Solana not too long ago encountered a major problem with an unprecedented variety of transaction failures. On Apr. 5, the community noticed over 75% of its transactions fail, highlighting a vital difficulty for a community that has quickly turn out to be a key participant within the DeFi area, dealing with huge buying and selling volumes. This surge in failed transactions raised issues in regards to the community’s capability to maintain its progress and preserve operational effectivity.

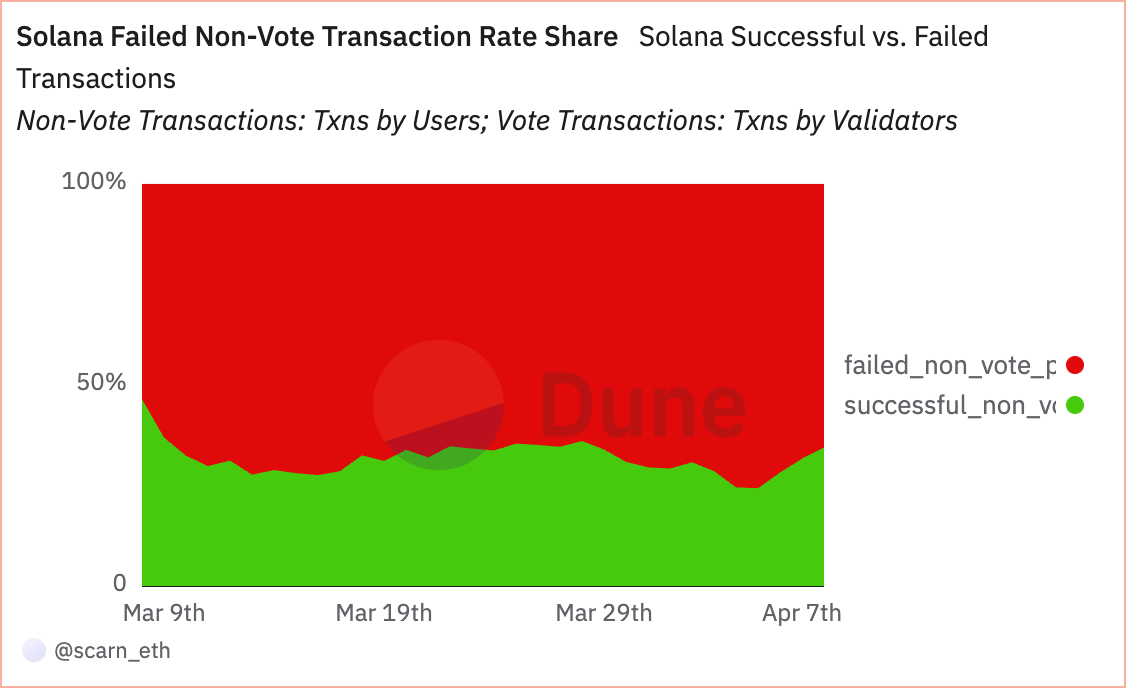

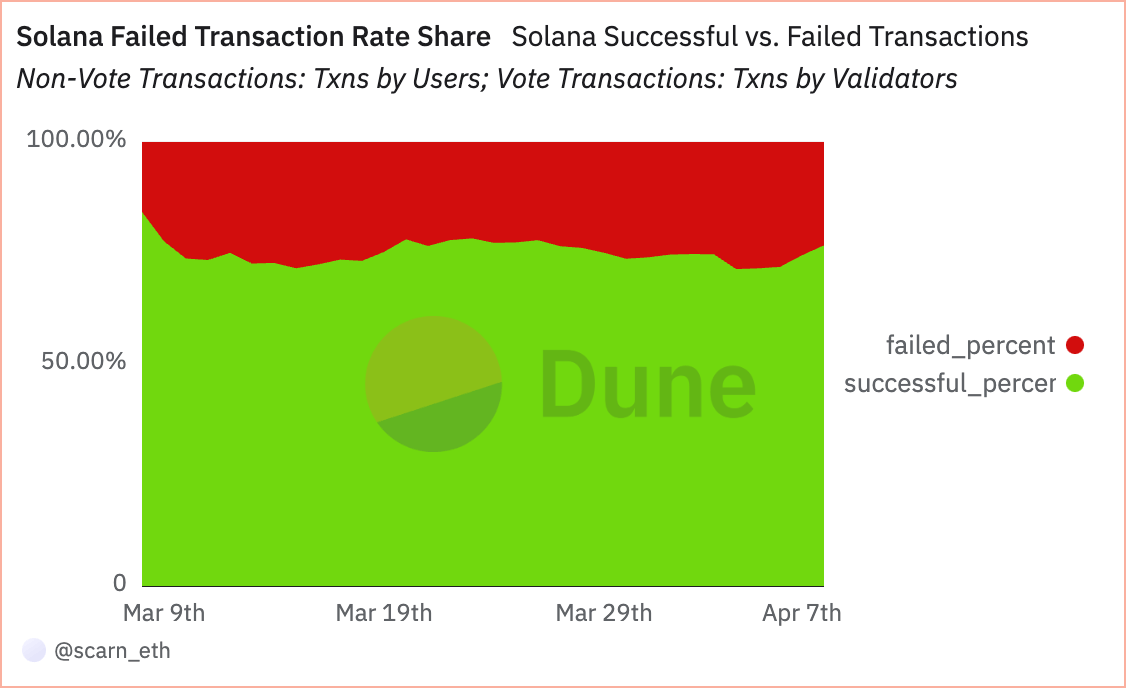

