Introduction

The realized value and the true market imply value are important indicators in Bitcoin’s on-chain knowledge evaluation, every offering important insights into the valuation and investor habits throughout the cryptocurrency panorama.

Understanding the excellence between these two metrics is essential for a complete grasp of Bitcoin’s valuation, as they collectively make clear each the broader holder base’s sentiment and the present market enthusiasm.

Realized value

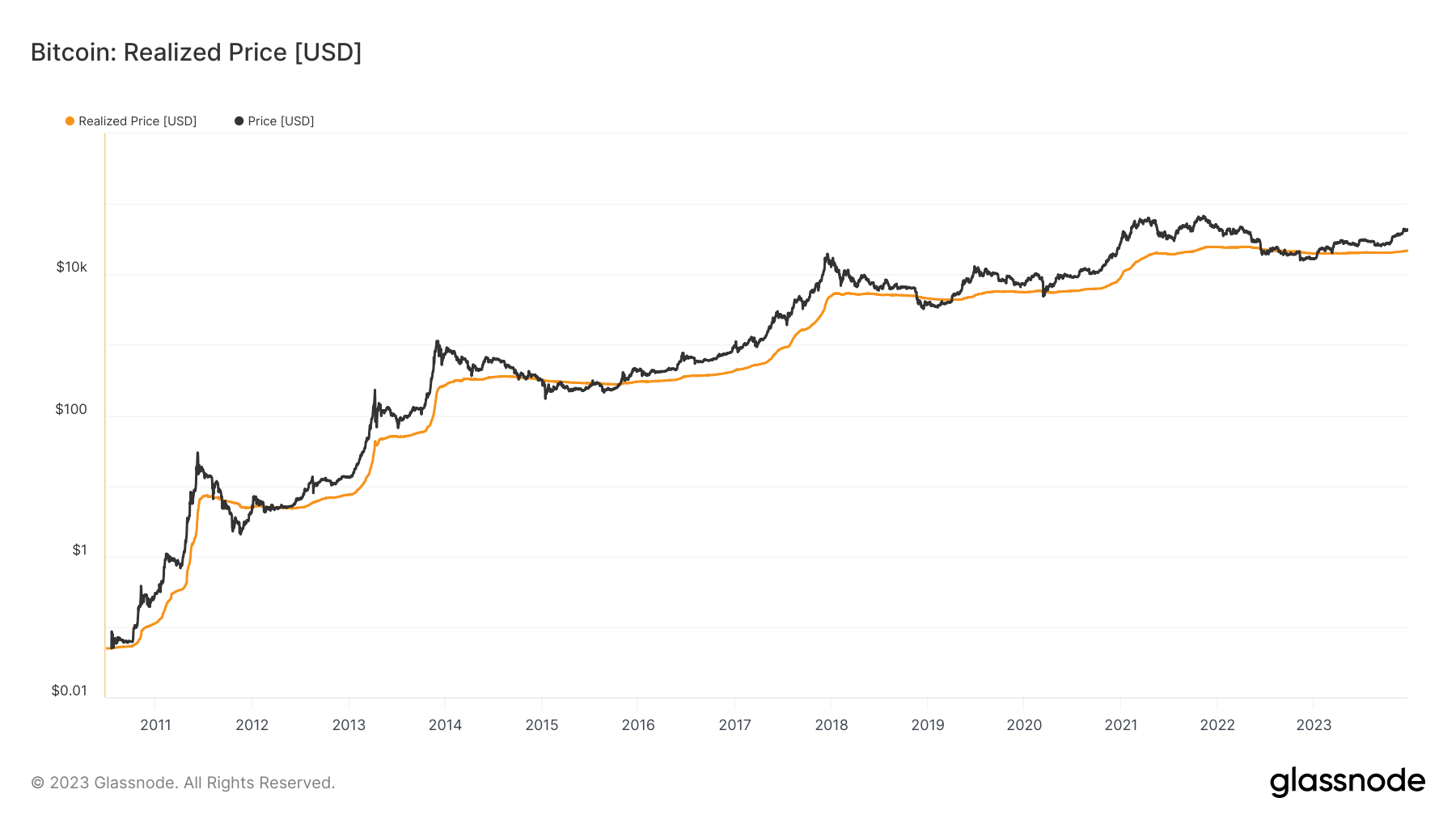

Realized value is a extra complicated metric in comparison with the market value, which is just the present buying and selling value on exchanges. It’s calculated by dividing the realized capitalization by the present provide of Bitcoin. It encompasses all cash in circulation, no matter origin (mining or secondary market transactions). This complete method ensures that the metric displays the whole financial weight of all bitcoins, giving a fuller image of the community’s worth. Realized capitalization is the sum of the worth of all Bitcoins on the value they have been final transacted on-chain. This calculation supplies a weighted common value of all Bitcoins primarily based on the final time every Bitcoin modified palms.

