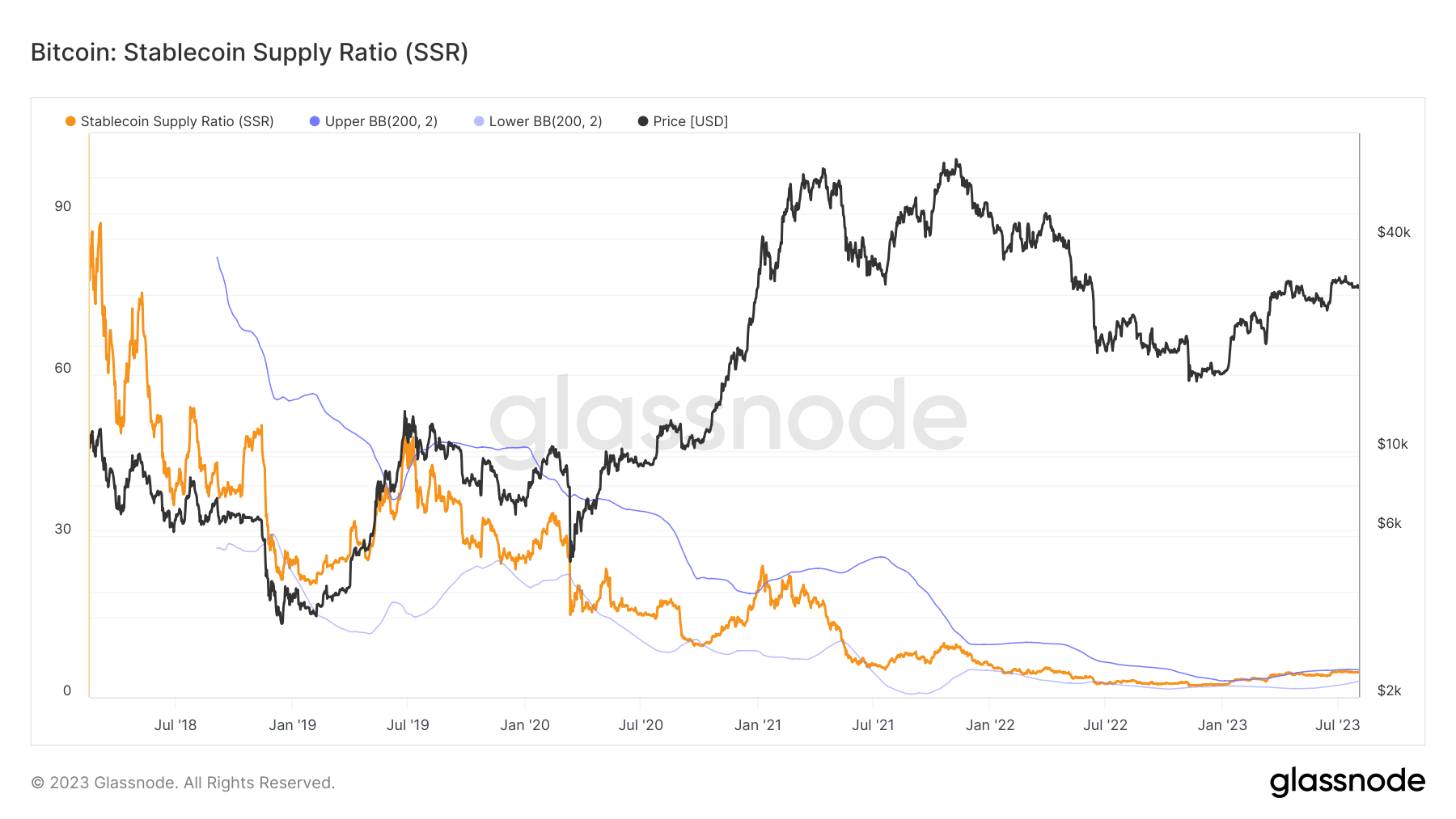

The Stablecoin Provide Ratio (SSR) is an important market indicator that has been steadily climbing because the begin of the 12 months, signifying a lower within the buying energy of stablecoins.

The SSR is a metric that gives perception into the provision and demand dynamics between Bitcoin (BTC) and the U.S. greenback. The calculation of SSR entails dividing the entire provide of stablecoins by the market capitalization of Bitcoin.

When the SSR is low, it signifies that the shopping for energy of stablecoins is excessive. Which means that for every greenback represented by stablecoins, there’s a bigger portion of Bitcoin’s market cap out there for buy.

Alternatively, a excessive SSR means that the shopping for energy of stablecoins is low. On this situation, every greenback represented by stablecoins should buy a smaller portion of Bitcoin’s market cap.

