each, then we may name it bearish (Blue triangle part).

At the moment, we may see that STX has been rebounding on the 200-day MA and it has reached the 50-day MA. As such we may count on it to rise above the 50-day. Nonetheless, as per its zig-zag motion, we might even see a value correction. Throughout this correction section, we might even see it looking for assist from the 200-day MA.

Within the occasion that the 200-day MA fails to assist STX, then it will search help from $0.4142, $0.3163, or $0.2069.

Stacks (STX) Worth Evaluation – Elder Drive Index

Elder Drive Index is an indicator that was invented by Alexander Elder, who was an entrepreneur. The indicator primarily makes use of two parameters to adjudicate the shopping for and promoting pressure and thereby predicts the market development. Particularly, it depends on value change and quantity. As such the energy of the shopping for pressure or promoting pressure depends on both the value change or the quantity.

Every time the EFI is larger than zero, or optimistic, let’s imagine that the development is bullish, as there may be extra shopping for strain. Nonetheless, when the EFI is within the adverse zone, let’s imagine that the cryptocurrency is within the adverse zone and the promoting strain is extra.

Furthermore, the Elder Drive may be used to determine development reversals and breakouts. As an example when the EFI is making decrease highs whereas the cryptocurrency is making larger highs, then let’s imagine that it is a bearish divergence. Nonetheless, within the occasion that the cryptocurrency is making decrease lows whereas the EFI is making larger lows, then it’s a bullish divergence represented within the chart.

At the moment, the EFI reveals a studying of 504.242K. Nonetheless, the road is slanting in direction of the zero line. As such we might even see the promoting strain improve and in consequence, the value of STX could depreciate. Nonetheless, the Bear Bull Energy (BBP) indicator is within the optimistic area and it’s rising. It’s at 0.0658 at press time, and heading larger within the optimistic zone.

Furthermore, the above chart reveals that the shopping for quantity has diminished fairly considerably after the formation of a giant inexperienced bar. It could possibly be that the patrons are dormant to let the STX attain the underside earlier than coming into the market. As such, it will be advisable to enter the market after there may be an equilibrium.

