- Bullish NEAR Protocol (NEAR) worth prediction ranges from $1.800 to $11.52

- Evaluation means that the NEAR worth may attain above $11.52 quickly.

- The NEAR bearish market worth prediction for 2023 is $1.789.

What Is NEAR Protocol?

NEAR Protocol is a layer-one blockchain that was designed and developed as a community-run cloud computing platform to remove a few of the limitations which have been bogging competing blockchains, equivalent to low transaction speeds, low throughput, and poor interoperability.

A platform that’s conducive to each builders and finish customers could also be established on this approach, making it appropriate for decentralized functions (dApps). In contrast to Ethereum’s encrypted pockets addresses, NEAR account names are comprehensible by people. NEAR additionally options an authentic consensus course of known as “Doomslug” and progressive approaches to scalability points.

The NEAR Collective is a group of builders, customers, and lovers working to enhance the NEAR Protocol by fixing bugs within the core code and increasing the platform.

NEAR Protocol was based by Erik Trautman. Nightshade is a expertise developed by NEAR that drastically will increase the pace of enterprise transactions. Nightshade is a variant of sharding that will increase the blockchain’s throughput by having a number of teams of validators course of transactions in parallel throughout totally different sharded chains.

Human-readable addresses and the flexibility to create decentralized functions with a registration stream akin to what customers are accustomed to are two methods through which the NEAR

Protocol simplifies the in any other case cumbersome onboarding technique of different blockchains. As well as, it affords builders modular elements, which expedite the launch of initiatives like token contracts and NFTs.

The NEAR Basis is a non-profit based mostly in Switzerland that’s chargeable for the protocol’s governance, in addition to its repairs, ecosystem funding, and management. The protocol has additionally created an middleman between Ethereum and NEAR, enabling the alternate of ERC-20 tokens between the 2 networks.

Use instances for the NEAR token embody prices related to dealing with monetary transactions and sustaining a database, working community validator nodes by staking NEAR tokens, and voting on a coverage that controls the distribution of community assets.

NEAR Protocol Market Overview

HTTP Request Failed… Error: file_get_contents(https://api.coingecko.com/api/v3/cash/close to): Didn’t open stream: HTTP request failed! HTTP/1.1 429 Too Many Requests

NEAR Protocol Present Market Standing

With 755,775,027 NEAR in circulation, NEAR Protocol trades at $2.20 on the time of writing. NEAR has a 24-hour buying and selling quantity of $122,675,345, and in the course of the earlier 24 hours, the value of NEAR decreased by 05.68%.

In the intervening time, the preferred exchanges that commerce NEAR Protocol (NEAR) are Binance, Kucoin, Coinbase, Kraken, and Bitfinex.

NEAR Protocol Value Evaluation 2023

At present, NEAR ranks thirty fifth on CoinMarketCap’s high record of cryptocurrencies by way of market capitalization. Will NEAR Protocol’s most up-to-date enhancements, additions, and modifications assist its worth rise? Let’s deal with the charts on this article’s NEAR worth forecast first.

NEAR Protocol Value Evaluation – Keltner Channel

The Keltner channel is a technical indicator launched by American grain dealer, Chester W. Keltner to gauge the volatility of the market. For this function, it has three bands; the Higher band, Center band (EMA), and decrease band.

The higher band is calculated by including twice the Common True Vary (ATR) to the EMA (center band), whereas the decrease band is calculated by subtracting twice the ATR from the EMA. Furthermore, the Keltner bands is also used to find out the path of the value motion.

The chart above exhibits two pink rectangles that denote the enlargement and contraction of the Keltner channels. When the bands widen it means that there’s going to be extra volatility. Or in different phrases, the costs may drastically drop or enhance. When the bands squeeze, there may very well be much less volatility. It’s because the vary of fluctuation could be restricted and the costs shall be constrained to maneuver sideways.

Moreover, when the value of a cryptocurrency constantly touches the higher or decrease band and thereafter touches the other band, (which is, if a cryptocurrency constantly touches the higher band and at last touches the decrease band, then we may decide that the bullish development has pale.) This is applicable vice-versa as effectively. This habits may very well be seen contained in the inexperienced rectangle.

