Robinhood will finish its assist for a variety of crypto tokens at present, June 27 following an announcement made earlier this month. Among the many tokens to be delisted are Polygon (MATIC) and Cardano (ADA).

The costs of each tokens dipped after the crypto buying and selling platform’s preliminary announcement added to the general negativity triggered by the US Securities and Alternate Fee (SEC)’s lawsuits towards crypto exchanges Binance and Coinbase.

What’s the worth outlook for the 2 tokens at the same time as Bitcoin (BTC) bids to carry above the psychological $30k degree?

Polygon worth outlook

MATIC worth fell 35% over two days when Robinhood introduced its delisting on June 9, tanking from close to $0.79 to $0.50. Whereas bulls face strain round $0.66, it’s doubtless a bounce to the $0.75 space might materialise and galvanise patrons.

One of many elements in favour of Polygon bulls is the elevated alternate outflows for MATIC. Knowledge exhibits that extra holders have moved tokens to self-custody wallets, the potential influence of which is additional discount in promoting strain.

In accordance with crypto analyst Michael van de Poppe, the dip to $0.50 resulted in “a sequence response of liquidations on the lengthy aspect.”

He notes that every one these have since been taken up and a breakout is probably going. Nonetheless, MATIC/USD must flip $0.75 into assist to offer a base for brand new upside momentum.

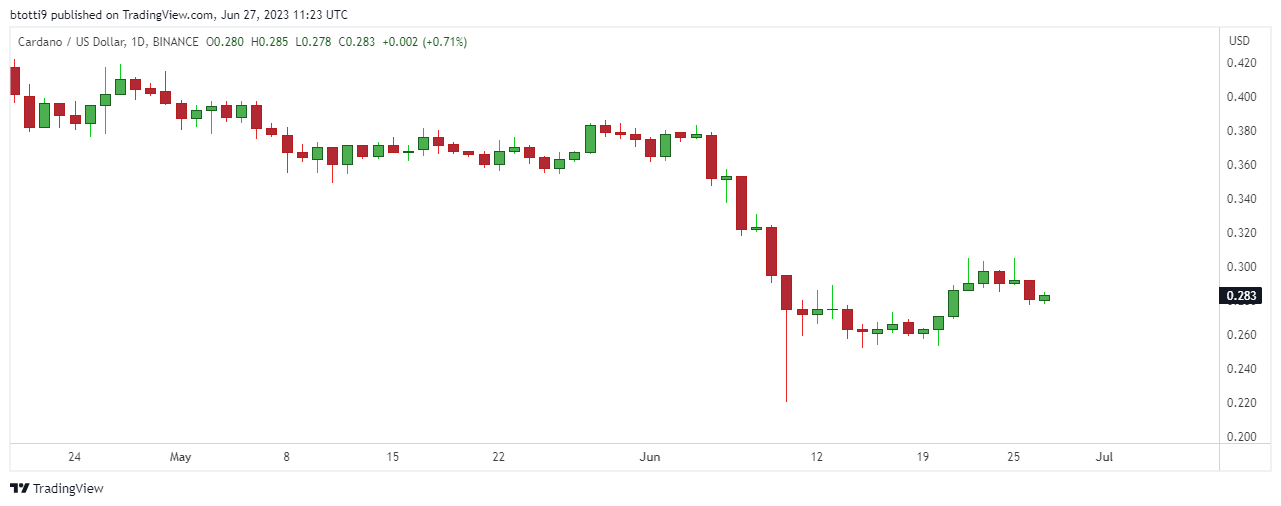

Cardano, like Polygon, fell sharply because the SEC labelled ADA a safety earlier this month. ADA misplaced over 42% of its worth within the week between June 5 and June 10, falling from highs of $0.37 to $0.22.

That was earlier than the current bounce throughout cryptocurrencies helped bulls push to $0.30.

Cardano worth chart. Supply: TradingView

However whereas ADA/USD is up almost 10% this previous week, the losses over the previous 30 days quantity to 24% at present costs of $0.28. The areas round $0.25 and $0.22 are key ought to bears strengthen within the quick time period.

In the meantime, the flipside would have breaking above $0.30 once more spotlight $0.40 as the subsequent main hurdle.