- Bitcoin ETFs recorded outflows of $243 millin as markets fell amid Iran’s missile assault on Israel.

- BTC value additionally fell, hitting lows of $60,300 earlier than recovering to above $61k.

Bitcoin exchange-traded funds recorded internet outflows for the primary time in two weeks, with $243 million exiting on October 2, 2024.

The outflows adopted a pointy decline for Bitcoin (BTC) value on Tuesday as geopolitical tensions within the Center East threatened to escalate additional with Iran’s assault on Israel. With institutional traders largely involved because the Center East teeters, spot Bitcoin ETFs hit outflows for the primary time since Sept.18.

Bitcoin ETFs break inflows streak

Outflows on Oct. 1 meant the US spot BTC ETFs market broke an eight day streak of internet inflows. It additionally noticed the Bitcoin ETFs file the most important outflows since greater than $287 million exited the market on Sept. 3. That outflows streak additionally hit eight consecutive days.

Aside from BlackRock’s IBIT, which recorded inflows of over $40.8 million, all different ETFs both noticed outflows or zero internet flows.

Constancy’s FBTC led with over $144.7 million in unfavorable flows, whereas Ark 21Shares’ ARKB noticed greater than $84.3 million offloaded. In the meantime, there have been zero internet flows for Grayscale’s Mini Bitcoin Belief in addition to Franklin, Invesco, Valkyrie, WisdomTree ETFs.

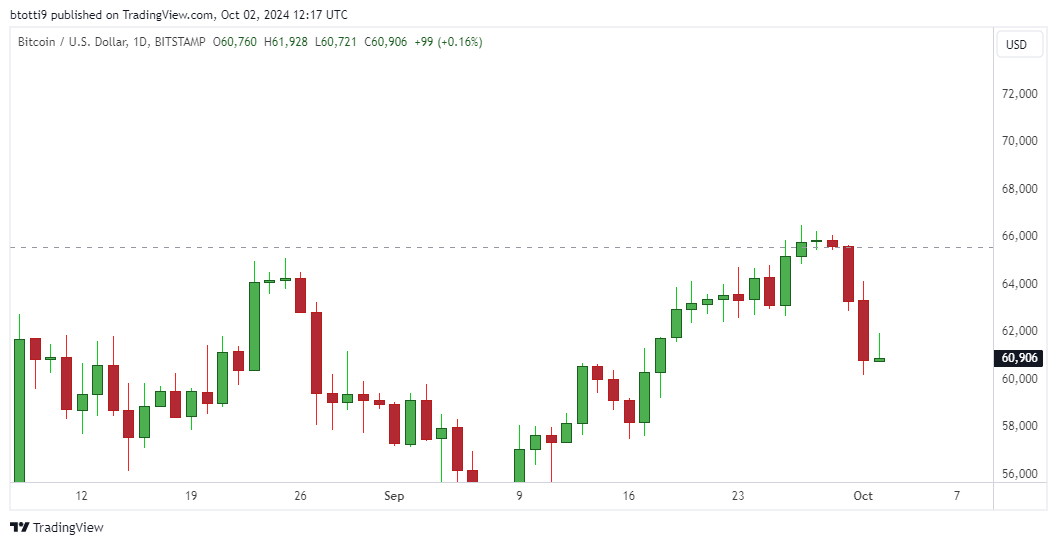

BTC value retreated to $60.3k

Amid these actions, BTC value slumped greater than 4%, with losses pushing it to lows of $60,300 throughout main crypto exchanges. From highs above $64k, it meant bulls gave up nearly $4k earlier than discovering assist.

This was the sharpest value dip for Bitcoin since Sept. 6, when BTC fell from above $56,170 to close $52,500.

As BTC value fell, a significant whale dumped over $46 million in BTC on Binance. This specific whale, in line with Spot On Chain, had gathered 3,933 BTC price greater than $234 million between August 29 and September 15, 2024.

Regardless of the sizable sale, the BTC whale nonetheless hodls 9,736 bitcoins price over $601 million.

Bitcoin has traded to above $61k.