Bitcoin had probably the most risky weekend in a 12 months as Bitcoin slipped as little as $64,550 after reaching a brand new all-time excessive of $72.760 on Thursday, March 14. As of press time, Bitcoin has recovered to commerce round $68,300. Nonetheless, a number of worth swings between 3% – 7% have been prevalent all through the weekend.

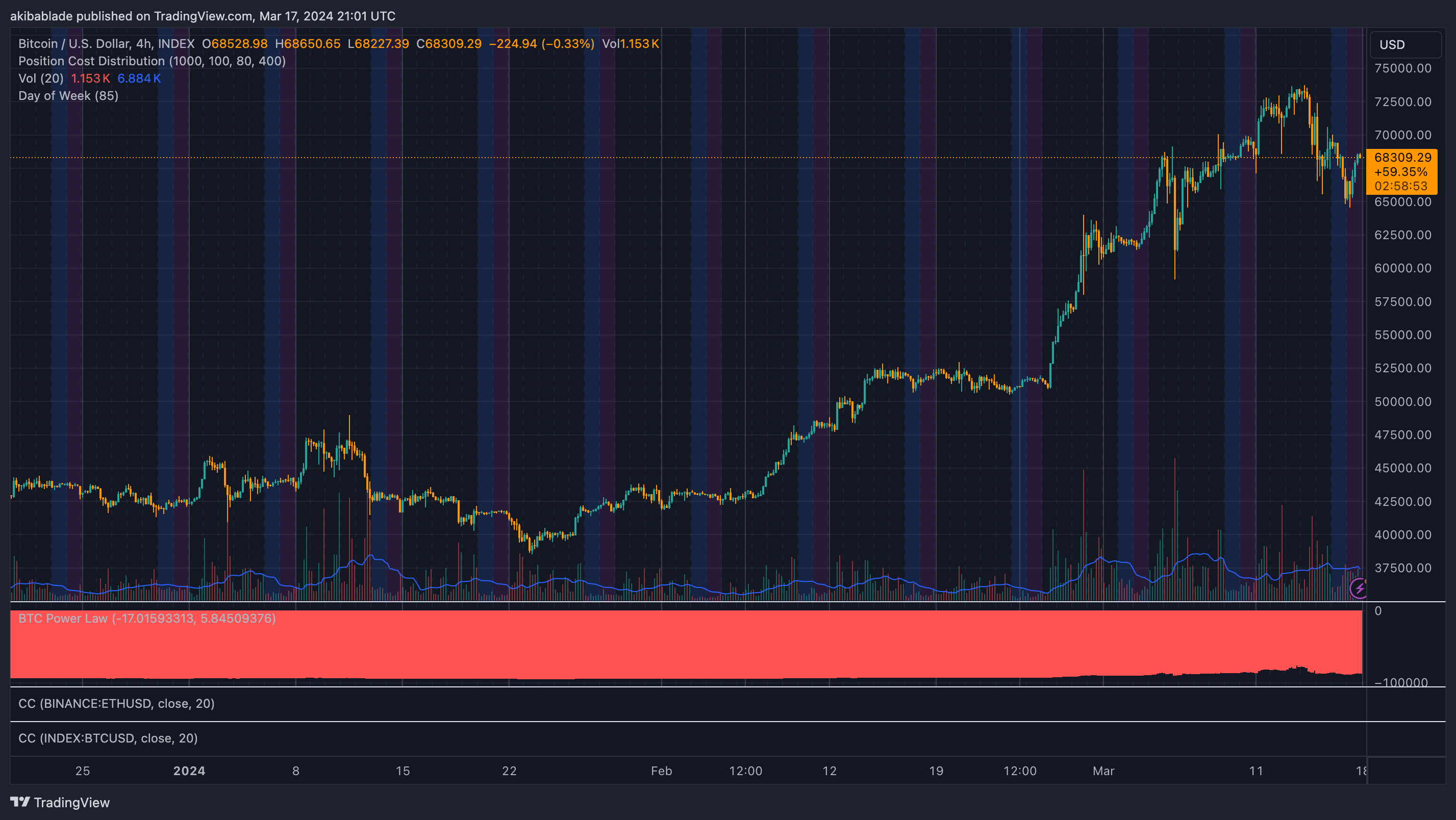

