- Cryptocurrencies continue to grow in reputation

- Bitcoin’s worth dynamics modified with institutional buyers’ adoption

- Bitcoin is now correlated with belongings within the conventional monetary market

Since digital currencies exist, the trade developed exponentially in somewhat greater than a decade. At present, greater than 22,000 cryptocurrencies are a part of one of the dynamic markets on the planet.

The large variety of currencies brings a number of challenges to merchants and buyers. First, crypto exchanges discover it troublesome to checklist all cryptocurrencies; thus, buyers could miss some alternatives.

Second, many tasks within the crypto area failed. Statistics say that 9 in ten blockchain tasks will fail.

For instance, in 2023 alone, 83 cash disappeared for numerous causes, resembling failing ICO, no goal, scams, or they’d no quantity.

Subsequently, to keep away from being caught in tasks doomed to fail or to be scammed, many buyers choose cryptocurrencies with a big market capitalization and well-established within the investing neighborhood. In different phrases, if a cryptocurrency turns into a part of institutional buyers’ portfolios, the possibilities are that it’ll nonetheless exist within the medium and long run.

Bitcoin is such a digital forex.

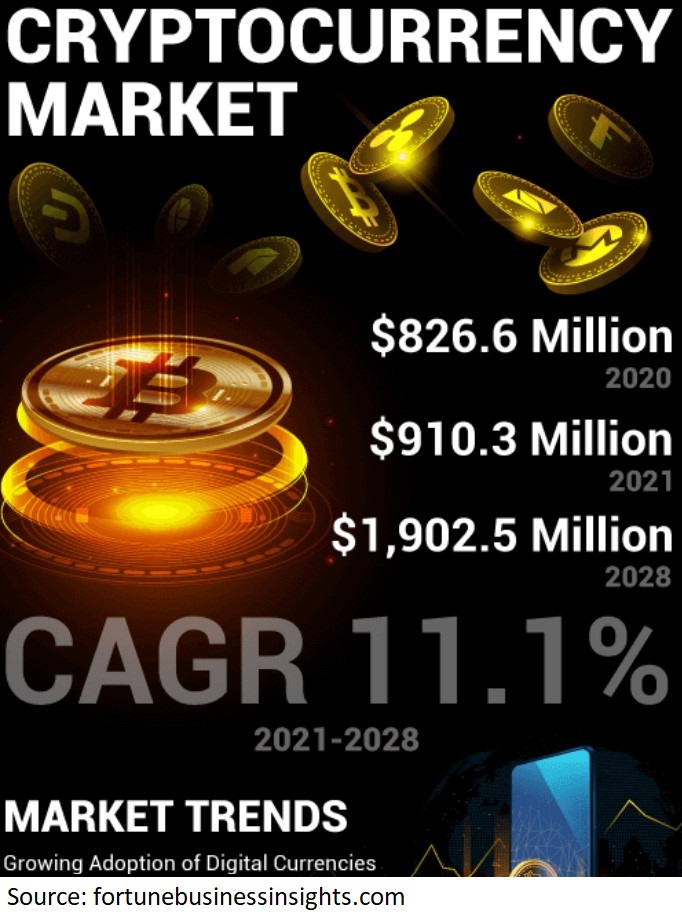

Bitcoin’s dynamics modified with the rising adoption of digital currencies

Because the investing neighborhood embraced digital currencies, Bitcoin turned a part of increasingly more institutional buyers’ portfolios.

However the adoption got here with some prices.

Bitcoin chart by TradingView

Take the chart above. It exhibits Bitcoin’s worth evolution since its inception.

When it first traded above $1,000, Bitcoin caught everybody’s consideration. Then, when it reached $20,000 for the primary time, everybody talked a couple of bubble.

So robust was the resistance stage that it took Bitcoin a number of years to beat it. Respecting the interchangeability precept, resistance has grow to be assist just lately.

However such ample strikes are unlikely to be seen sooner or later. As a result of Bitcoin’s correlation to conventional monetary markets elevated, it’s unlikely for the value to triple or double with out related strikes elsewhere.

Summing up, Bitcoin could also be a superb funding for the long run, however the rising adoption of cryptocurrencies will make it increasingly more troublesome for the value to maneuver the way in which it did earlier than.