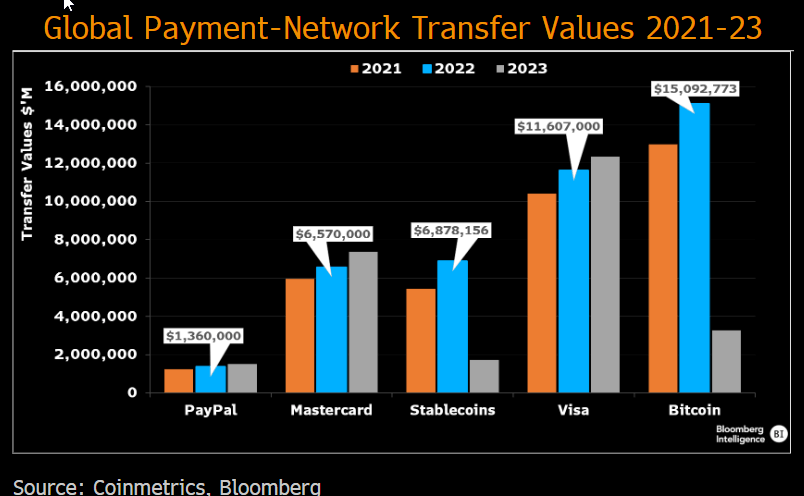

Fiat-backed stablecoins have eclipsed Mastercard and PayPal in shifting extra worth throughout their networks in 2022, in keeping with a Bloomberg Intelligence be aware on Aug. 25.

In keeping with Bloomberg Intelligence crypto market analyst Jamie Coutts, stablecoins on a number of Layer-1 networks transacted $6.87 trillion in 2022, surpassing the transaction volumes of Mastercard and PayPal.

Nevertheless, stablecoins nonetheless lagged behind the Visa community, which processed practically double the amount at $11.6 trillion.

Notably, the bear market of 2023 has not been so variety to the stablecoin market because it fell behind Mastercard year-to-date.

Coutts means that stablecoins’ adoption progress, which has outpaced Bitcoin and Ethereum prior to now two years, is about to speed up resulting from community results and important enhancements in blockchain scaling.

These elements are laying the inspiration for elevated international adoption of stablecoins. Nevertheless, it’s additionally price noting that stablecoin volumes have considerably declined in 2023, primarily as a result of cyclicality of crypto asset costs and an unfavorable US regulatory surroundings.

Regardless of these challenges, the function of stablecoins within the digital cash evolution is indeniable. Coutts initiatives that the variety of stablecoin customers may even overtake Bitcoin within the subsequent three to 5 years.

This potential progress is attributed to the community results of cost integration with service provider corporations like PayPal, Visa, and Shopify, together with product improvements like real-world property producing yield for stablecoins.

Moreover, developments in blockchain scaling are laying the mandatory infrastructure for the mainstream adoption of stablecoins. The crypto trade is present process speedy adjustments, with Layer-2 networks experiencing a major improve in lively addresses, thus suggesting that the Ethereum community is perhaps undervalued.

Due to this fact, Coutts argues that stablecoins have cemented their place within the digital age, proving their price regardless of a difficult crypto market. Because the crypto ecosystem continues its enlargement, the affect of stablecoins is anticipated to develop, doubtlessly reshaping the digital monetary panorama within the coming years.

Digital cost wars.

The information comes alongside the choice to shutter Mastercard providers for Binance on Aug. 24, eradicating pre-paid card providers to LatAm and Center East clients.

In February, stories from Reuters circulated that Visa and Mastercard would pause future crypto ventures till the regulatory local weather had improved. Visa disputed the claims on the time.

Latest analysis information suggests Visa is actively engaged on crypto merchandise, comparable to exploring leveraging account abstraction on Ethereum to permit Visa card funds for fuel charges.

Additional, Bloomberg reported in February that one other key legacy cost supplier, PayPal, was additionally pulling again on crypto. Nevertheless, PayPal’s stablecoin was launched lower than six months later.

In August, PayPal launched its PYUSD stablecoin with plans to push on to DeFi, and a collaboration with Ledger is already dwell.

In the meantime, Mastercard seems to be now focusing its crypto efforts on CBDCs over enhancing digital asset cost rails.

With stablecoins overtaking Mastercard and PayPal in 2022 and the launch of PayPal’s personal stablecoin, the way forward for digital funds seems to be set to contain a conflict of consideration between legacy cost suppliers and the brand new wave of digital disruptors.