The full crypto market cap fell $53 billion as information of the U.S. Securities and Alternate Fee (SEC) submitting towards Binance got here by way of.

On June 5, the SEC charged Binance, its CEO Changpeng Zhao, and associated entities with 13 violations, together with wash buying and selling, evasion of laws, and providing unregistered securities.

Binance stated it was disillusioned with the criticism and had at all times labored cooperatively with regulator’s inquiries. Nevertheless, it disputed the enforcement motion and meant to “vigorously” defend the fees.

A key element of Binance’s protection facilities on the SEC’s purported unwillingness to offer regulatory readability. It additional claimed that the corporate was a sufferer of the continuing “regulatory tug-of-war,” by which authorities businesses search to “declare jurisdictional floor from different regulators.”

“Sadly, the SEC’s refusal to productively have interaction with us is simply one other instance of the Fee’s misguided and aware refusal to offer much-needed readability and steering to the digital asset business.“

Crypto markets crash

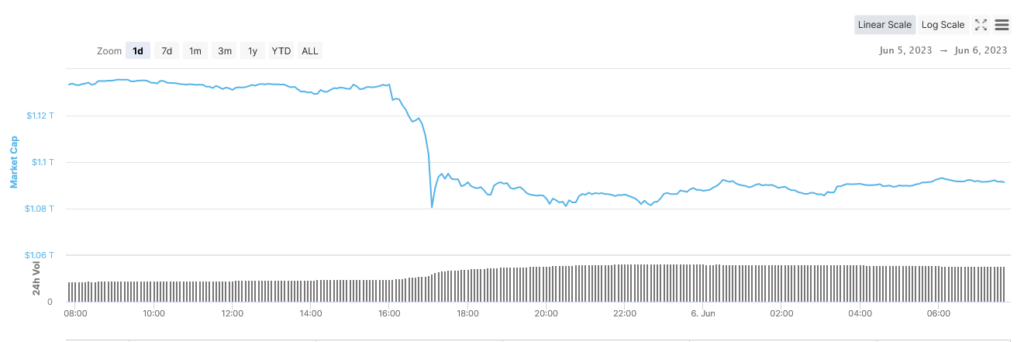

Markets tanked on the information of the SEC submitting towards Binance.

On June 5, at 16:00 BST, simply earlier than the information broke, the whole crypto market cap was valued at $1.13 trillion. As phrase unfold, the following dump bottomed at $1.08 trillion roughly an hour later – equating to a $52.7 billion, or 4.7%, drawdown.

A bounce adopted to prime out at $1.1 trillion. The market has since traded flat as members take into account the gravity of the scenario, significantly the allegations that a number of third-party tokens have been named as securities within the SEC submitting, together with ADA, SOL, and MATIC.

Greatest winners and losers

Of the highest 100, the largest losers during the last 24 hours have been Pepe, The Sandbox, and Sui, which misplaced 15.2%, 14.8%, and 12.7%, respectively. The Sandbox was named as an unregistered safety within the SEC submitting.

Kava was the one prime 100 token (excluding stablecoins) to remain inexperienced over the interval, which grew 9.6%.

Market chief Bitcoin suffered a peak-to-trough lack of 5% to seek out help at $25,400. It has since peaked at $25,890 however is shaping to retest $25,600 help.