Bitcoin’s buying and selling hours have surpassed these of the trendy US fiat inventory market for the reason that Nixon Shock, however claims of it exceeding the complete historical past of US inventory buying and selling or fiat globally could be untimely. A more in-depth examination reveals a extra nuanced image of market longevity and buying and selling exercise.

The crypto neighborhood not too long ago buzzed with a statistic highlighting how Bitcoin had collected extra buying and selling hours than the fiat inventory market following an evaluation by Cory Bates.

Bates identifies how Bitcoin buying and selling has now surpassed the fiat inventory market, however it’s essential to keep in mind that this doesn’t imply the complete US inventory market historical past. Nonetheless, it may be derived that Bitcoin buying and selling is older than fiat buying and selling within the US. It’s not, nonetheless, older than fiat globally.

The earliest identified use of fiat foreign money was in China through the Music Dynasty (960–1279 CE). The federal government issued paper cash not backed by bodily commodities like gold or silver. This foreign money was initially backed by the state’s credit score and have become broadly accepted for commerce and taxation.

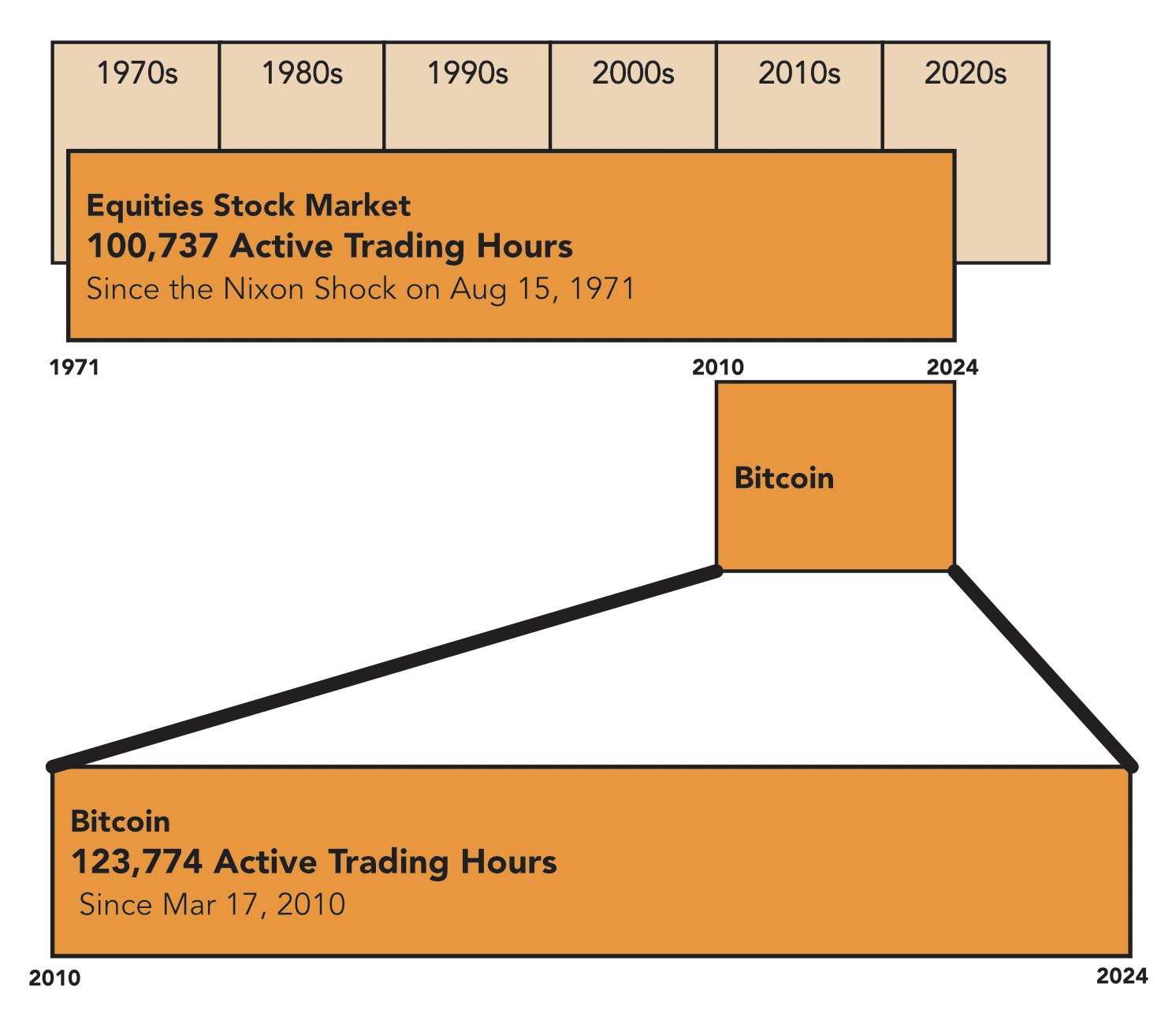

Bitcoin buying and selling hours vs US fiat inventory market

Bitcoin, launched in 2009, has amassed 123,774 energetic buying and selling hours since its first recorded commerce on March 17, 2010. This surpasses the 100,737 hours logged by US equities markets since August 15, 1971 – the date of the Nixon Shock, which marked a major shift in international monetary techniques by way of the removing of the gold normal.

Nevertheless, the US inventory market’s historical past extends far past 1971. The New York Inventory Trade, based in 1792, has a legacy spanning over two centuries. When accounting for this whole historical past, the image adjustments dramatically.

Calculations primarily based on the NYSE’s founding date reveal roughly 380,509 energetic buying and selling hours as much as September 6, 2024. This determine dwarfs Bitcoin’s present tally regardless of the digital asset’s 24/7 buying and selling schedule.

Bitcoin’s round the clock availability offers it a major benefit in accumulating buying and selling hours. The standard inventory market operates on a extra restricted schedule, usually 6.5 hours per day, 5 days per week, excluding holidays.

Given Bitcoin’s steady buying and selling, projections point out it’s going to take till round April 15, 2053, for the digital asset to actually surpass the whole buying and selling hours of the US inventory market’s total historical past. This assumes each markets proceed working underneath their present schedules with out important disruptions.