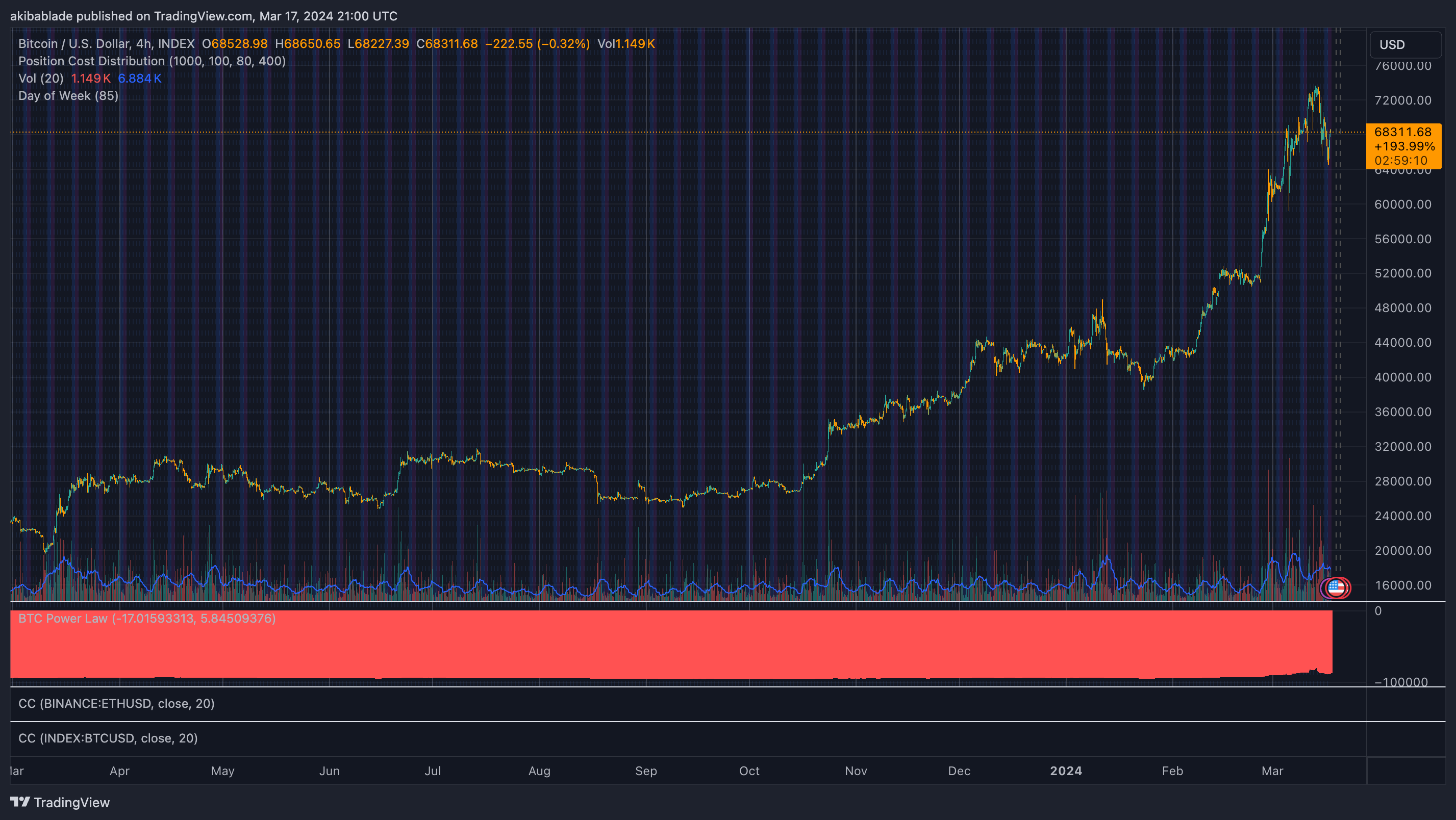

Bitcoin has seen pretty steady weekend buying and selling for the reason that launch of the Bitcoin ETFs within the US earlier this 12 months, with a lot of the volatility occurring early within the week throughout US buying and selling hours. Nonetheless, additional evaluation of weekend intervals all through 2023 reveals that flat weekends have been a pattern for a lot of 2023.

