- Bullish NEO worth prediction ranges from $18.38 to $20.13.

- NEO worth may additionally attain $25.67 this 2023.

- NEO’s bearish market worth prediction for 2023 is $6.03.

Neo is an open-source community-driven blockchain platform aimed toward turning into a decentralized sensible economic system. Furthermore, the Neo undertaking additionally hopes to make numerous property, “digital or bodily”, simply accessible by programmers and customers with minimal belief and permission.

One of many options of the Neo undertaking is to allow builders to digitize and automate the administration of property by sensible contracts. Other than a wealthy number of options, Neo additionally consists of “highly effective native infrastructure.” Furthermore, Neo claims that it’s the first public blockchain platform to implement a twin token mechanism function in its native token, NEO. Nonetheless, few members of the crypto neighborhood nonetheless ponder the query about NEO’s worth forecast through the years.

Learn this worth prediction article to know extra concerning the Neo undertaking and NEO’s worth evaluation and forecast for the years 2023, 2024, 2025, 2026, as much as 2050.

Neo (NEO) Market Overview

| 🪙 Title | NEO |

| 💱 Image | neo |

| 🏅 Rank | #65 |

| 💲 Value | $10.43 |

| 📊 Value Change (1h) | 1.35791 % |

| 📊 Value Change (24h) | 8.32207 % |

| 📊 Value Change (7d) | 12.76351 % |

| 💵 Market Cap | $736390203 |

| 📈 All Time Excessive | $198.38 |

| 📉 All Time Low | $0.078349 |

| 💸 Circulating Provide | 70530000 neo |

| 💰 Whole Provide | 100000000 neo |

What’s Neo (NEO)?

Neo is an open-source community-driven blockchain platform aimed toward turning into a decentralized sensible economic system. Furthermore, the undertaking crew claims that NEO is probably the most “feature-complete” blockchain platform for constructing decentralized functions. As a part of its mission, the Neo undertaking permits builders to digitize and automate the administration of property by sensible contracts.

Furthermore, Neo’s multi-language assist would make it straightforward for builders to construct on the platform. As talked about earlier, Neo consists of a “highly effective native infrastructure” reminiscent of decentralized storage, oracles, and area title service, which might lay down a stable basis for the subsequent technology of the Web.

In the meantime, Neo’s native token, NEO, adopted a twin token mechanism, permitting the token to have two options. NEO’s first function offers the customers with governance rights by permitting them to vote for the Neo Council members. The Neo Committee, which consists of chosen members and consensus nodes, would keep the community and regulate the vital blockchain parameters. NEO additionally permits customers the suitable to assert GAS, which is used to pay for transaction charges.

Moreover, Neo claims that the N3 is “probably the most important improve” to its blockchain. N3’s protocol stage permits customers and functions to learn from its enhanced structure. Furthermore, Neo highlights that N3 consists of a various set of important elements for the functions whereas offering a seamless UX/DX expertise. In the end, N3 lowers the obstacles to entry into the blockchain business for conventional builders.

NEO Present Market Standing

After its current launch, NEO already ranked within the 61 place primarily based on its market capitalization, in response to CoinMarketCap. The present circulating provide of Neo’s native token is at 70,538,831 NEO, whereas its whole provide is 100,000,000.

Furthermore, NEO is priced at $10.25, experiencing a 9.53% spike in seven days. With a market cap of $722,775,542, NEO can also be experiencing a 7.46% surge in 24 hours. It was noticed that NEO continues to have an enormous demand and continues to be within the merchants’ highlight because the buying and selling quantity, valued at $98,265,360, skilled a surge of 161.71% in at some point, indicating that traders’ demand for this token is regularly rising.

A number of the crypto exchanges for buying and selling NEO are presently Binance, KuCoin, Bybit, OKX, and Poloniex. Nonetheless, merchants ought to observe that over time NEO may very well be accessible throughout many different high crypto exchanges.

Now, let’s dive additional and focus on the worth evaluation of Neo’s native token, NEO, for 2023.

NEO Value Evaluation 2023

Will NEO’s most up-to-date enhancements, additions, and modifications assist the worth of cryptocurrencies rise? Furthermore, would the adjustments within the blockchain business have an effect on NEO’s sentiment over time? Learn extra to seek out out about NEO’s 2023 worth evaluation.

