- Bullish OXT worth prediction ranges from $0.4468 to $0.5352.

- OXT worth may additionally attain $0.7 this 2023.

- OXT’s bearish market worth prediction for 2023 is $0.0508.

With a mission of upholding customers’ privateness and enhancing its safety, Orchid hopes to create a brighter, freer, and extra empowered future. Furthermore, by using the options of decentralization, Orchid goals to mix the privateness and freedom of customers.

OXT, the native token of Orchid, acts as a staking asset for the VPN market. This ERC-20 digital asset permits suppliers to compete for person fee move by staking OXT. The native token of Orchid may be added and staked by suppliers to seize extra bandwidth gross sales on the community.

Let’s now perceive about Orchid and the assorted options of this community. Furthermore, this text will conduct a complete evaluation of Orchid and forecast the worth for 2023, 2024, 2025, 2026, until 2050.

Orchid (OXT) Market Overview

| 🪙 Title | Orchid Protocol |

| 💱 Image | oxt |

| 🏅 Rank | #413 |

| 💲 Value | $0.082863 |

| 📊 Value Change (1h) | 3.76493 % |

| 📊 Value Change (24h) | -8.31397 % |

| 📊 Value Change (7d) | 61.52177 % |

| 💵 Market Cap | $48306088 |

| 📈 All Time Excessive | $1.026 |

| 📉 All Time Low | $0.04665814 |

| 💸 Circulating Provide | 591544728.952 oxt |

| 💰 Whole Provide | 1000000000 oxt |

What’s Orchid (OXT)?

Orchid defines itself as a decentralized digital non-public community (VPN) permitting customers to purchase bandwidth from a decentralized pool of service suppliers. The native token of Orchid may empower and safe this new method to VPN service and is among the core parts of the Orchid community.

One of many main features of OXT is to offer a staking-advertising mechanism. Furthermore, the ERC-20 token additionally permits suppliers to earn rewards relying on the OXT staked by them. Customers can even pay for a personal and safe web connection utilizing nano funds.

Other than OXT, Orchid consists of different core parts — Orchid app, Orchid Accounts, Orchid Protocol, Nanopayments, Programmable, and Staking. As an example, the Orchid Protocol is designed to make use of a customized VPN protocol, just like OpenVPN or WireGuard. Designed for top efficiency, the Orchid Protocol runs on prime of WebRTC, a standard net commonplace.

Orchid explains that this protocol may permit customers to request entry to distant community sources and pay for these sources utilizing cryptocurrencies through the Orchid nano funds system.

Orchid (OXT) Present Market Standing

On the time of writing, OXT has been buying and selling close to its intra-day excessive of $0.0973 whereas it continues to take care of a distance from its intra-day low of $0.07549. After the native token of orchid noticed a surge of 9.18% in one-day, OXT’s market cap is valued at $86,419,388, based on CoinMarketCap.

