Monitoring the modifications within the provide held by entities with varied Bitcoin balances supplies perception into investor conduct and potential value actions. Every class of holder—from particular person retail traders to massive establishments—performs a definite function within the crypto ecosystem, and their collective actions can considerably affect the general market.

Adjustments within the provide distribution amongst completely different pockets sizes could be a sturdy indicator of market sentiment. For example, small entities accumulating BTC typically suggests elevated retail curiosity and presumably a bullish sentiment amongst particular person traders who could view present costs as engaging for entry or funding enlargement. Redistribution by bigger entities may characterize varied methods or responses to the market, together with profit-taking, portfolio rebalancing, or reactions to regulatory or financial modifications. This exercise is essential as it would characterize institutional or skilled traders’ views, which could be a bellwether for broader market strikes.

The focus of Bitcoin in massive wallets, or its dispersal throughout a broader vary of smaller holders, impacts the liquidity and volatility of the market. A excessive focus in just a few wallets can result in elevated volatility if these entities resolve to maneuver massive parts of their holdings. Conversely, a extra distributed base of small and medium holders can improve market stability and liquidity, as gross sales or purchases are much less more likely to impression the worth drastically.

Understanding which market segments are rising or shrinking can present insights into how exterior elements impression various kinds of traders.

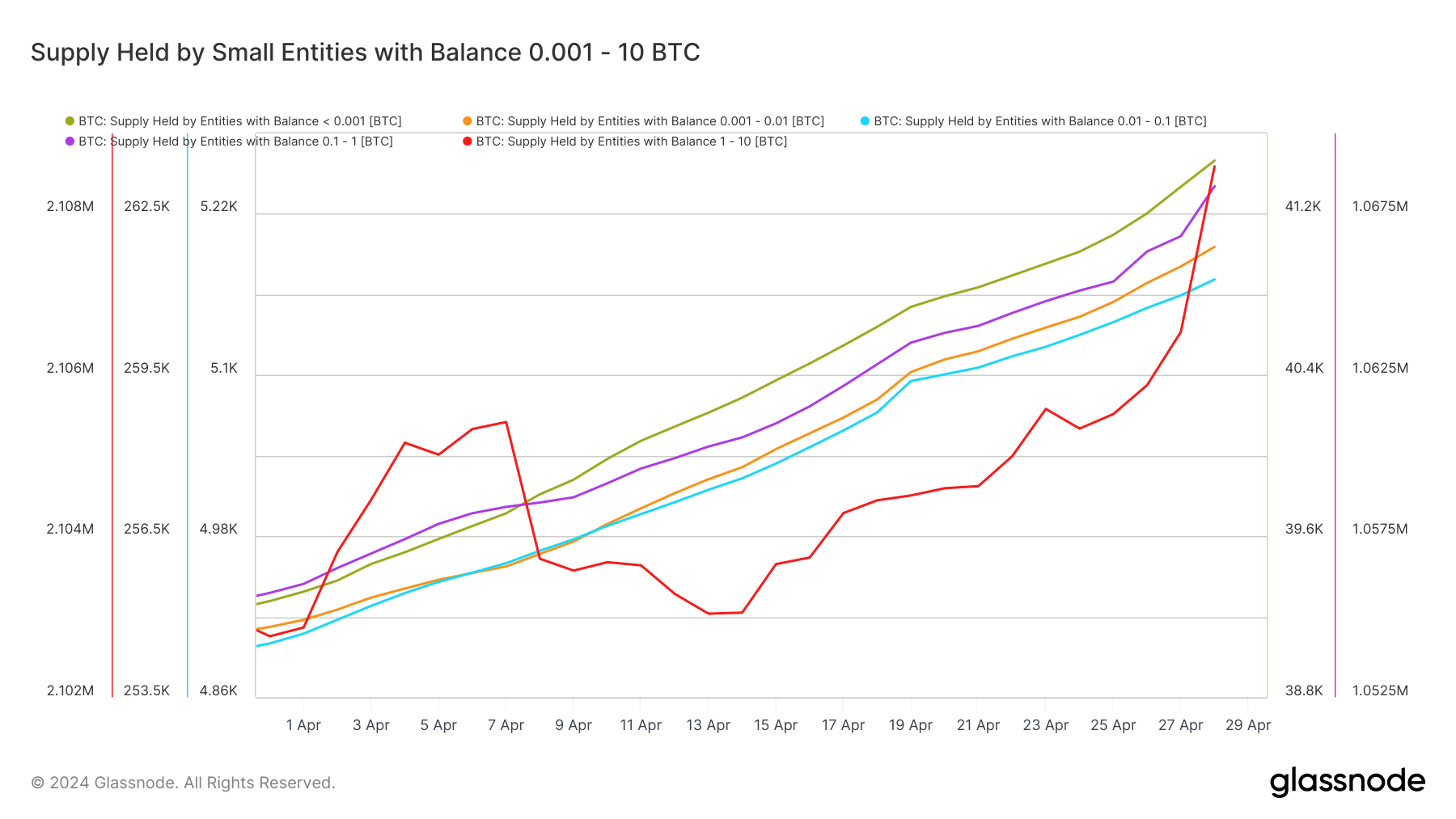

Knowledge from Glassnode confirmed a rise within the provide of Bitcoin held throughout all classes of smaller entities, starting from entities with a steadiness of lower than 0.0001 BTC to balances as much as 10 BTC. Entities with a steadiness between 0.01 – 0.1 BTC noticed the most important improve of their Bitcoin holdings. This group’s provide elevated from 254,503.7 BTC to 261,281.4 BTC. It represents a rise of 6,777.7 BTC, the very best absolute improve among the many smaller entity teams noticed over the previous 30 days.

