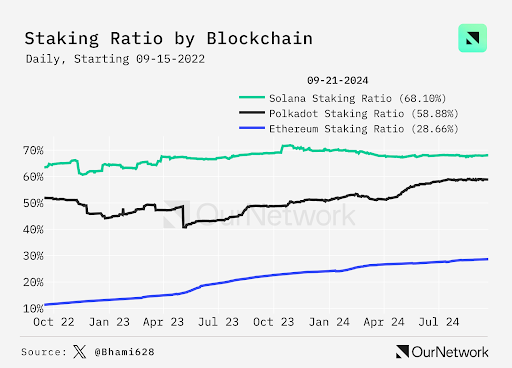

- Solana surpasses Ethereum with a staking ratio of 68%, in comparison with Ethereum’s 28%.

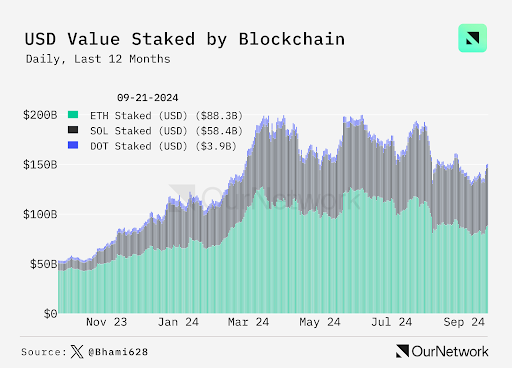

- Solana’s staked worth skyrockets to $58 billion, reflecting a $50 billion improve in only one 12 months.

- Polkadot follows carefully with 58.88% of its provide staked, though its complete worth lags at $3.9 billion.

In a notable shift in blockchain staking traits, Solana has overtaken Ethereum in staking ratio, with 68% of its complete provide staked as of September 2024. By comparability, solely 28% of Ethereum’s provide is staked. This demonstrates a major distinction in consumer participation throughout the 2 main blockchain networks.

If you stake, you lock up tokens to assist safe a blockchain community in change for rewards. This staking ratio is a vital metric to evaluate how a lot of a blockchain’s provide is getting used for validation and safety.

The info on staking ratios consists of each native staking, the place tokens are locked immediately inside the community, and liquid staking, which permits customers to stake tokens whereas sustaining liquidity via spinoff tokens.

Solana Has $50B Extra Locked in Staking Swimming pools Than a Yr In the past

Although Solana has the next staking ratio, Ethereum stays the biggest proof-of-stake (PoS) blockchain by complete worth staked. As of September, Ethereum had over $88 billion in tokens staked, in comparison with Solana’s $58 billion.

In the meantime, Solana’s present staked worth displays a dramatic development from $7.5 billion in September 2023, which suggests contemporary capital of over $50 in a single 12 months. This sharp improve highlights Solana’s rising community engagement and adoption. However Ethereum’s bigger complete worth staked exhibits its power because the main PoS blockchain by asset worth.

Notably, the Polkadot (DOT) community has seen much more staked tokens over the previous 12 months. Polkadot is simply behind Solana when it comes to staked ratio, with 58.88% of its provide locked. Whereas Solana and Ethereum have a number of billion {dollars} in locked worth, Polkadot is much behind with simply $3.9 billion.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version is just not answerable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.