The vertical bars on the charts above denote Saturdays and Sundays buying and selling for Bitcoin all through 2023 and 2024. In contrast to this weekend, most weekends noticed little worth swings past 2-3%. Bitcoin’s concern and greed index stays within the ‘excessive greed‘ zone, whereas it has fallen a few factors since final week’s heights.

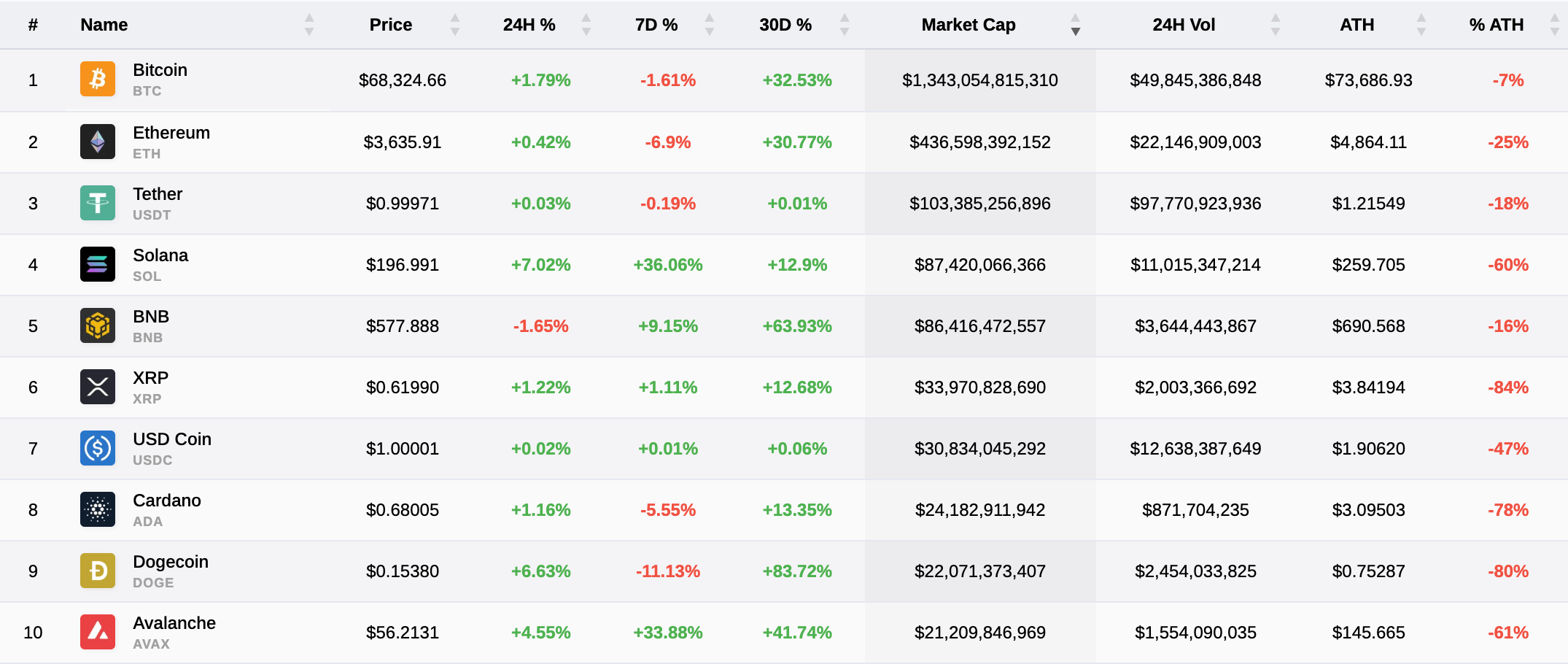

Throughout the broader market, a sea of inexperienced denotes optimistic motion over the previous 24 hours, with the bulk remaining optimistic over the past seven days. Probably the most notable is Solana, which has seen a dramatic 36% improve over the previous week, rising in opposition to Bitcoin and main the market.

Dogecoin, Cardano, and Ethereum are the one digital belongings that haven’t recovered to close native highs over the previous seven days. Nonetheless, solely Bitcoin and BNB Chain are presently inside 20% of the all-time highs.

As of press time, the US market would hole down roughly 2% if the value remained at present ranges over the following 16 hours.

The publish Most risky weekend in a 12 months as Solana dominates but Bitcoin recovers appeared first on starcrypto.