The U.S. Securities and Trade Fee’s newest delays on the spot Bitcoin (BTC) ETF functions led to a market-wide pullback that resulted in $130 million in liquidations during the last 24 hours.

SEC delays spot ETF choice

On Aug. 31, the monetary regulator issued notices indicating the postponement of selections on all ETF functions till October. The delay was attributed to the regulator’s want for enough time to deliberate on the proposed rule change and the related issues.

This choice impacted functions from outstanding companies, together with BlackRock, Valkyrie, WisdomTree, Invesco Galaxy, Bitwise, and Sensible Origin.

The current delay comes as no shock, because it aligns with prior predictions by Bloomberg analysts Eric Balchunas and James Seyffart. That they had foreseen the SEC’s inclination to defer functions whereas deliberating on its subsequent transfer, particularly after Grayscale’s current authorized success in opposition to the regulatory physique.

However the SEC’s actions, these analysts keep a optimistic outlook, suggesting that the probabilities of ETF approval have climbed to a promising 75%.

Bitcoin crashes

Following information of the delay, Bitcoin, already experiencing a cooling-off interval following the Grayscale-induced current surge, dropped by roughly 5%, pushing its valuation beneath the $26,000 mark. BTC was buying and selling for $25,976 as of press time, in keeping with StarCrypto’s knowledge.

Concurrently, the broader cryptocurrency market witnessed an almost 4% decline, collectively amounting to a complete market capitalization of $1.05 trillion.

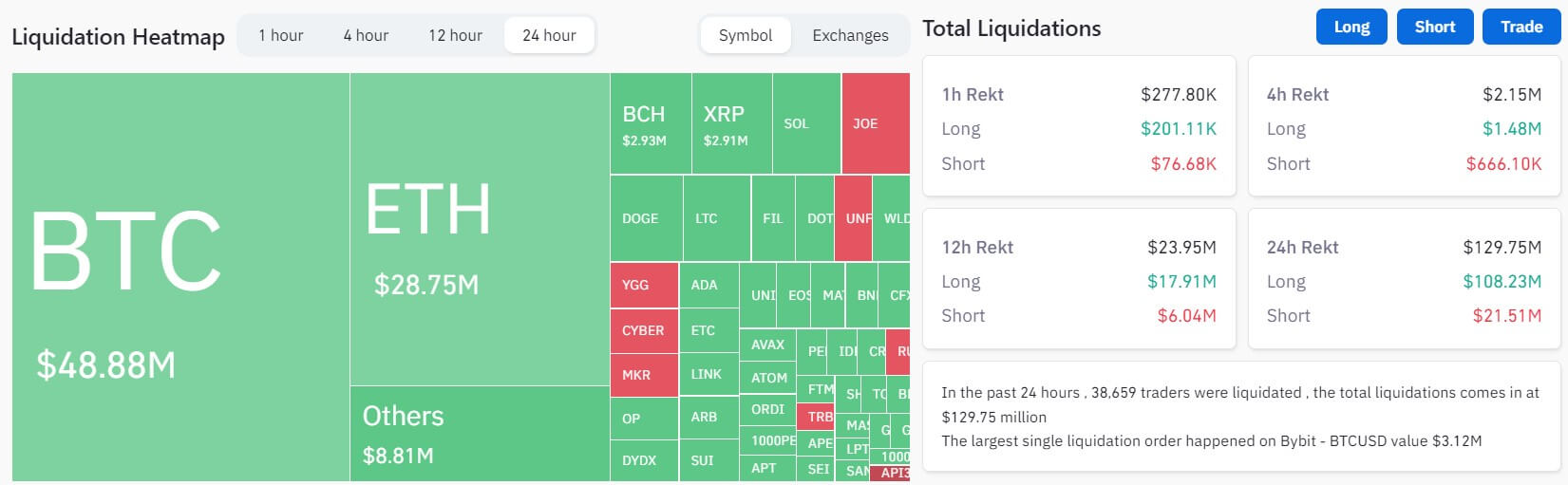

These worth actions resulted in $130 million value of liquidations that majorly affected lengthy merchants. Per Coinglass knowledge, BTC and Ethereum (ETH) accounted for practically $80 million of those positions, whereas merchants with positions in belongings like BNB, XRP, Bitcoin Money, Solana, and others recorded tens of millions in losses.

In the meantime, essentially the most important single-order liquidation was a protracted BTCUSD place valued at $3.12 million on ByBit. Throughout exchanges, OKX and Binance accounted for greater than 60% of the whole liquidations.

The submit SEC ETF delay pulls market again resulting in $130M liquidation havoc appeared first on StarCrypto.