Crypto’s US Greenback market depth has considerably dropped over the previous month following Silvergate’s struggles, in accordance with Kaiko information.

US exchanges have gotten much less liquid.

Kaiko stated U.S.-based exchanges and market makers have gotten much less liquid as they appear most affected by Silvergate’s implosion.

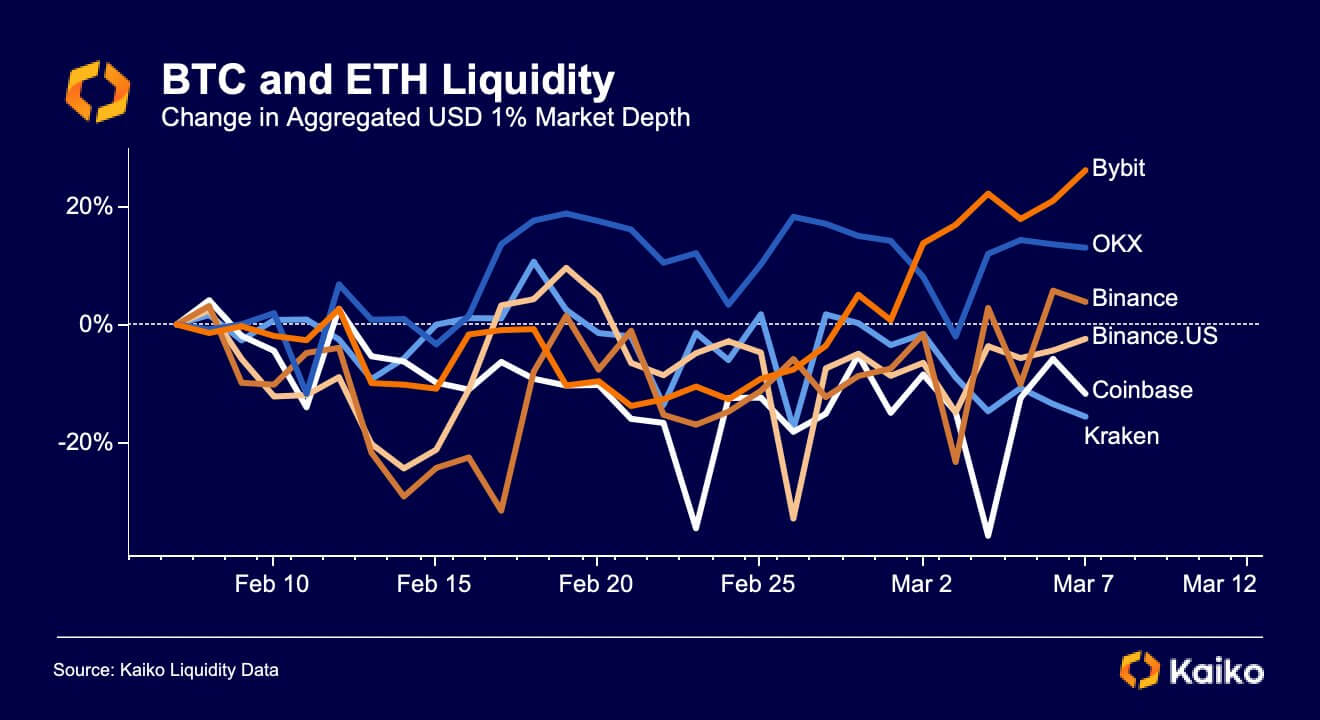

In accordance with Kaiko information, Bitcoin and Ethereum’s market depth improved throughout worldwide exchanges like Binance, OKX, and ByBit within the final 30 days. Nonetheless, they worsened on US-based exchanges like Coinbase and Kraken throughout the identical interval.

The crypto market’s liquidity measures how the market can take in massive purchase and promote orders with out considerably affecting costs.

