World cryptocurrency adoption stays heading in the right direction to achieve roughly 750 million customers by the top of 2023, based on Triple-A.

Per the report, the highest 5 nations by the estimated variety of holders are the U.S., India, Pakistan, Nigeria, and Vietnam at 46 million, 27 million, 26 million, 22 million, and 20 million, respectively. Vietnam’s possession proportion got here in at 26% of the inhabitants, with the U.S.’s at 13.2%.

The U.Okay. positioned low, having simply 3.7 million estimated holders, representing 5.5% of the inhabitants. However regardless of falling quick on cryptocurrency adoption metrics in comparison with different nations, the U.Okay.’s ruling Conservative occasion has signaled its intent to include digital property into its financial plans.

In January, regardless of the fallout from the FTX collapse persevering with to linger, Financial Secretary to the Treasury Andrew Griffith spoke about championing cryptocurrency and blockchain expertise to result in future financial advantages.

Griffith stated he totally intends to show the U.Okay. into a complicated monetary middle, which “completely [has] room” for cryptocurrency and blockchain expertise.

The wording utilized by Griffith recommended cryptocurrency will play second fiddle to the pound. However studying between the traces, may Griffith be deliberately downplaying the significance of digital property to the U.Okay.? Particularly contemplating the pound’s decline.

The British pound

Historians famous that in Anglo-Saxon instances, from 410-1066AD, one pound was the equal of a pound weight (454 grams) of silver, a substantial fortune on the time.

Nonetheless, it wasn’t till 1815–1920 and the rise of the British East India Firm, a buying and selling physique for English retailers, that the pound rose amongst world currencies rankings to imagine the position of reserve forex.

Though the pound misplaced its reserve forex standing to the greenback beneath the Bretton Woods settlement, it wasn’t till the Nineteen Seventies, as U.S. President Nixon “suspended” the greenback’s convertibility to gold, that the pound’s decline grew to become undeniably obvious.

In 1976, confronted with a monetary disaster, the U.Okay. authorities was pressured to hunt a $4 billion IMF mortgage. Contributory components to the scenario included a spiraling steadiness of funds deficit, extreme public spending, and the quadrupling of oil costs.

Adjusted for inflation, $4 billion in 1976 equals $21.03 billion in as we speak’s cash – a cumulative improve of 426% over 47 years.

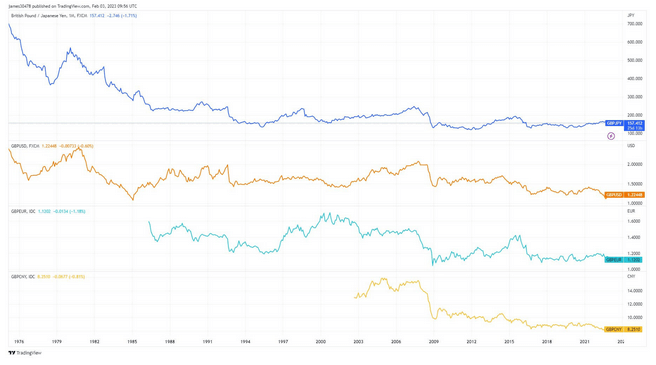

The chart beneath reveals a greenback was valued at round £2.60 in 1972. By the mid-80s, this had plummeted to as little as £1.10, spurred partially by a common decline in British trade, together with the top of the coal mining sector, and greenback energy ensuing from important tax cuts by President Regan.

Dwindling world affect

The late 80s noticed a reversal of downward strain on the pound because the nation went about redefining itself as a service economic system – notably in respect of economic companies. However the macro downtrend re-exerted itself following the beginning of the final recession in 2006.

Additional down strain got here in 2016, because the U.Okay. left the E.U. beneath the Brexit referendum and, extra just lately, through the financial naivety of former Prime Minister Liz Truss, who triggered market panic as a consequence of her “mini-budget” of unfunded tax cuts, inflicting the pound to crash to close 1985 lows.

