- A brand new Tweet by Glassnode recommended that there might be some volatility in retailer for BTC’s value.

- The evaluation platform identified that the drawdowns skilled throughout BTC’s latest upswing in value motion are smaller than in earlier years.

- At press time, BTC was buying and selling arms at $26,835.02, following a 0.90% value lower.

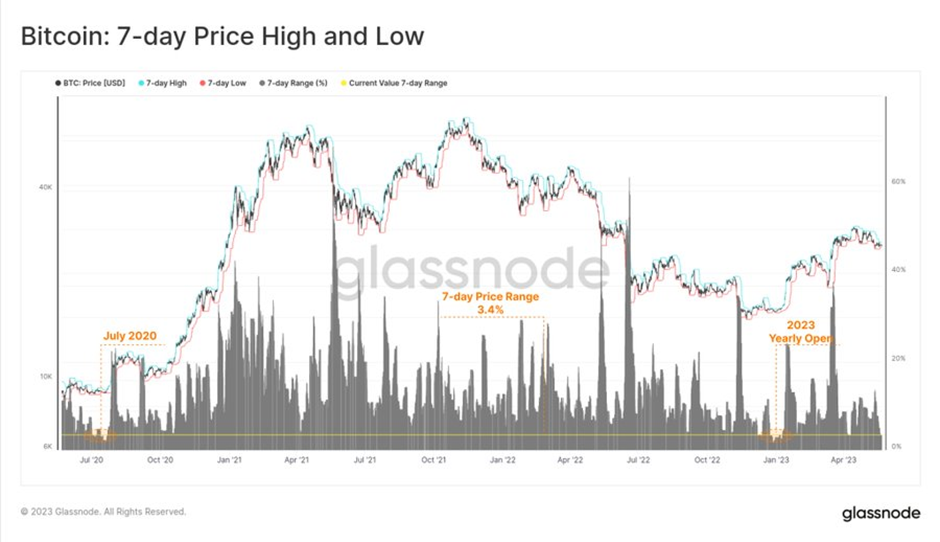

The on-chain evaluation platform, Glassnode, lately took to Twitter to share some new insights in regards to the crypto market chief Bitcoin (BTC), and defined that some excessive volatility is probably going on the horizon for the crypto. This conclusion was drawn based mostly on BTC’s value actions over the previous week.

In line with the submit, the 7-day value vary that BTC has been consolidating inside is the tightest seen previously three years. Glassnode added that this consolidation for BTC could be in comparison with these from January of 2023 and July of 2020.

The evaluation platform added that it’s price noting that these consolidation phases for BTC preceded giant value strikes. This may increasingly lead merchants to imagine that there might be some volatility within the playing cards for BTC within the close to future.

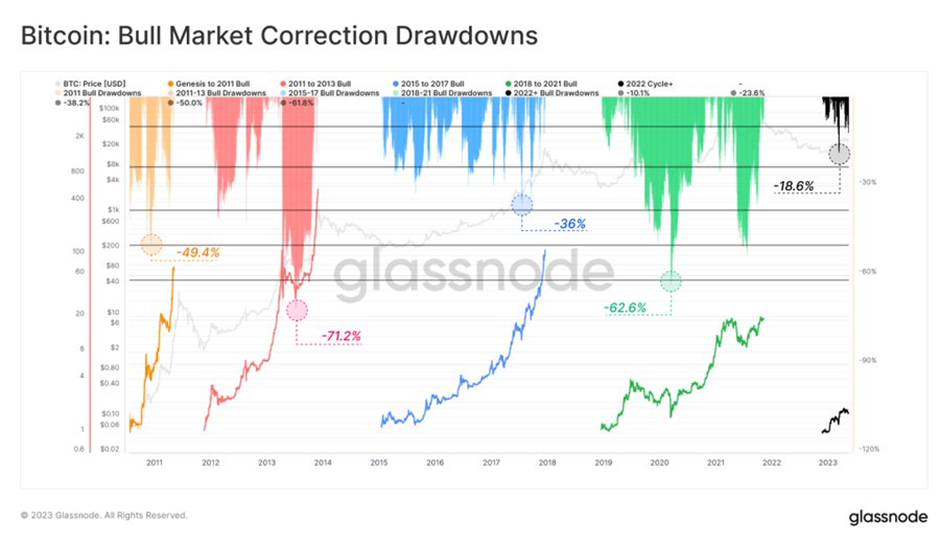

Though issues would possibly get rocky for BTC, Glassnode added in a separate Tweet that the magnitude of drawdowns skilled throughout BTC’s latest upswing in value motion stays marginal when in comparison with different cycles. The bull peak drawdown for 2011-2013 stood at -71.2%.

Along with this, the 2015-2017 and the 2018-2021 bull peak breakdowns stood at -36% and -62.6% respectively. To place this into perspective, the 2022+ bull peak breakdown stands at solely -18.6%, in keeping with Glassnode’s knowledge.

In the meantime, CoinMarketCap indicated that at press time, BTC was buying and selling arms at $26,835.02 at press time. This adopted a 0.90% value drop in BTC’s value over the previous 24 hours. BTC was additionally down by greater than 2% over the previous week of buying and selling.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this value evaluation, are printed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own threat. Coin Version and its associates won’t be held chargeable for any direct or oblique injury or loss.