- Crypto Tony tweets about 150K ETH transactions from an unknown pockets to Coinbase.

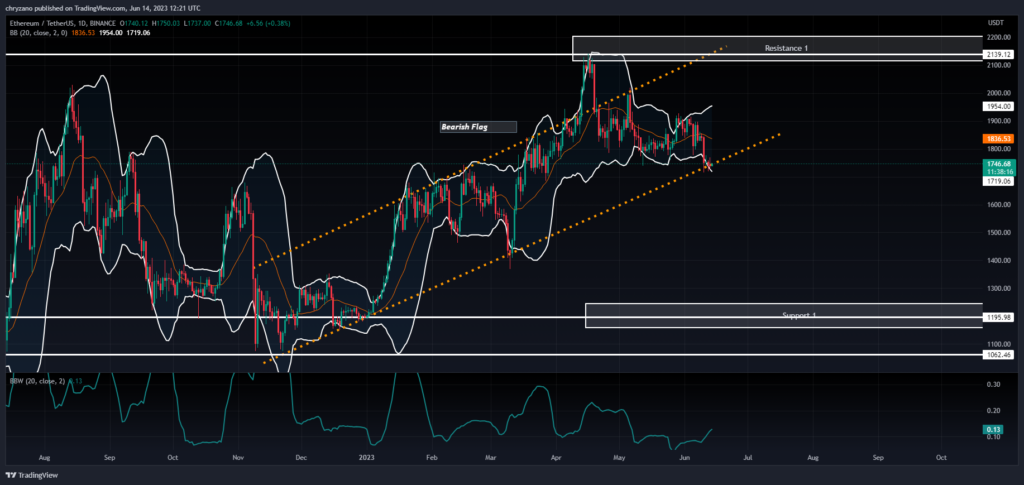

- Ethereum fluctuates inside a bearish flag, since late 2022, it may escape at any second.

- Bollinger bands purchase time for a breakout as ETH touched the decrease band.

Crypto Tony, a dealer and analyst retweeted Whale Alerts, a blockchain transaction surveyor’s tweet which acknowledged that 149,999 ETH was transferred from an unknown pockets to Coinbase. The transferred ETH accumulates to $261,949,642.

Nonetheless, the explanation behind this mass transaction is but to be decided. It could possibly be that the whale is gearing as much as alternate ETH for another coin, or could possibly be one thing else that the whale could possibly be having up its sleeve, therefore, merchants could have to take precautions.

When contemplating the above chart, Ethereum has been buying and selling in a bearish flag since late November 2022. ETH touched the higher development line more often than not throughout its abode within the flag. It has been making increased highs and better lows for nearly six months. As such we may count on Ethereum to interrupt out from the flag at any given time.

In accordance with the perfect practices of buying and selling the bearish flag, it’s advisable to have the take revenue of the quick place slightly below the Help 1 stage. The above thesis is predicated on the perfect apply of trans-positioning the peak of the wedge on the early phases of formation, to the breakout level from the wedge.

Furthermore, the cease loss could possibly be positioned on the prime development line of the wedge to offer sufficient slack for ETH to fluctuate. If Ethereum crashed from the wedge it may attain $1062.

When contemplating the timing of the breakout, the Bollinger bands appear to negate the truth that ETH may escape from the wedge now. It is because ETH has touched the decrease Bollinger Band, therefore, it could retrace and rise. As such, ETH additional has the chance to constantly fluctuate contained in the wedge for fairly a while. Furthermore, the Bollinger bandwidth indicator can also be rising, therefore, the bands could widen additional and there could possibly be elevated volatility.

Therefore, it’s of utmost significance for merchants to time the market, significantly the breakout level from the wedge. It’s advisable that they use the right mixture of indicators to adjudicate the market conduct.

Disclaimer: The views, opinions, and data shared on this value prediction are printed in good religion. Readers should do their analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates is not going to be answerable for direct or oblique harm or loss.