The Bitcoin derivatives market skilled vital volatility up to now week. Along with fluctuations in open curiosity (OI), buying and selling quantity fluctuated considerably.

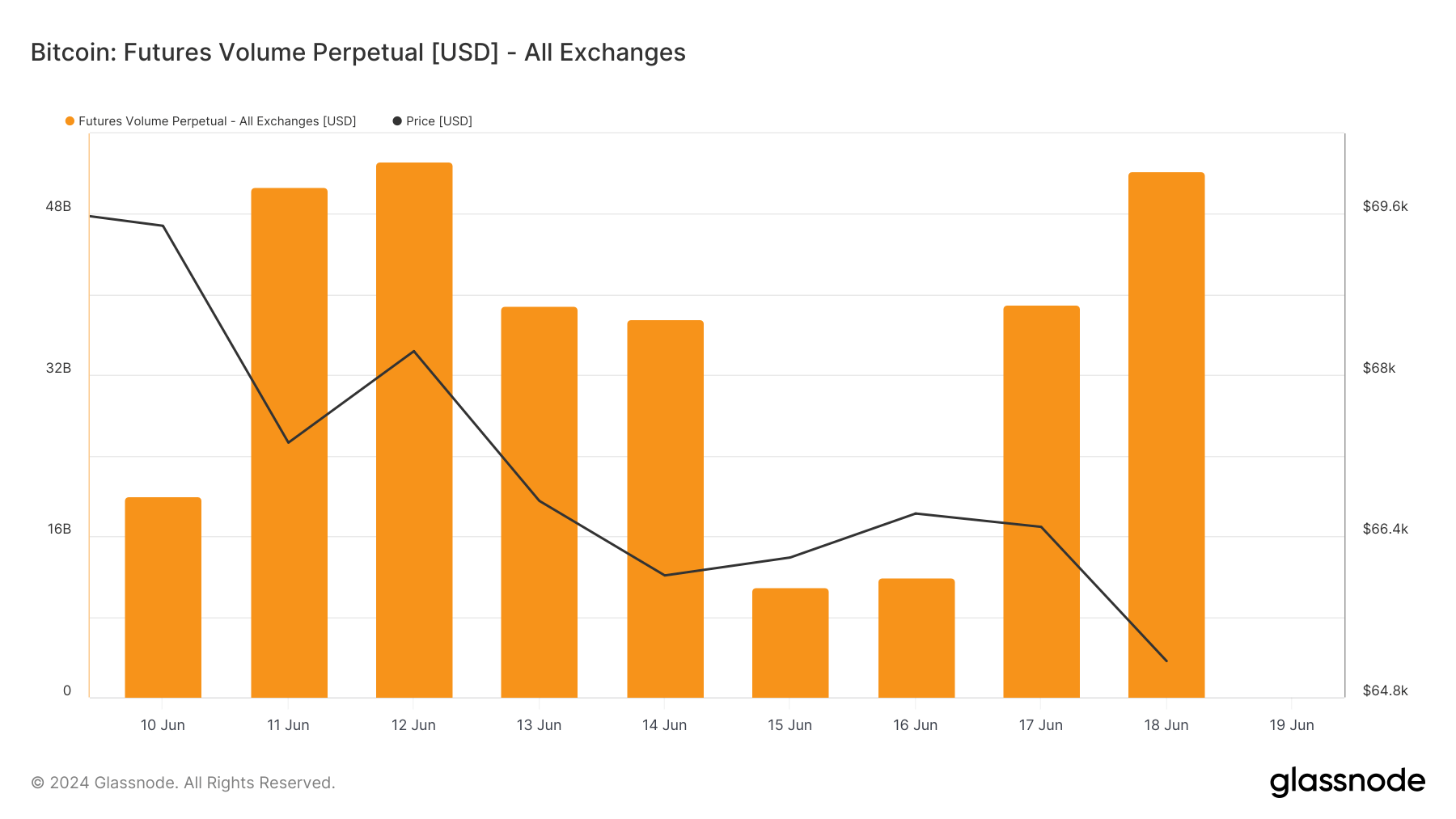

Information from Glassnode confirmed that the whole 24-hour buying and selling quantity for perpetual futures throughout all exchanges dropped from $53.156 billion on June 12 to $10.910 billion on June 15. Buying and selling quantity rebounded to $51.239 billion by June 18.