The SSR is a crucial indicator as a result of it supplies a snapshot of the potential shopping for energy of stablecoins within the Bitcoin market. It helps merchants and buyers perceive whether or not the market is at the moment dominated by these holding dollar-pegged stablecoins or Bitcoin holders.

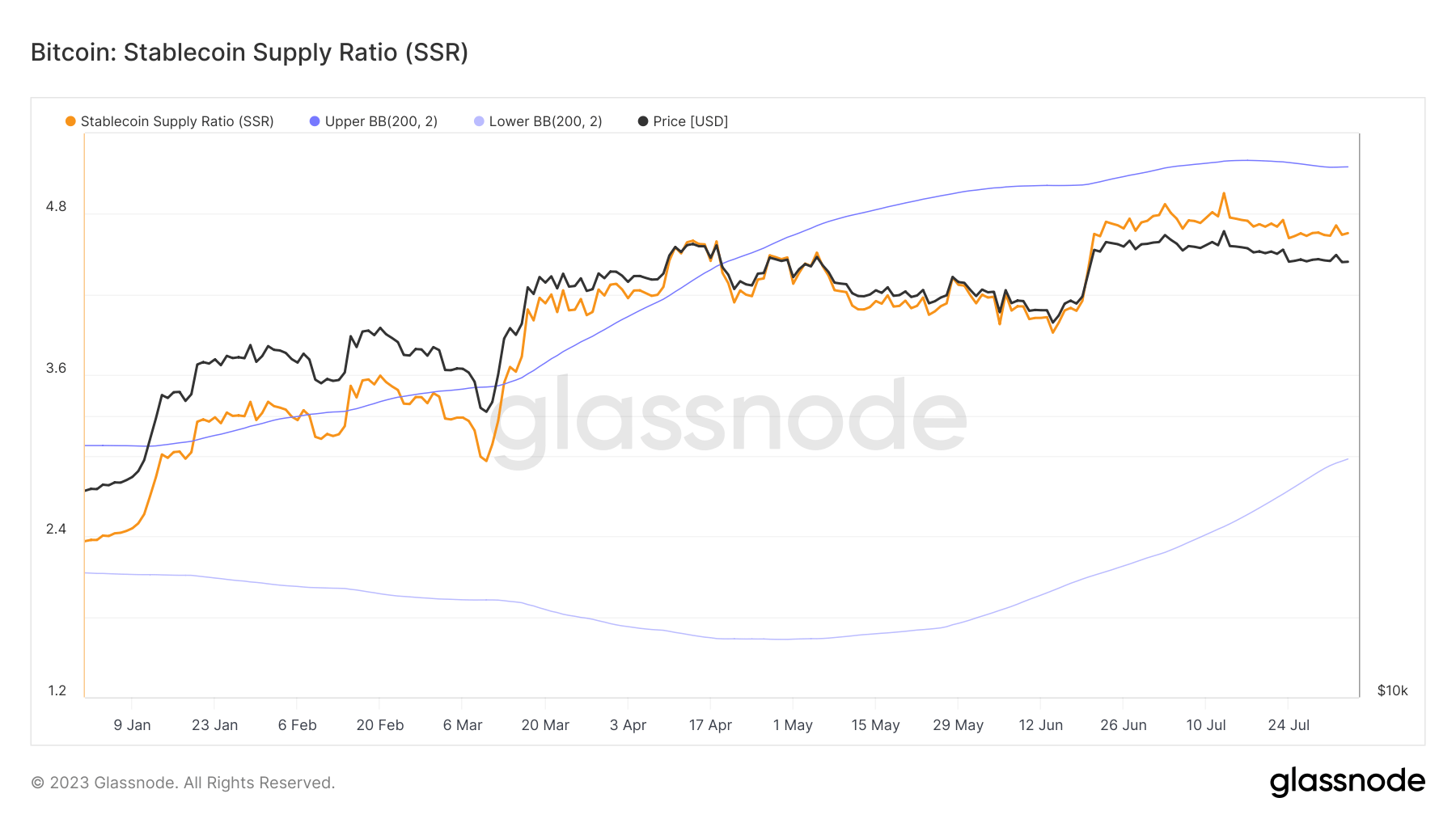

From the start of the 12 months, we’ve got seen the SSR rise from 2.36 to 4.65. This sharp enhance signifies a big decline within the buying energy of stablecoins. This development has occurred in tandem with the rising value of Bitcoin.