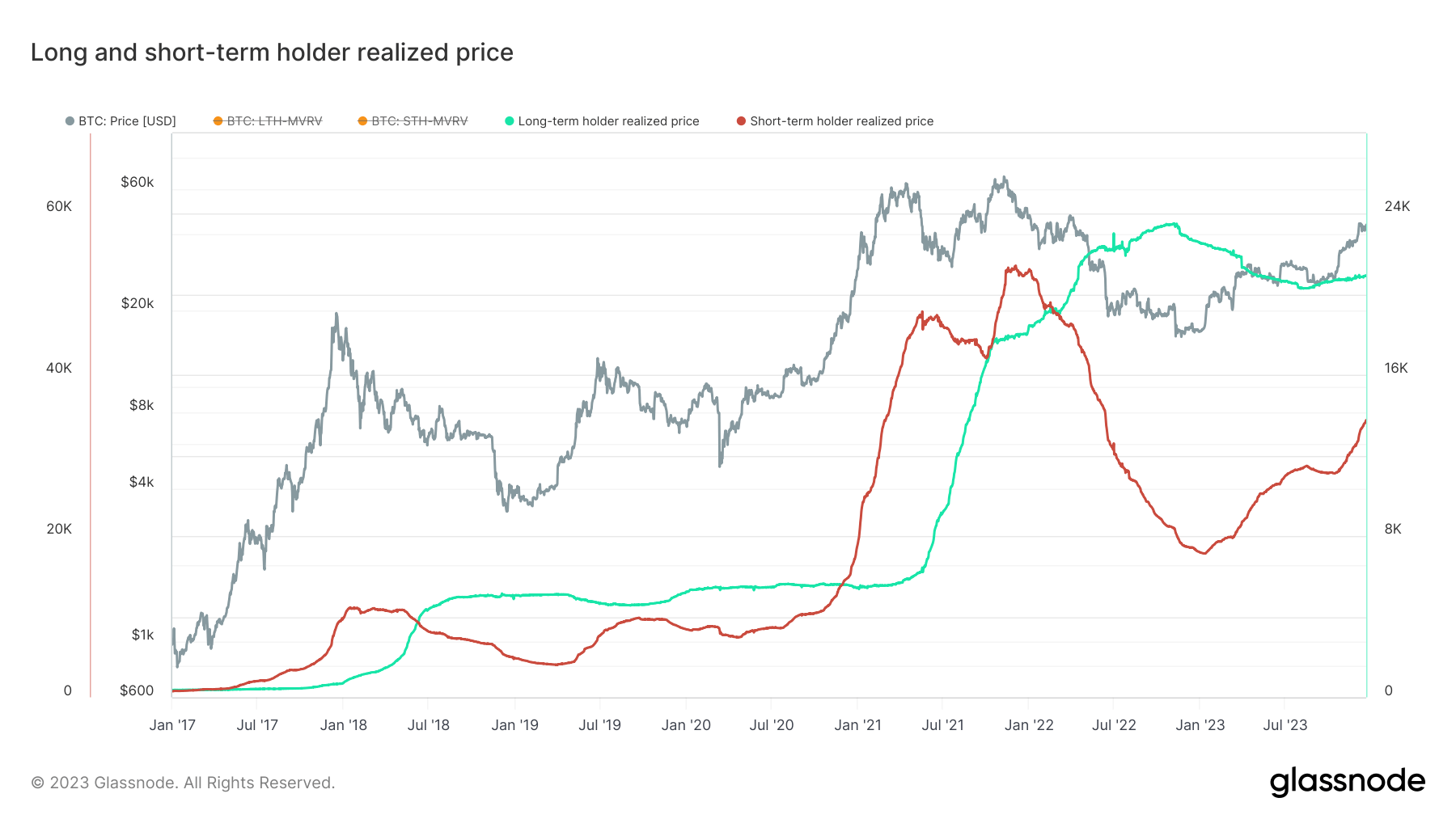

The realized value may be divided into two varieties: these held by long-term holders (LTH) and people held by short-term holders (STH). LTH realized value is calculated contemplating solely these cash that haven’t moved in no less than 155 days, whereas STH realized value accounts for cash moved inside this era. This distinction permits analysts to know the habits and sentiment of various investor cohorts. The LTH realized value typically displays a value stage that long-term traders entered at, serving as a help stage throughout bear markets. In distinction, the STH realized value can point out latest market sentiment and potential resistance ranges in bull markets.

