- Bullish Open Campus (EDU) worth prediction ranges from $0.57 to $1.7.

- Evaluation means that the EDU worth may attain $1.48.

- The EDU’s bearish market worth prediction for 2023 is $0.193.

What’s Open Campus (EDU)?

The Open Campus Protocol is a decentralized answer for educators, content material creators, mother and father, college students, and co-publishers designed to deal with the numerous instructional challenges at the moment.

As an example, the service of educators who endeavor to form the longer term is commonly undervalued and underpaid regardless of their valiant efforts to groom a greater era. Moreover, mother and father regularly lack management over their youngsters’s instructional content material.

At its core, the Open Campus Protocol is a community-driven initiative that harnesses the facility of blockchain expertise to create a fairer schooling system. By decentralizing the creation and distribution of instructional content material, the Open Campus Protocol empowers college students to entry extra numerous instructional content material whereas offering educators with new alternatives to earn income and achieve recognition for his or her contributions. The last word purpose of the Open Campus Protocol is to revolutionize the US$5 trillion Schooling trade by returning management to educators and learners.

Moreover, the Open Campus Protocol aspires to forge a vibrant, collaborative ecosystem that unites educators, learners, publishers, and co-publishers, drawing upon its distinguished launch companions’ schooling and web3 experience.

With a imaginative and prescient of fostering synergy amongst these dynamic neighborhood members, the Open Campus Protocol empowers them to create, develop, and share useful instructional content material that not solely addresses learners’ numerous wants but additionally fuels the sustained development and evolution of the ecosystem.

On this thriving setting, innovation, creativity, and knowledge-sharing are celebrated and nurtured, fostering a brighter future for schooling.

The $EDU token is a BEP-20 token on the BNB Chain with a complete mounted provide of 1,000,000,000 tokens. These tokens might be used as fee to reward content material creators and co-publishers for his or her income share. Moreover, it might be used for minting instructional content material as an NFT. It may be used as fee to entry associate instructional platforms of Open Campus. Furthermore, these holding these tokens win voting rights inside EDU governance.

Not being restricted to the previous utilities, the Open Campus ecosystem expects to broaden the utility of the token sooner or later. As such, the tokens might be used for purchasing and promoting on the Open Campus Protocol market (for instance, co-publishers shopping for Writer NFTs).

It may be used for issuing grants and scholarships by way of Sensible Donations. It might be used for a decentralized peer-review system.

Open Campus (EDU) Market Overview

HTTP Request Failed… Error: file_get_contents(https://api.coingecko.com/api/v3/cash/edu-coin): Did not open stream: HTTP request failed! HTTP/1.1 429 Too Many Requests

Analyst’s View on Open Campus

Chairman of Animoca Manufacturers, a Hong Kong-based sport software program firm, Yat Siu tweeted that Open Campus began the story of decentralizing schooling a decade in the past. He cited the inception of the Tiny Faucet platform in 2012, an academic platform for toddlers and preschoolers, because the grassroots of Open Campus which ship extra fairness to academics and creators beginning

Open Campus (EDU) Present Market Standing

Open Campus has a circulating provide of 187,395,833 EDU, whereas its most provide is 1,000,000,000 EDU in accordance with CoinMarketCap. On the time of writing, EDU is buying and selling at $0.5771 representing 24 hours lower of 0.22%. The buying and selling quantity of EDU previously 24 hours is $7,119,350 which represents a 1.66% lower.

Some prime cryptocurrency exchanges for buying and selling EDU are Binance, WEEX, Bybit, Bitget, and LBank.

Now that you understand EDU and its present market standing, we will talk about the worth evaluation of EDU for 2023.

Open Campus (EDU) Worth Evaluation 2023

Will the EDU’s blockchain’s most up-to-date enhancements, additions, and modifications assist its worth rise? Furthermore, will the modifications within the fee and crypto trade have an effect on EDU’s sentiment over time? Learn extra to search out out about EDU’s 2023 worth evaluation.