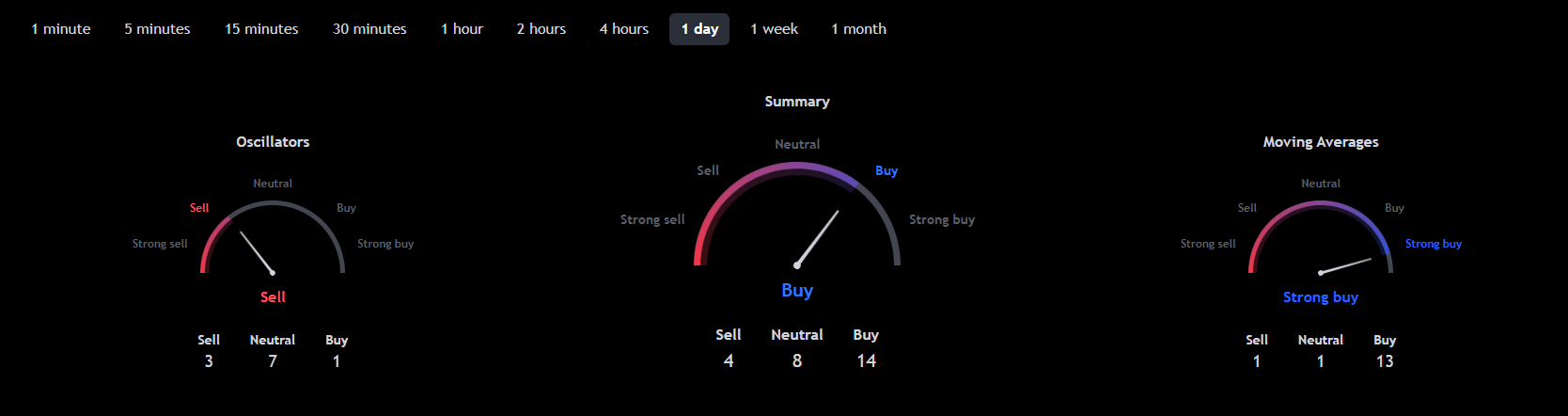

Moreover, over the seven-day interval, OXT additionally skilled a 74.52% pike, pushing the ERC-20 into the inexperienced area. Furthermore, TradingView’s market abstract additionally signifies that the consumers might be experiencing a purchase sentiment over the one-day interval. Allow us to make the most of the technical indicators to additional perceive the market.

Orchid (OXT) Value Evaluation 2023

Will developments and upgrades inside the Orchid community drive the worth of OXT upwards? Might OXT climb up and break the resistance degree? Might it attain a brand new All-Time Excessive over a brief span of time?

Orchid (OXT) Value Evaluation – Bollinger Bands

The Bollinger Bands is a technical evaluation device that’s used to research worth motion and volatility. Bollinger Bands (BB) makes use of the time interval and the stand deviation of the worth. Usually, the default worth of BB’s interval is about at 20. The higher band of the BB is calculated by including 2 instances the usual deviations to the Easy Shifting Common (SMA), whereas the decrease band is calculated by subtracting 2 instances the usual deviation from the SMA. Primarily based on the empirical legislation of normal deviation, 95% of the info units will fall inside the two commonplace deviations of the imply.

Trying on the Bollinger bands, the bands have expanded indicating that OXT might be experiencing a excessive volatility. Furthermore, the bands’ enlargement might be attributable to the most recent noticed by OXT. The BBW additionally identifies that the bands might proceed to broaden as it’s pointed upwards. Nevertheless, there could also be an opportunity for a downfall, since candlesticks are inclined to retrace after a particularly bullish sentiment.

Orchid (OXT) Value Evaluation – Relative Energy Index (RSI)

The Relative Energy Index (RSI) is a momentum indicator utilized to search out out the present development of the worth motion and decide whether it is within the oversold or overbought area. Merchants typically use this device to make choices about when to purchase or promote the tokens. When the RSI is commonly valued beneath or at 30, it’s thought of an oversold area, and a worth correction may occur quickly. Furthermore, when the RSI is valued above or at 70, it’s considered the overbought area, and merchants count on the worth may fall quickly.

The RSI is valued at 81.99 which is clearly the overbought area. There might be an opportunity that the candlesticks might have skilled attributable to consumers’ optimistic conduct. The consumers’ entry into the market additionally helped the bull come again into energy. Ideally, when the RSI hits the overbought area, there could also be an opportunity that costs may retrace. With an analogous perception and RSI pointed downwards, we may count on that the RSI might fall.

Orchid (OXT) Value Evaluation – Shifting Common Convergence Divergence (MACD)

The Shifting Common Convergence Divergence (MACD) indicator can be utilized to determine potential worth traits, momentums, and reversals in markets. MACD will simplify the studying of a transferring common cross simpler. The MACD indicator is calculated by subtracting the long-term EMA (Exponential Shifting Common) indicator from the short-term EMA. Usually, the default values for the MACD are set at 12-day EMA, 26-day EMA, and 9-day EMA. Furthermore, MACD is taken into account a lagging indicator because it can’t present commerce indicators with none previous worth knowledge. MACD performs an vital function as it may possibly verify the traits and determine potential reversals.

