- Revolut to delist Solana, Polygon, and Cardano crypto tokens within the U.S.

- This was a results of the prior SEC lawsuit in opposition to Coinbase and Binance exchanges.

- The worth of those tokens (SOL, MATIC, and ADA) is predicted to fall additional.

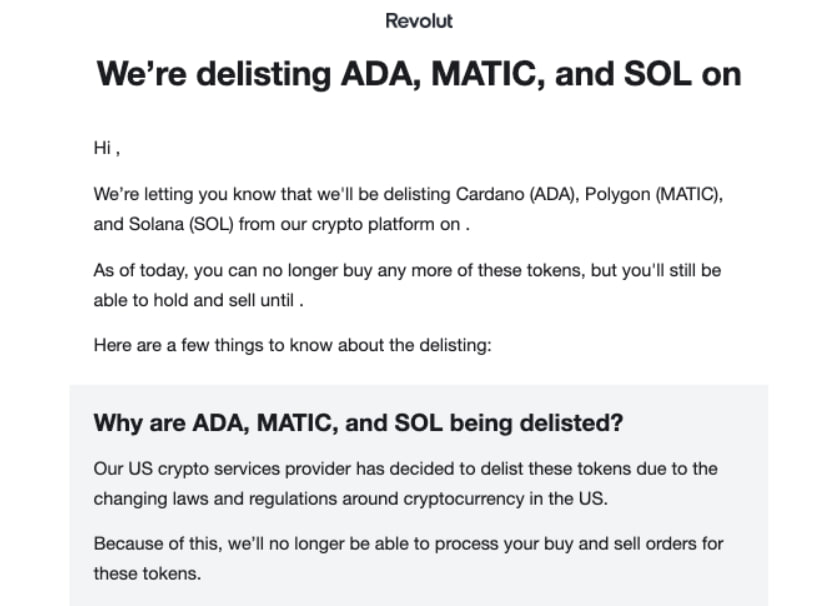

The UK-based neo-bank Revolut has notified a lot of its customers by electronic mail that they are going to delist Solana (SOL), Polygon (MATIC), and Cardano (ADA) crypto tokens within the U.S. Bakkt, Revolut’s digital companies supplier additionally introduced that it could delist these tokens because of the lack of regulatory readability.

The official electronic mail additionally knowledgeable prospects of the next: Customers can withdraw all three tokens from their account earlier than September 18. In the meantime, all remaining tokens will probably be bought at market worth and transformed into greenback deposits after that.

Revolut’s spokesperson additionally added that there are not any plans to take away these tokens from different markets. Ever because the SEC filed lawsuits in opposition to the highest cryptocurrency exchanges like Binance and Coinbase, alleging that they supply “unregistered securities” to their prospects, the regulatory panorama has been shaky.

In accordance with a report by Bloomberg, different platforms have begun to take comparable actions in opposition to these crypto tokens. Robinhood introduced this June that they’d take away these tokens, and eToro has additionally determined to ban U.S. customers from opening new positions in quite a few crypto tokens, together with Polygon (MATIC), Algorand (ALGO), Sprint (DASH), and Decentraland (MANA).

The SEC lawsuits are nonetheless being litigated, and the ripple impact seems to have scared different exchanges into delisting the tokens categorized as “securities” by the SEC so as to keep away from any additional regulatory scrutiny.

Galaxy Digital Holdings Ltd. founder Mike Novogratz stated there’s a “fixed, small, little shopping for on a regular basis of retail ‘hodlers’ on apps like Sq., Robinhood, Revolut over the UK.” Within the interim, institutional buyers are withdrawing from cryptocurrency investments in response to the SEC rules, Bloomberg commented.

In accordance with CoinMarketCap, the token costs of SOL, ADA, and MATIC went from $22 to $19.16, $0.38 to $0.29, and $0.9 to $0.7 in a single month, respectively.