Open Campus (EDU) Worth Evaluation – Bollinger Bands

The Bollinger bands are a kind of worth envelope developed by John Bollinger. It has an Higher band, a Decrease band, and a Easy Transferring Common (SMA). The higher band offers the highest restrict and the decrease band offers the decrease restrict for the worth to fluctuate. The Bollinger bands work on the precept of normal deviation and interval (time).

As such each time the worth of the cryptocurrency reaches the higher or decrease band, the probabilities of it retracing are 95%. When the bands widen, it exhibits there’s going to be extra volatility and after they contract, there may be much less volatility.

The sections highlighted by crimson rectangles within the chart above present how the bands broaden and contract. When the bands widen, we may anticipate extra volatility, and when the bands contract, it denotes much less volatility. The inexperienced rectangle present how EDU retraced after constantly touching the decrease band (oversold).

Presently, the Bollinger bands are shifting sideways whereas sustaining a relentless distance between them. The higher band is at $0.60450 and the decrease band is at $0.56425. EDU is presently retracing after it nearly touched the decrease band. At current, it is extremely near the SMA, there’s a risk that EDU may cross above the SMA, because the formation of two inexperienced candlesticks might be discovered.

The above chart exhibits how the pattern for EDU has modified when thought of with respect to the Bollinger bands. The Inexperienced patch at round Could and June of 2023 exhibits that EDU has been in an uptrend. Though the indicator exhibits an uptrend, EDU appears to have moved extra sideways than vertically.

The Purple patch on the chart exhibits that EBU was in a downtrend. Nonetheless, when contemplating the downtrend, we may see that EDU’s slope is fading away. Furthermore, when giving extra consideration to the Bollinger band width percentile we may see a variety of data.

The Bollinger Band Width (BBW) percentile or multi-colored line denotes how the bands have been increasing and contracting. When the bands broaden and the indicator reads 100% then it’s thought of the utmost enlargement (crimson bars). The yellow patches within the line present mid-high expansions, and the highlighter inexperienced exhibits mid-level enlargement shut the 50% on the chart. The Azur coloration signifies mid-low and the blue indicators low enlargement or contraction.

Presently, it’s within the Azur zone which denotes the bands are contracting. Primarily based on the earlier observations, it might be famous that when the BBW line cross the 9-day SMA line from beneath, there was an enlargement within the Bollinger bands. Because the 9-day SMA is shifting downwards and the BBW percentile line is shifting upwards, there is perhaps one other enlargement when these two cross.

Open Campus (EDU) Worth Evaluation – Relative Power Index

The Relative Power Index is an indicator that’s used to search out out whether or not the worth of a safety is overvalued or undervalued. As per its title, RSI indicators assist decide how the safety is doing at current, relative to its earlier worth.

As such, the indicator has a sign line which is a Easy Transferring Common (SMA) that acts as a yardstick or reference to the RSI line. Therefore, each time the RSI line is above the SMA, it’s thought of bullish; if it’s beneath the SMA, it’s bearish.

The above chart exhibits an RSI studying of 38.85 and the road is titling downwards. As such, we may anticipate the costs to fall even additional. The RSI which is beneath the Sign provides to this bearish sentiment. Furthermore, if the sellers preserve the strain on, then the RSI may fall additional and will even attain the oversold area.

The larger time-frame for EDU exhibits that the RSI is approaching the sign line from above. Presently, the RSI reads a price of 37.03 and the RSI may cross beneath the Sign line. Nonetheless, there is perhaps a small dip earlier than EDU costs begin to improve. The above assertion might be justified by the dwindling crimson candlesticks.

Open Campus (EDU) Worth Evaluation – Transferring Common

The Exponential Transferring averages are fairly just like the straightforward shifting averages (SMA). Nonetheless, the SMA equally distributes down all values whereas the Exponential Transferring Common offers extra weightage to the present costs. Since SMA undermines the weightage of the current worth, the EMA is utilized in worth actions.

