- The crypto market sees a glimmer of hope as stablecoin provide surges to a brand new yearly excessive.

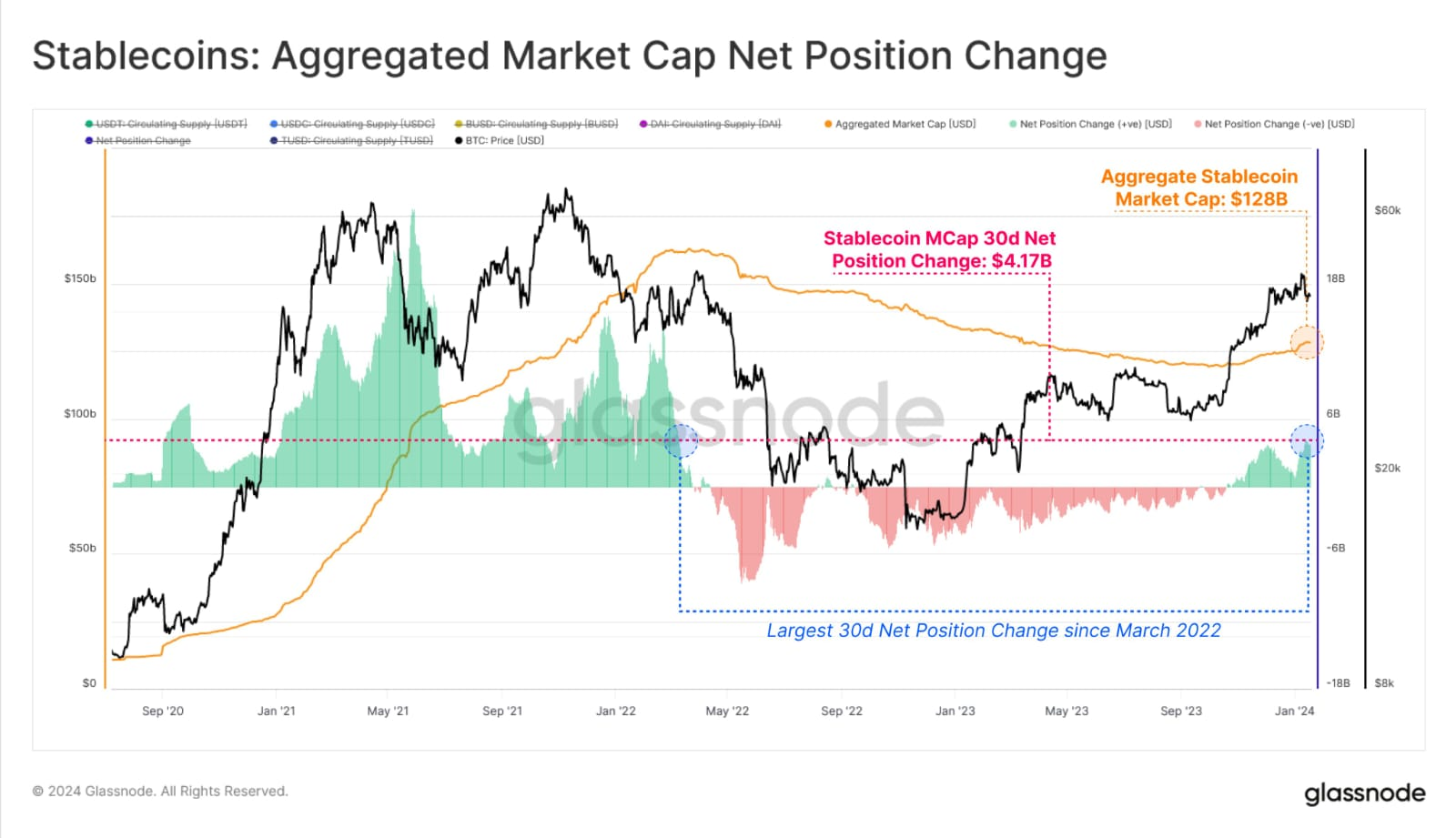

- The valuations of stablecoins clocked $134.3 billion, with a $4.17 billion change in 30 days.

- The $4.17 billion influx marks the biggest internet influx since March 2022.

The crypto market has been in a steady bearish development because the emergence of crypto ETFs, with market individuals trying to find causes to stay optimistic amid the prevailing crimson candles.

In a latest submit on X, the favored YouTube channel Crypto Banter drew consideration to an rising improvement historically recognized to be a bullish sign. Particularly, Crypto Banter cited statistics from famend analytic agency Glassnode on the unfolding development within the stablecoin panorama.

Glassnode information revealed that the provision of stablecoins has soared to a brand new yearly excessive this month. Particularly, the report indicated that the general valuations of stablecoins clocked $128 billion on the time of the disclosure. Nevertheless, the determine has since elevated to over $134.3 billion, per real-time information from CoinMarketCap.

Moreover, the Glassnode report famous that the surge in stablecoin provide adopted a big rise of $4.17 billion available in the market cap’s 30-day internet place change. In different phrases, over $4 billion entered the crypto market prior to now month by way of stablecoin.

Based on the analytic report, the 30-day influx represents probably the most substantial internet place change since March 2022.

Notably, Crypto Banter understated that the surge in stablecoin provide straight interprets into a big enhance in liquidity or funds available to be invested in risky tokens. Based on the analyst, it units the stage for a bullish market, attracting extra individuals and propelling costs to new highs.

Moreover, earlier than the brand new noticed development, the online flows into stablecoins had been unfavourable, as depicted within the chart. Moreover, the chart illustrated that stablecoin’s all-time excessive influx mirrored the crypto market’s peak in 2021. It additionally mirrored the bearish development that adopted.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be answerable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.