Transactions on Solana are categorized into two sorts: vote and non-vote transactions. Vote transactions are associated to the consensus mechanism, basically votes by validators on the state of the blockchain. Non-vote transactions embody all different sorts, together with transfers, good contract executions, and DEX trades. The sharp enhance in failed non-vote transactions, with charges as excessive as 75.68%, factors to extreme limitations in dealing with user-initiated actions.

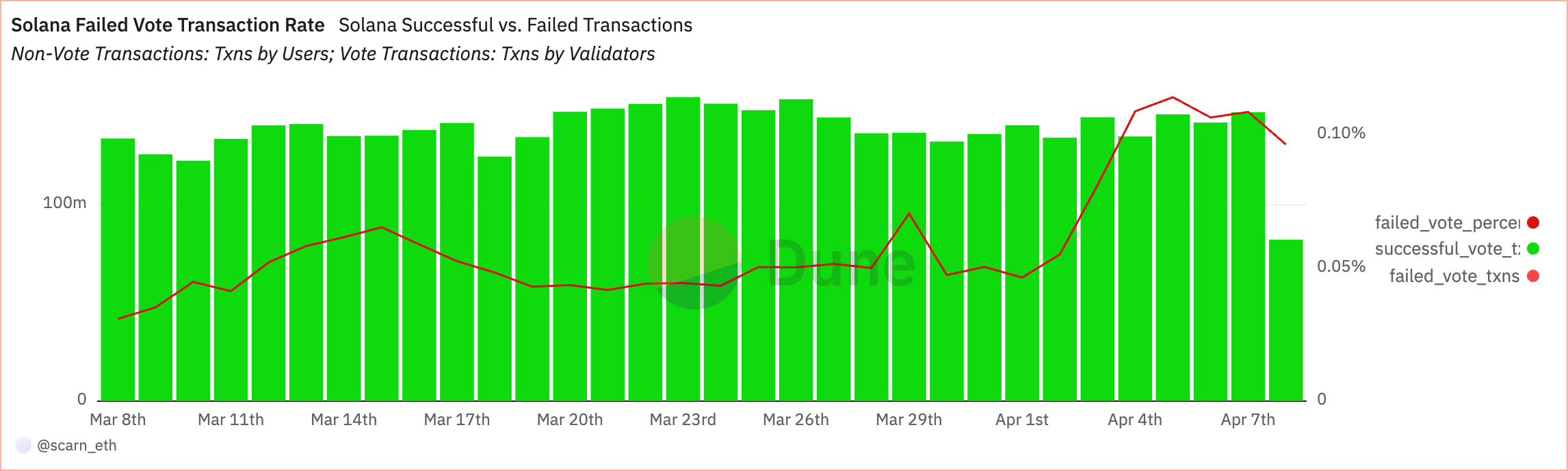

Conversely, the low failure charges of vote transactions, which have additionally elevated considerably however nonetheless stay below 0.11%, point out that the consensus mechanism itself stays secure regardless of the stress on the community.