The 200-day EMA is taken into account to be the long-term shifting common whereas the 50-day EMA is taken into account the short-term shifting common in buying and selling. Primarily based on how these two traces behave, the energy of the cryptocurrency or the pattern will be decided on common.

Nonetheless, as EDU hasn’t been present for lengthy we can not use the 200-day EMA. As such, the short-term indicator is the 9-day EMA whereas the long-term indicator is the 50-day EMA. Presently, each indicators are shifting downwards. The 9-day EMA appears to have recovered as its falling gradient has now decreased. This might be an indication of EDU restoration within the quick time period.

As EDU is presently testing the 9-day EMA, we should always anticipate some resistance there primarily based on previous observations. Nonetheless, when EDU has reached its backside consumers will enter the market and uplift its worth.

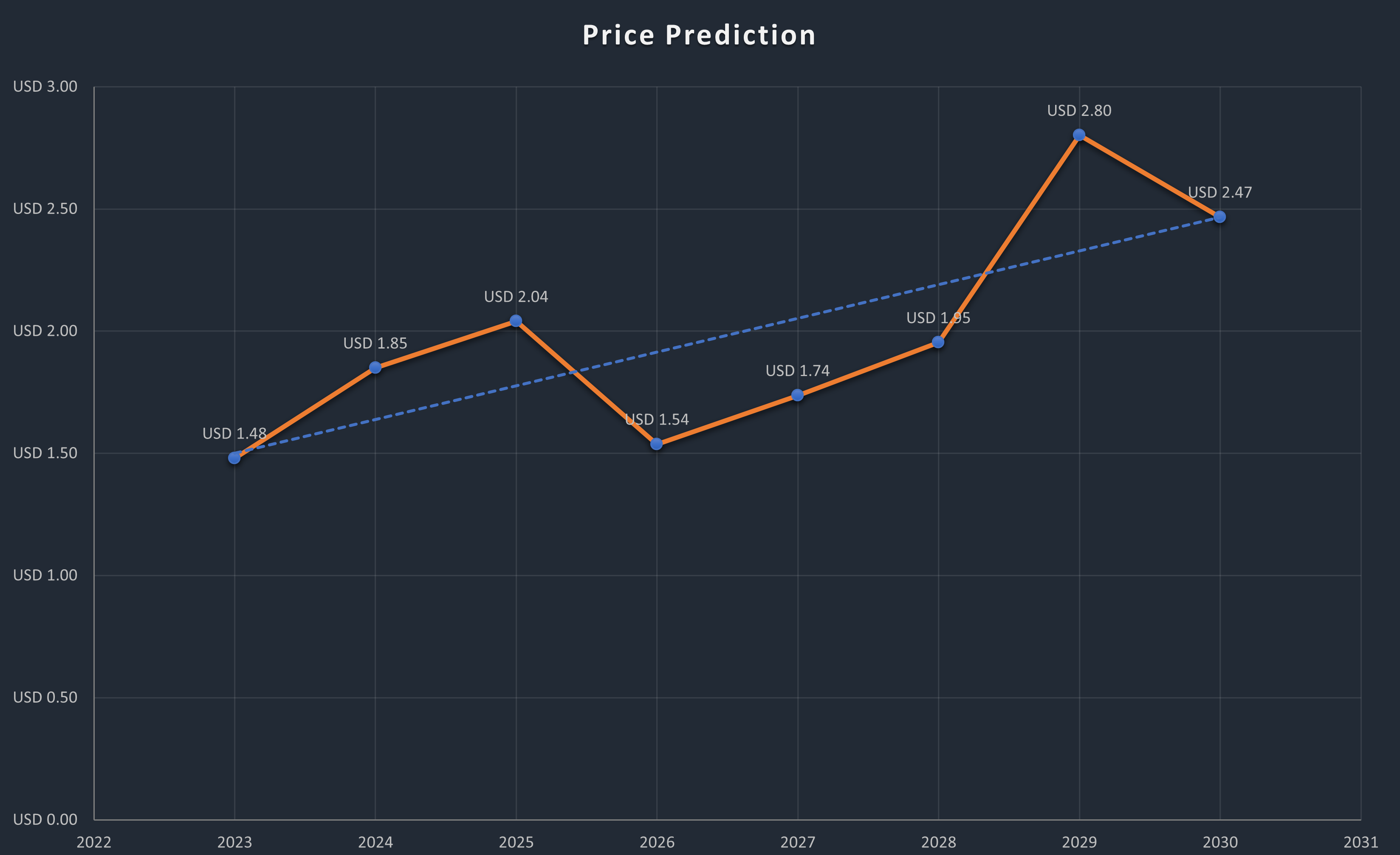

Open Campus (EDU) Worth Prediction 2023-2030 Overview

| 12 months | Minimal Worth | Common Worth | Most Worth |

| 2023 | $1.40 | $1.48 | $1.55 |

| 2024 | $1.80 | $1.84 | $1.95 |

| 2025 | $1.98 | $2.03 | $2.15 |

| 2026 | $1.43 | $1.5 | $1.61 |

| 2027 | $1.65 | $1.7 | $1.78 |

| 2028 | $1.82 | $1.9 | $2.61 |

| 2029 | $2.71 | $2.8 | $2.91 |

| 2030 | $2.23 | $2.4 | $2.68 |

| 2040 | $3.10 | $3.2 | $3.32 |

| 2050 | $4.92 | $5.1 | $5.25 |

Open Campus (EDU) Worth Prediction 2023

The above chart exhibits how EDU has been shedding worth since its inception. It has been making new decrease lows. Nonetheless, the gradient of the EDU’s descent appears to have flattened a bit. This might give the indication that the bulls are taking up and becoming a member of the market. As such, we might even see EDU rising in worth.

If the Bulls push exhausting they may assist EDU get to $0.735 at Resistance 1. Nonetheless, with extra power from the bulls, EDU may break Resistance 1 and attain Resistance 2 at $1.250. Within the occasion that bulls preserve dominating the market, then Resistance 3 at 1.48 can be the following goal that EDU is perhaps eyeing.

