- On-chain knowledge exhibits contradicting conduct between present SHIB traders.

- Glassnode, exhibits a current surge in new SHIB addresses.

- The worth of SHIB has remained stagnant over the identical interval.

On-chain knowledge exhibits contradicting conduct between present SHIB traders and newcomers. Knowledge from the crypto analytical platform, Glassnode, exhibits a current surge in new SHIB addresses. Nonetheless, the value of the main meme coin has remained stagnant over the identical interval.

A famend market watcher, Ali Martinez, noticed the surge, notably the spike on Might 26, when 2,538 new SHIB addresses joined the community in a single day. That spike marked the best enhance within the variety of SHIB addresses in three months.

Regardless of the current rise in community exercise, SHIB’s value has remained comparatively stagnant. The meme coin’s value has continued within the slim horizontal channel it traded up to now three weeks. All through this era, SHIB’s value moved between an higher boundary of $0.00000917 and a decrease assist of $0.00000829.

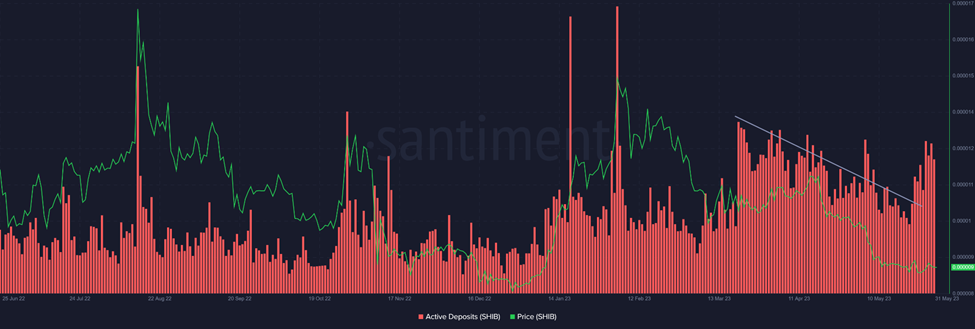

From another analytical platform, Santiment, there may be proof of a surge within the SHIB energetic deposits. Often, an increase in energetic deposits may recommend that traders are doubtlessly promoting their belongings. With the present scenario, the alternate steadiness for SHIB has not modified a lot. Total, this means the brand new entrants into the community are exhibiting bullish tendencies.

Accessible knowledge recommend doubtlessly bullish traders are getting into the Shiba Inu community lately. Nonetheless, the general end result exhibits an identical resistance from present traders with a bearish outlook. The dearth of restoration by SHIB suggests an absence of participation by the over 1.2 million present SHIB addresses.

Crypto customers could attribute the dearth of participation to the general market pattern. The crypto market has consolidated for the reason that preliminary rally of Q1 2023 pale. Some analysts imagine it’s a regular conduct for the crypto market because it prepares for elevated volatility forward of the following Bitcoin halving.