When evaluating these fluctuations with Bitcoin’s worth throughout the identical interval, which dropped from $68,237 on June 12 to $65,160 on June 18, we discover that the buying and selling volumes for perpetual futures don’t transfer in strict correlation with worth. As an illustration, the buying and selling quantity dropped considerably on June 15 and 16 whereas Bitcoin’s worth remained comparatively steady, indicating that buying and selling volumes in perpetual futures are influenced by components different than simply worth actions.

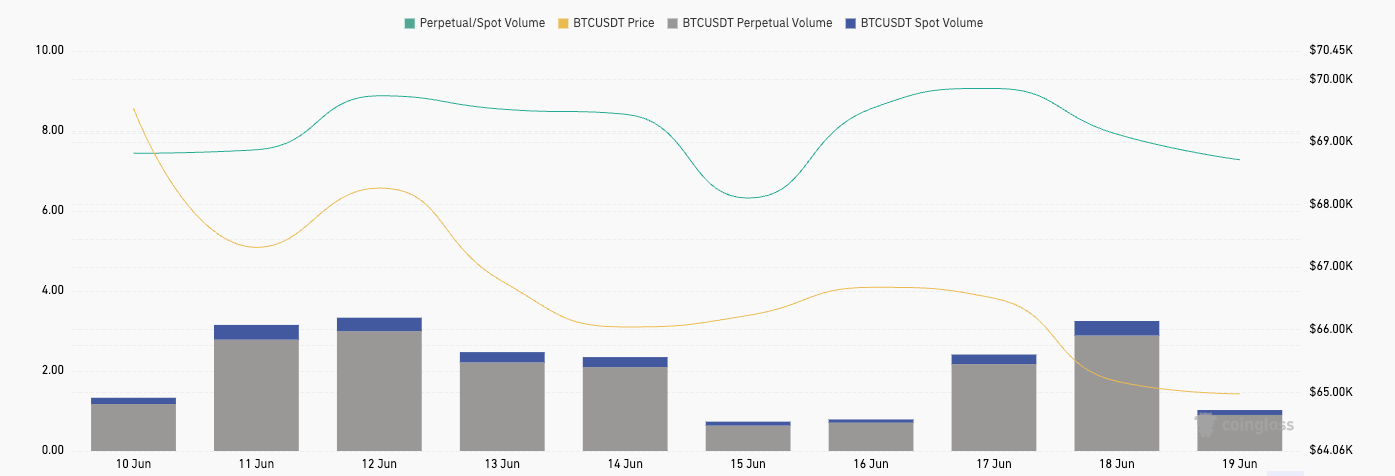

Wanting on the buying and selling quantity for BTCUSDT perpetual futures on Binance, we observe an identical sample of fluctuation, with a excessive of $22.65 billion on June 12, a low of $4.79 billion on June 15, after which an increase to $21.82 billion by June 18. That is extra in keeping with the general market pattern, displaying how vital Binance’s position is within the perpetual futures market.

One other discrepancy arises when evaluating the perpetual futures buying and selling quantity on Binance with the spot buying and selling quantity for the BTCUSDT pair. The spot buying and selling volumes are considerably decrease, peaking at $2.75 billion on June 18 in comparison with the perpetual futures’ $21.82 billion on the identical day. The perpetual-to-spot quantity ratio, which varies from 6.32 on June 15 to 9.06 on June 17, reveals a persistent desire for buying and selling perpetual futures over spot buying and selling on the change.

The distinction between low spot quantity and excessive perpetual futures quantity may be indicative of the truth that new cash just isn’t coming into the market at a major fee. Spot buying and selling, which includes the precise buy and sale of Bitcoin, is mostly related to new market entrants trying to purchase the asset straight. A decline or stagnation in spot quantity means that there could also be fewer new traders shopping for Bitcoin, which might indicate an absence of contemporary capital flowing into the market.

However, perpetual futures are sometimes favored by extra skilled and complex traders trying to leverage their positions to maximise features from worth actions. Skilled merchants would possibly desire perpetual futures as a result of their capability to hedge positions and the chance to amplify returns by means of leverage. Market makers and institutional gamers may be answerable for the excessive volumes we’ve seen. They usually use derivatives to handle danger and supply liquidity, considerably influencing the quantity in perpetual futures markets.

One other necessary issue to contemplate is the acute state of the market. In a market characterised by uncertainty or an absence of clear course, like we’ve seen up to now week, merchants would possibly desire the liquidity and suppleness of derivatives. The flexibility to rapidly enter and exit positions within the futures market permits merchants to react to information and market modifications extra effectively than they could within the spot market.

The publish Perpetual futures buying and selling quantity surges as Bitcoin spot buying and selling lags appeared first on StarCrypto.