Nonetheless, within the occasion, EDU travels in the wrong way it could crash to $0.45. Furthermore, if the $0.45 degree is simply too weak for the bears, then EDU might creak the $0.45 degree and fall to $0.19.

Open Campus (EDU) Worth Prediction – Resistance and Assist Ranges

These days EDU has been falling beneath the 1:1 Gann fan line as proven within the chart beneath. However earlier than the autumn, EDU was shifting sideways between the 0.382 and 0.5 fib retracement ranges. Nonetheless, after crashing, EDU was supported by the 4:1 Gann line throughout mid-June.

However earlier than lengthy the bears have been too sturdy, as such EDU skipped one other degree down and for help (8:1 Gann line). The 8:1 Gann line too was too weak for the bears as they breached this degree and EDU is presently buying and selling on the 1.0 fib retracement degree. If EDU additional falls it’d fall alongside the 1:1 Gann line.

Open Campus (EDU) Worth Prediction 2024

There will likely be Bitcoin halving in 2024, and therefore we should always anticipate a constructive pattern available in the market as a consequence of consumer sentiments and the search by buyers to build up extra of the coin. Because the Bitcoin pattern impacts the path of commerce of different cryptocurrencies, we may anticipate EDU to commerce at a worth not beneath $1.8495 by the tip of 2024.

Open Campus (EDU) Worth Prediction 2025

EDU should still expertise the after-effects of the Bitcoin halving and is anticipated to commerce above its 2024 worth. Many commerce analysts speculate that BTC halving may create a huge effect on the crypto market. Furthermore, just like many altcoins, EDU will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that EDU would commerce past the $2.0399 degree.

Open Campus (EDU) Worth Prediction 2026

It’s anticipated that after an extended interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, EDU may tumble into its help areas. Throughout this era of worth correction, EDU may lose momentum and be a bit beneath its 2025 worth. As such it might be buying and selling at $1.5375 by 2026.

