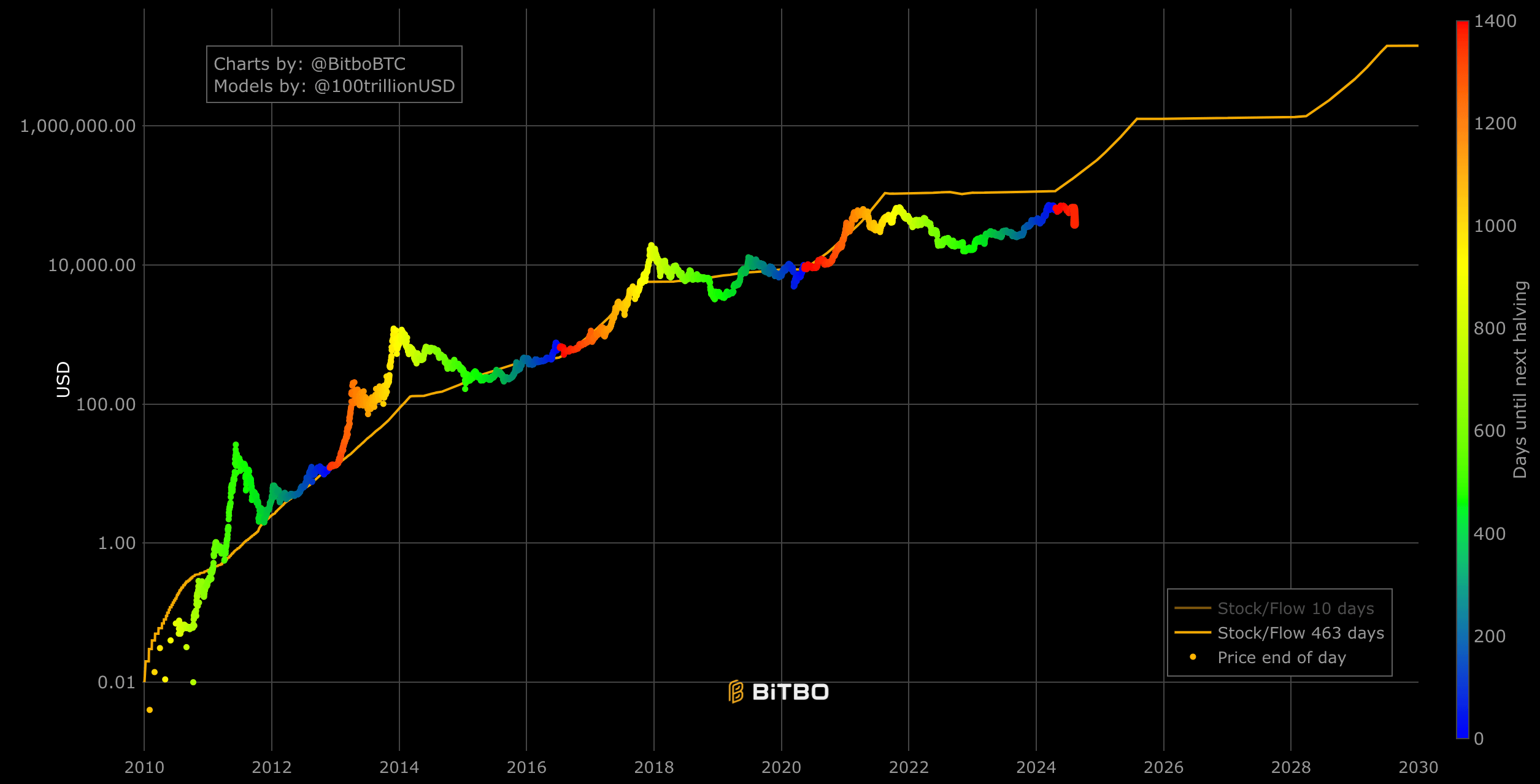

PlanB’s Inventory-to-Circulation (S2F) mannequin, recognized for predicting Bitcoin’s worth based mostly on shortage, has confronted scrutiny because the digital asset’s worth has remained beneath the mannequin’s expectations since 2021. The S2F mannequin, which correlates the rising shortage of Bitcoin as a consequence of halving occasions with worth appreciation, recommended a considerably greater worth than the precise market worth over the previous few years. As of current information, the discrepancy has reached roughly $130,000, elevating questions concerning the mannequin’s reliability within the face of unpredictable market situations. The mannequin predicts a worth of round $180,000 at current, whereas Bitcoin stays simply above $50,000.

The S2F mannequin operates on the precept that because the stream of latest bitcoins decreases, the prevailing inventory turns into extra invaluable, thus driving up the value. Till 2021, this mannequin traditionally aligned nicely with vital worth actions, particularly round halving occasions. Nonetheless, the sustained divergence noticed since 2021 signifies a break from this sample.