At present, NEAR is testing the higher band, therefore, there may very well be a development reversal awaiting NEAR. As such, merchants ought to be vigilant. Furthermore, because the Keltner channels are tilted upwards, there’s a chance that the NEAR bulls might have some momentum left in them. If the previous assertion is the case for NEAR, then it might keep its surge sooner or later.

NEAR Protocol Value Evaluation – Bollinger Bands

The Bollinger bands are a kind of worth envelope developed by John Bollinger. It offers a spread with an higher and decrease restrict for the value to fluctuate. The Bollinger bands work on the precept of ordinary deviation and interval (time). The higher band as proven within the chart is calculated by including two occasions the usual deviation to the Easy Shifting Common whereas the decrease band is calculated by subtracting two occasions the usual deviation from the Easy Shifting Common.

When this setup is utilized in a cryptocurrency chart, we may count on the value of the cryptocurrency to abide throughout the higher and decrease bounds of the Bollinger bands 95% of the time.

The above thesis is derived from an Empirical regulation often known as the three-sigma rule or the 68-95-99.7 which states that the majority noticed knowledge for a standard distribution (regular scattering of knowledge) will fall inside three normal deviations.

As such for an information set that follows a traditional distribution, 68% of knowledge will fall inside 1 normal deviation of the imply, whereas 95% of knowledge for the conventional distribution will fall inside 2 normal deviations of the imply and 99.7% of knowledge will fall inside 3 normal deviations of the imply.

Therefore, because the Bollinger bands are calculated utilizing two normal deviations, we may count on NEAR to abide throughout the Bollinger bands 95% of the time. (i.e each time the cryptocurrency touched the higher band, the possibilities of it coming down are 95%.). This idea applies vice-versa as effectively.

Furthermore, the sections highlighted by pink rectangles present how the bands increase and contract. When the bands widen, we may count on extra volatility, and when the bands contract, it denotes much less volatility. At present, the bands are increasing, therefore, NEAR may go up or crash drastically.

Moreover, the NEAR has overlapped the higher Bollinger band and has been within the overbought area. As such, there may very well be a worth correction and the value of NEAR might fall sooner or later.

Notably, the Bollinger Band behaves very intently with the Keltner channel. For example, if you happen to have been to make use of each the Bollinger bands and Keltner channel indicators for a cryptocurrency, you’ll see that just about more often than not each indicators overlap. Nonetheless, the one distinction between with Bollinger band and the Keltner channel is that the Bollinger bands use Normal Deviation whereas the Keltner channel makes use of Common True Vary for calculating its bands that are the highest and backside limits.

NEAR Protocol Value Evaluation – Relative Power Index

The Relative Power Index is an indicator that’s used to seek out out whether or not the value of a safety is overvalued or undervalued. As per its title, RSI indicators assist decide how the safety is doing at current, relative to its earlier worth.

Furthermore, it has a sign line which is a Easy Shifting Common (SMA) that acts as a yardstick or reference to the RSI line. Therefore, each time the RSI line is above the SMA it’s thought of bullish and if it’s beneath the SMA then it’s bearish.

When contemplating the primary inexperienced rectangle from the left of the chart beneath we are able to see that the RSI line (purple) is above the Sign line (yellow). As such, RUNE is bullish or gaining worth as its making greater highs. The second inexperienced rectangle exhibits that the RSI is beneath the sign. Therefore, it’s bearish as it’s making decrease lows.

At present, the RSI is rebounding on the Sign. Since each the RSI and SMA are tilted upwards we may count on the NEAR costs to extend.

Furthermore, the RSI compares the features of the securities in opposition to the losses it made prior to now. This ratio of features in opposition to the losses is then deducted from the 100.

If the reply is lower than 30, then we name that the value of the safety is within the oversold area. Which means that many are promoting the safety out there, and as such the safety is undervalued. Furthermore, as per the Provide-demand curve concept, the value is meant to drop when there is a rise in provide.

If the reply is greater than 70 then the safety is overbought as many are shopping for. Since many wish to purchase the safety the demand will increase which intuitively will increase the costs.

Moreover, the RSI may very well be used to find out how sturdy a development is. For example, when a cryptocurrency is bullish or reaching greater highs, then the RSI line additionally ought to be making greater highs in unison. Contrastingly, the chart exhibits how NEAR was making greater highs when the RSI was making decrease highs.

The above sentiment exhibits that though the cryptocurrency is on a bullish development it’s dropping worth and therefore a development reversal may very well be lurking across the nook.