Open Campus (EDU) Worth Prediction 2027

Naturally, merchants anticipate a bullish market sentiment after the crypto trade was affected negatively by the bears’ claw. Furthermore, the build-up to the following Bitcoin halving in 2028 may evoke pleasure in merchants. As such we may anticipate EDU to commerce at round $1.7369 by the tip of 2027.

Open Campus (EDU) Worth Prediction 2028

Because the crypto neighborhood’s hope will likely be re-ignited wanting ahead to Bitcoin halving like many altcoins, EDU will proceed to kind new greater highs and is anticipated to maneuver in an upward trajectory. Therefore, EDU can be buying and selling at $1.9532 after experiencing an enormous surge by the tip of 2028.

Open Campus (EDU) Worth Prediction 2029

2029 is anticipated to be one other bull run as a result of aftermath of the BTC halving. Nonetheless, merchants speculate that the crypto market would steadily turn into steady by this yr. In tandem with the steady market sentiment and the slight worth surge anticipated after the aftermath, EDU might be buying and selling at $2.8015 by the tip of 2029.

Open Campus (EDU) Worth Prediction 2030

After witnessing a bullish run available in the market, EDU and lots of altcoins would present indicators of consolidation and may commerce sideways and transfer downwards for a while whereas experiencing minor spikes. Subsequently, by the tip of 2030, EDU might be buying and selling at $2.4058.

Open Campus (EDU) Worth Prediction 2040

The long-term forecast for EDU signifies that this altcoin may attain a brand new all-time excessive(ATH). This could be one of many key moments as HODLERS might anticipate to promote a few of their tokens on the ATH level.

Nonetheless, EDU might face a slight fall earlier than beginning its upward journey as soon as once more. It’s anticipated that the common worth of EDU may attain $3.7214 by 2040.

Open Campus (EDU) Worth Prediction 2050

The neighborhood believes that there will likely be widespread adoption of cryptocurrencies, which may keep gradual bullish positive factors. By the tip of 2050, if the bullish momentum is maintained, DOT may surpass the resistance degree of $5.1201

Conclusion

As mentioned above, the worth of EDU might even attain above $1.5 if buyers have determined that cryptocurrency is an efficient funding, together with mainstream cryptocurrencies.

FAQ

The Open Campus Protocol is a decentralized answer for educators, content material creators, mother and father, college students, and co-publishers designed to deal with the numerous instructional challenges at the moment

EDU tokens will be traded on many exchanges like different digital belongings within the crypto world. Binance,Gate.io, Pancakeswap V2, Bitget are presently the most well-liked cryptocurrency exchanges for buying and selling EDU.

EDU has a risk of surpassing its current all-time excessive (ATH) worth of $1.684 in April 2023. Nonetheless, as a result of constructive sentiments of its buyers, this might be reached inside a brief body of time..

EDU is among the few cryptocurrencies that has retained its bullish momentum previously seven days. If this momentum is maintained, EDU may attain $1.7 quickly after its breaks the Resistance 1 degree.

EDU has been some of the appropriate investments within the crypto house. It has been rising exponentially, therefore, merchants could also be allured to spend money on EDU.

EDU has a gift all-time low worth of $0.5628.

The utmost provide of EDU 1,000,000,000 EDU cash.

EDU was launched in 2023.

EDU will be saved in a chilly pockets, sizzling pockets, or alternate pockets.

EDU is anticipated to achieve $1.48 by 2024.

EDU is anticipated to achieve $1.8495 by 2024.

EDU is anticipated to achieve $2.0399 by 2025.

EDU is anticipated to achieve $1.5375 by 2026.

EDU is anticipated to achieve $1.7369 by 2027.

EDU is anticipated to achieve $1.9532 by 2028.

EDU is anticipated to achieve $2.8015 by 2029.

EDU is anticipated to achieve $2.4058 by 2030.

EDU is anticipated to achieve $3.7214 by 2040.

EDU is anticipated to achieve $5.1201 by 2050.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this worth prediction, are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates is not going to be held answerable for any direct or oblique injury or loss.