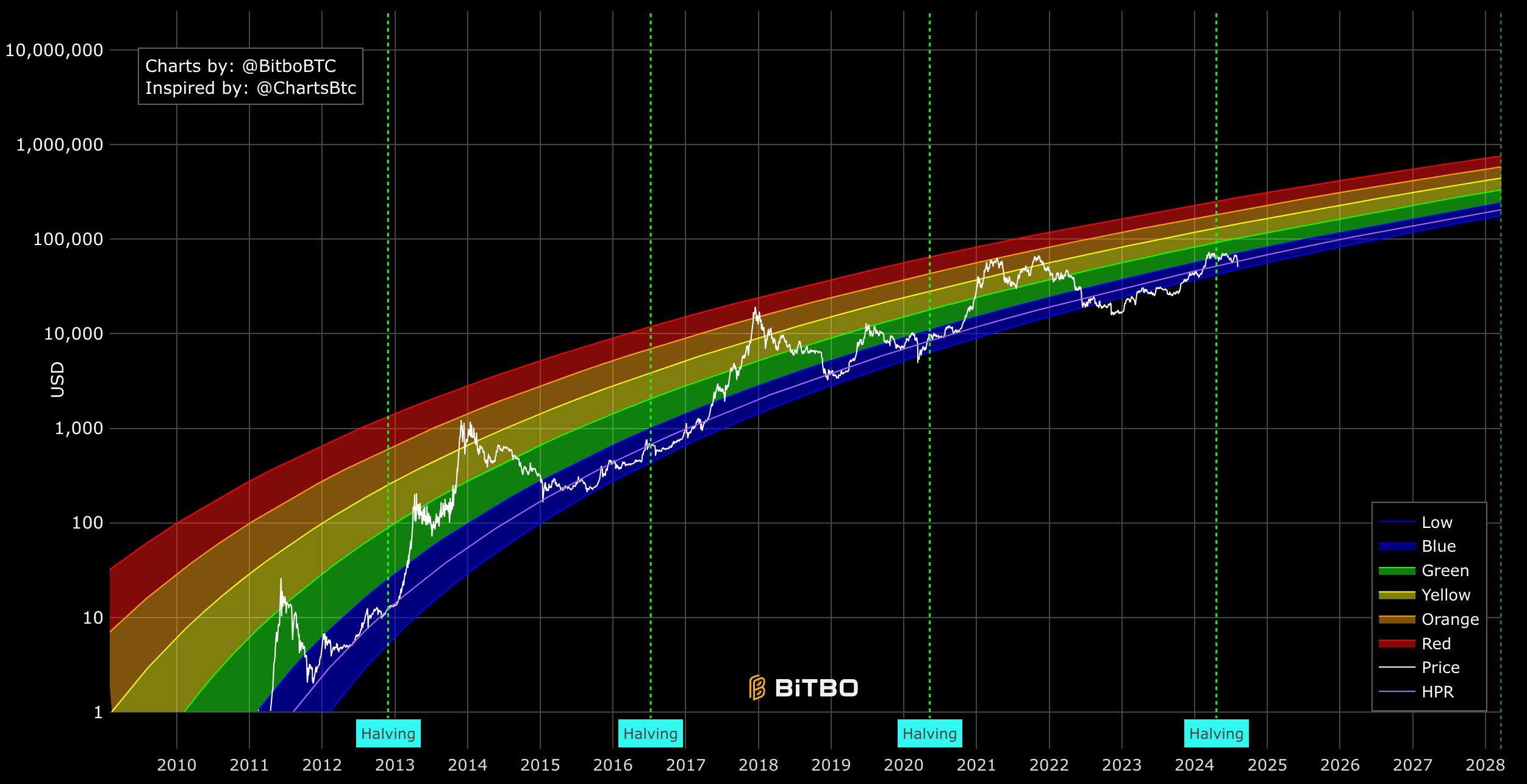

In distinction to the S2F mannequin, different analytical instruments, such because the Rainbow Value Chart and Energy Regulation Mannequin, have offered totally different views on Bitcoin’s valuation. The Rainbow Chart, which categorizes worth ranges by market sentiment bands starting from “Low” to “Excessive,” has depicted Bitcoin primarily buying and selling inside reasonable bands since 2022. This means a interval of secure development with out reaching speculative peaks, which the S2F mannequin may need overestimated. Bitcoin is transferring towards the decrease certain of the rainbow chart, which it broke all through 2022 and 2023. At $50,000, Bitcoin is $220,000 beneath its higher restrict.

