- Ripple’s CLO clarifies Terra ruling has no influence on XRP’s safety standing.

- Alderoty stated, “the [Terra] Choose has to just accept the whole lot that the SEC alleges as true (for now).”

- Terra decide misinterpret reasoning behind Ripple decide’s choice on secondary market sale.

Within the wake of the latest ruling within the Terra case, Stuart Alderoty, the Chief Authorized Officer (CLO) at Ripple, has come ahead to make clear that the choice has no bearing on the standing of XRP as a safety.

Alderoty emphasised that regardless of the differing consequence within the Terra case versus that of XRP, it doesn’t alter the conclusion reached within the Ripple case, the place it was dominated that XRP token isn’t a safety. He underlined that the Ripple case benefited from a complete factual file developed over two years, whereas the Terra case remains to be in its early phases.

The Terra case is simply beginning, and the Choose has to just accept the whole lot that the SEC alleges as true (for now). Our [Ripple’s] ruling got here after a full factual file was offered to the courtroom.

Moreover, Alderoty identified that the Terra decide appeared to have misinterpret the reasoning behind the Ripple decide’s choice. He highlighted a selected oversight concerning the excellence between institutional and public gross sales of digital belongings that “secondary market merchants can’t ‘make investments cash’ in anybody or something in the event that they don’t know who they’re shopping for from.”

The ruling within the Terra case, which allowed the Securities and Change Fee (SEC) to proceed with its case towards Terraform Labs and its founder Do Kwon, has created confusion within the crypto business concerning regulatory readability.

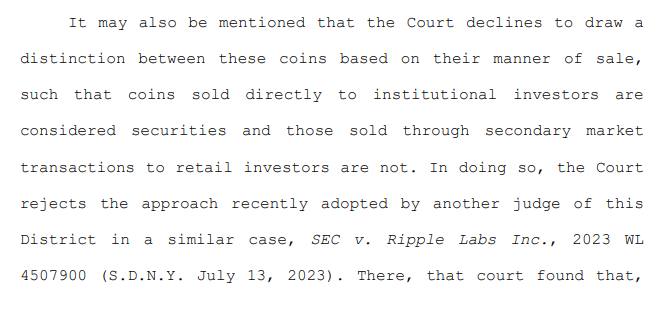

Within the Ripple case, Choose Torres dominated that XRP token is taken into account a safety when offered on to institutional buyers, however not when traded on exchanges by most people. Nevertheless, within the Terra ruling, Choose Rakoff rejected this method and didn’t differentiate between cash offered to institutional buyers and people traded on secondary markets.

The SEC’s claims lies within the alleged misrepresentations made by Terraform Labs and Kwon. They purportedly enticed buyers, each institutional and retail, to buy and maintain their merchandise utilizing false and materially deceptive statements.