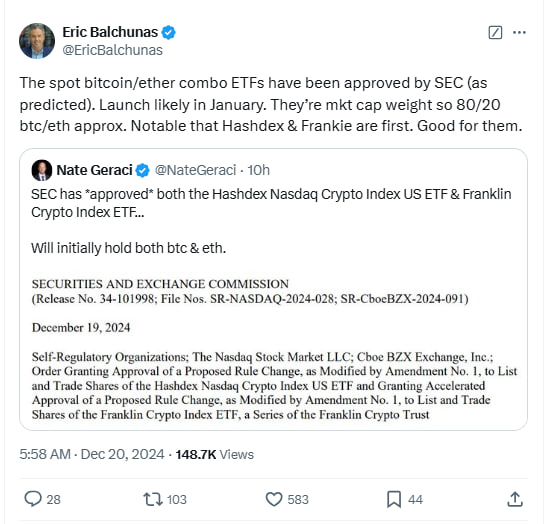

- Franklin Templeton’s and Hashdex’s spot BTC-ETH ETFs had been authorized by the SEC.

- Bitcoin dropped as little as $95.5K whereas ETH dipped to $3.3K previously day.

- Spot BTC and ETH ETFs recorded $680 million and $60.4 million in outflows on Thursday, respectively.

Bitcoin’s worth dropped beneath $100,000 after a 4% decline over 24 hours, simply because the U.S. Securities and Alternate Fee (SEC) gave its approval to Hashdex and Franklin Templeton’s spot BTC/ETH mixture exchange-traded funds (ETFs). Ethereum’s worth noticed an 8.4% lower throughout this era.

The SEC introduced on December 19 that it had licensed Hashdex and Franklin Templeton to listing their BTC-ETH funding merchandise on the Nasdaq inventory market and Cboe BZX Alternate. These new choices are named Hashdex’s Nasdaq Crypto Index US ETF and Franklin Crypto Index ETF.

These ETFs will monitor spot costs of Bitcoin and Ether. Franklin Templeton’s ETF follows the Institutional Digital Asset Index, which displays the value actions of cryptocurrencies like BTC and ETH. Hashdex’s ETF displays the Nasdaq Crypto US Settlement Value Index.

The SEC issued a separate submitting that confirmed Franklin Templeton’s utility obtained “accelerated foundation” approval. Eric Balchunas, Senior ETF Analyst at Bloomberg, predicts these funding merchandise might launch in January. The ETFs share substantial similarities with different Bitcoin and Ether ETPs that obtained approval earlier this yr.

File Outflows Hit BTC and ETH ETFs

SoSoValue information reveals U.S. spot Bitcoin ETFs recorded a complete web outflow of $680 million on December 19, marking the very best single-day outflow in historical past and the primary single-day web outflow in 15 days. Spot Ethereum ETFs skilled a complete web outflow of $60.4677 million, their first web outflow in 18 days.

Learn additionally: El Salvador Scales Again Bitcoin Adoption Below IMF Mortgage Phrases

Bitcoin fell to $95.5K regardless of the brand new ETF approvals, whereas Ethereum declined to a each day low of $3,330.87 from $3,717.66. Ethereum’s buying and selling quantity elevated by 11.55% to $57.8 billion, in keeping with CoinMarketCap information, however the cryptocurrency has struggled to take care of costs above $4,000 in previous weeks.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be chargeable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.