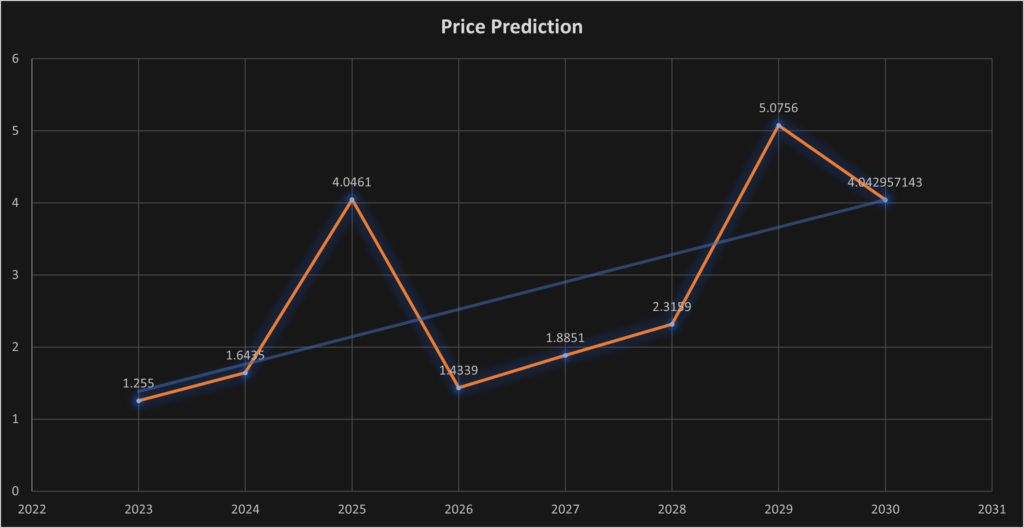

Stacks (STX) Worth Prediction 2023-2030 Overview

| Yr | Minimal Worth | Common Worth | Most Worth |

| 2023 | $1.1280 | $1.2550 | $1.3250 |

| 2024 | $1.4520 | $1.6435 | $1.7580 |

| 2025 | $3.9512 | $4.0461 | $4.251 |

| 2026 | $1.2358 | $1.4339 | $1.6251 |

| 2027 | $1.7231 | $1.8851 | $1.9250 |

| 2028 | $2.2150 | $2.3159 | $2.5142 |

| 2029 | $4.9125 | $5.0756 | $5.1200 |

| 2030 | $3.9120 | $4.0429 | $4.5260 |

| 2040 | $6.920 | $7.6280 | $8.2141 |

| 2050 | $9.1241 | $11.1386 | $15.204 |

Stacks (STX) Worth Prediction 2023

When contemplating the above chart, we may see that Stacks has been fluctuating in a congested falling wedge since April. It has been making decrease lows and decrease highs because the vary has been shrinking.

As per the books, STX ought to surge as soon as it breaks out of the wedge. At the moment, STX could be very near the higher trendline and in reality, it has touched the higher trendline. If it breaks the wedge proper now, we might even see surge Resistance 1 at $0.85.

The above thesis could possibly be justified by one of the best observe of buying and selling a falling wedge. That’s by taking the peak of the wedge within the early days of its formation and setting it on the breakout level, anticipating the value to surge by the peak of the wedge.

Nonetheless, when the previous habits of STX is taken into account, we may see that from the present place the place STX is, it surge to Resistance 3 at $1.25. Therefore, we may count on it to reciprocate this habits as soon as once more.

On its method up, STX could expertise some friction at Resistance 2 ($1.025). If at this level the bears are capable of cease the bulls’ rampant march, then STX could settle there.

Lengthy place holders could wish to set their entry level on the verge of STX breaking the wedge. Furthermore, they could set their take revenue as per their discretion close to Resistance 1, 2, or 3. Nonetheless, they could want to present STX some room for correction, as such they could want to contemplate having their cease loss close to the decrease development line.

In the meantime, there may be additionally the potential of STX touchdown on assist 1 at $0.5455. It might be earlier than the breakout. If that’s the case then Help 1 can be a wonderful entry level. If assist is denied at Help 1 then we might even see STX attain for assist on the weak assist at $0.4315 and surge. Within the occasion that assist is denied there too then it could tank to Help 2 at $0.2235.

Stacks (STX) Worth Prediction – Resistance and Help Ranges

When contemplating the chart above, we may see that STX was closely depending on the two:1 Gan line and three:1 Gann line for assist. Furthermore, though STX examined and broke above the 1:1 Gann line in Might 2021, it wasn’t capable of keep there for a very long time, as such, it crashed and acquired assist from the three:1 Gann line, which propelled to the two:1 Gann line. Nonetheless, STX is at the moment falling between the 4:1 and three:1 Gann strains. Because it has been making decrease lows after testing the 4:1 Gann line, we might even see it reaching for assist on the 3:1 Gann line.

Stacks (STX) Worth Prediction 2024

There can be Bitcoin halving in 2024, and therefore we must always count on a optimistic development out there attributable to person sentiments and the search by buyers to build up extra of the coin. Nonetheless, the 12 months of BTC halving didn’t yield the utmost STX based mostly on the earlier halving. Therefore, we may count on STX to commerce at a value not under $1.65 by the tip of 2024.

Stacks (STX) Worth Prediction 2025

STX could expertise the after-effects of the Bitcoin halving and is predicted to commerce a lot larger than its 2024 value. Many commerce analysts speculate that BTC halving may create a big impact on the crypto market. Furthermore, just like many altcoins, STX will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that STX would commerce past the $4.05 degree.

Stacks (STX) Worth Prediction 2026

It’s anticipated that after a protracted interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, STX may tumble into its assist areas. Throughout this era of value correction, STX may lose momentum and be method under its 2025 value. As such it could possibly be buying and selling at $1.5 by 2026.