Wanting on the share of vote versus non-vote transactions reveals notable shifts in community exercise. Though a good portion of the community’s transactions are for voting functions, the substantial share of non-vote transactions reveals that almost all of Solana’s use circumstances transcend consensus duties.

Nevertheless, the overall failed transaction price reached a file excessive of 28.50% on Apr. 5, though decrease than the non-vote failure price, nonetheless signifies a troubling development that might undermine person belief and community utility.

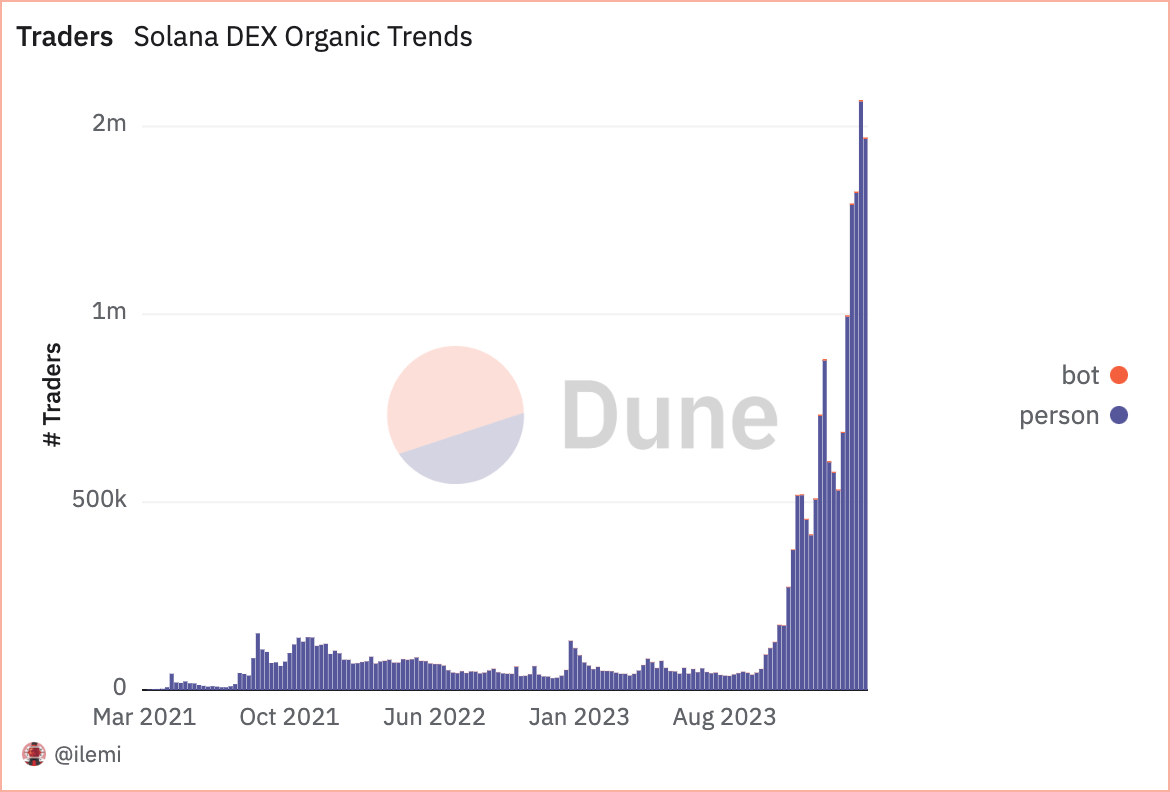

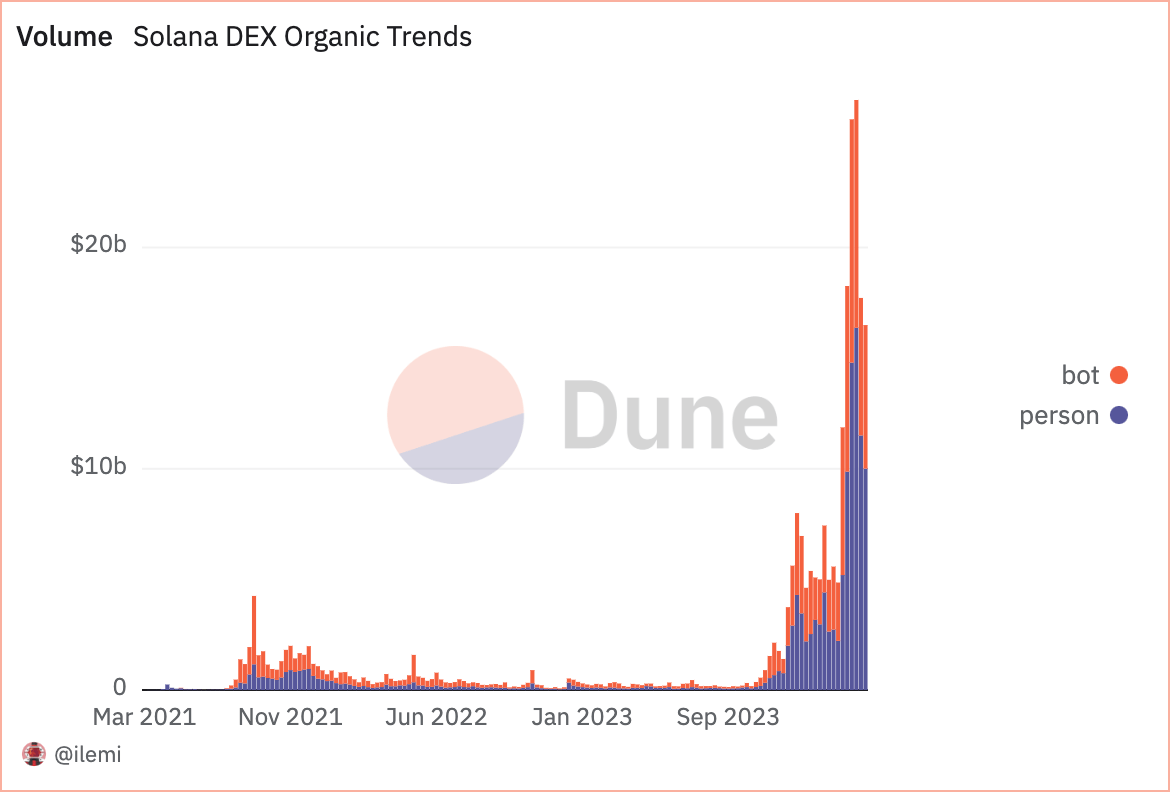

A number of various factors have contributed to the excessive failure price on the community. Nevertheless, the proliferation of bots on the community appears to be the dominant one. Bots are automated packages designed to execute transactions at excessive speeds and have been thought of a major pressure on Solana’s infrastructure for fairly some time. Regardless of representing a small fraction of the community’s customers, bots account for a disproportionately massive quantity of buying and selling exercise.

On Mar. 18, Solana recorded its largest DEX buying and selling quantity ever, with $26.7 billion, of which $10.3 billion was attributed to bot exercise. This discrepancy highlights the influence of bots on community congestion and the transaction failures that end result from it.

Solana might face extreme penalties from such excessive failure charges. These failures translate into misplaced alternatives and potential monetary losses for customers, particularly in DeFi. For the community, persistent points with transaction reliability might deter builders and customers from constructing on or utilizing Solana, favoring extra secure alternate options.

Addressing these challenges is the arduous half, although. Enhancing community infrastructure to handle excessive volumes of transactions effectively is paramount, however implementing it on the pace and scale this drawback requires will stay extraordinarily troublesome. Whereas this might contain processes like upgrading consensus mechanisms and optimizing transaction processing, implementing higher measures to handle bot exercise needs to be prioritized.

Whereas the community faces important challenges with transaction failures, primarily resulting from non-vote transactions and bot exercise, on-chain knowledge reveals its foundational stability stays comparatively intact.

The put up Solana’s rising pains: Why 75% of non-vote transactions failed appeared first on starcrypto.