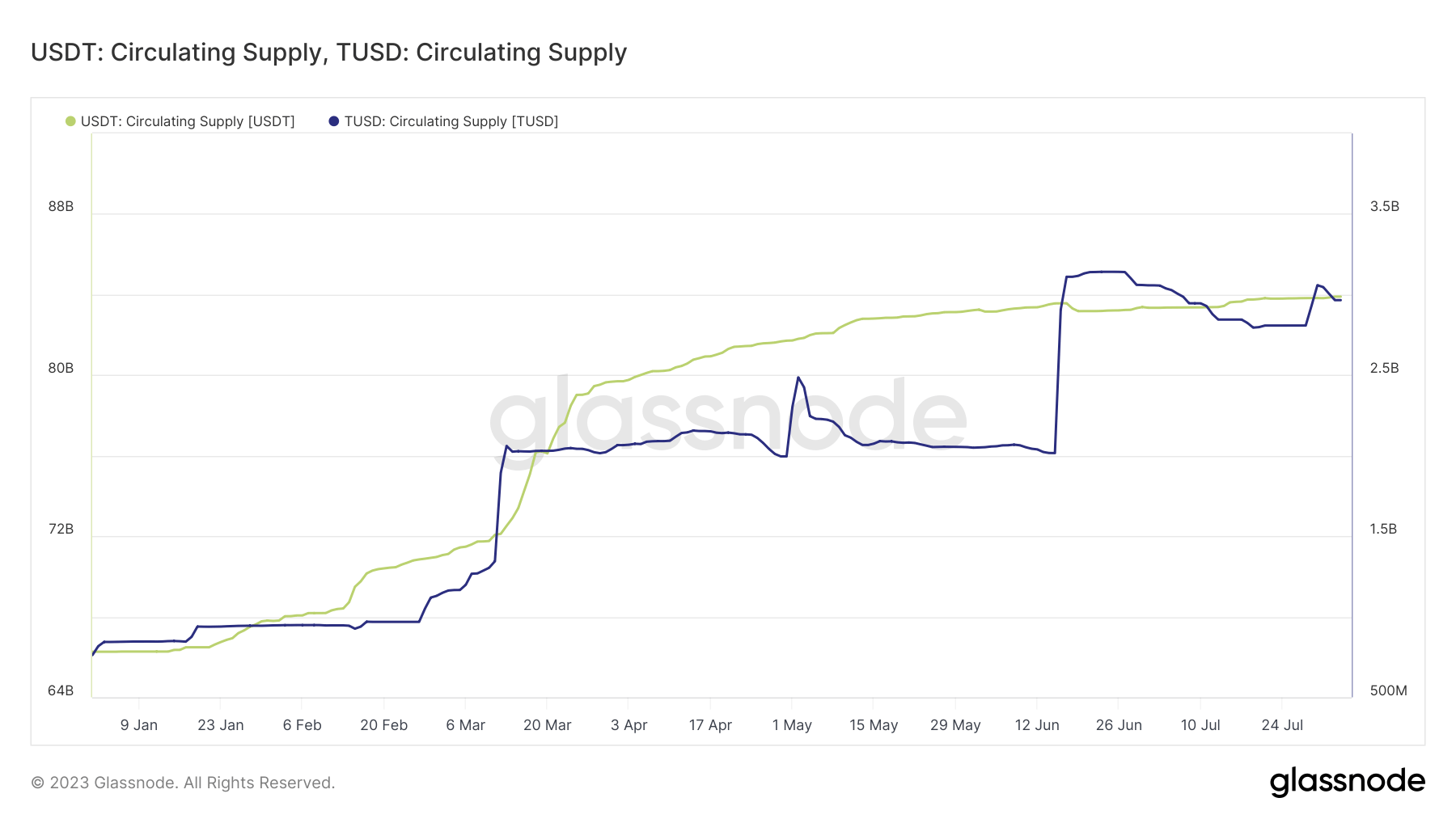

Given the current surge within the SSR, it’s value noting the marked enhance within the provide and prominence of sure stablecoins. As coated in earlier StarCrypto evaluation, Tether (USDT) and TrueUSD (TUSD) have seen their circulating provides attain all-time highs this 12 months.

On the finish of July, Tether’s provide hit an all-time excessive of $83.89 billion, whereas TrueUSD’s provide peaked at $3.04 billion. These two stablecoins are notably important as they represent the vast majority of crypto to stablecoin buying and selling pairs on centralized exchanges.

The implications of this rising SSR are multifaceted and require cautious evaluation. On one hand, the rising provide of stablecoins signifies a sturdy demand for these belongings, which are sometimes used as a secure haven during times of market volatility.

Alternatively, the rising SSR means that the shopping for energy of stablecoins relative to Bitcoin is reducing. This might doubtlessly result in a lower within the demand for Bitcoin, which in flip may exert downward stress on its value.

The publish Rising provide diminishes stablecoin Bitcoin shopping for energy appeared first on StarCrypto.