- NFT exercise on OpenSea noticed a big surge in January 2023.

- The NFT loans reached an all-time excessive in January.

- Polygon overtook Ethereum by way of NFTs bought final month.

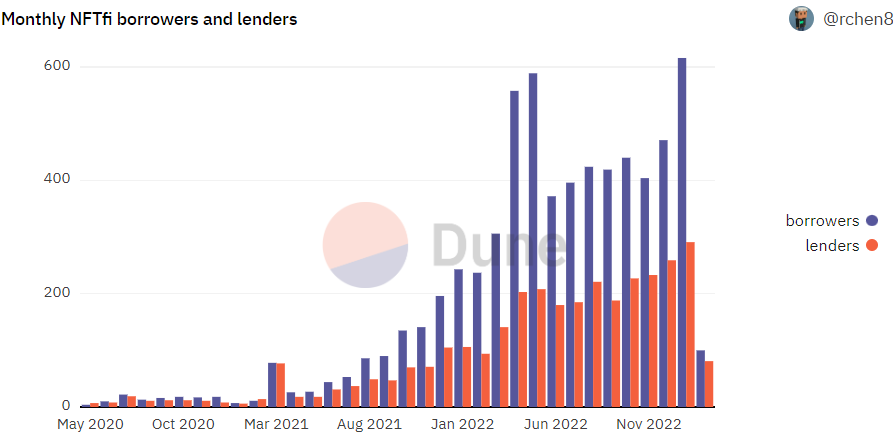

The NFT lending ecosystem noticed vital progress throughout the first month of 2023. NFT exercise on fashionable chains like Ethereum and Polygon reached document highs by way of lenders and debtors, month-to-month mortgage quantity, and the variety of loans processed in January.

On-chain information derived from Dune Analytics offered perception into the NFT lending metrics from January. The NFT mortgage quantity in USD got here in at $26.3 million, the best since Might 2022. At 4399, the variety of month-to-month NFT loans reached an all-time excessive. January noticed extra debtors than any month earlier than.

A series-wise breakdown of the NFT gross sales quantity on NFT revealed that Polygon beat Ethereum by way of month-to-month NFT gross sales. Polygon customers purchased 1.5 million NFTs in January, in comparison with Ethereum customers, who purchased 1.1 million NFTs. The typical mortgage measurement was almost $6,000.

Nonetheless, Ethereum customers took the lead by way of gross sales quantity. After 5 months of declining gross sales, the month of January noticed a resurgence with greater than $446 million in NFT gross sales reported on OpenSea, the best since August final 12 months. Polygon NFT gross sales on OpenSea accounted for $15.3 million.

The NFT lending ecosystem has been on the rise since June final 12 months. The timing means that the rising loans via NFTs had been possible because of the crypto contagion that began proper round that point. Traders had been possible cashing in or borrowing towards the NFTs they amassed throughout the bull run of 2021. The variety of debtors persistently grew from June.