True market imply value

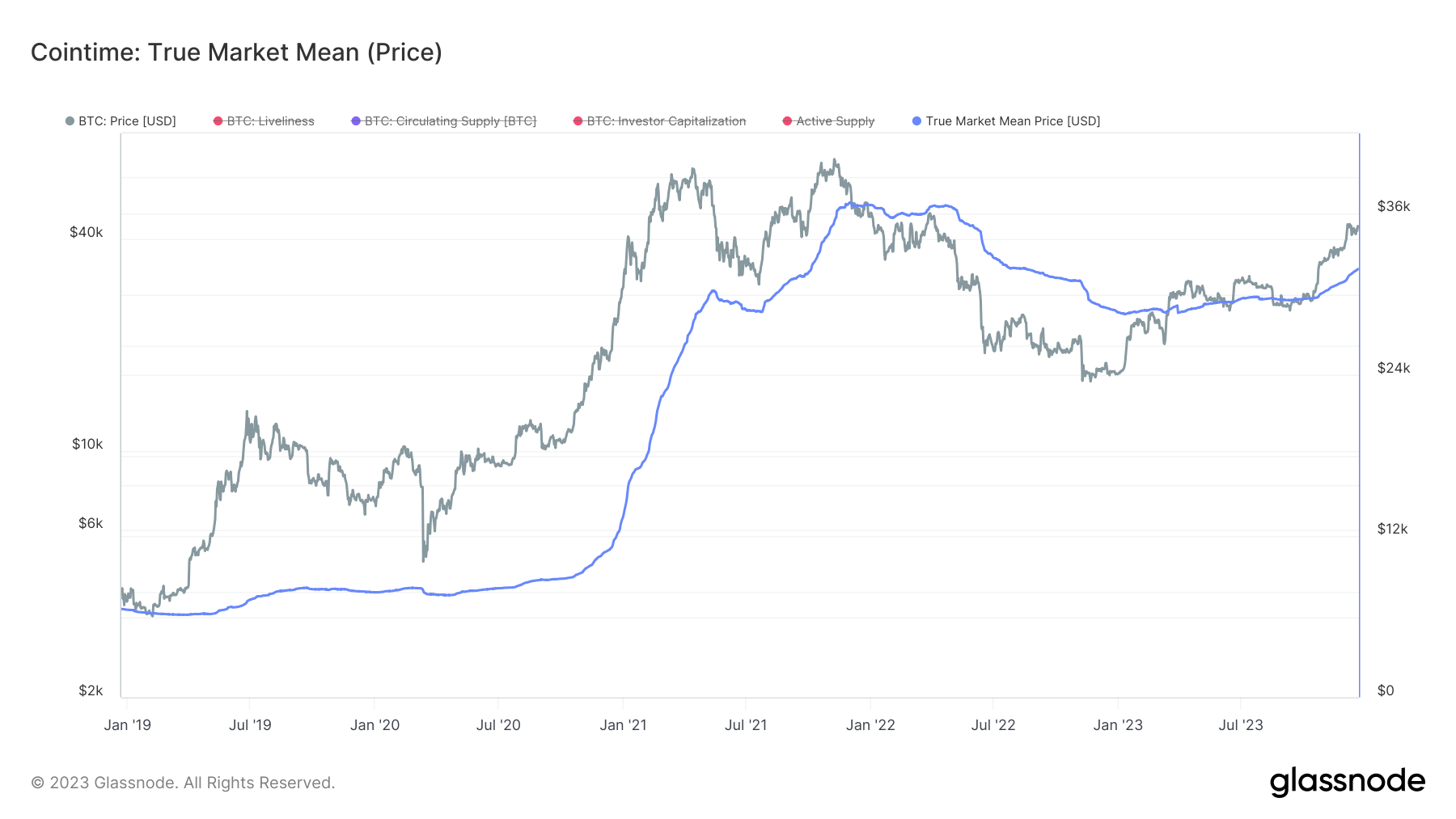

The true market imply value, a comparatively new idea launched in Glassnode’s Cointime Economics report earlier this yr, affords a unique lens for understanding Bitcoin. This metric focuses completely on cash which have been actively traded, excluding Bitcoin’s thermocap. Thremocap represents the whole cumulative income miners have earned, together with block rewards (newly minted cash) and transaction charges.