This vital improve may point out a rising confidence amongst what could be thought-about “informal” traders—people who should not simply dipping their toes within the Bitcoin market however are probably utilizing it as a minor but significant part of their crypto holdings. The rise throughout all of those entities signifies they’re accumulating. With Bitcoin’s value dropping from $73,000 to $63,000 over the previous month, the timing helps the notion that these traders are shopping for the dip, probably viewing decrease costs as a horny entry level. This conduct is attribute of retail traders and smaller market members who could understand long-term worth at cheaper price factors.

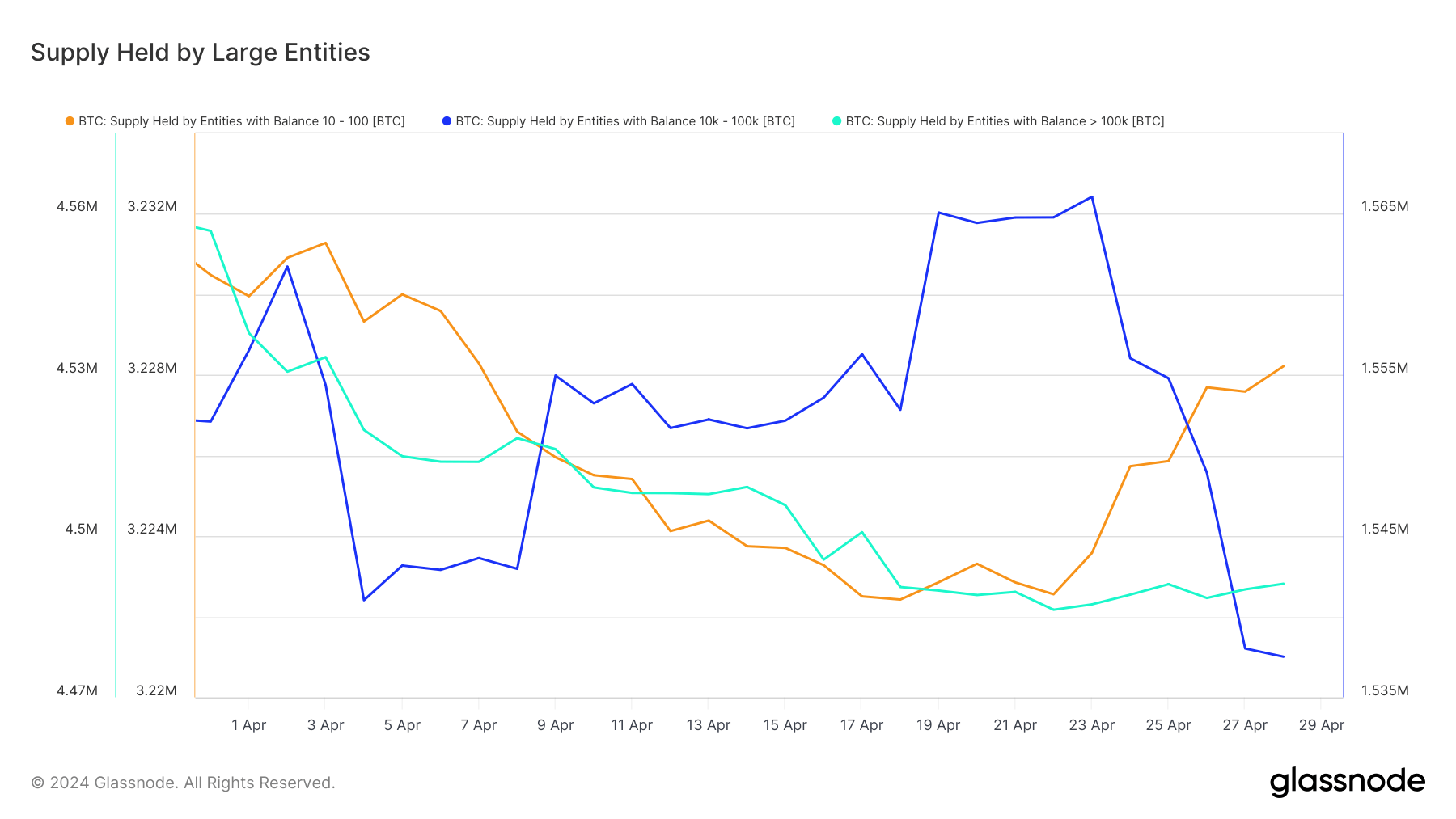

Conversely, bigger entities confirmed combined modifications of their balances, with most exhibiting decreases over the previous 30 days.

The discount in holdings among the many largest entities may very well be attributed to a number of elements, together with the promoting pressures from ETF outflows, notably from merchandise like GBTC, and miners promoting their holdings to comprehend income or cowl operational prices amidst a lower-price setting. The motion in massive balances aligns with institutional conduct, the place changes in holdings may be strategic or a response to market situations.

The submit Small Bitcoin holders are accumulating at the same time as costs fall appeared first on StarCrypto.