The MACD continues to kind inexperienced bars on the histogram mannequin, which might be an indication that OXT might be experiencing a bullish sign. Furthermore, the candlesticks climbing up past the 200SMA may additional point out that the bullish sentiment out there nonetheless prevails. It’s anticipated that even when OXT falls, there could also be a slight probability that the 200SMA present place may act as a help.

Orchid (OXT) Value Prediction 2023-2030 Overview

| Yr | Minimal Value | Common Value | Most Value |

| 2023 | $0.0562 | $0.162 | $0.5352 |

| 2024 | $1.002 | $1.172 | $1.227 |

| 2025 | $1.402 | $1.525 | $1.636 |

| 2026 | $1.272 | $1.423 | $1.857 |

| 2027 | $2.261 | $2.316 | $2.417 |

| 2028 | $2.573 | $2.645 | $2.728 |

| 2029 | $2.718 | $2.819 | $3.0192 |

| 2030 | $2.917 | $3.0182 | $3.223 |

| 2040 | $9.561 | $10.475 | $11.378 |

| 2050 | $24.184 | $25.720 | $26.013 |

Orchid (OXT) Value Prediction 2023

OXT might have been buying and selling downtrend inside the regression line, nevertheless, it appears a breakout occurs. Though an imminent breakout was about to occur, the candlesticks shot up above the 200SMa. Furthermore, the Bull vs Bear Energy exhibits that the consumers had been one of many major causes behind this surge. At present, the ADX continues to develop after being valued at 59 whereas the sellers are greater than the customer. There could also be an opportunity for a fall over time.

In the meantime, the forecast for OXT stays to be bullish and is anticipated to achieve past the extent of $0.4. The bearish worth prediction for OXT ranges from $0.0508 to $0.0362. Nevertheless, on the off probability, OXT experiences a particularly bullish sentiment once more, there’s a excessive risk that it commerce past the extent of $0.7.

| Bullish Value Prediction | Bearish Value Prediction |

| $0.4468 – $0.5352 | $0.0362 – $0.0508 |

Orchid (OXT) Value Prediction 2023 – Resistance and Assist

Trying on the charts, the candlesticks is at present residing beneath the Resistance 1 area. If it continues to expertise a bullish development it has the potential to cross past the Resistance 1 area. A particularly bullish development may push the altcoin past the resistance 2. Every resistance handed may turn out to be the brand new help ranges for OXT.

Orchid (OXT) Value Prediction 2024

Merchants are wanting ahead to this yr because it might be a historic second for cryptocurrencies, because the Bitcoin halving is anticipated to occur in 2024. More often than not, at any time when BTC rises, merchants have noticed an analogous surge within the altcoins. OXT may be affected by Bitcoin halving and will commerce past the worth of $1.2 by the tip of 2024.

Orchid (OXT) Value Prediction 2025

OXT may nonetheless expertise the after-effects of the Bitcoin halving and is anticipated to commerce above its 2024 worth. Many commerce analysts speculate that BTC halving may create a huge effect on the crypto market. Furthermore, just like many altcoins, OXT will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that OXT would commerce past the $1.6 degree.

Orchid (OXT) Value Prediction 2026

It’s anticipated that after an extended interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, OXT may tumble into its help area of $98. Furthermore, when OXT stays within the oversold area, there might be a worth correction quickly. OXT, by the tip of 2026, might be buying and selling past the $1.8 resistance degree after experiencing the worth correction.

Orchid (OXT) Value Prediction 2027

Naturally, merchants count on a bullish market sentiment after the crypto business was affected negatively by the bears’ claw. OXT is anticipated to rise after its slumber within the bear season. Furthermore, OXT may even break extra resistance ranges because it continues to get well from the bearish run. Due to this fact, OXT is anticipated to commerce at $2.4 by the tip of 2027.