Removed from being an remoted pattern towards the greenback, for the reason that 70s, the pound’s worth towards different main currencies, such because the yen, euro, and yuan, has additionally collapsed. For instance, in 1976, one pound may purchase 700 yen. Right now, the speed is nearer to 150 yen – a close to 80% decline in worth.

The pound’s decline runs in lockstep with the U.Okay.’s dwindling affect on the worldwide stage. Calling Britain and the pound a shadow of their former selves can be a well mannered solution to body the scenario – one thing Westminister is totally conscious of.

Why is the U.Okay. seeking to digital property?

In latest instances, the U.Okay. authorities has signaled its intent to control cryptocurrencies, thus sanctioning their legitimacy inside its jurisdiction.

A publish from the Treasury dated Feb. 1 highlighted proposals to control monetary intermediaries, together with crypto exchanges, laying the groundwork for a pleasant regulatory panorama.

“These steps will assist to ship a strong world-first regime strengthening guidelines across the lending of cryptoassets, while enhancing shopper safety and the operational resilience of companies.”

However to what diploma are these actions directed by a honest perception in cryptocurrency tenets? In any case, Bitcoin is the antithesis of centralization and is ideologically incompatible with management constructions outdoors of private sovereignty.

The Treasury might be prepared to cede a proportion of its financial monopoly in alternate for the potential financial advantages of nationwide cryptocurrency adoption. This name is probably going pushed by an understanding that cryptocurrency adoption will improve over time.

As such, removed from advocating cryptocurrency tenets, it’s extra doubtless the U.Okay. is positioning itself favorably in readiness for mass adoption.

Individuals are not pleased with the monetary system

Whereas legacy system cracks started exhibiting way back to 1976, the final 12 months noticed an acceleration of the pound’s decline as humorous cash insurance policies in response to the well being disaster took impact.

U.Okay. households are experiencing a big fall in disposable incomes, and on a regular basis persons are struggling amid the price of dwelling disaster – making it more and more evident that the system is damaged, even to put individuals who is probably not fiscally knowledgeable.

Previously, Brits purchased property to counter inflation and forex debasement. However with home costs being 11 instances the typical wage for Londoners, affordability is at present working nicely previous sustainable ranges.

The shortage of (conventional) choices to park cash amid an setting of dwindling buying energy has fostered extra dissatisfaction with the monetary system. Beneath such circumstances, folks will search novel alternate options, together with cryptocurrencies. For that cause, the more serious issues get, the extra cryptocurrency adoption will advance.

It’s very telling that creating nations, the place monetary inclusion and financial stability are sometimes low, thus sowing financial dissatisfaction, make up 4 out of the 5 high spots for the estimated variety of cryptocurrency holders.

In rubber stamping cryptocurrencies, the U.Okay. Treasury has inadvertently admitted that persons are shedding religion within the pound and legacy financial system.

However in equity, diminishing confidence within the native forex is an issue going through all nations, not simply the U.Okay. As the worldwide legacy system continues floundering, anticipate cryptocurrency adoption developments to speed up.

CBDCs – the elephant within the room

The Deputy Governor of the Financial institution of England (BoE,) Sir Jon Cunliffe, informed the Treasury Choose Committee that the U.Okay. is 70% more likely to launch a digital pound Central Financial institution Digital Foreign money (CBDC).

Critics argue that CBDCs current dangers to privateness and might be used for monetary manipulation by governments and central banks, notably concerning proscribing transactions and taking away folks’s proper to transact freely.

The dedication to each personal cryptocurrencies and a digital pound raises questions in regards to the U.Okay. authorities’s imaginative and prescient of a complicated monetary middle – as the 2 are philosophically incompatible.

It stays to be seen how the Treasury will mesh its crypto hub imaginative and prescient with the digital pound, ought to it see the sunshine of day.