NEO Value Evaluation – Bollinger Bands

The Bollinger Bands is a technical evaluation device that’s used to investigate worth motion and volatility. Bollinger Bands (BB) makes use of the time interval and the stand deviation of the worth. Usually, the default worth of BB’s interval is about at 20. The higher band of the BB is calculated by including 2 instances the usual deviations to the Easy Shifting Common (SMA), whereas the decrease band is calculated by subtracting 2 instances the usual deviation from the SMA. Based mostly on the empirical legislation of normal deviation, 95% of the info units will fall inside the two commonplace deviations of the imply.

Earlier, a excessive volatility sentiment elevated the likelihood of a pattern reversal. After going through a bearish fall, the candlesticks regularly began to lower and noticed low volatility available in the market for just a few days. After a while, the candlesticks skilled a surge because it reached the highest area of the Bollinger Bands.

Nonetheless, it reached the overbought area and confronted a retracement, thus, NEO fell. Lastly, the candlestick, as soon as once more, reached the highest area after its bearish fall. If the bands broaden, there may very well be a pattern reversal once more. In the meantime, if the hole between the higher band and the decrease band is maintained, then, there’s a excessive likelihood that NEO might proceed residing within the uptrend.

NEO Value Evaluation – Relative Power Index (RSI)

The Relative Power Index (RSI) is a momentum indicator utilized to seek out out the present pattern of the worth motion and decide whether it is within the oversold or overbought area. Merchants typically use this device to make selections about when to purchase or promote the tokens. When the RSI is usually valued beneath or at 30, it’s thought-about an oversold area, and a worth correction might occur quickly. Furthermore, when the RSI is valued above or at 70, it’s considered the overbought area, and merchants anticipate the worth might fall quickly.

The RSI is valued at 54.30, which is taken into account a powerful pattern area by most merchants. Furthermore, the RSI climbed above the SMA, which is one other affirmation that NEO might expertise a bullish pattern. RSI’s climb above the SMA, reached NEO into the robust area. There’s a excessive likelihood that NEO might stay within the robust pattern area for a while. Nonetheless, if the RSI exhibits indicators of a pattern reversal, NEO might fall and commerce within the oversold area. In the end, the RSI would expertise an uptrend for just a few days, earlier than it falls or faces worth correction.

NEO Value Evaluation – Shifting Averages

The Shifting Common indicators reveal that the candlesticks are presently buying and selling in between the 50MA and the 200MA, which is taken into account because the consolidation space. Earlier, a golden cross fashioned because the 50MA crossed above the 200MA. Through the formation of the golden cross, the candlesticks have been buying and selling above the MA indicators, which is taken into account an uptrend. At present, inexperienced candlesticks have fashioned, nonetheless, the gap between the 50MA and the 200MA is lowering, indicating {that a} dying cross may very well be fashioned after a while. In the end, it might take a while earlier than a dying cross may very well be fashioned.

NEO Value Evaluation – Shifting Common Convergence Divergence (MACD)

The Shifting Common Convergence Divergence (MACD) indicator can be utilized to establish potential worth developments, momentums, and reversals in markets. MACD will simplify the studying of a transferring common cross simpler. The MACD indicator is calculated by subtracting the long-term EMA (Exponential Shifting Common) indicator from the short-term EMA. Usually, the default values for the MACD are set at 12-day EMA, 26-day EMA, and 9-day EMA. Furthermore, MACD is taken into account a lagging indicator because it can’t present commerce alerts with none previous worth knowledge. MACD performs an essential position as it might probably affirm the developments and establish potential reversals.

Wanting on the charts, the MACD line is presently above the SMA, which is taken into account as an uptrend by most merchants. Furthermore, the inexperienced bars on the MACD’s histogram are rising, which might point out that the candlestick could proceed upwards. The hole between the MACD line and the sign line might proceed to develop over time, which might affirm NEO’s uptrend.