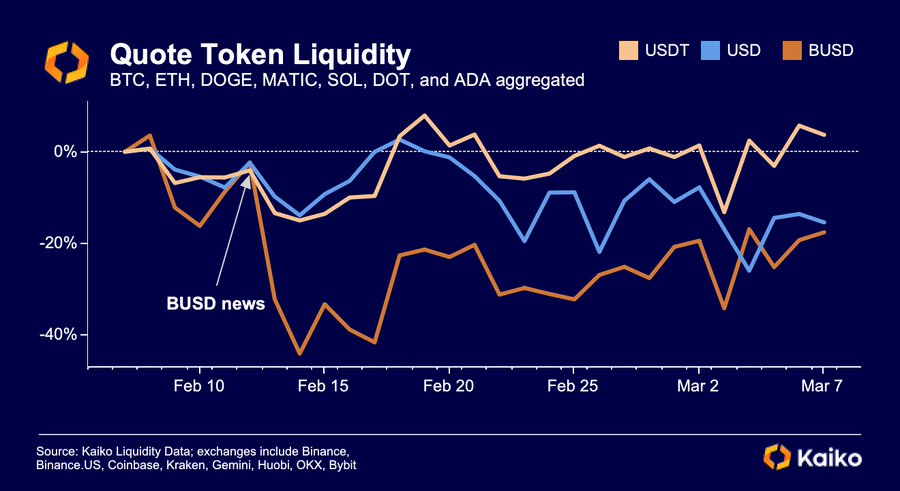

The on-chain information aggregator famous that the USD’s liquidity degree was near that of Binance USD (BUSD) stablecoin. Nonetheless, BUSD’s liquidity for its prime pairs had dropped by as a lot as 40% when New York’s monetary regulator ordered the asset’s issuer Paxos to cease additional mints.

Whereas BUSD’s liquidity degree has begun to enhance barely, Kaiko stated the Silvergate information was “weighing on USD pairs,” bringing it nearer to the extent of the embattled stablecoin.

In the meantime, the liquidity drop throughout US exchanges seems to have contributed to ETH and BTC’s slight damaging market depth over the interval.

Silvergate position in crypto’s USD liquidity

The numerous USD liquidity decline exhibits Silvergate’s position in connecting the standard monetary system and the crypto trade.

At its peak, the financial institution’s Silvergate Change Community (SEN) reportedly processed over $219 billion in transfers and generated $9.3 million in income in the course of the fourth quarter of the 2021 market rally.

Main crypto companies, together with Coinbase, Gemini, Paxos, and Circle, used the providers. Sadly, these establishments had been compelled to drop the financial institution attributable to considerations about its skill to proceed working.

Altcoins affected

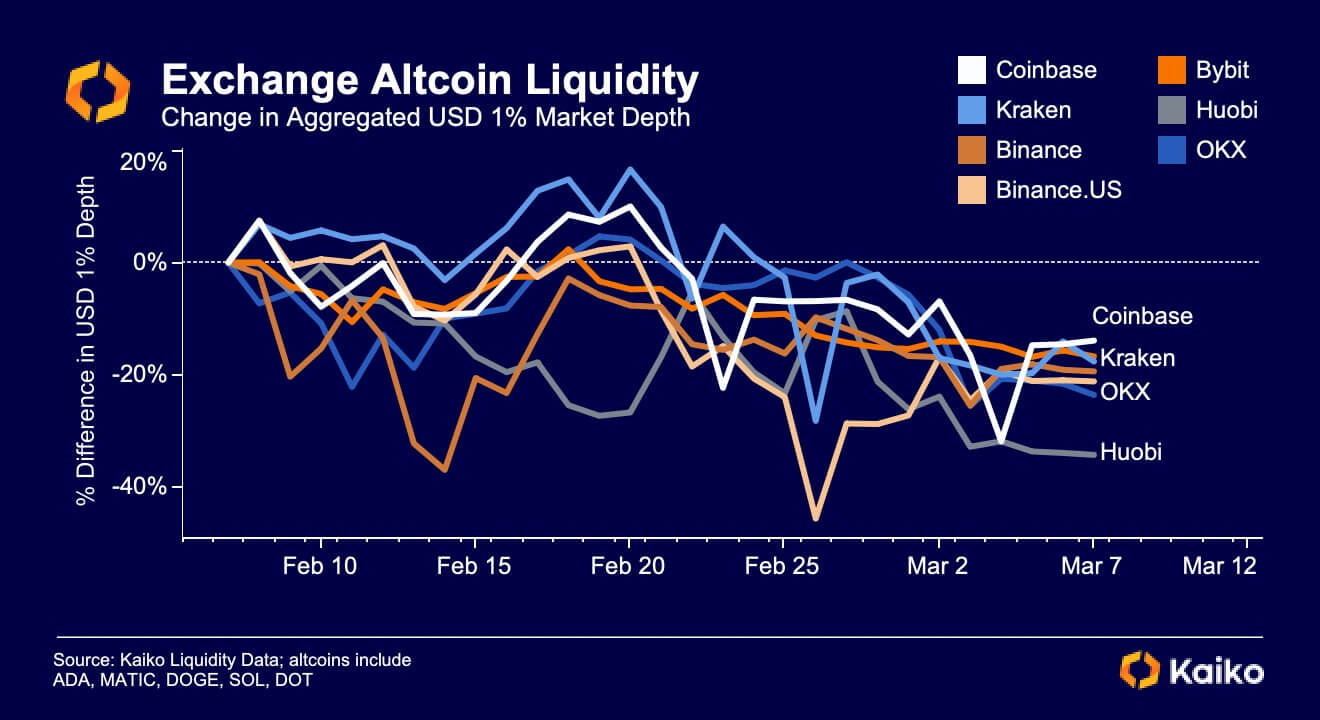

In the meantime, the worsening liquidity seems to have an effect on altcoins throughout a number of exchanges.