At present, NEAR is within the overbought area and it’s tiling downwards in direction of the Sign line. If the RSI is meant to lower, it could search the help of the Sign to rebound on it, as at different occasions.

Nonetheless, the RSI may additionally give false alarms for breakouts. Though we might count on, the costs to retrace if it goes to the oversold or overbought area, the costs can also keep within the oversold or overbought area for an prolonged interval. As such, merchants ought to be cautious of it and let the market saturate earlier than making important selections.

NEAR Protocol Value Evaluation – Shifting Common

The Exponential Shifting averages are fairly much like the straightforward shifting averages (SMA). Nonetheless, the SMA equally distributes down all values whereas the Exponential Shifting Common offers extra weightage to the present costs. Since SMA undermines the weightage of the current worth, the EMA is used.

The 200-day MA is taken into account to be the long-term shifting common whereas the 50-day MA is taken into account the short-term shifting common in buying and selling. Based mostly on how these two strains behave, the power of the cryptocurrency or the development could be decided on common.

Specifically, when the short-term shifting common (50-day MA) approaches the long-term shifting common (200-day MA) from beneath and crosses it, we name it a Golden Cross. Contrastingly, when the short-term shifting common crosses the long-term shifting common from above then, a loss of life cross happens.

Normally, when a Golden Cross happens, the costs of the cryptocurrency will shoot up drastically, however when there’s a Dying Cross, the costs will crash.

At any time when the value of cryptocurrency is above the 50-day or 200-day MA, or above each we might say that the coin is bullish. Contrastingly, if the token is beneath the 50-day or 200-day, or beneath each, then we may name it bearish (Inexperienced triangle part).

When contemplating the timeframe from early 2023 to late February, NEAR was above the 50-day MA. Therefore lets say that it was bullish within the brief time period. Nonetheless, NEAR is presently recovering after falling beneath each shifting averages. Furthermore, the 50-day MA is sort of on the verge of crossing the 200-day MA from beneath.

If the previous occurs, then NEAR may have a Golden Cross and the costs may surge. Though the Golden Cross doesn’t essentially result in an awesome surge, NEAR has responded with massive deviations. Therefore, there may very well be one other surge awaiting NEAR.