Nevertheless, it’s essential to notice that buying and selling hours alone don’t totally seize market depth, liquidity, or total financial impression. The US inventory market stays a cornerstone of world finance, with a depth and breadth of listed firms and buying and selling quantity that Bitcoin has but to match.

Whereas Bitcoin has made outstanding strides in its brief existence, the complete weight of the US inventory market’s centuries-long historical past stays a formidable benchmark.

A whole historical past of fiat cash buying and selling

Bitcoin’s journey, although speedy, nonetheless has many years to go earlier than it will possibly genuinely declare to have outlasted the cumulative buying and selling hours of America’s storied inventory markets. Additional, when assessing the declare that it has additionally surpassed fiat, foreign exchange markets have been out there 24 hours a day on weekdays since 1971.

Estimating the whole buying and selling hours for fiat foreign money globally presents a singular problem because of the staggered historic adoption of fiat techniques. Whereas fiat foreign money in some type has been used since historical China, trendy buying and selling hours solely turned constant within the twentieth century, notably after the transition away from the gold normal following the Nixon Shock in 1971.

Earlier than 1971, international buying and selling hours had been localized, irregular, and various between areas. Whilst fiat techniques turned extra frequent, there was no unified international buying and selling market, and exchanges operated with restricted hours. Nevertheless, after 1971, the emergence of the international change (foreign exchange) market turned a extra dependable benchmark for calculating buying and selling hours.

Immediately, trendy foreign currency trading operates roughly 120 hours per week (24 hours a day, 5 days per week). Utilizing this as a baseline, it may be estimated that since 1971, there have been about 6,240 hours of fiat buying and selling per 12 months. Over the 53 years from 1971 to 2024, that will quantity to roughly 330,720 buying and selling hours for fiat in trendy international markets.

In abstract, whereas Bitcoin has surpassed the post-1971 US fiat equities market when it comes to buying and selling hours, the cumulative buying and selling hours of world fiat buying and selling for the reason that inception of organized international foreign exchange markets are considerably greater.

Thus, Bitcoin has not surpassed the whole international buying and selling hours of fiat currencies—neither when it comes to trendy foreign currency trading nor when contemplating the deep historical past of fiat cash globally. Nonetheless, except main foreign exchange markets are additionally opened for weekends, Bitcoin may theoretically catch up ultimately. Nevertheless, Some brokerages permit restricted weekend buying and selling for the preferred foreign exchange pairs.