- Polkadot’s breakout alerts a possible rally, focusing on $8.80–$9.00 upside.

- ORDI’s breakout suggests a powerful upward pattern, aiming for $100.00 goal worth.

- Continued momentum for DOT and ORDI depends on sustaining key help ranges.

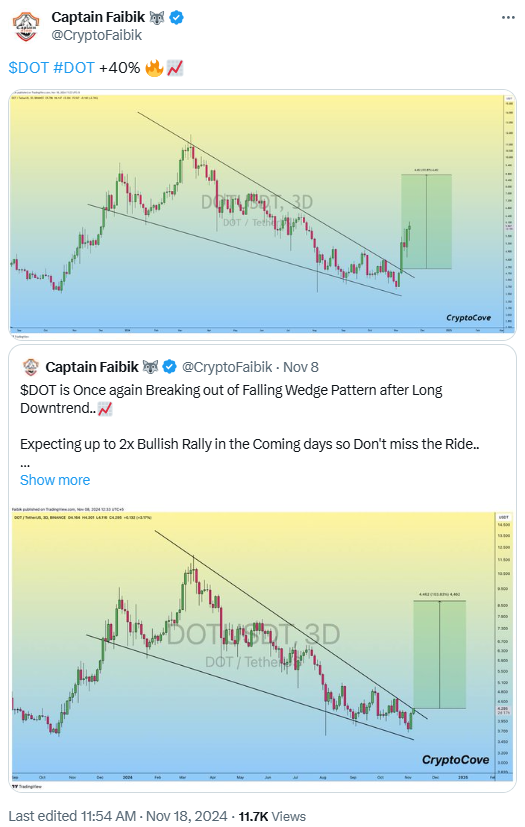

Polkadot (DOT) and ORDI present spectacular bullish potential, in keeping with technical evaluation by Captain Faibik. Each property broke out from descending channels, signaling attainable pattern reversals. These breakouts, confirmed by sturdy bullish momentum, counsel each tokens might rally considerably.

Polkadot (DOT) Breakout Evaluation

Polkadot has seen a optimistic shift after breaking out from a descending channel on its 3-day timeframe. Beforehand, the worth was shifting inside a bearish channel, characterised by two parallel downward sloping strains. The breakout occurred when the worth closed above the higher boundary of the channel.

After the breakout, consecutive bullish candles confirmed the sturdy shopping for momentum. This pattern pushed DOT to key help and resistance ranges, with the breakout zone round $4.15 to $4.50 now appearing as essential help. This space may very well be a basis for additional upward motion if retested. The decrease boundary of the channel, close to $3.00, stays crucial long-term help.

On the resistance facet, DOT is testing the $6.10 resistance degree. A break above this might set off a rally. Projections point out a possible goal of $8.80 to $9.00, with a attainable upside of 103.83%.

Continued bullish momentum will rely on sustaining help round $5.50–$6.00 and avoiding a breakdown beneath the breakout zone. With a stay worth of $5.76, Polkadot is up 2.30% within the final 24 hours, indicating rising market curiosity.

ORDI Reveals Comparable Bullish Alerts

ORDI is following an identical pattern to Polkadot, having damaged out from a descending channel on the 3-day timeframe. The breakout from this channel marked a shift from a bearish to a doubtlessly bullish pattern. The breakout was confirmed with a powerful bullish candle, displaying stable shopping for curiosity and suggesting a sustained upward motion if the breakout degree holds as help.

Learn additionally: Crypto Market Massacre: What’s Subsequent for SOL, NOT, STRK, ORDI, and GALA?

The important thing help zone for ORDI is round $37.00 to $38.50. A profitable retest of this space would solidify the breakout and reinforce a bullish outlook. If this help holds, ORDI might proceed its ascent in direction of its fast resistance close to $41.50 to $44.00. A decisive break above this zone might result in a goal of $100.00, providing a 165.18% potential upside.

As at press time, ORDI is priced at $38.99, with a slight 0.13% drop up to now 24 hours. Nonetheless, the general pattern stays bullish, and a break above resistance ranges would set off substantial worth motion.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version isn’t liable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.