By excluding Thermocap, the true market imply value focuses solely on the cash traded or transferred between traders. Thermocap contains cash most probably held in miner reserves, which could not replicate energetic market participation.

Mining actions are essentially completely different from funding or buying and selling actions. Miners obtain Bitcoin as a reward for validating transactions and securing the community, unbiased of market circumstances. These cash is likely to be held regardless of market sentiment or value, which may skew the typical price foundation if included. By excluding these cash, the true market imply value affords a metric that extra precisely displays investor-driven market dynamics.

Whereas the realized value supplies a broad view of the market’s common price foundation, it contains all cash, regardless of their present financial exercise. This broad inclusion can typically masks particular investor behaviors, particularly in periods of low on-chain exercise. In distinction, the true market imply value affords a extra focused view, specializing in the segments of Bitcoin actively taking part available in the market. This focus makes it a probably extra acute device for understanding the fast market sentiment and funding patterns.

Comparability and insights

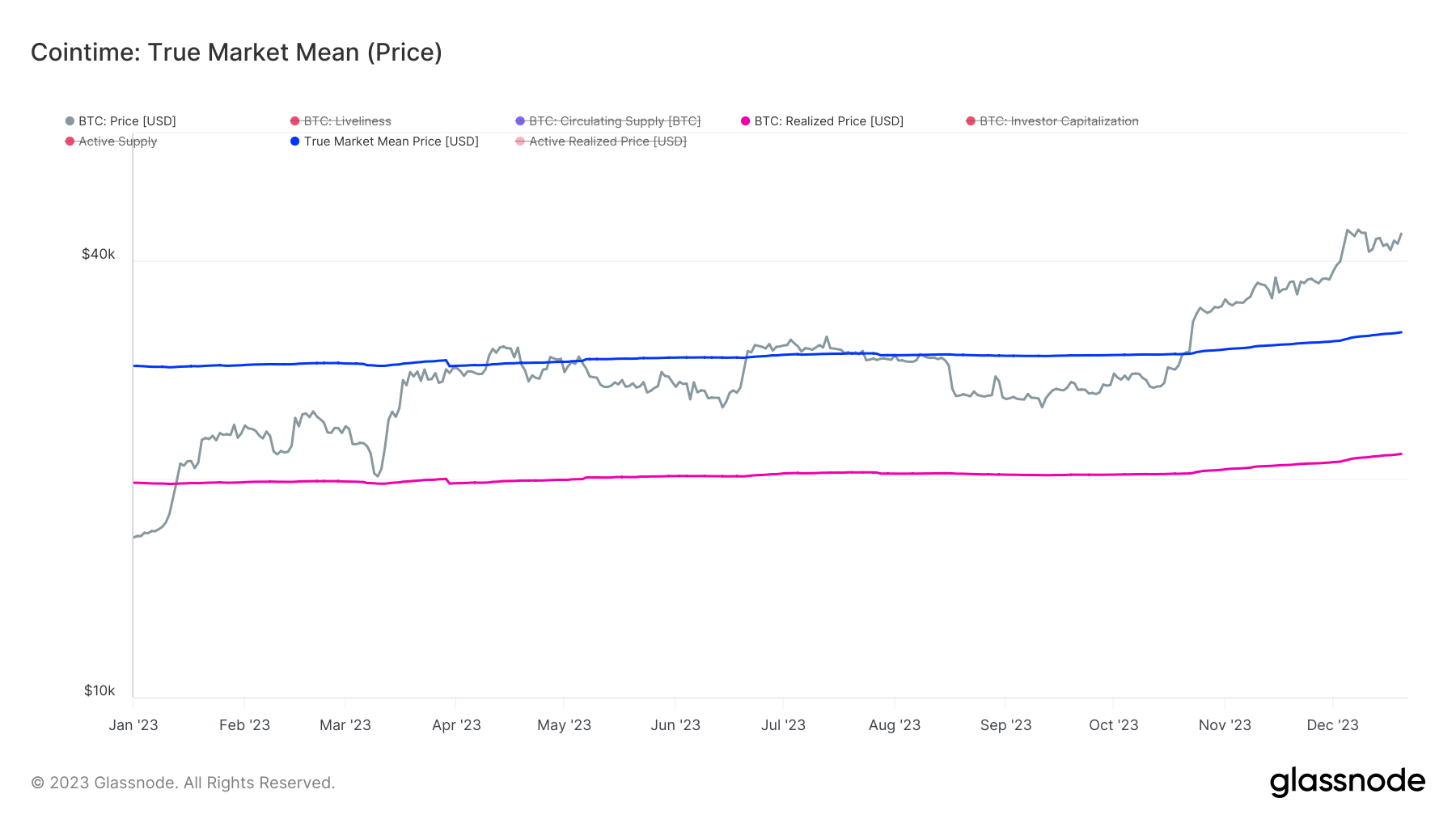

The true market imply value elevated from $28,659 on Jan. 1, 2023, to $31,896 on Dec. 20, 2023. This rise means that energetic traders on secondary markets have elevated the typical acquisition value of Bitcoin by 11%. This means elevated shopping for exercise at larger costs.

The realized value elevated from $19,772 to $21,672 over the identical interval. This 9.6% improve, whereas smaller than the true market imply value, additionally signifies a common upward motion within the common price foundation of all Bitcoin holders. This might imply extra Bitcoin was moved or offered at larger costs, rising the realized capitalization.

The market value of Bitcoin rose considerably from $16,620 on Jan. 1 to $43,629 on Dec. 20. The big hole between the market value and each the true market imply value and the realized value implies that present buying and selling ranges are a lot larger than the typical acquisition costs. A chronic interval of excessive divergence may point out a probably overvalued market ripe with hypothesis. Nonetheless, on condition that Bitcoin’s spot value has been above the true market imply value for under about 60 days, it signifies a rising bullish sentiment available in the market.

The comparability between the will increase within the true market imply value and the realized value of Bitcoin, whereas comparable in percentages and greenback phrases, carries completely different implications as a result of nature of the metrics.

