- SHIB’s 200-EMA golden cross on the each day timeframe might set off an uptrend in the long run.

- The token lacked liquidity because of the stagnancy within the OBV.

- Merchants should not enthusiastic about its short-term prospects.

IntoTheBlock knowledge revealed that Shiba Inu’s (SHIB) 90.16% decline from its All-Time Excessive (ATH) has left 81% of its holders in a loss. This case explains how the token has been unable to meet up with different cryptocurrencies throughout short-term rallies.

In line with the crypto market perception platform, this efficiency has left SHIB’s correlation with Bitcoin (BTC) at 0.86. Though this correlation may very well be thought-about close to excellent, it means that the meme has not adopted BTC’s motion 100% in current occasions.

Nonetheless, SHIB’s incapacity to supply beneficial properties to its long-term holders may not be linked to submerged curiosity and a scarcity of liquidity alone.

SHIB’s bearish nature continues to linger

As an alternative, the emergence of Pepecoin (PEPE) has additionally performed a component. Regardless of the drop within the token worth, the broader crypto neighborhood nonetheless appeared to have their eyes on it.

This was as a result of LunarCrush confirmed that its social engagement elevated considerably over the past week. For the unfamiliar, when social engagement spikes, it implies that search and dialogue round an asset have elevated. However how quickly will SHIB exit this underwhelming efficiency?

Based mostly on the each day chart above, SHIB has been unable to carry on to notable resistance. As of 19 April, the 0.00001549 psychological resistance fell sharply. And subsequent makes an attempt have additionally ended futile.

As well as, the 20-day Exponential Shifting Common (EMA) crossed the 50-day EMA (orange). The state of those indicators means that sellers are in management. Due to this fact, it may very well be tough for SHIB to recuperate within the quick time period.

Nonetheless, there was an upward crossover or golden cross of the 200-day EMA (purple) above the 20 and 50 EMAs on 9 March. A state of affairs like this means that SHIB might set up a brand new uptrend within the mid to long run.

In the meantime, the On-Steadiness-Quantity (OBV) which measures shopping for and promoting strain has principally stayed flatlined. At press time, the OBV confirmed that the intent of market gamers have swayed from shopping for and promoting the token.

Shorts’ time to reign available in the market

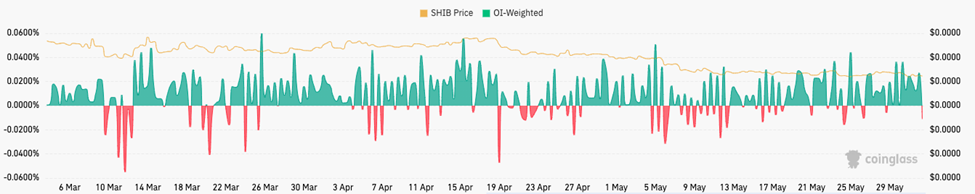

By way of funding price, Coinglass revealed that SHIB had gone destructive. Which means merchants holding quick positions had been keen to pay the funding charges of lengthy place holders to maintain their futures contracts open.

On the flip aspect, when the funding price is optimistic, it implies bullishness with merchants’ place. Therefore, long-positioned merchants could be keen to pay shorts.

In the long term, SHIB has the tendency to revive contemplating the way it’s one of many prime tokens held by whales. Nonetheless, short-term expectations may proceed languishing within the bearish space.

Disclaimer: The views, opinions, and knowledge shared on this value prediction are printed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be accountable for direct or oblique harm or loss.