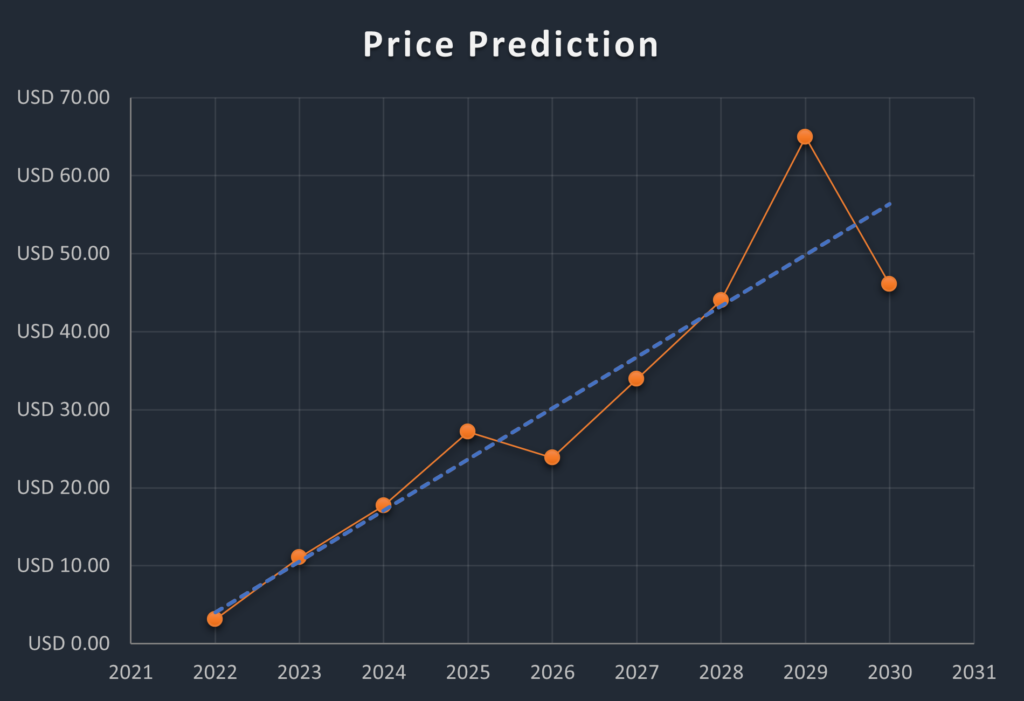

NEAR Protocol Value Prediction 2023 – 2030 Overview

| 12 months | Minimal Value | Common Value | Most Value |

| 2023 | $10.09 | $11.052 | $12.52 |

| 2024 | $15.62 | $17.681 | $22.16 |

| 2025 | $24.23 | $27.126 | $28.62 |

| 2026 | $25.15 | $23.825 | $ 21.00 |

| 2027 | $28.92 | $33.927 | $38.55 |

| 2028 | $41.13 | $43.979 | $58.65 |

| 2029 | $62.55 | $64.91 | $70.45 |

| 2030 | $65.50 | $46.09 | $50.12 |

| 2040 | $110 | $121 | $130 |

| 2050 | $155 | $187 | $196 |

NEAR Protocol Value Prediction 2023

When contemplating the chart above we may see that the NEAR has been making an attempt exhausting to stand up however the bears have been too sturdy for the bulls. As such we may see how NEAR was rejected a couple of occasions at Resistance 2 at ≈$6.30 after which it fell beneath Resistance 1 at ≈ $4.70.

NEAR has been holden up by Assist 1 at ≈ $1.8 since early January 2023. Nonetheless, currently, NEAR has discovered some momentum and has taken off of Assist 1. We might even see it rise to Resistance 2 at ≈ $6.30. Nonetheless, NEAR shall be encountered with Resistance 1. If the NEAR bulls will not be sturdy sufficient then NEAR might rebound and fall again to Assist 1.

Based mostly on NEAR’s previous habits, there’s additionally a chance that it may surge to Resistance 3 at ≈$11.52. Though it could encounter some consolidation at Resistance 1 and Resistance 2, if the consumers carry on the stress, then NEAR has the potential to succeed in Resistance 3.

Nonetheless, NEAR has touched the higher Bollinger band, therefore, there may very well be a development reversal and NEAR may retrace.

NEAR Protocol Value Prediction – Resistance and Assist Ranges

The chart above exhibits how NEAR reciprocates nearly the mirror picture of fluctuation on the left. The #1 highlighted sections on either side of the mirror present nearly the identical fluctuation. When contemplating the quantity 2 highlighted sections on both facet of the mirror, we are able to see that the picture on the proper facet had fewer sideways actions, because the bulls have been weakened by the immense bear stress. As such, the bulls’ efforts have been nullified.

The quantity 3 highlighted part on both facet of the mirror differs with respect to the truth that the proper picture failed to check Resistance 1 as a lot because the left facet. This too exhibits that the bears have been in management. If that is the cycle of NEAR fluctuation, then we might even see one other surge– could also be a reciprocation of the fluctuating sample on the left of the mirror.

NEAR Protocol Value Prediction 2024

There shall be Bitcoin halving in 2024, and therefore we should always count on a constructive development out there resulting from person sentiments and the hunt by traders to build up extra of the coin. Because the Bitcoin development impacts the path of commerce of different cryptocurrencies, we may count on NEAR to commerce at a worth not beneath $17.5001 by the top of 2024.

NEAR Protocol Value Prediction 2025

NEAR should still expertise the after-effects of the Bitcoin halving and is predicted to commerce above its 2024 worth. Many commerce analysts speculate that BTC halving may create a big impact on the crypto market. Furthermore, much like many altcoins, NEAR will proceed to rise in 2025 forming new resistance ranges. It’s anticipated that NEAR would commerce past the $27.126 stage.

NEAR Protocol Value Prediction 2026

It’s anticipated that after an extended interval of bull run, the bears would come into energy and begin negatively impacting the cryptocurrencies. Throughout this bearish sentiment, NEAR may tumble into its assist areas. Throughout this era of worth correction, NEAR may lose momentum and be just a little beneath its 2025 worth. As such it may very well be buying and selling at $23.825 by 2026.