Orchid (OXT) Value Prediction 2028

As soon as once more, the crypto neighborhood is wanting ahead to this yr as there will likely be a Bitcoin halving. Alike many altcoins, OXT will proceed to kind new larger highs and is anticipated to maneuver in an upward trajectory. Therefore, OXT could be buying and selling at $2.7 after experiencing an enormous surge by the tip of 2028.

Orchid (OXT) Value Prediction 2029

2029 is anticipated to be one other bull run as a result of aftermath of the BTC halving. Nevertheless, merchants speculate that the crypto market would regularly turn out to be steady by this yr. In tandem with the steady market sentiment and the slight worth surge anticipated after the aftermath, OXT might be buying and selling at $3 by the tip of 2029.

Orchid (OXT) Value Prediction 2030

After witnessing a bullish run out there, OXT and lots of altcoins would present indicators of consolidation and may commerce sideways for a while whereas experiencing minor spikes. Due to this fact, by the tip of 2030, OXT might be buying and selling at $3.2.

Orchid (OXT) Value Prediction 2040

The long-term forecast for OXT signifies that this altcoin may attain a brand new all-time excessive(ATH). This might be one of many key moments as HODLERS might count on to promote a few of their tokens on the ATH level. Nevertheless, OXT might face a slight fall earlier than beginning its upward journey as soon as once more. It’s anticipated that the worth of OXT may attain $11 by 2040.

| Minimal Value | Common Value | Most Value |

| 9.56 | 10.47 | 11.37 |

Orchid (OXT)Value Prediction 2050

The neighborhood believes that there will likely be widespread adoption of cryptocurrencies, which may keep gradual bullish good points. By the tip of 2050, if the bullish momentum is maintained, OXT may surpass the resistance degree of $26.

| Minimal Value | Common Value | Most Value |

| 24.18 | 25.72 | 26.01 |

Conclusion

To summarize, if buyers proceed to indicate curiosity in OXT and add these tokens to their portfolio, then, it may proceed to stand up. OXT’s bullish worth prediction exhibits that it may move past the $0.7 degree. Furthermore, OXT may surpass the $26 degree by the tip of 2050.

FAQ

Orchid defines itself as a decentralized digital non-public community (VPN) permitting customers to purchase bandwidth from a decentralized pool of service suppliers. The native token of Orchid may empower and safe this new method to VPN service and is among the core parts of the Orchid community.

OXT may be traded on many exchanges like different digital property within the crypto world. Binance, KuCoin, Coinbase, Kraken, OKX, and Gate.io are at present common exchanges for buying and selling OXT.

OXT’s function is a singular promoting level in comparison with different cryptocurrencies. Furthermore, the rising demand for privateness and decentralization may drive the costs of OXT upwards.

OXT achieved its all-time excessive of $1.02 in 2021.

If buyers proceed so as to add OXT into their portfolio, then, OXT has the potential to commerce past the extent of $10 by 2040.

The entire provide of OXT is 1,000,000,000 OXT.

OXT may be saved in a chilly pockets, scorching pockets, or trade pockets.

OXT is anticipated to achieve $0.4 in 2023.

OXT is anticipated to achieve $1.2 in 2024.

OXT is anticipated to achieve $1.6 in 2025.

OXT is anticipated to achieve $1.8 in 2026.

OXT is anticipated to achieve $2.4 in 2027.

OXT is anticipated to achieve $2.7 in 2028.

OXT is anticipated to achieve $3 in 2029.

OXT is anticipated to achieve $3.2 in 2030.

OXT is anticipated to achieve $11 in 2040.

OXT is anticipated to achieve $26 in 2050.

Disclaimer: The views and opinions, in addition to all the data shared on this worth prediction, are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates is not going to be held responsible for any direct or oblique harm or loss.