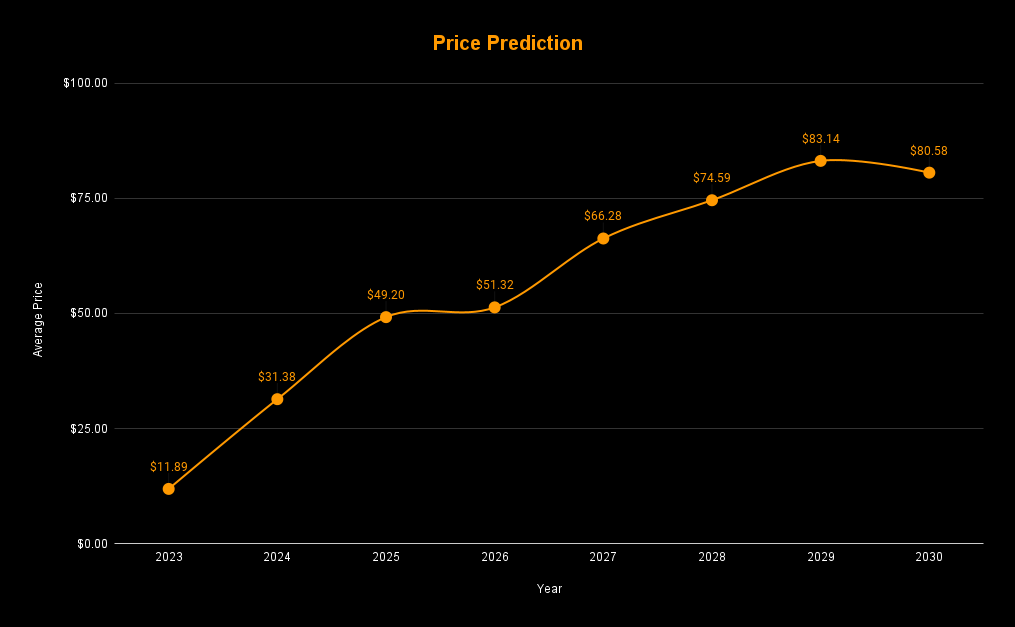

NEO Value Prediction 2023 – 2030 Overview

| Yr | Minimal Value | Common Value | Most Value |

| 2023 | $6.03 | $11.89 | $25.67 |

| 2024 | $15.48 | $31.38 | $42.38 |

| 2025 | $20.80 | $49.20 | $55.31 |

| 2026 | $42.75 | $51.32 | $60.91 |

| 2027 | $52.41 | $66.28 | $73.82 |

| 2028 | $62.08 | $74.59 | $84.11 |

| 2029 | $78.36 | $83.14 | $94.15 |

| 2030 | $70.10 | $80.58 | $97.30. |

| 2040 | $107.49 | $115.83 | $124.27 |

| 2050 | $151.96 | $156.32 | $164.89 |

NEO Value Prediction 2023

NEO’s candlesticks are presently struggling to remain afloat above the 200MA, nonetheless, a just lately fashioned inexperienced candlestick might create a possible uptrend. Furthermore, the MACD line is above the sign line, which confirms that NEO might expertise a bullish sentiment over time. If the candlesticks observe the MACD’s commentary, then, the candlestick might begin climbing above the 200MA, confirming the long-term bullish pattern. Furthermore, the ADX is valued at 28.13, which is taken into account a powerful pattern, additional confirming NEO’s upcoming bullish pattern

In the meantime, the worth prediction of NEO for 2023 stays to be bullish and is predicted to achieve past the extent of $20.13. The bearish worth prediction vary for NEO is between $6.03 to $7.19. Nonetheless, if NEO experiences excessive bullish sentiment, then it might attain the $25.67 stage.

| Bullish Value Prediction | Bearish Value Prediction |

| $18.38 – $20.13 | $6.03 – $7.19 |

NEO Value Prediction 2023 – Resistance and Assist Ranges

At present, NEO’s candlesticks are buying and selling in between the Weak Resistance and the Assist area. If the candlesticks cross the Weak Resistance, NEO’s goal can be to achieve Resistance 1 at $50.91. If NEO reached the realm between Resistance 5 and Resistance 6, the candlesticks’ new goal can be to kind new All-Time Highs and new resistance ranges. In the meantime, it’s anticipated that NEO wouldn’t fall beneath its Assist area.

NEO Value Prediction 2024

Merchants are trying ahead to this 12 months because it may very well be a historic second for cryptocurrencies, because the Bitcoin halving is predicted to occur in 2024. More often than not, each time BTC rises, merchants have noticed an identical surge within the altcoins. NEO may be affected by Bitcoin halving and will commerce past the worth of $42.38 by the top of 2024.