Kaiko’s information confirmed that a number of exchanges had misplaced extra than 15% of their market depth for altcoins, like Cardano’s ADA, Polygon’s MATIC, Dogecoin’s DOGE, Solana’s SOL, and Polkadot’s DOT over the past 30 days.

In accordance with the info, the least affected alternate was Coinbase, whose depth for these crypto-assets dropped 14%, whereas others like Bybit and Kraken misplaced 17% every. Binance and its US subsidiary shed 20%, respectively, whereas Huobi is down 35%.

Euro’s quantity rises in opposition to USD.

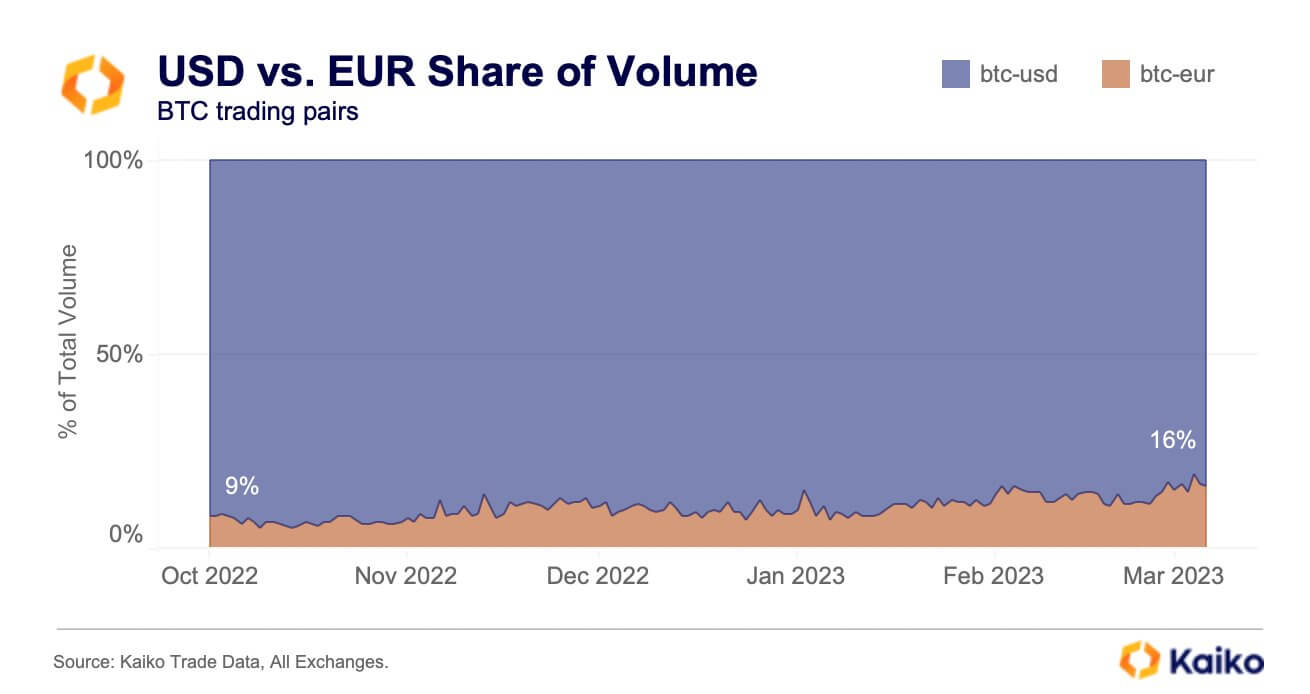

Whereas USD’s liquidity has been dropping in opposition to the crypto market, the European Union’s Euro has been gaining floor in opposition to Bitcoin, in accordance with Kaiko information.

Kaiko identified that the Euro’s quantity relative to USD has almost doubled since FTX’s collapse in November 2022. In accordance with the agency, Euro’s quantity rose to 16% from 9% for BTC markets.

The elevated Euro quantity has coincided with the rise of Euro-backed stablecoins. Consequently, the highest two stablecoin issuers, Tether and Circle, have launched stablecoins backed by the Euro to realize market share.