- A JPMorgan report highlighted that retail merchants led the February crypto market rally.

- The report factored in inflows into lately accepted spot Bitcoin funds.

- Retail merchants’ resurgence led by optimism for Bitcoin halving, Ethereum community improve, and ETH ETFs.

A brand new report from JPMorgan has instructed that retail merchants have emerged as key gamers propelling the resurgence of the cryptocurrency market in February. Bloomberg captured particulars of the evaluation from JPMorgan in a latest report.

As per the report, the resurgence of ‘mom-and-pop’ buyers in crypto markets following the January crash is the driving power behind the latest surge in common cryptocurrencies like Bitcoin, reaching multi-year highs.

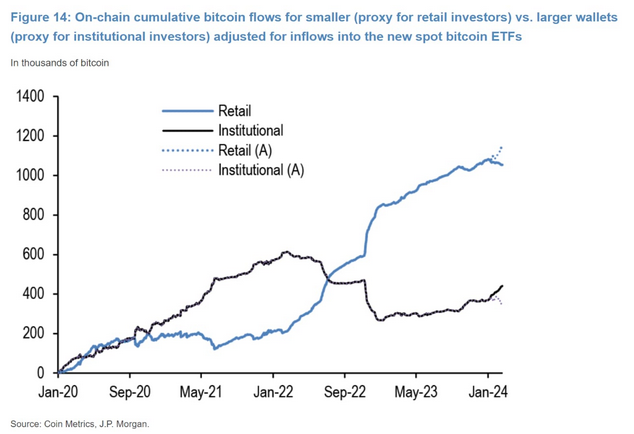

Particularly, the analysis workforce led by Nikolaos Panigirtzoglou, Managing Director of JPMorgan, argued that on-chain Bitcoin flows from small wallets have considerably outpaced these from institutional buyers. In addition to, the report famous that inflows into lately accepted spot Bitcoin funds have been factored into the evaluation.

This was needed to stop giant institutional wallets from showing artificially inflated, as they embrace funds from retail merchants who’ve lately invested in these new funds. Primarily, the report instructed the noticed development for retail main the crypto rally holds even after adjusting for inflows into new spot Bitcoin ETFs.

Moreover, JPMorgan analysts famous that this resurgence is pushed by anticipation surrounding three pivotal crypto catalysts within the coming months. This contains the Bitcoin halving occasion in April, the upcoming Ethereum community improve, and the potential approval of spot Ethereum exchange-traded funds (ETFs) in Could.

In the meantime, JPMorgan argued that the primary two catalysts are largely factored into the present market dynamics. Nevertheless, for the third, the analyst estimated solely a 50% probability of approval for spot Ethereum ETFs.

The development of elevated retail funding is just not remoted to February alone. Studies from fee giants PayPal and Robinhood Markets point out a notable uptick in internet constructive Bitcoin buyer purchases within the fourth quarter of 2023, marking a stark enchancment from earlier quarters.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not chargeable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.