NEO Value Prediction 2025

NEO might nonetheless expertise the after-effects of the Bitcoin halving and is predicted to commerce above its 2024 worth. Many commerce analysts speculate that BTC halving might create a big impact on the crypto market. Furthermore, just like many altcoins, NEO will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that NEO would commerce past the $55.31 stage.

NEO Value Prediction 2026

It’s anticipated that after a protracted interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, NEO might tumble into its assist area of $49.75. Furthermore, when NEO stays within the oversold area, there may very well be a worth correction quickly. NEO, by the top of 2026, may very well be buying and selling past the $60.91 resistance stage after experiencing the worth correction.

NEO Value Prediction 2027

Naturally, merchants anticipate a bullish market sentiment after the crypto business was affected negatively by the bears’ claw. NEO is predicted to rise after its slumber within the bear season. Furthermore, NEO might even break extra resistance ranges because it continues to get better from the bearish run. Subsequently, NEO is predicted to commerce at $73.82 by the top of 2027.

NEO Value Prediction 2028

As soon as once more, the crypto neighborhood is trying ahead to this 12 months as there will likely be a Bitcoin halving. Alike many altcoins, NEO will proceed to kind new larger highs and is predicted to maneuver in an upward trajectory. Therefore, NEO can be buying and selling at $84.11 after experiencing an enormous surge by the top of 2028.

NEO Value Prediction 2029

2029 is predicted to be one other bull run as a result of aftermath of the BTC halving. Nonetheless, merchants speculate that the crypto market would regularly grow to be steady by this 12 months. In tandem with the steady market sentiment and the slight worth surge anticipated after the aftermath, NEO may very well be buying and selling at $94.15 by the top of 2029.

NEO Value Prediction 2030

After witnessing a bullish run available in the market, NEO and plenty of altcoins would present indicators of consolidation and may commerce sideways for a while whereas experiencing minor spikes. Subsequently, by the top of 2030, NEO may very well be buying and selling at $97.30.

NEO Value Prediction 2040

The long-term forecast for NEO signifies that this altcoin might attain a brand new all-time excessive(ATH). This is able to be one of many key moments as HODLERS could anticipate to promote a few of their tokens on the ATH level. Nonetheless, NEO could face a slight fall earlier than beginning its upward journey as soon as once more. It’s anticipated that the worth of NEO might attain $124.27 by 2040.

| Minimal Value | Common Value | Most Value |

| $107.49 | $115.83 | $124.27 |

NEO Value Prediction 2050

The neighborhood believes that there will likely be widespread adoption of cryptocurrencies, which might keep gradual bullish positive factors. By the top of 2050, if the bullish momentum is maintained, NEO might surpass the resistance stage of $164.89.

| Minimal Value | Common Value | Most Value |

| $151.96 | $156.32 | $164.89 |

Conclusion

To summarize, if traders proceed to indicate curiosity in NEO and add these tokens to their portfolio, then, it might proceed to stand up. NEO’s bullish worth prediction exhibits that it might cross past the $20.13 stage. Furthermore, NEO might surpass the $164.89 stage by the top of 2050.

FAQ

Neo is an open-source community-driven blockchain platform aimed toward turning into a decentralized sensible economic system. Furthermore, the undertaking crew claims that NEO is probably the most “feature-complete” blockchain platform for constructing decentralized functions.

Neo’s platform has numerous advantages and utilities, which improve the worth of its native token. Furthermore, Neo might proceed to grow to be one of many tokens below the watch checklist as they intention to supply a stable basis for the brand new technology of the Web.

The utmost provide of NEO is 100,000,000.

Antshares was rebranded to Neo in 2017.

NEO might be saved in a chilly pockets, sizzling pockets, or alternate pockets.

Da Hongfei and Erik Zhang are the co-founders of Neo.

NEO is predicted to achieve $20.13 in 2023.

NEO is predicted to achieve $42.38 in 2024.

NEO is predicted to achieve $55.31 in 2025.

NEO is predicted to achieve $60.91 in 2026.

NEO is predicted to achieve $73.82 in 2027.

NEO is predicted to achieve $84.11 in 2028.

NEO is predicted to achieve $94.15 in 2029.

NEO is predicted to achieve $97.30 in 2030.

NEO is predicted to achieve $124.27 in 2040.

NEO is predicted to achieve $164.89 in 2050.

Disclaimer: The views and opinions, in addition to all the data shared on this worth prediction, are revealed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates is not going to be held chargeable for any direct or oblique harm or loss.