Peter Schiff, the Chief Market Strategist at Euro Pacific Asset Administration, is among the most revered folks in finance. He has been proper on so many issues prior to now, together with the tempo of rates of interest, US authorities debt, and the continued dangers available in the market. I share most of his considerations.

One space I disagree with Schiff is on his Bitcoin outlook. For a very long time, Schiff has advocated towards Bitcoin, which he believes that has no worth. As a substitute, Schiff, who additionally runs a gold firm known as Schiff Gold, has advocated for gold.

Lastly @novogratz obtained one thing proper about #Bitcoin. He admitted that it isn’t purchased, however bought. Nobody wants Bitcoin. So folks solely purchase it after another person talks them into doing so. Then as soon as they purchase, they instantly attempt to persuade others to purchase too. It is like a cult.

— Peter Schiff (@PeterSchiff) October 18, 2023

Gold has carried out nicely over years. It has moved from $35 in Nineteen Seventies to nearly $2,000 right this moment and he expects it to proceed hovering over time. He cites the hovering authorities debt and the rising accumulation by central banks like these in Russia, Turkey, and Chiba.

Whereas gold is an effective asset, the truth is that it has not been funding prior to now decade. Gold has jumped by nearly 220% since November 2006 whereas the S&P 500 index has jumped by nearly 400%. Together with dividends, the index has carried out significantly better.

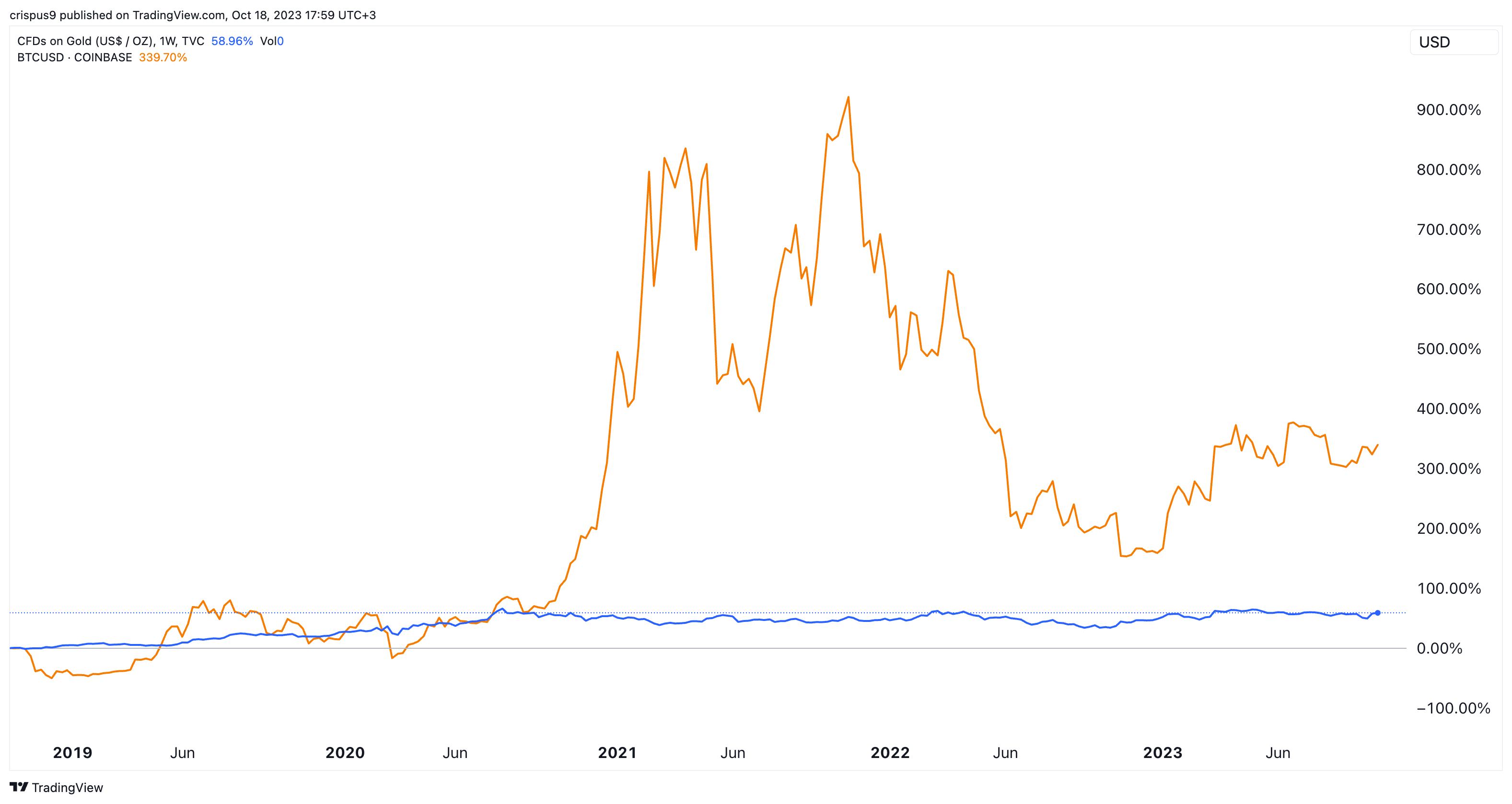

Bitcoin has additionally carried out higher than gold by far. Whereas BTC has dropped sharply from its all-time excessive, it has nonetheless overwhelmed gold prior to now few years. Bitcoin has risen by nearly 400% prior to now 5 years whereas gold is up by simply 63%.

Peter Schiff argues that Bitcoin has no actual worth and that it is just purchased by speculators. That is flawed. Whereas there are a lot of speculators within the crypto house, the truth is that many massive buyers have held it for years. MicroStrategy has held Bitcoin for 3 years now whereas the typical holding interval was over 3 years.

It’s also price noting that gold has no actual use within the industrial house. As a substitute, many patrons achieve this as a result of it’s a retailer of worth. This explains why gold is generally purchased by buyers and central banks.

Occasions of the previous few years are proof that Bitcoin is an actual asset. For one, the coin survived the Mt. Gox collapse, the Covid-19 pandemic, and the present part of stagflation. It’s also surviving when rates of interest have jumped to the best stage in 22 years.

All which means Bitcoin has actual worth, which explains why firms like Blackrock and Invesco are searching for to launch an ETF. In an announcement this week, Blackrock’s CEO famous that the corporate was seeing robust demand from worldwide buyers.

Methods to purchase Bitcoin

eToro

eToro provides a variety of cryptos, corresponding to Bitcoin, XRP and others, alongside crypto/fiat and crypto/crypto pairs. eToro customers can join with, study from, and duplicate or get copied by different customers.

Public

Public is an investing platform that permits you to make investments shares, ETFs, crypto, and various belongings like advantageous artwork and collectibles—multi function place.