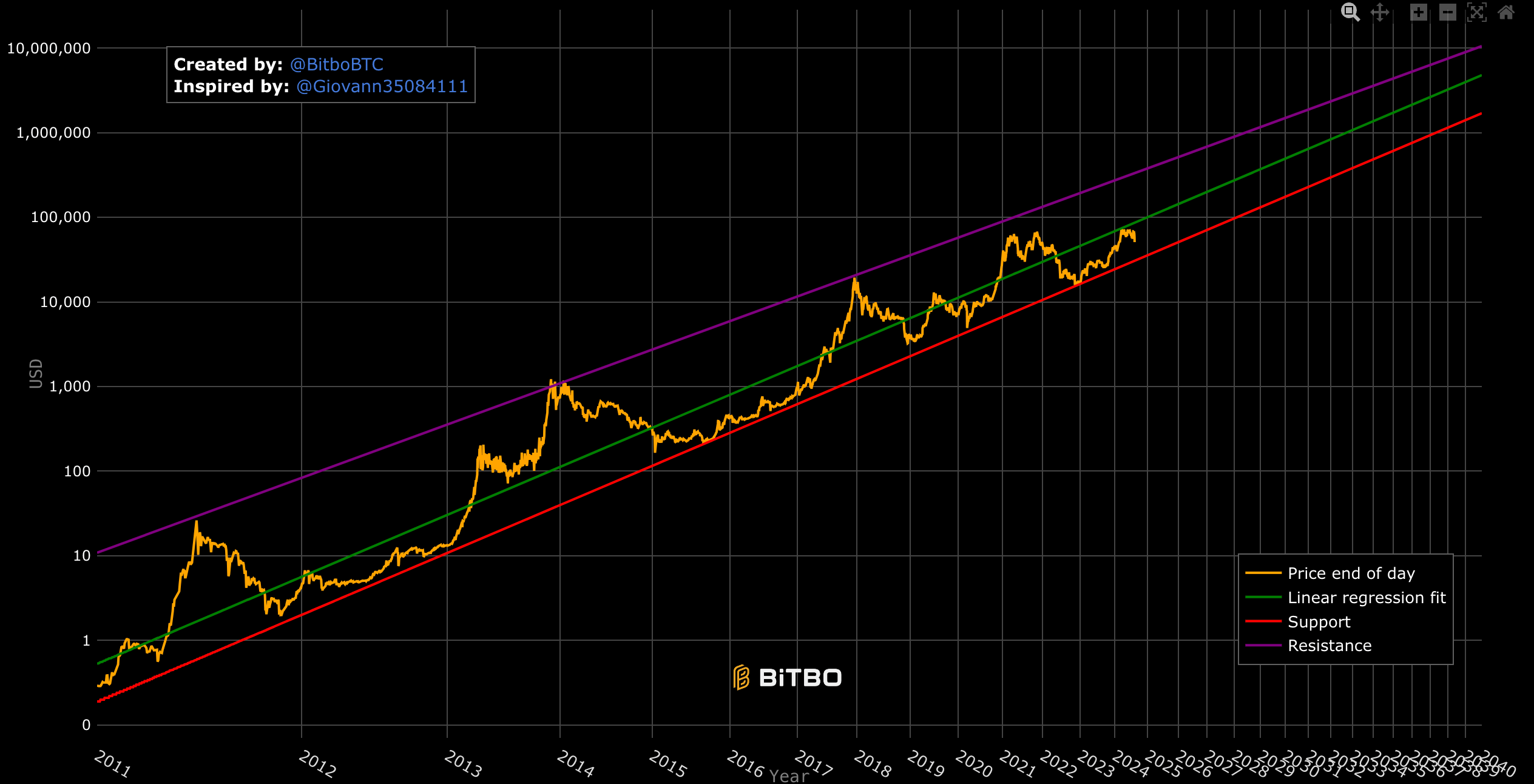

The facility regulation mannequin is a statistical mannequin that describes relationships between portions the place one amount varies as an influence of one other. The Bitcoin energy regulation mannequin refers back to the relationship between the value and time. It tasks a long-term worth channel with outlined help and resistance ranges. Bitcoin’s current worth actions have adhered extra carefully to this mannequin’s projections, sustaining an upward trajectory throughout the channel however ceaselessly encountering higher-level resistance.

In line with the ability regulation mannequin, Bitcoin remains to be nicely inside regular limits and simply $40,000 beneath the regression match or truthful worth.

These discrepancies spotlight the complexity of predicting Bitcoin’s worth. Whereas the S2F mannequin has been a preferred framework for anticipating market tendencies, its perceived shortcomings counsel that it might not totally account for the varied and dynamic elements influencing Bitcoin’s worth. The deviation of as much as $130,000 from the mannequin’s forecast illustrates the necessity for a extra nuanced understanding of market forces, together with the impression of investor sentiment, technological developments, and broader financial situations. Additional, the ability regulation, which additionally seems in nature and different man-made phenomena, appears to align extra carefully with Bitcoin, a forex correlated on to its vitality utilization.