Given its unique deal with energetic traders, the rise within the true market imply value suggests a big stage of exercise and sentiment change amongst this group. Since this metric solely accounts for cash which have been actively traded, a rise implies that energetic traders are shopping for and promoting Bitcoin at larger costs. This might point out a powerful bullish sentiment or elevated demand amongst merchants and traders actively taking part available in the market. The rise on this metric, even when numerically much like the realized value, holds appreciable weight as a result of it displays a concentrated change within the habits of a particular phase of the market.

Alternatively, an argument may be made that realized value supplies a broader view of the market’s common price foundation as a result of it contains all cash — each actively traded and held dormant. On this regard, though the rise in realized value is barely smaller, it is likely to be extra important contemplating its broader base. This means that the typical price foundation of all Bitcoin holders, together with long-term holders, can be rising.

Nonetheless, StarCrypto’s take is that the rise within the true market imply value holds extra weight as a result of it displays a concentrated change within the habits of a specific phase of the market. It’s extra reflective of the fast market sentiment, because it instantly displays the actions of energetic merchants, which have traditionally had a considerably larger impression on Bitcoin’s value motion.

Conclusion

The rise within the true market imply value, accentuating the energetic investor phase’s habits, underscores a big shift in market sentiment amongst this group. Conversely, the realized value’s development, although barely much less in proportion phrases, affords a broad lens by way of which all the spectrum of Bitcoin holders is considered.

The trajectories of those metrics in 2023 present simply how complicated and multifaceted Bitcoin’s construction is. The true market imply value’s sharper improve highlights the important function of energetic merchants in influencing Bitcoin’s short-term value actions. In the meantime, the regular climb in realized value signifies the underlying confidence and a gradual and regular change within the angle of the broader Bitcoin market, because it contains each long-term holders and new members.

Shifting ahead, the interaction between these metrics will solely improve in significance. Understanding the impression of energetic buying and selling, as mirrored within the true market imply value, alongside the broader market sentiment encapsulated by the realized value, shall be essential for traders, analysts, and merchants aiming to navigate the market.

The submit Realized value and true market imply: Understanding Bitcoin’s key cost-basis indicators appeared first on StarCrypto.