NEAR Protocol Value Prediction 2027

Naturally, merchants count on a bullish market sentiment after the crypto business was affected negatively by the bears’ claw. Furthermore, the build-up to the subsequent Bitcoin halving in 2028 may evoke pleasure in merchants. As such we may count on NEAR to commerce at round $34 by the top of 2027.

NEAR Protocol Value Prediction 2028

Because the crypto group’s hope shall be re-ignited trying ahead to Bitcoin halving like many altcoins, NEAR will proceed to kind new greater highs and is predicted to maneuver in an upward trajectory. Therefore, NEAR could be buying and selling at $44 after experiencing a large surge by the top of 2028.

NEAR Protocol Value Prediction 2029

2029 is predicted to be one other bull run as a result of aftermath of the BTC halving. Nonetheless, merchants speculate that the crypto market would regularly develop into steady by this 12 months. In tandem with the steady market sentiment and the slight worth surge anticipated after the aftermath, NEAR may very well be buying and selling at $64.91 by the top of 2029.

NEAR Protocol Value Prediction 2030

After witnessing a bullish run out there, NEAR and lots of altcoins would present indicators of consolidation and may commerce sideways and transfer downwards for a while whereas experiencing minor spikes. Due to this fact, by the top of 2030, NEAR may very well be buying and selling at $46.

NEAR Protocol Value Prediction 2040

The long-term forecast for NEAR signifies that this altcoin may attain a brand new all-time excessive(ATH). This could be one of many key moments as HODLERS might count on to promote a few of their tokens on the ATH level.

Nonetheless, NEAR might face a slight fall earlier than beginning its upward journey as soon as once more. It’s anticipated that the typical worth of NEAR may attain $121 by 2040.

NEAR Protocol Value Prediction 2050

The group believes that there shall be widespread adoption of cryptocurrencies, which may keep gradual bullish features. By the top of 2050, if the bullish momentum is maintained, DOT may surpass the resistance stage of $187.

Conclusion

As mentioned above, the value of NEAR might even attain above $11.52 if traders have determined that the cryptocurrency is an effective funding, together with mainstream cryptocurrencies.

FAQ

As a layer-one blockchain constructed as a community-run cloud computing platform, NEAR Protocol overcomes points impacting different blockchains, equivalent to sluggish transaction charges, low throughput, and poor compatibility. A platform that’s conducive to each builders and finish customers could also be established on this approach, making it appropriate for dApps.

Like different digital property within the crypto world, NEAR could be traded on many exchanges. Binance, Huobi World, Mandala Change, FTX, and OKX are presently the preferred cryptocurrency exchanges for buying and selling NEAR.

Since NEAR offers traders with quite a lot of alternatives to revenue from their crypto holdings, NEAR appears to be a very good funding in 2022. Notably, NEAR has a excessive chance of surpassing its present ATH in 2027.

When it comes to energetic crypto property, NEAR is likely one of the few that continues to rise in worth. So long as this bullish development continues, NEAR may break via $11.694 and attain as excessive as $21.68. In fact, if the present market favoring crypto continues, that is extraordinarily prone to occur.

As one of many fastest-rising cryptocurrencies, NEAR is predicted to proceed its rise. We may additionally conclude that NEAR is a wonderful cryptocurrency to take a position on this 12 months, given the current partnerships which have improved its adoption.

The bottom worth that NEAR has is $0.526, which was tapped on November 04, 2020.

NEAR was launched in 2020.

They’re Erik Trautman and Illia Polosukhin.

NEAR has a most supple of 1,000,000,000 NEAR.

NEAR could be saved in a chilly pockets, sizzling pockets, or alternate pockets.

NEAR worth is predicted to succeed in $11.5 by 2023.

NEAR is predicted to succeed in $17.5 by 2024.

NEAR is predicted to succeed in $27.126 by 2025.

NEAR is predicted to succeed in $23.825 by 2026.

NEAR is predicted to succeed in $34 by 2027.

NEAR is predicted to succeed in $44 by 2028.

NEAR is predicted to succeed in $64.91 by 2029.

NEAR is predicted to succeed in $46 by 2030.

NEAR is predicted to succeed in $121 by 2040.

NEAR is predicted to succeed in $187 by 2050.

Disclaimer: The views and opinions, in addition to all the knowledge shared on this worth prediction, are revealed in good religion. Readers should do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. CoinEdition and its associates is not going to be held chargeable for any direct or oblique harm or loss.