Stacks (STX) Worth Prediction 2027

Naturally, merchants count on a bullish market sentiment after the crypto trade was affected negatively by the bears’ claw. Furthermore, the build-up to the subsequent Bitcoin halving in 2028 may evoke pleasure in merchants. Nonetheless, that pleasure has not been reciprocated in STX. As such, we may count on STX to commerce slightly below its 2026 worth at round $1.88 by the tip of 2027.

Stacks (STX) Worth Prediction 2028

Because the crypto neighborhood’s hope can be re-ignited wanting ahead to Bitcoin halving like many altcoins, STX could reciprocate its previous habits in the course of the BTC halving. Therefore, STX can be buying and selling at $2.35 after experiencing a substantial surge by the tip of 2028.

Stacks (STX) Worth Prediction 2029

2029 is predicted to be one other bull run as a result of aftermath of the BTC halving. Nonetheless, merchants speculate that the crypto market would steadily change into steady by this 12 months. In tandem with the steady market sentiment, STX could possibly be buying and selling at $5.1 by the tip of 2029.

Stacks (STX) Worth Prediction 2030

After witnessing a bullish run out there, STX and plenty of altcoins would present indicators of consolidation and may commerce sideways and transfer downwards for a while whereas experiencing minor spikes. Due to this fact, by the tip of 2030, STX could possibly be buying and selling at $4.05

Stacks (STX) Worth Prediction 2040

The long-term forecast for STX signifies that this altcoin may attain a brand new all-time excessive(ATH). This may be one of many key moments as HODLERS could count on to promote a few of their tokens on the ATH level.

If they begin promoting then STX may fall in worth. It’s anticipated that the typical value of STX may attain $7.65 by 2040.

Stacks (STX) Worth Prediction 2050

The neighborhood believes that there can be widespread adoption of cryptocurrencies, which may preserve gradual bullish beneficial properties. By the tip of 2050, if the bullish momentum is maintained, STX may hit $11.15

Conclusion

If buyers proceed exhibiting their curiosity in STX and add these tokens to their portfolio, it may proceed to rise. STX’s bullish value prediction reveals that it may attain the $1.255 leve

FAQ

Stacks is a Bitcoin layer for sensible contracts; it permits sensible contracts and decentralized functions to trustlessly use Bitcoin as an asset and settle transactions on the Bitcoin blockchain.

STX tokens may be traded on many exchanges like Binance, OKX, Bitrue, LBank, and CoinW.

STX has a chance of surpassing its current all-time excessive (ATH) value of $3.6104 in 2021.

STX is among the few cryptocurrencies that has proven resilience. If STX breaks out of its falling wedge, it’d attain $1.25 quickly after it breaks the Resistance 1 and a couple of ranges.

STX has been one of the crucial appropriate investments within the crypto area. It’s extremely unstable, as such, it has fairly a margin when its value fluctuates. Therefore, merchants could also be allured to put money into STX. It’s funding within the quick time period and in the long run as effectively.

The current all-time low value of STX is $0.04501.

STX may be saved in a chilly pockets, sizzling pockets, or trade pockets.

STX was launched in 2013.

STX was co-founded by Y Combinator, Digital Forex Group and Winklevoss Capital.

The utmost provide of STX is 1,818,000,000 STX cash..

STX may be saved in a chilly pockets, sizzling pockets, or trade pockets.

STX is predicted to succeed in $1.2550 by 2023.

STX is predicted to succeed in $1.6435 by 2024.

STX is predicted to succeed in $4.0461 by 2025.

STX is predicted to succeed in $1.4339 by 2026.

STX is predicted to succeed in $1.8851 by 2027.

STX is predicted to succeed in $2.3159 by 2028.

STX is predicted to succeed in $5.0756 by 2029.

STX is predicted to succeed in $4.0429 by 2030.

STX is predicted to succeed in $7.6280 by 2040.

STX is predicted to succeed in $11.1386 by 2050.

Disclaimer: The views and opinions, in addition to all the data shared on this value prediction, are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates is not going to be held answerable for any direct or oblique harm or loss.