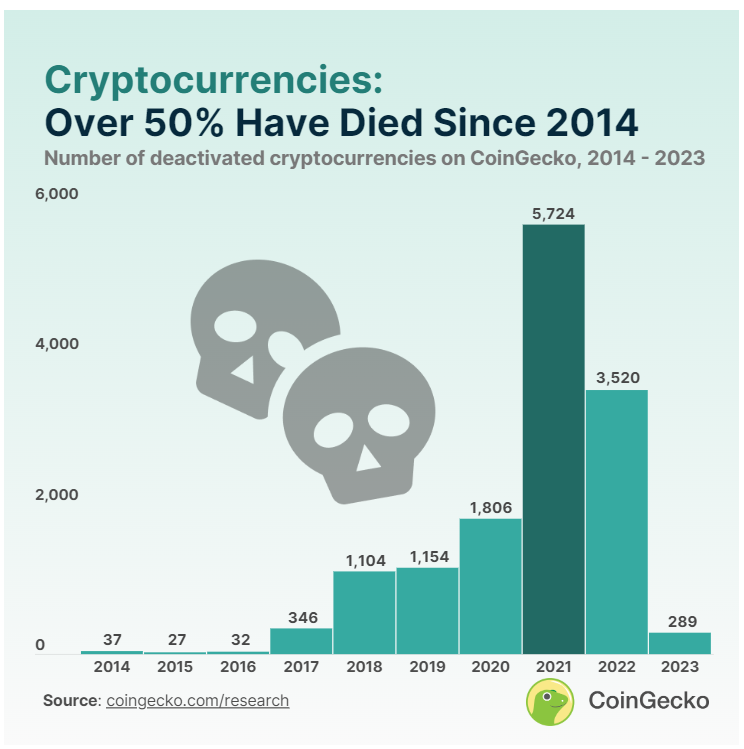

- Over 50% of cash and tokens listed on CoinGecko since 2014 are actually thought-about “lifeless.”

- Cryptocurrencies launched in 2021 have the best failure fee, with over 70% failing inside three years.

- Tasks from the 2020-2021 bull run account for 53% of all lifeless cryptocurrencies, totaling 7,530 initiatives.

Cryptocurrency information aggregator CoinGecko reveals that over 50% of all of the cash and tokens listed since 2014 have ceased operations or turn into fully nugatory. This interprets to a staggering 14,039 “lifeless cash” out of the greater than 24,000 ever listed on the platform.

The examine, performed by CoinGecko, examines the general rely of cash and tokens collectively referred to as ‘cryptocurrencies’ as soon as listed on their platform, categorizing them as ‘lifeless’ or ‘failed.’ The evaluation spans from 2014 to 2023.

Cryptocurrencies launched in 2021 exhibit the best fee of lifeless cash, with over 70% (5,724 initiatives) failing inside simply three years. Following intently is 2022, witnessing a failure fee of roughly 60% (3,520). Nevertheless, a glimmer of hope emerges in 2023, with lower than 10% (289) of listed initiatives failing to date.

The report additional breaks down the info, portray a very regarding image for initiatives launched in the course of the 2020-2021 bull run. A considerable 53% of all lifeless cryptocurrencies, totaling 7,530 initiatives, belong to this era. This determine represents round 70% of the 11,000 crypto initiatives listed in the course of the bull cycle.

Compared, the 2017-2018 bull run noticed the same failure fee of round 70%, albeit with a smaller variety of venture launches at round 3,000.

CoinGecko’s evaluation attributes this development to components like the convenience of deploying tokens and the surge of memecoins, typically deserted shortly after launch as a result of absence of a tangible product or utility.

The report additionally outlines particular causes for venture failure, together with an absence of buying and selling exercise for 30 days, confirmed scams or “rug pulls,” initiatives voluntarily deactivating as a result of closure or token overhauls, and adherence to particular liquidity and exercise thresholds.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not chargeable for any losses incurred on account of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.