- SHIB burn fee surges 5564%, fueling market optimism.

- SHIB consolidation hints at a doable bullish breakout.

- The symmetrical triangle sample indicators a possible SHIB breakout.

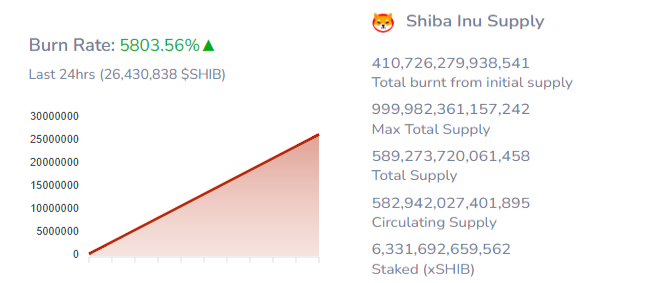

The meme coin sector not too long ago witnessed Shiba Inu grabbing consideration once more as its burn fee soared by over 5500%. On Could 10, the Shibburn tracker reported that roughly 26 million SHIB had been destroyed up to now 24 hours. This dramatic spike injected a wave of optimism into the dog-themed meme coin’s market prospects.

Shiba Inu Burn Fee (Supply: Shibburn)

In keeping with Shibburn’s information, Shiba Inu’s burn fee skyrocketed by 5564.09%, eradicating 25.93 million SHIB from its complete provide. The surge provided renewed hope amongst buyers, with the decreased provide anticipated to help a worth enhance.

SHIB Worth Motion

As of press time, the Shiba Inu token has skilled a 3.78% climb up to now 24 hours, buying and selling at $0.00002351. This uptick coincides with a current acceleration in its burn fee, whereas weekly information suggests consolidation, with SHIB drifting laterally but garnering a light 2.48% uptick.

SHIB/USD 24-Hour Chart (Supply: CoinStats)

Regardless of this consolidation, the accelerated burn fee serves as a optimistic harbinger, hinting at a bullish trajectory for Shiba Inu. Relative to Bitcoin, SHIB has appreciated by 0.69% during the last 24 hours.

This optimistic sentiment has propelled SHIB’s market capitalization, securing its place because the eleventh largest cryptocurrency with a 3.29% surge, now standing at $13,840,081,439. On the identical accord, its buying and selling quantity has ticked up modestly by 1.37%, reaching $382,472,354, reflecting rising investor enthusiasm and assurance.

SHIB Holds Regular in Symmetrical Triangle Sample

Shiba Inu’s newest bullish ascent is underscored by a symmetrical triangle sample on the token’s one-day chart, signaling a consolidation part that portends an impending breakout in both course. Market individuals stay cautious because the instant path is unsure, hinging on which faction seizes management. A robust surge looms on the horizon, able to favor the prevailing pressure and reshape the buying and selling panorama.

SHIB/USD 1-Day Chart (Supply: Tradingview)

If bulls dominate and drive costs upward, a breakout above the symmetrical triangle would sign bullish momentum. This might push the SHIB token to rally in the direction of the resistance stage on the 78.6% Fibonacci stage, permitting bulls to purpose for his or her goal area.

Conversely, if bears seize management, a breakout to the draw back would present bearish momentum, probably resulting in a retest of essential help ranges close to $0.000020804. An additional decline may push the SHIB token in the direction of the January low, the place it would discover a stronger help stage.

SHIB/USD 1-Day Chart (Supply: Tradingview)

Technically, the MACD (Transferring Common Convergence Divergence) indicator is flattening round $0.000000595 beneath the zero line, suggesting consolidation and a possible breakout in both course. The MACD histogram mirrors this state of affairs, as its bars are flattening alongside the zero line, emphasizing the market’s present indecision.

In the meantime, the RSI (Relative Energy Index) indicator is barely above the sign line and approaching the impartial zone at 45.09, signifying that SHIB may pivot in any course. This crucial place means that merchants ought to intently monitor worth motion, as an upward or downward pattern may quickly emerge.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be chargeable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.